Home » Posts tagged 'Coolpad'

Tag Archives: Coolpad

Chinese smartphone brands to conquer the global market?

The smartphone market in China became saturated between Q3’12 and Q4’13 as per the below chart from Analysys International (EnfoDesk):

Note that this chart corresponds to Chinese writing traditions, i.e. in Q2’11 16.81 million smartphones and 51.01 million feature phones were sold, while in Q4’13 97.63 million smartphones and 9.2 million feature phones. Source: 易观分析:2013年第4季度中国手机销量增速放缓,智能手机市场呈现饱和态势 (Analysys analysis: China mobile phone sales growth slowed in the fourth quarter of 2013, the smart phone market is saturated) [EnfoDesk, March 11, 2014]

Chinese Handset Vendors Will Account for Over 50% of Mobile Handset Sales in 2015 [ABI Research press release, March 10, 2014]

ABI Research reports that Chinese handset vendors will account for over 50% of mobile handsets in 2015. Chinese vendors already accounted for 38% of mobile handset shipments in 2013 and the ongoing shift in growth to low cost handsets, especially smartphones, will increase their market share.

Greater China has long dominated the mobile handset manufacturing supply chain, but now its OEMs are beginning to dominate sales at the expense of the traditional handset OEMs, including even Samsung.

Many of the Chinese OEMs have focused almost exclusively on the huge Chinese market, with little activity beyond its borders, but this is set to change. Huawei (6th in worldwide market share for 2013) and ZTE (5th) have already made an impact on the world stage, but other Chinese handset OEMs like Lenovo—the Motorola acquisition is a clear statement of intent—and Xiaomi are set to join them.

“Chinese vendors already take up five of the top ten places in terms of worldwide market share, despite three of them only really shipping into China. The Chinese vendors highlight the changing shape of the mobile handset market, as the Chinese manufacturing ecosystem, specifically reference designs, enable the next wave of smartphone growth in low cost emerging markets and amongst price conscious consumers everywhere,” said Nick Spencer, senior practice director, mobile devices.

“South East Asia has already experienced this trend, but ABI Research expects to see the impact of these Chinese vendors increasing in all emerging markets and even advanced markets, especially on prepay,” added Spencer.

The New Phone Giants: Indian And Chinese Manufacturers’ Fast Rise To Threaten Apple And Samsung [Business Insider India, March 15, 2014]

The top Indian and Chinese smartphone manufacturers are classically disruptive. They produce products that are “good enough,” at a fraction of the cost of comparable models from premium brands. These ultra low-cost devices are the key to nudging consumers in massively untapped markets like India and Indonesia onto smartphones.

And these companies are starting to aim higher – producing 4G LTE smartphones that have the same processing power as Samsung and Apple premium devices.

They’re also far more innovative than they’re given credit for in terms of their strategy, supply chain management, and hardware.

In a new report from BI Intelligence, we explain why global consumer Internet and mobile companies will increasingly need to work with companies like Xiaomi and Micromax – not to mention Lenovo, Huawei, ZTE, Coolpad, Karbonn, and others – if they don’t want to miss out on mobile’s next growth phase in emerging markets

- Major local manufacturers now account for two-fifths of China’s smartphone market, and one-fourth of India’s. Xiaomi already sells four of the top 10 best-selling Android devices in China, and operates one of the top five app stores.

- Combined, the top five manufacturers in China and the top two in India – the “Local 7” in the chart above – are now shipping about 65 million smartphones every quarter, more than Apple, and coming close to drawing even with Samsung.

- These local manufacturers wield influence in various ways. They run their own successful app stores, mobile operating systems, and mobile services. They also hold the keys to which apps are preloaded on their phones. When BlackBerry wanted to take its BBM messaging service for Android into India, it signed a deal with Micromax.

- The local manufacturers are not provincial outfits producing knock-offs, as some might be inclined to assume. But their main competitive tool, for now, remains price. Local manufacturers in China and India match the features of more expensive devices and manage to produce comparable hardware at a fraction of the price. A Micromax handset comparable to Apple’s iPhone 5C costs less than one-fourth as much.

- Xiaomi has used a four-point strategy in its three-year rise to produce four of the most popular phone models in China. We discuss all four aspects, including tight inventory management and crowdsourcing product development feedback.

- These manufacturers will continue to expand overseas, in search of new growth opportunities. Micromax is in Nepal, Bangladesh, and Sri Lanka. Xiaomi has its eyes on Malaysia and Brazil. Huawei is already in the U.S. For example, it sells a 4G LTE handset on MetroPCS.

Smartphone Prices Race to the Bottom as Emerging Markets Outside of China Come into the Spotlight for Future Growth, According to IDC [press release, Feb 24, 2014]

Singapore and London, February 24, 2014 – Emerging markets have become the center of attention when talking about present and future smartphone growth. According to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, in 2013 the worldwide smartphone market surpassed 1 billion units shipped, up from 752 million in 2012. This boom has been mainly powered by the China market, which has tripled in size over the last three years. China accounted for one out of every three smartphones shipped around the world in 2013, equaling 351 million units.

Recently the surge in growth has started to slow as smartphones already account for over 80% of China’s total phone sales. The next half billion new smartphone customers will increasingly come mainly from poorer emerging markets, notably India and in Africa.

“The China boom is now slowing,” said Melissa Chau, Senior Research Manager for mobile devices at IDC Asia/Pacific. “China is becoming like more mature markets in North America and Western Europe, where smartphone sales growth is slackening off.”

Emerging markets in Asia/Pacific outside of China, together with the Middle East and Africa, Central and Eastern Europe, and Latin America, account for four fifths of the global feature phone market, according to IDC data. “This is a very big market opportunity,” said Simon Baker, Program Manager for mobile phones at IDC CEMA. “Some 660 million feature phones were shipped last year, which could add two thirds to the size of the current global smartphone market.”

India will be key to future smartphone growth as it represents more than a quarter of the global feature phone market. “Growth in the India market doesn’t rely on high-end devices like the iPhone, but in low-cost Android phones. Nearly half of the smartphones shipped in India in 2013 cost less than US$120,” said Kiranjeet Kaur, Senior Market Analyst for mobile phones at IDC Asia/Pacific.

“Converting feature phone sales to smartphone sales implies a relentless push towards low cost,” added Baker. IDC research shows nearly half the mobile handsets sold across the world have retail prices of less than US$100 without sales tax. Two thirds of those have prices of less than US$50.

“The opportunity gets larger the lower the price falls,” continued Baker. “If you take retail prices without sales tax, in 2013 nearly three quarters of the US$100-125 price tier was already accounted for by smartphones. Within US$75-100 the proportion was down to just over half, and between $50-75 it was not much more than a third.”

Many smartphone vendors have begun gearing up for this next wave of cost pressure. Samsung is increasingly switching production to Vietnam, where manufacturing costs currently undercut mainland China. Even Hon Hai, one of the largest contract manufacturers for handsets in China, has announced plans for a plant in Indonesia to furnish a lower production cost base.

In addition to the table below, an interactive graphic showing worldwide sub-$100 feature phone shipments by region is available here. The chart is intended for public use in online news articles and social media. Instructions on how to embed this graphic can be found by viewing this press release on IDC.com.

Worldwide Sub-$100 Feature Phone Shipments by Region, 2013

Region

Shipments (M Units)

India

212.3

Middle East & Africa

150.0

Asia/Pacific (excluding Japan, China, and India)

140.7

Latin America

76.4

PRC

68.1

Central & Eastern Europe

43.6

Western Europe

39.8

North America

13.9

Total

744.9

Source: IDC Worldwide Mobile Phone Tracker, February 24, 2014

Analysys International: Xiaomi Ranked Among Top Five in Q4, 2013 [March 11, 2014]

The statistics from EnfoDesk, the Survey of China Mobile Terminals Market in Q4, 2013, newly released by Analysys International, shows that the market share of Samsung, Lenovo, Huawei, Coolpad and Xiaomi ranked the top five of China smartphone in Q4, 2013. The market share of Samsung shrink slightly over the previous quarter, but it still accounted for 15.07 percent of smartphone market and maintain the leading position.

The release of Apple‘s new product has brought efficiency in Q4, and its market share slightly rebounded. Owning to the release of MI3 (Xiaomi), the market share of Xiaomi up 3.85 percentage points compared to the previous quarter. MI3 still should be bought from booking and the booking is relatively frequent. Meanwhile, the purchase restriction of MI2(Xiaomi) and Red MI(Xiaomi) has been relaxed, coupled with the strategic cooperation between Xiaomi and mobile operators, making it easier to buy custom models as well as contributing to the enlargement of Xiaomi’s market share. It can be expected that Xiaomi will put more energy into the complement of its retail capabilities and continue to increase their market share.

From: UMENG Insight Report – China Mobile Internet 2013 Overview [UMENG, March 12, 2014]

– The number of active smart devices in China exceeded 700 Million by the end of 2013.

– The five fastest growing mobile apps categories (excluding games) are : news, health & fitness, social networking, business, and navigation. These areas will bring new opportunities for developers in 2014.

– Socializing your apps is the key to success for developers. Currently among the top 1,000 apps (apps and games) in the Chinese market, 55% of them provide links to Chinese social networking services (e.g. Sina Weibo, Wechat, QQ, Renren) The amount of app content sharing to social network platforms per mobile Internet user per day has tripled in the last 6 months.

– Social network sharing in game has become incredibly popular on all social networking platforms, 48% of in app sharing traffic to social networks are from games.

– High-end devices (pricing above 500US$) have a significant market share in China, contributing 27% of total devices. These users have dynamic needs on mobile apps . The users of below 150US$ phones prefer casual games for their entertainment requirements.

– The year of 2013 became known as the first year Chinese developers took IP seriously with many developers licensing IP from rights holders. By the end of 2013, among the Top 100 games, 20% license 3rd party IP.

– Over the course of 2013 the percentage of iOS jailbroken devices in the Chinese Mainland fell by 17% to 13% of all devices. Domestic users are becoming more hesitant to jailbreak their devices.

…

700 Million active smart devices in China

…

The market for budget Android phones is strong in China with 57% of devices under 330 USD price range. However over a quarter of users are using high-end smart phones costing over 500USD, 80% of these are iPhones.

…

Fragmented Android device market

- In the 4th quarter of 2013, Samsung and XiaoMi (a local brand) prove to be the most popular Android brands as between them they manufacture all of the top 10 active Android devices.

- However the Android market is still highly fragmented with hundreds of different handsets on the market. Samsung who manufacture many devices in all price ranges control 24% of the device market, while the domestic manufactures are battling it out with the international brands to extend their market share.

…

- In 2013, changes to device connectivity saw a large growth in WiFi connectivity, from 38% at the beginning of the year to 52% at year end. Mobile Internet infrastructure has become better in China. However Chinese users are still price sensitive to mobile data tariff.

…

- Glossary:

Active Device: active device refers to device which has activated at least one app covered by Umeng platform in the stipulated time frame. All the “devices” in the report refers to “active devices”, not the actual shipment.…

- Data Source:

Analysis data in the report is based on over 210,000 Android and iOS apps from the Umeng platform. All data was collected from January to December 2013.

From: More than 247 million mobile handsets shipped in India during CY 2013, a Y-o-Y growth of 11.6%; over 70 million mobile handsets shipped in 4Q 2013 alone [CyberMedia Research press release, Feb 26, 2014]

According to CMR’s India Monthly Mobile Handsets Market Review, CY 2013, February 2014 release, India recorded 247.2 million mobile handset shipments for CY (January-December) 2013. During the same period, 41.1 million smartphones were shipped in the country.

…

India Smartphones Market

The India smartphones market during 2H 2013 saw a rise in shipments by 60.3% over 1H 2013, taking the overall contribution of smartphones to 16.6% for the full year. Further, 65.8% of the total smartphones shipped in the country were 3G smartphones during CY 2013.

Commenting on these results, Tarun Pathak, Lead Analyst, Devices, CMR Telecoms Practicesaid, “CY 2013 was primarily the year of smartphones for the India market, particularly for local handset vendors. A first for the India market was a marginal decline in featurephone shipments on a year-on-year basis. This trend is likely to continue with more vendors focusing on entry level smartphone offerings aimed at the consumer segment.”

“Nearly 70 vendors operated in the highly competitive India smartphones market in CY 2013, with ‘Tier One’ brands like Apple, Samsung, Nokia, Sony, HTC, LG and Blackberry capturing close to 53% of the total smartphones market, followed by India brands capturing close to 43% of total smartphone shipments. The remaining market of roughly 4% smartphone shipments was captured by China OEM brands, where we expect a few more players to enter the India market directly, instead of continuing as ODM partners to Indian brands”, Tarun added.

Rapid Growth In Smartphones Offset The Slump Witnessed In Feature Phone Sales In 4Q13, Says IDC [press release, Feb 26, 2014]

India was one of the fastest growing countries worldwide in terms of smartphone adoption in 2013. According to the International Data Corporation (IDC) in 2013 the smartphone market surpassed 44 million units shipped, up from 16.2 million in 2012. This surge has been mainly powered by home grown vendors which have shown a tremendous and consistent growth over the past 4 quarters of 2013.

The overall phone market stood at close to 257 million units in CY 2013 – an 18% increase from 218 million units in CY2012.

CY2013 also witnessed a remarkable migration of the user base from feature phones to smartphones primarily due to the narrowing price gaps between these product categories.

Q413 Perspective:

The India smartphone market grew by 181% year over year (YoY) in the fourth quarter of 2013 (4Q13). According to International Data Corporation’s (IDC) APEJ Quarterly Mobile Phone Tracker, vendors shipped a total of 15.06 million smartphones in 4Q13 compared to 5.35 million units in the same period of 2012. 4Q13 grew by almost 18% Quarter-on-Quarter.

The shipment contribution of 5.0inch-6.99inch screen size smartphones (phablets) in 4Q2013 was noted to be around 20% in the overall market. The category grew by 6% in 4Q13 in terms of sheer volume over 3Q13.

The overall mobile phone market (Feature Phones and Smartphones) stood at 67.83 million units, a 16% growth YoY and a meager 2% growth quarter over quarter (QoQ).The share of feature phones slid further to make 78% of the total market in 4Q13, with the market showing a decline of 2% in 4Q13 over 3Q13.

The fourth quarter of 2013 witnessed a spike in the smartphone shipments by smaller homegrown vendors like LAVA, Intex which have shown tremendous growth in the past couple of quarters.

“The growth in the smartphone market is being propelled by the launch of low-end, cost competitive devices by international and local vendors which are further narrowing the price gaps that exist between feature phones and smartphones”, said Manasi Yadav, Senior Market Analyst with IDC India.

“The international vendors have understood the importance of creating a diverse portfolio of devices at varied price points and are striving to launch cost competitive devices that cater to every segment in the target audience ” comments Kiran Kumar, Research Manager with IDC India.

Top Five Smartphone Vendor Highlights

Samsung: Samsung maintained its leadership spot with about 38% in terms of market share. Its smartphone shipments grew by close to 37% from 3Q 2013 to 4Q2013. The fourth quarter saw quite a few new launches across price points by Samsung – however the low-end Galaxy portfolio in smartphones contribute to 50% in terms of shipment volumes

Micromax: Micromax held on to its second spot with about 16% in terms of market share in 4Q2013. Some of the top selling models were the entry level smartphones like A35 Bolt and A67. The Canvas range of devices has also done well in terms of volume contribution owing to the marketing campaigns launched around them.

Karbonn: The market share for Karbonn in 4Q2013 was close to 10%, some of the top selling models for this brand were A1+ and A51.

Sony: Sony managed to make a comeback in the top-5 smartphone vendor list in 4Q13 and garnered a market share of 5%. The top selling models included Xperia M Dual and Xperia C handsets, which are targeted at mid-tier price range.

Lava : Lava managed to hold onto the number 5 spot in the top-5 smartphone vendor list. The continued traction around the XOLO and IRIS range of devices helped the vendor garner a market share of 4.7% in 4Q13. Some of the top selling models include the newly launched XOLO A500 S and the existing models like IRIS 402 and IRIS 349.

IDC India Forecast:

IDC anticipates the growth in Smartphone segment to outpace the overall handset market growth for the foreseeable future. The end-user shift towards mid-to-high screen size products will be amplified by the declining prices and availability of feature-rich localized product offerings. Vendors who are able to differentiate their offerings at affordable prices will maintain a competitive edge and secure a strong position in the mobile phone market in CY 2014.

From: Gartner Says Annual Smartphone Sales Surpassed Sales of Feature Phones for the First Time in 2013 [press release, Feb 13, 2014]

…

Worldwide Smartphone Sales to End Users by Vendor in 2013 (Thousands of Units)

Company

2013

Units

2013 Market Share (%)

2012

Units

2012 Market Share (%)

Samsung

299,794.9

31.0

205,767.1

30.3

Apple

150,785.9

15.6

130,133.2

19.1

Huawei

46,609.4

4.8

27,168.7

4.0

LG Electronics

46,431.8

4.8

25,814.1

3.8

Lenovo

43,904.5

4.5

21,698.5

3.2

Others

380,249.3

39.3

269,526.6

39.6

Total

967,775.8

100.0

680,108.2

100.0

Source: Gartner (February 2014)

Worldwide Smartphone Sales to End Users by Vendor in 4Q13 (Thousands of Units)

Company

4Q13

Units

4Q13 Market Share (%)

4Q12

Units

4Q12 Market Share (%)

Samsung

83,317.2

29.5

64,496.3

31.1

Apple

50,224.4

17.8

43,457.4

20.9

Huawei

16,057.1

5.7

8,666.4

4.2

Lenovo

12,892.2

4.6

7,904.2

3.8

LG Electronics

12,822.9

4.5

8,038.8

3.9

Others

106,937.9

37.9

75,099.3

36.2

Total

282,251.7

100.0

207,662.4

100.0

Source: Gartner (February 2014)

Top Smartphone Vendor Analysis

Samsung: While Samsung’s smartphone share was up in 2013 it slightly fell by 1.6 percentage points in the fourth quarter of 2013. This was mainly due to a saturated high-end smartphone market in developed regions. It remains critical for Samsung to continue to build on its technology leadership at the high end. Samsung will also need to build a clearer value proposition around its midrange smartphones, defining simpler user interfaces, pushing the right features as well as seizing the opportunity of bringing innovations to stand out beyond price in this growing segment.

Apple: Strong sales of the iPhone 5s and continued strong demand for the 4s in emerging markets helped Apple see record sales of 50.2 million smartphones in the fourth quarter of 2013.

“However, Apple’s share in smartphone declined both in the fourth quarter of 2013 and in 2013, but growth in sales helped to raise share in the overall mobile phone market,” said Mr. Gupta. “With Apple adding NTT DOCOMO in Japan for the first time in September 2013 and signing a deal with China Mobile during the quarter, we are already seeing an increased growth in the Japanese market and we should see the impact of the last deal in the first quarter of 2014.”

Huawei: Huawei smartphone sales grew 85.3 percent in the fourth quarter of 2013 to maintain the No. 3 spot year over year. Huawei has moved quickly to align its organization to focus on the global market. Huawei’s overseas expansion delivered strong results in the fourth quarter of 2013, with growth in the Middle East and Africa, Asia/Pacific, Latin America and Europe.

Lenovo: Lenovo saw smartphone sales in 2013 increase by 102.3 percent and by 63.1 percent in the fourth quarter of 2013. Lenovo’s Motorola acquisition from Google will give Lenovo an opportunity to expand within the Americas.

“The acquisition will also provide Lenovo with patent protection and allow it to expand rapidly across the global market,” said Mr. Gupta. “We believe this deal is not just about entering into the U.S., but more about stepping out of China.”

Gartner expects smartphones to continue to drive overall sales in 2014 and an increasing number of manufacturers will realign their portfolios to focus on the low-cost smartphone sector. Sales of high-end smartphones will slow as increasing sales of low- and mid-price smartphones in high-growth emerging markets will shift the product mix to lower-end devices. This will lead to a decline in average selling price and a slowdown in revenue growth.

In the smartphone OS market, Android’s share grew 12 percentage points to reach 78.4 percent in 2013 (see below). The Android platform will continue to benefit from this, with sales of Android phones in 2014 approaching the billion mark.

Worldwide Smartphone Sales to End Users by Operating System in 2013 (Thousands of Units)

Operating System

2013 Units

2013 Market Share (%)

2012 Units

2012 Market Share (%)

Android

758,719.9

78.4

451,621.0

66.4

iOS

150,785.9

15.6

130,133.2

19.1

Microsoft

30,842.9

3.2

16,940.7

2.5

BlackBerry

18,605.9

1.9

34,210.3

5.0

Other OS

8,821.2

0.9

47,203.0

6.9

Total

967,775.8

100.0

680,108.2

100.0

Source: Gartner (February 2014)

…

2014 will be the last year of making sufficient changes for Microsoft’s smartphone and tablet strategies, and those changes should be radical if the company wants to succeed with its devices and services strategy

For the company’s most recent “ONE Microsoft” strategy see:

– Microsoft reorg for delivering/supporting high-value experiences/activities [‘Experiencing the Cloud’, July 11, 2013]

– How the device play will unfold in the new Microsoft organization? [‘Experiencing the Cloud’, July 14, 2013]

Update: There are extremely worrying signs on the horizon as per Jan 27, 2014:

– MediaTek MT6592-based True Octa-core superphones are on the market to beat Qualcomm Snapdragon 800-based ones UPDATE: from $147+ in Q1 and $132+ in Q2

– End of the Nokia “magic” hurting European and Asian consumers while mobile carriers are uncertain about the future under the Microsoft brand

End of Update

As 2014 will be the last year of “free ride” in the smartphone and tablet spaces for ARM-based competitors of Intel – at least what Intel is insisting again [‘Experiencing the Cloud’, Jan 17, 2014] it is time to summarize the ARM-based opportunities for 2014 (note that Intel’s goal in the tablet space is only 40 million units, both Android and Windows):

Compare everything to 2014 global notebook demand forecast [DIGITIMES Research, Dec 5, 2013] which estimates that global notebook shipments in 2014 will reach around 160 million units, down from a peak of over 200 million in 2011, but the drop in 2014 will be lower than the on-year drop in 2013, with new market developments, new product opportunities, and changes in the major players’ strategies all playing critical roles in the IT industry’s future trends.

Compare everything to 2014 global notebook demand forecast [DIGITIMES Research, Dec 5, 2013] which estimates that global notebook shipments in 2014 will reach around 160 million units, down from a peak of over 200 million in 2011, but the drop in 2014 will be lower than the on-year drop in 2013, with new market developments, new product opportunities, and changes in the major players’ strategies all playing critical roles in the IT industry’s future trends.

Digitimes Research: Global smartphone shipments to top 1.24 billion units in 2014 [Jan 14, 2014]Global smartphone shipments are expected to top 1.24 billion units in 2014, with Samsung Electronics, Apple, LG Electronics, Sony Mobile Communications, Lenovo, Huawei [according to the company: 52 million units in 2013 vs 60 million target] , Microsoft, ZTE, Coolpad and TCL serving as top-10 vendors, according to Digitimes Research.Apple may see its shipments double in 2014 largely due to increased shipments to China and Japan as it will benefit from its cooperation with the largest telecom operators in the two countries, said Digitimes Research.The growth rate for Samsung will be limited in 2014 as its sales in the US, China and Japan will be depressed by growing popularity of iPhones.China-based Lenovo, Huawei and Coolpad are expected to step up their efforts to boost sales in overseas markets after being enlisted among the top-10 vendors due to higher shipment volumes in the home market in China.However, TCL and ZTE will continue to ship smartphones to overseas markets mainly, but will also strengthen sales in China, with domestic sales to account for less than 50% of their total shipments in 2014, commented Digitimes Research.This article is an excerpt from a Digitimes Research Special Report (2014 global smartphone market forecast).Digitimes Research: China smartphone-use application processor shipments edge up 2.4% in 4Q13 [Jan 15, 2014]Shipments of application processors for smartphone applications to China grew 2.4% sequentially and 20.8% on year in the fourth quarter of 2013, according to data compiled by Digitimes Research.MediaTek saw its AP shipments decline 3.9% sequentially in the fourth quarter due to inventory checks at clients and a high growth recorded in the previous quarter.However, it was a 20% sequential shipment decline suffered by Qualcomm the fourth quarter that weakened the growth momentum of the application processor sector, said Digitimes Research.Meanwhile, MediaTek has been shifting its focus to the high-margin segment, instead of seeking high shipment growth. China-based Spreadtrum Communications was hit with high inventory of TD-SCDMA chips and slow sales of its dual- and quad-core solutions, Digitimes Research indicated.Qualcomm also saw its performance weaken in the fourth quarter as its QRD (Qualcomm reference design) chips were less competitive than those offered by rivals in terms of product features.This article is an excerpt from a Chinese-language Digitimes Research report. Click here if you are interested in receiving more information about the content and price of a translated version of the full report. |

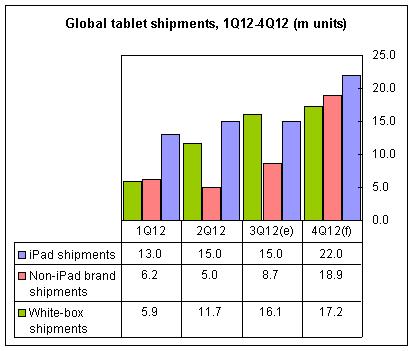

Digitimes Research estimates that in 2014 global tablet shipments will reach 289 million units [Dec 31, 2013]China white-box makers add extra value to tablets as cost reduction is no longer possible [DIGITIMES Research, Jan 16, 2014]China white-box players have not been able to lower their Wi-Fi-based tablets’ prices since the third quarter of 2013 because there is no room for further reductions in their BOM costs.The average BOM cost for a white-box tablet – most of which adopted a dual-core processors – stood at about US$25 as of the fourth quarter of 2013. Dual-core processor pricing could not drop any further, as their average prices came to about US$4, only less than US$1 higher than that of a single-core one.Memory and 7-inch TN LCD panels are the two key components that account for major shares of white-box tablet BOM costs. However, most panel suppliers have been only willing to upgrade specifications instead of dropping their quotes, and therefore, white-box players have been left with upgrading their devices with better panels without an option of reducing the panel cost.While cost reduction is no longer a feasible way to attract consumers, many white-box players have turned to push tablets with phone functions to increase their devices’ functionalities and value. The devices also provide higher gross margins for vendors.Digitimes Research estimates that currently, 80% of white-box tablets are available in countries other than China, because white-box tablets with phone functions have seen rising demand in Russia and other markets in Eastern Europe and Southeast Asia since the second half of 2013.China white-box players’ partnerships with regional brand vendors in emerging markets have also helped raise local consumers’ demand for tablets with phone functions.In the first half of 2013, most white-box tablets with phone functions adopted China-based Allwinner Technology’s solution which combined an entry-level single-core processor with a discrete baseband module. However, many white-box device makers have turned to MediaTek solutions for their tablets since the second half of 2013 after the Taiwan-based chipmaker also integrated a baseband chip into its tablet processor solution.MediaTek’s solution is more expensive, but its support for product development and hardware design has given it an upper hand over competitions. Meanwhile, independent design houses (IDHs), which provide white-box players with product design services, also started to design tablets using MediaTek’s smartphone processors in the second half of 2013, which prompted white-box players to adopt MediaTek’s solutions.Digitimes Research estimates that tablets with phone functions will account for 40% of 7-inch white-box tablet shipments in 2014, up from 20% in 2013. |

In 2014, smartphones are expected to continue penetrating rapidly into emerging markets such as Russia, India, Indonesia and Latin America, while China’s smartphone shipments will see weakened on-year growth in the year, but still enormous volume. Within the top-10 smartphone vendors in 2013, four of them are from China and in 2014 more China-based vendors are expected to enter the top 10.Three China-based handset vendors increase component deliveries [DIGITIMES, Dec 11, 2014]China-based handset vendors Xiaomi Technology, Gionee and Hisense have been taking increasing deliveries of panels and touch panels from suppliers in preparation for launching new models during the peak period before the 2014 Lunar New Year at the end of January, according to Taiwan-based supply chain makers.Other China-based vendors including Lenovo, Huawei Device and Oppo have begun to follow suit, the sources indicated.Xiaomi has seen success in marketing its high-end Xiaomi 3, mid-range Xiaomi 2S and entry-level Hong-mi (Red Rice), the sources noted.Gionee focuses on marketing high-end smartphones priced above CNY2,000 (US$328) through general retail chains without cooperation with China’s three mobile telecom carriers, the sources indicated. Gionee has shipped more than two million smartphones a quarter so far in 2013.Hisense is among several licensed vendors of 4G smartphones and has launched the 5-inch X6T, its first 4G smartphone featuring TD-LTE, LTE-FDD, TD-SCDMA, WCDMA and GSM, on 12 frequency bands, the sources noted. Hisense has taken delivery of components for use in more than one million handsets to be launched before the 2014 Lunar New Year, the sources noted.China market: Xiaomi lowers price for Hongmi smartphone [DIGITIMES, Jan 7, 2014]China-based vendor Xiaomi Technology has reduced the retail price for its budget TD-SCDMA smartphone, the Hongmi, launched in August 2013, from CNY799 (US$132) to CNY699, heralding upcoming competition in the Android smartphone segment in China, according to industry watchers.Rival vendor Huawei is likely to counteract by slashing the prices of its Honor-branded budget smartphones, while other local brands in China are also expected to follow suit soon, said the observers.Optimizing its policy of offering smartphones with high hardware specifications and yet at low prices, Xiaomi has managed to ramp up its shipments to over three million units a month and is expected to ship over 40 million smartphones in 2014, the sources estimated. [According to Xiaomi: “7.2 million devices … in 2012 and 18.7 million …bought in 2013. … for 2014 – the CEO expects forty million Xiamoi smartphones to be bought”]Asustek expected to ship 2014 target of 5 million smartphones [DIGITIMES, Jan 7, 2014]Asustek Computer unveiled three ZenFone-series smartphones for the opening of CES 2013. Viewing that ZenFone models have comparatively high price-performance ratios, Asustek will be able to hit its target shipments of five million smartphones for 2014, and is likely to ship 8-10 million units, according to market analysts.The three ZenFone models will initially launch in the Taiwan, China and Southeast Asia markets in March at contract-free retail prices of US$99 for the 4-inch model, US$149 for the 5-inch, and US$199 for the 6-inch.All three models are equipped with Intel Atom processors and Asustek will launch 3-4 models also with Atom processors in the second half of 2014, the sources indicated.Since Intel has offered incentives to attract PC vendors to adopt its platforms for smartphones, Asustek is expected to procure Atom processors at discount prices and receive subsidies from Intel for marketing the devices, the sources said.Asustek likely to release smartphone orders to China ODMs in 2H14, says paper [DIGITIMES, Jan 15, 2014]Asustek Computer does not rule out the possibility of tying up with handset ODMs in China for the production of smartphones in the second half of 2014, the Chinese-language Economic Daily News (EDN) has quoted company CEO Jerry Shen as saying.After unveiling five new models at the recently concluded CES 2014, Asustek plans to launch another five smartphones in the second half of the year, and therefore it needs more ODMs to support production, Shen was quoted as indicating.The three ZenFone-series smartphones out of the five models unveiled by Asustek at CES 2014, with displays sized in 4-, 5-, and 6-inch, will be available for US$99, US$149 and US$199 unlocked, respectively, and are designed to take on China-based rivals in the entry-level smartphone segment.The possible switch of orders to China-based ODMs may affect its current production partners in Taiwan, including Wistron and Pegatron, said the paper.Digitimes Research: Asustek ZenFone smartphones have lower price-performance ratios than comparable models from China [Jan 17, 2014]Asustek Computer unveiled three ZenFone-series smartphones at CES 2014 and will initially launch the models in the Taiwan, China and Southeast Asia markets in March with prices comparable to low-cost models offered by China-based Xiaomi Technology and Huawei. But the price-performance ratios of the ZenFones will be still lower than rival models from China-based vendors due to the use of different marketing channels, according to Digitimes Research.China-based vendors such as Huawei and Coolpad have been duplicating the business model initiated by Xiaomi by introducing entry-level models with higher hardware specifications and marketing the gadgets mainly through the Internet.Leveraging subsidies offered by telecom operators, Asustek has been able to lower prices for its ZenFone models to levels comparable to those offered by Xiaomi, Huawei and Coolpad, but the price-performance ratios are lower than of the Hongmi smartphone from Xiaomi, the Honor 3C from Huawei and the Great God F1 from Coolpad, due to markup costs added by channel operators in China selling the ZenFones.Due to the lower price-performance ratios, Asustek’s goal of shipping over five million smartphones in 2014 through a low-pricing model remains hard to achieve, commented Digitimes Research.This article is an excerpt from a Chinese-language Digitimes Research report. Click here if you are interested in receiving more information about the content and price of a translated version of the full report. |

Total: ~289+ million

|

More information (going back to end of July 2013) which is directly related to the possible changes on the 2014 markets in terms of 2014 will be the last year of “free ride” in the smartphone and tablet spaces for ARM-based competitors of Intel – at least what Intel is insisting again [‘Experiencing the Cloud’, Jan 17, 2014]:

-

Nokia should introduce an Android forked smartphone for the $75-120 range in order to enhance its Asha Software Platform strategy [‘Experiencing the Cloud’, Jan 17, 2014]

-

China market: Acer launches CNY599 7-inch tablet [DIGITIMES, Jan 17, 2014]

-

Microsoft to open Allwinner entry into Windows RT, for the production of 900 yuan (US$149) level Windows RT tablet [‘USD 99 Allwinner’, Jan 16, 2014]

-

The first wave of computational photography capabilities from Qualcomm for its new Snapdragon 805 SoCs [‘USD 99 Allwinner’, Jan 4, 2014]

-

The Cortex-A53 as the Cortex-A7 replacement core is succeeding as a sweet-spot IP for various 64-bit high-volume market SoCs to be delivered from H2 CY14 on [‘Experiencing the Cloud’, Dec 23, 2013]

-

MediaTek MT6592-based True Octa-core superphones are on the market to beat Qualcomm Snapdragon 800-based ones [‘Experiencing the Cloud’, Dec 22, 2013]

-

The future is here: Yes, it is Microsoft Surface 2 with modern apps only! (And ARM, not x86/x64!) [‘Experiencing the Cloud’, Nov 17, 2013]

-

Q3’13 smartphone and overall mobile phone markets: Android smartphones surpassed 80% of the market, with Samsung increasing its share to 32.1% against Apple’s 12.1% only; while Nokia achieved a strong niche market position both in “proper” (Lumia) and “de facto” (Asha Touch) smartphones [‘Experiencing the Cloud’, Nov 14, 2013]

-

The tablet market in Q1-Q3’13: It was mainly shaped by white-box vendors while Samsung was quite successfully attacking both Apple and the white-box vendors with triple digit growth both worldwide and in Mainland China [‘Experiencing the Cloud’, Nov 14, 2013]

-

The first multimode Android tablets and laptops from Lenovo [‘Experiencing the Cloud’, Nov 14, 2013]

-

Leading PC vendors of the past: Go enterprise or die! [‘Experiencing the Cloud’, Nov 7, 2013]

-

Intel is ready to push big in smartphones next year with its winning multimode voice and data, multiband LTE modem technology capable of global LTE roaming via a single SKU [‘Experiencing the Cloud’, Nov 5, 2013]

-

Leading edge Nokia phablets for both entertainment and productivity: Lumia 1320 targeting the masses at $339, and Lumia 1520 the imaging conscious business users and individuals at $749 [‘Experiencing the Cloud’, Oct 26, 2013]

-

Why Intel is pressed to go as far down as to $99 with its Android tablet prices (but not with Windows 8.1)? [‘Experiencing the Cloud’, Oct 16, 2013]

-

Dell’s all Intel tablets and laptops targeting the evolving mobile workforce even with their most consumer specific Android tablets [‘Experiencing the Cloud’, Oct 3, 2013]

-

Amazon’s move into overall leadership: Kindle Fire HDX with Snapdragon 800, “revolutionary on-device tech support” (Mayday), enterprise and productivity capable Fire OS 3.0 forked from Android 4.2.2 etc. PLUS a significantly enhanced, new Kindle Fire HD for a much lower, $139 price [‘Experiencing the Cloud’, Sept 27, 2013]

-

Multi-tasking and multi-window view used together for high performance productivity scenarios in the state-of-the-art UX environment of Microsoft Windows 8.1 – the ultimate solution not available with Apple and Android devices [‘Experiencing the Cloud’, Sept 26, 2013]

-

2nd generation Microsoft Surface family of productivity tablets priced upto $2420 (when for an All-in-One configuration) [‘Experiencing the Cloud’, Sept 24, 2013]

-

The long awaited Windows 8.1 breakthrough opportunity with the new Intel “Bay Trail-T”, “Bay Trail-M” and “Bay Trail-D” SoCs? [‘Experiencing the Cloud’, Sept 14, 2013]

-

The new Air Command S Pen User Experience making the Samsung Galaxy Note 3 phablet, and Galaxy Note 10.1, 2014 Edition tablet next-generation devices [‘Experiencing the Cloud’, Sept 12, 2013]

-

Companion Device Computing as envisaged and implemented by Pranav Mistry and his TTT team from Samsung: the case of Galaxy Gear + Galaxy Note 3 [‘Experiencing the Cloud’, Sept 12, 2013]

-

Samsung Exynos 5 Octa with Heterogeneous Multi-Processing and GPU Compute is the hidden gem in the Galaxy Note 3 and GALAXY Note 10.1, 2014 Edition, launched at ‘Samsung UNPACKED 2013 Episode 2’ event [‘Experiencing the Cloud’, Sept 12, 2013]

-

Xiaomi announcements: from Mi3 to Xiaomi TV [‘Experiencing the Cloud’, Sept 3, 2013]

-

Assesment of the Xiaomi phenomenon before the global storm is starting on Sept 5 [‘Experiencing the Cloud’, Aug 30, 2013]

-

Windows [inc. Phone] 8.x chances of becoming the alternative platform to iOS and Android: VERY SLIM as it is even more difficult for Microsoft now than any time before [‘Experiencing the Cloud’, Aug 20, 2013]

-

Android to overtake the overall PC market? [‘Experiencing the Cloud’, Aug 20, 2013]

-

With Android and forked Android smartphones as the industry standard Nokia relegated to a niche market status while Apple should radically alter its previous premium strategy for long term [‘Experiencing the Cloud’, Aug 17, 2013]

-

Google Play catchup with iOS App Store and its way of assuring compatibility across Android 1.6 to 4.3 [‘Experiencing the Cloud’, Aug 15, 2013]

-

Superphones turning point: segment satured with Tier 1 globals while the Chinese locals are at less than 40% of the Samsung price [‘Experiencing the Cloud’, Aug 3, 2013]

-

Xiaomi, OPPO and Meizu–top Chinese brands of smartphone innovation [‘Experiencing the Cloud’, Aug 1, 2013]

-

GiONEE (金立), the emerging global competitor on the smartphone market [‘Experiencing the Cloud’, July 22, 2013, Jan 17, 2014]

MediaTek MT6592-based True Octa-core superphones are on the market to beat Qualcomm Snapdragon 800-based ones UPDATE: from $147+ in Q1 and $132+ in Q2

[‘Experiencing the Cloud’, July 22-29, 2013; Jan 27, 2014]

MediaTek MT6592-based True Octa-core superphones are on the market to beat Qualcomm Snapdragon 800-based ones UPDATE: from $147+ in Q1 and $132+ in Q2

… prices are starting as low as $247 in China (ZOPO Black 2, sold outside as ZP998)

UPDATE: China market: Prices of octa-core smartphones drifting below CNY1,000 [US$165] [DIGITIMES, Jan 27, 2014]

The battle for the entry-level smartphone segment in China is intensifying, and Coolpad with releasing an octa-core model priced below CNY1,000 (US$165), according to industry sources.

The Coolpad Great God F1, one of two 8-core smartphones released by Coolpad recently, comes with a MediaTek 1.7GHz 8-core MT5692 processor, 5-inch display with 720p resolution and 13-megapixel camera, and a price tag of only CNY888 (US$147).

China-based vendors including ZTE, Huawei, Lenovo, TCL and Gionee have launched 8-core smartphones with prices ranging from CNY1,699-1,999 (US$280-330).

My own insert here: Currently the cheapest one on the market outside China is the Ulefone U9592 : http://www.fastcardtech.com/Ulefone-U9592

Ulefone U9592 – Ulefone is the cheapest MTK6592 smart phone so far, but it has the best performance on the hardware as you can see in the review. The quality of the display is really good, even better then 720P. 5.0inch capacitive touch screen 854×480 MTK6592 Cortex A7 Octa core CPU,1.7GHz 2GB RAM +16GB ROM Dual camera:2.0MP front camera and 8.0MP back camera with flashlight Dual SIM Card Dual Standby

This video is from another vendor, |

Coolpad’s aggressive pricing will force other vendors to slash their prices soon, commented the sources.

Xiaomi Technology also plans to launch an 8-core model in the second quarter of 2014, and market sources believe that Xiaomi is likely to tag the price of its 8-core model at CNY799 (US$132).

The keen competition in the 8-core segment could also affect pricing for the 4G LTE smartphone market, said the sources, adding that prices of mainstream LTE models will fall to around CNY1,500 (US$248) in the first half of 2014 and drop to below CNY1,000 (US$165) in the second half of the year.

Demand for low-cost entry-level LTE smartphones from China Mobile, and fierce competition among LTE chipset suppliers including Qualcomm, Marvell Technology, MediaTek and Spreadtrum Communications will also accelerate price erosion of LTE smartphones, added the sources.

And here is the case of a global brand: Alcatel One Touch Idol X+ 5″ 1080p with MT6592 Octa Core [Charbax YouTube channel, Jan 17, 2014], list price indication given to PCMag was: “Alcatel projected a ballpark price point of below $300.”

END OF UPDATE

Detailed MT6592 SoC information is in Eight-core MT6592 for superphones and big.LITTLE MT8135 for tablets implemented in 28nm HKMG are coming from MediaTek to further disrupt the operations of Qualcomm and Samsung [‘Experiencing the Cloud’, July 20-29, 2013]. See also MediaTek True Octa-core [MediaTek technology page, July 22, 2013].

MT6592 True Octa-core : Performance Benchmark [mediateklab YouTube channel, Dec 20, 2013], its Chinese version was made available on Youku Nov 23, 2013, the competitor’s quad-core at 2.3GHz is obviously the Snapdragon 800

MT6592 True Octa-Core: Thermal Benchmark [mediateklab YouTube channel, Dec 20, 2013]

MT6592 True Octa-Core : Low Power Benchmark

MediaTek Launches MT6592 True Octa-Core Mobile Platform [MediaTek press release, Nov 20, 2013]

The MT6592 is the world’s first heterogeneous computing SOC with scalable eight-core processing for superior multi-tasking, industry-leading multimedia and excellent performance-per-watt.

TAIWAN, Hsinchu – 20 November, 2013 – MediaTek Incorporated (2454:TT) today unveiled the MT6592, the world’s first true octa-core mobile platform. The MediaTek MT6592 System on a Chip (SOC) combines an advanced eight-core application processor with industry-leading multimedia capabilities and mobile connectivity for a perfect balance of performance and power consumption.

The greater computational capabilities of the MediaTek MT6592 deliver premium gaming performance, advanced multi-tasking and enhanced web browsing for high-end smartphones and tablets. The MT6592 builds on the success of existing MediaTek quad-core mobile platforms, which have revolutionized price-performance efficiency for mobile devices, and is expected to be available in devices running Android ‘Jelly Bean’ by the end of 2013. MT6592 enabled mobile devices running Android ‘Kit-Kat’ are expected in early 2014.

Building on the advanced 28nm HPM high-performance process, the MT6592 has eight CPU cores, each capable of clock speeds up to 2GHz. The true octa-core architecture is fully scalable, and the MT6592 runs both low-power and more demanding tasks equally effectively by harnessing the full capabilities of all eight cores in any combination. An advanced MediaTek scheduling algorithm also monitors temperature and power consumption to ensure optimum performance at all times.

The MT6592 features a world-class multimedia subsystem with a quad-core graphics engine, an advanced video playback system supporting Ultra-HD 4Kx2K H.264 video playback and support for new video codecs such as H.265 and VP9, a 16-megapixel camera and a Full HD display. The SOC also features MediaTek ClearMotion™ technology for automatic frame-rate conversion of standard 24/30fps video to high-quality 60fps video for significantly smoother playback.

Enhancing mobile performance still further, the MT6592 incorporates the MediaTek advanced multi-mode cellular modem and a full connectivity capability for dual-band 801.11n Wi-Fi, Miracast screen-sharing as well as Bluetooth, GPS and an FM tuner.

In addition to MediaTek’s leadership in Heterogeneous Multi-Processing (HMP) in CPU, all of its mobile SOC’s including the MT6592 have been using a Heterogeneous Computing (HC) architecture, distributing the workload to different kinds of processors and other specialized computing engines to optimize performance. These HC building blocks include the CPU, GPU, DSP, multiple connectivity engines, multiple multimedia engines, camera engines, display engines, navigation, and sensor cores. MediaTek is committed to apply the best-in-class technologies to each of these building blocks.

“We are thrilled to offer the new MT6592 to our customers as part of our ongoing commitment to providing inclusive mobile technology,” said Jeffrey Ju, MediaTek General Manager, Smartphone Business Unit. ”The MT6592 delivers longer battery life, low-latency response times and the best possible mobile multimedia experience. Being the first to market with this advanced eight-core SOC is testament to the industry-leading position of MediaTek.”

” MediaTek has taken a pioneering position with the MT6592 by being the first to use the power-efficient ARM® Cortex®-A7 processor in an octa-core configuration with the ARM Mali™ GPU,” said Noel Hurley, ARM Vice President of Strategy and Marketing, Processor Division. “We are delighted that our partnership with MediaTek continues to deliver new and innovative mobile consumer products, extending our low-power and high-performance leadership in mobile devices.”

###

About MediaTek Inc.

MediaTek Inc. is a leading fabless semiconductor company for wireless communications and digital multimedia solutions. The company is a market leader and pioneer in cutting-edge SOC system solutions for wireless communications, high-definition TV, optical storage, and DVD and Blu-ray products. Founded in 1997 and listed on Taiwan Stock Exchange under the “2454” code, MediaTek is headquartered in Taiwan and has sales or research subsidiaries in Mainland China, Singapore, India, United States, Japan, Korea, Denmark, England, Sweden and Dubai. For more information, visit MediaTek’s website at www.mediatek.com.

Gameloft Modern Combat 5 True Octa Core vs Quad Core Comparison [techand trickz YouTube channel, Nov 26, 2013]

Gameloft teams up with MediaTek to unleash stunning graphical gameplay for Modern Combat 5 [MediaTek press release, Nov 18, 2013]

Gameloft to use latest True Octa-Core MT6592 to bring mobile gaming to the next level

Paris – November 18, 2013 – Gameloft, a leading global publisher of digital and social games, and MediaTek, a leading fabless semiconductor company specializing in wireless communications and digital multimedia solutions, announce that the hotly anticipated Modern Combat 5 will be optimized on the new MT6592 octa-core smartphone chip, for Android smartphones.The MT6592, MediaTek’s latest innovation, is the first true octa-core processor in the world, and Gameloft’s next title, Modern Combat 5, will be the first game optimized for the new chip. As mobile gaming moves forward highly detailed and realistic gameplay, the need for higher performance chipset is required. Specific features of the new Modern Combat 5 include definition levels not seen before, especially in the technically difficult mediums of water distortion effects, reflections and shadowing.

Modern Combat 5 is a fast-moving, visually exciting action game played across various terrains and conditions. MT6592 allows for continuous scrolling in high definition with attention to detail from soft particle display to enhanced depth of field to create a more immersive experience.

“We’re thrilled to expand our collaboration with MediaTek,” said Ludovic Blondel, Vice President OEM at Gameloft. “This new octa-core system on a chip is focused on high performance and is one of the best mobile technologies on today’s market. We are delighted to showcase this innovative, high-end technology in Modern Combat 5, one of our most awaited games of 2014.”

“With the rapid development of mobile Internet applications and services, mobile gaming has become one of the leading value-added services for our customers and the best medium to experience the power of True Octa-Core with our MT6592 chip,” said Jeffrey Ju, General Manager of MediaTek Smartphone Business Unit. “Our partnership with Gameloft on Modern Combat 5 is a major breakthrough for the industry and gaming community, as we empower the ultimate gaming experience that can be enjoyed anywhere, anytime.”

Modern Combat 5 will be available on all smartphone models equipped with the MT6592 chip, and will be available for download from the Google Play Store in early 2014.

###

About Gameloft

A leading global publisher of digital and social games, Gameloft® has established itself as one of the top innovators in its field since 2000. Gameloft creates games for all digital platforms, including mobile phones, smartphones and tablets (including Apple® iOS and Android® devices), set-top boxes and connected TVs. Gameloft operates its own established franchises such as Asphalt®, Order & Chaos, Modern Combat, and Dungeon Hunter, and also partners with major rights holders including Universal®, Illumination Entertainment®, Disney®, Marvel®, Hasbro®, FOX®, Mattel® and Ferrari®. Gameloft is present on all continents, distributes its games in over 100 countries and employs over 5,000 developers. Gameloft is listed on NYSE Euronext Paris (NYSE Euronext: GFT.PA, Bloomberg: GFT FP, Reuters: GLFT.PA). Gameloft’s sponsored Level 1 ADR (ticker: GLOFY) is traded OTC in the US.

Current (Dec 22, 2013) MT6592-based smartphones in PDAdb.net:

|

Coolpad 9976A ???

|

O2 Super K1 [RMB 2,199 – $362]

|

|

THL W11 Monkey King II

|

Uniscope XC2S

|

|

UMI X2S ???

|

|

Newman K18 16GB ???

|

Newman K18 32GB ???

|

|

Zopo ZP998 [internally as Zopo Black 2 for RMB 1,499 – $247]

|

|

Alcatel One Touch Idol X+ (TCL S960T) [RMB 1,999 – $329]

|

Huawei Ascend G750-T00 / Honor 3X / Glory 4

|

The case of the most ambitious newcomer, ZOPO:

Next Step of ZOPO-Return Banquet of Partners of ZOPO Draws to a Successful Conclusion [ZOPOMOBILE YouTube channel, Aug 31, 2013]

From: At August 30, 2013, Return Banquet of Partners(global Market) of Shenzhen ZOPO Communications-equipment Co., Ltd. was held at the The Pavilion Hotel, Shenzhen, China. More than 50 people attended this return banquet activity, including Mr. Kevin Xu, President of ZOPO Communications-equipment Co., Ltd., Mr. Allen Cao, senior manager, Mr Shawn Sun, executive director of zopomobileshop.com, and representatives of various reseller, such as dx.com, efox-shop.com, lightinthebox.com and other retail business.

The return banquet at afternoon started with Mr. Allen Cao, senior manager of international market, delivered his thanksgiving remarks to the guests on behalf of the ZOPO Communications-equipment Co., Ltd, thanking the partners of the various fields for their constant trust and support to ZOPO Communications-equipment Co., Ltd. He introduced to partners achievements of the accelerated development the ZOPO mobile phone business on global market in 2012 and 2013. ZOPO already have 4 official distributors in European: French, Germany, Italy, Spain. ZOPO also have built up strategic partnership with more then 10 E- business, such as zopomobileshop.com, pandawill.com, ebay, paypal, AliExpress and so on. Mr.Cao show special thanks to zopomobileshop.com team, appreciate Ms. Jessica Tang and Zopomobileshop team provide global customers a channel to understand ZOPO and the reliable service. Afterwards,Mr. Kevin Xu,President of the company introduced its direction for future development in becoming “ a reliable and professional smart phone supplier by providing users phone with the latest tech”. He confirms that ZOPO will be the first factory to release smart phone with 8 cores. Further more, the ZP980 and C2, will have a update to a 2rd generation version and a version with batter price come out soon. Then Mr. Jay Wang, CEO of Pandawill.com has a speech as partners representative.

Return banquet of partners of ZOPO communications-equipment CO.,Ltd. has been end of a dinner. Mr. Kevin Xu, President of ZOPO Communications-equipment Co., Ltd., Mr. Allen Cao, senior manager, drank with all guests, praying together for a bright and beautiful future. The party thus drew to its successful conclusion and happy wishes.

Zopo – Factory Testing of Zopo C2 Mobile Phone [Digital Playworld YouTube channel, July 31, 2013]

Zopo Factory Tour — How Popular Zopo 990, 980 Phones Be Made [Jody Elife YouTube channel, Nov 19, 2013]

ZOPO ZP998 AnTuTu Benchmark [ZOPOMOBILE YouTube channel, Dec 17, 2013]

ZOPO zp998 Octa Core NFC Test – Zopomobileshop [ZOPOMOBILE YouTube channel, Dec 17, 2013]

Pre-order ZOPO ZP998 FIRST TRUE 1.7GHz Eight-core 2GRAM+32 ROM MTK6592T 14.0MP CAMERA (Delivery after 30days)

Q3’13 smartphone and overall mobile phone markets: Android smartphones surpassed 80% of the market, with Samsung increasing its share to 32.1% against Apple’s 12.1% only; while Nokia achieved a strong niche market position both in “proper” (Lumia) and “de facto” (Asha Touch) smartphones

Details about Samsung’s strengths you can find inside the Samsung has unbeatable supply chain management, it is incredibly good in everything which is consumer hardware, but vulnerability remains in software and M&A [‘Experiencing the Cloud’, Nov 11, 2013] post of mine.

My findings supporting the above title:

- 205 million Android smartphones were delivered in Q3’13, representing 15.2% growth sequentially (Q/Q) and 67.3% growth relative to the same period of last year (Y/Y)

- Meanwhile the number of Apple iPhones shipped increased only to 33.8 million, growing by 8.3% sequentially (Q/Q), but still representing a 25.65% growth relative to the same period of last year (Y/Y)

- The shipment of “proper” smartphones from Nokia (S60/Symbian and Lumia/Windows Phone) increased to 8.8 million units, representing 18.9% growth sequentially (Q/Q) and 39.7% growth relative to the same period of last year (Y/Y)

- Meanwhile the shipment of “de facto” smartphones from Nokia (S60/Symbian, Lumia/Windows Phone and Asha Full Touch in S40 Series) increased to 14.7 million units, representing 25.6% growth sequentially (Q/Q) and 14.8% growth relative to the same period of last year (Y/Y). It is also important that the decline of Asha Full Touch after its peak of 9.3 million units sold in Q4’12 has been reversed with 5.9 million units shipped, representing a sizable 37.2% growth sequentially (Q/Q).

- The new (in Q3’13) Asha 501 became the most popular smartphone on the Indian market in the $60-80 price range (as per Flipkart, see above), successfully beating off the best competitive offerings from Samsung and the two leading local brands, Micromax and Karbonn. This is another positive sign of successfull revival of the Asha Touch platform started with Asha 501 (via the Asha Software Platform 1.0) as described in the New Nokia Asha platform for developers [‘Experiencing the Cloud’, May 9, 2013] and New Asha platform and ecosystem to deliver a breakthrough category of affordable smartphone from Nokia [‘Experiencing the Cloud’, May 9 – July 5, 2013] posts of mine. Everything is well represented by comparing the “micro reports” included into the bottom left corner of the overall chart a quarter ago and now:

- As one currently could see this Nokia (the devices part of it soon becoming the part of Microsoft*) could realise its goal of selling “100 million of the new generation Asha smartphones over the coming years, beginning with the Nokia Asha 501”. The Asha 500, Asha 502 and Asha 503 introduced in October 22 could already deliver a huge jump in shipments of “de facto smartphones” under Asha brand, helping to defend further and even improve Nokia’s market position against the sub $100 Android smartphones in Q4’13. Note also that Asha 500 was announced for $69 list price (before taxes or subsidies) which means that—depending on “race to the bottom” competition—could easily mean a street price of $60+ on the Indian market.

-

* See also the previous posts of mine:

– Unique Nokia assets (from factories to global device distribution & sales, and the Asha sub $100 smartphone platform etc.) will now empower the One Microsoft devices and services strategy [‘Experiencing the Cloud’, Sept 3 – Oct 23, 2013]

– Microsoft answers to the questions about Nokia devices and services acquisition: tablets, Windows downscaling, reorg effects, Windows Phone OEMs, cost rationalization, ‘One Microsoft’ empowerment, and supporting developers for an aggressive growth in market share [‘Experiencing the Cloud’, Sept 3 – Oct 23, 2013]

– Microsoft Nokia Transaction Conference Call with slides from Microsoft Strategic Rationale inserted-ebook – 3-Sept-2013 edited by Sándor Nacsa from those two sources into an ebook format PDF

– Leading edge Nokia phablets for both entertainment and productivity: Lumia 1320 targeting the masses at $339, and Lumia 1520 the imaging conscious business users and individuals at $749 [‘Experiencing the Cloud’, Oct 26, 2013] - The Asha Touch revival was also able to stop the decline of the overall Nokia “mobile phones” category (Nokia S30, S40, Asha and Asha Full Touch phones) exactly at 55.8 million units, the same number as for the Q1’13.

- In addition there are now the Leading edge Nokia phablets for both entertainment and productivity: Lumia 1320 targeting the masses at $339, and Lumia 1520 the imaging conscious business users and individuals at $749 [‘Experiencing the Cloud’, Oct 26, 2016].

- With that Nokia established a strong niche market position on both the $130+ market (starting with Lumia 520 sold at that price in India, also the most popular one on Flipkart for the the $80-160 price range of devices) and the sub $80 market against the onslaught of Android devices. The rest will depend now only on Microsoft.

Than for the lead smartphone market, i.e. Mainland China I will include here:

- China market: Smartphone sales top 93 million units in 3Q13, says Analysys [Digitimes, Nov 12, 2013]

There were 102.66 million handsets sold in the China market during the third quarter of 2013, growing 13.6% on quarter and 54.5% on year, of which 93.08 million units were smartphones, increasing 20.7% on quarter and 89.3% on year, according to China-based consulting company Analysys International.

While for the worldwide market:

- China-based smartphone vendors set to rise in 2013 rankings, says IC Insights [Digitimes, Nov 13, 2013]

Lenovo, ZTE, Huawei and Yulong/Coolpad have taken advantage of the surging low-end smartphone market. According to IC Insights, the four major China-based handset companies are forecast to ship 168 million smartphones in 2013 and together hold a 17% share of the worldwide smartphone market.

Lenovo, ZTE, Huawei and Yulong/Coolpad shipped a combined 98 million smartphones in 2012, a more than 300% surge from the 29 million units shipped in 2011, IC Insights disclosed. It should be noted that the China-based suppliers of smartphones are primarily serving the China and Asia-Pacific marketplace, and offer low-end models that typically sell for less than US$200.

Low-end smartphones are expected to represent just under one-third (310 million) of the total 975 million smartphones shipped in 2013. IC Insights forecast that by 2017, low-end smartphone shipments will represent 46% of the total smartphone market with China and the Asia-Pacific region to remain the primary markets for these low-end models.

Samsung Electronics and Apple are set to continue dominating the total smartphone market in 2013. The two vendors are forecast to ship 457 million units and together hold a 47% share of the total smartphone market in 2013, IC Insights said. In 2012, Samsung and Apple shipped 354 million smartphones and took a combined 50% share of the total smartphone market.

Nokia was third-largest supplier of smartphones behind Samsung and Apple in 2011, but has seen its share of the smartphone market fall. Nokia’s smartphone shipments are forecast to decline by another 4% and grab an only 3% share of the total smartphone market in 2013, IC Insights indicated.

Other smartphone producers that have fallen on hard times include RIM and HTC. While each of these companies had about a 10% share of the smartphone market in 2011, IC Insights estimated they will have only about 2% shares of the 2013 smartphone market.

-

Gartner Says Smartphone Sales Accounted for 55 Percent of Overall Mobile Phone Sales in Third Quarter of 2013 [press release, Nov 14, 2013]

– Western Europe Grew for the First Time this Year

– Lenovo Became the No. 3 Worldwide Smartphone Vendor for the First Time

Worldwide mobile phone sales to end users totaled 455.6 million units in the third quarter of 2013, an increase of 5.7 percent from the same period last year, according to Gartner, Inc. Sales of smartphones accounted for 55 percent of overall mobile phone sales in the third quarter of 2013, and reached their highest share to date.

Worldwide smartphone sales to end users reached 250.2 million units, up 45.8 percent from the third quarter of 2012. Asia/Pacific led the growth in both markets – the smartphone segment with 77.3 percent increase and the mobile phone segment with 11.9 percent growth. The other regions to show an increase in the overall mobile phone market were Western Europe, which returned to growth for the first time this year, and the Americas.

“Sales of feature phones continued to decline and the decrease was more pronounced in markets where the average selling price (ASP) for feature phones was much closer to the ASP affordable smartphones,” said Anshul Gupta, principal research analyst at Gartner. “In markets such as China and Latin America, demand for feature phones fell significantly as users rushed to replace their old models with smartphones.”

Gartner analysts said global mobile phone sales are on pace to reach 1.81 billion units in 2013, a 3.4 percent increase from 2012. “We will see several new tablets enter the market for the holiday season, and we expect consumers in mature markets will favor the purchase of smaller-sized tablets over the replacement of their older smartphones” said Mr. Gupta.

While Samsung’s share was flat in the third quarter of 2013, Samsung increased its lead over Apple in the global smartphone market (see Table 1). The launch of the Samsung Note 3 helped reaffirm Samsung as the clear leader in the large display smartphone market, which it pioneered.

Lenovo’s sales of smartphones grew to 12.9 million units, up 84.5 percent year-on-year. It constantly raised share in the Chinese smartphone market.

Apple’s smartphone sales reached 30.3 million units in the third quarter of 2013, up 23.2 percent from a year ago. “While the arrival of the new iPhones 5s and 5c had a positive impact on overall sales, such impact could have been greater had they not started shipping late in the quarter. While we saw some inventory built up for the iPhone 5c, there was good demand for iPhone 5s with stock out in many markets,” said Mr. Gupta.

In the smartphone operating system (OS) market (see Table 2), Android surpassed 80 percent market share in the third quarter of 2013, which helped extend its leading position. “However, the winner of this quarter is Microsoft which grew 123 percent. Microsoft announced the intent to acquire Nokia’s devices and services business, which we believe will unify effort and help drive appeal of Windows ecosystem,” said Mr. Gupta. Forty-one per cent of all Android sales were in mainland China, compared to 34 percent a year ago. Samsung is the only non-Chinese vendor in the top 10 Android players ranking in China. Whitebox Yulong [Coolpad] is the third largest Android vendor in China with a 9.7 percent market share in the third quarter of 2013. Xiaomi represented 4.3 percent of Android sales in the third quarter of 2013, up from 1.4 percent a year ago.

Mobile Phone Vendor Perspective

Samsung: Samsung extended its lead in the overall mobile phone market, as its market share totaled 25.7 percent in the third quarter of 2013 (see Table 3). “While Samsung has started to address its user experience, better design is another area where Samsung needs to focus,” said Mr. Gupta. “Samsung’s recent joint venture with carbon fiber company SGL Group could bring improvements in this area in future products.”

Nokia: Nokia did better than anticipated in the third quarter of 2013, reaching 63 million mobile phones, thanks to sales of both Lumia and Asha series devices. Increased smartphone sales supported by an expanded Lumia portfolio, helped Nokia move up to the No. 8 spot in the global smartphone market. But regional and Chinese Android device manufacturers continued to beat market demand, taking larger share and creating a tough competitive environment for Lumia devices.

Apple: Gartner believes the price difference between the iPhone 5c and 5s is not enough in mature markets, where prices are skewed by operator subsidies, to drive users away from the top of the line model. In emerging markets, the iPhone 4S will continue to be the volume driver at the low end as the lack of subsidy in most markets leaves the iPhone 5c too highly priced to help drive further penetration.

Lenovo: Lenovo moved to the No. 7 spot in the global mobile phone market, with sales reaching approximately 13 million units in the third quarter of 2013. “Lenovo continues to rely heavily on its home market, which represents more than 95 per cent of its overall mobile phone sales. This could limit its growth after 2014, when the Chinese market is expected to decelerate,” said Mr. Gupta.

With Android and forked Android smartphones as the industry standard Nokia relegated to a niche market status while Apple should radically alter its previous premium strategy for long term

Here is the chart reflecting the performance of the market-leading mobile phones upto Q2’13:

From this the most visible things are:

- Android and Android-forked (Xiaomi etc.) smartphones are the undisputed industry standards to dominate the market in years to come

- Both the Symbian to Windows Phone and S40 to Asha Full Touch smartphone platform transition strategies from Nokia could survive the continued Android onslaught but only in a niche market status

- There is no room for Apple’s further growth, and both the platform and the company could face a gradual decline in the smartphone market

My other observations about the state of the smartphone market after Q2’13 were already presented in the following posts:

- Superphones turning point: segment satured with Tier 1 globals while the Chinese locals are at less than 40% of the Samsung price [‘Experiencing the Cloud’, Aug 3, 2013] OR Samsung is leapfrogging Apple while the Chinese local brands are coming close to Samsung but at less than 40% price. Meanwhile the superphone segment of the market becomes saturated.

- Xiaomi, OPPO and Meizu–top Chinese brands of smartphone innovation [‘Experiencing the Cloud’, Aug 1, 2013]

- GiONEE (金立), the emerging global competitor on the smartphone market [‘Experiencing the Cloud’, July 22, 2013]

- Eight-core MT6592 for superphones and big.LITTLE MT8135 for tablets implemented in 28nm HKMG are coming from MediaTek to further disrupt the operations of Qualcomm and Samsung [‘Experiencing the Cloud’, July 20-29, 2013]

- China: Entry-level dual core IPS WVGA (480×800) smartphones $65+ now, quad-core $70+ in June [‘Experiencing the Cloud’, April 29, 2013]

In essence we came to a point when the superphone market came down in price to as low as $110 and up, while the entry-level segment of good quality came down to a $65+ price level. Also the smartphone market became saturated in all segments which brings an end to Samsung’s ability to base its premium profitability ambitions on smartphones alone (almost), as it was reflected in 20 years of Samsung “New Management” as manifested by the latest, June 20th GALAXY & ATIV innovations [‘Experiencing the Cloud’, July 2-26, 2013]:

… innovations in the broadest sense of the world: technology, hardware and software engineering and design, marketing in general and branding in particular etc.

Updates: Q2 record-high operating profit + smartphone worries deepen + overall business situation + nonproportionally high capex of the semiconductor business + the #2 capex beneficiary, the Display Panel Segment

These observations also led to much greater conclusions about the upcoming changes:

- China is the epicenter of the mobile Internet world, so of the next-gen HTML5 web [‘Experiencing the Cloud’, Aug 5, 2013]

- The Upcoming Mobile Internet Superpower [‘Experiencing the Cloud’, Aug 13, 2013]

Below I will assess the ‘Nokia Q2’13 market situation and changes’ as well as include ‘Gartner’s own assessment of the Q2’13 overall market situation and the changes’ to complete the picture.

Nokia Q2’13 market situation and changes:

Looking at the progress of Nokia Symbian to Windows Phone transformation Q2’13 was a straight continuation of the trends noted for Q1’13 in Nokia: Continued moderate progress with Lumia, urgent Asha Touch refresh and new innovations to come against the onslaught of unbranded Android and forked Android players in China and India [‘Experiencing the Cloud’, April 18, 2013] as you could also well observe from the chart included here as well:

Nokia was extensively discussing its Windows Phone transition in Nokia Corporation Interim Report for Q2 2013 and January-June 2013 [press release, July 18, 2013]:

-

Lumia Q2 volumes increased 32% quarter-on-quarter to 7.4 million units, reflecting strong demand from customers for a broadened Lumia product range.

-

Commenting on the second quarter results, Stephen Elop, Nokia CEO, said: “ … In our Smart Devices business unit, we continue to focus on delivering meaningful differentiation to consumers around the world. We are very proud of the recent creations by our Lumia team, from the Lumia 520 – our most affordable Windows Phone 8 product which has enjoyed a strong start in markets like China, France, India, Thailand, the UK, the US and Vietnam – to the Lumia 1020, our star imaging product which we unveiled to the world last week. Overall, Lumia volumes grew to 7.4 million in the second quarter, the highest for any quarter so far and showing increasing momentum for the ecosystem. During the third quarter, we expect that our new Lumia products will drive a significant part of our Smart Devices revenue.”

-

In the third quarter 2013, supported by the wider availability of recently announced Lumia products as well as recently announced Mobile Phones products, Nokia expects higher Devices & Services net sales, compared to the second quarter 2013.

-

The year-on-year decline in our Smart Devices volumes in the second quarter 2013 continued to be driven by the strong momentum of competing smartphone platforms and our portfolio transition from Symbian products to Lumia products. The decline was primarily due to lower Symbian volumes, partially offset by higher Lumia volumes. Our Symbian volumes decreased from 6 million units in the second quarter 2012 to approximately zero in the second quarter 2013. Our Lumia volumes increased from 4.0 million in the second quarter 2012 to 7.4 million in the second quarter 2013.

-

On a sequential basis, the increase in our Smart Devices volumes in the second quarter 2013 was due to higher Lumia volumes, as we started shipping the Lumia 520 and 720 in significant volumes. In the second quarter 2013, the vast majority of Smart Devices volumes were from Windows Phone 8-based Lumia products.

-