Home » Posts tagged 'Windows Phone 7'

Tag Archives: Windows Phone 7

Nokia’s non-Windows crossroad

Update: 3” display with 240 x 320 pixels, not AMOLED screen, 3.2 MP camera. More information:

– New Asha platform and ecosystem to deliver a breakthrough category of affordable smartphone from Nokia [‘Experiencing the Cloud’, May 9, 2013] my composite post of the all relevant launch information

– New Nokia Asha platform for developers [‘Experiencing the Cloud’, May 9, 2013] my composite post of the all relevant development platform information End of update

There was a question why I was so affirmative with the headline of Temporary Nokia setback in India [‘Experiencing the Cloud’, April 28, 2013]. The quite remarkable cross-platform development story for Nokia Asha current and future devices is the major part of my affirmative approach. Take a look and convince yourself as well!

Nokia’s cross-platform strategy is aimed at the following value proposition to developers (see in the “Nokia’s own Asha cross-platform efforts for developers (so far)” section):

Consider Co-Development, instead of classic “porting”

As the Category:Silverlight [Nokia Developer Wiki, April 22, 2013] is stating:

Deprecated Category. Please move any articles across to Category:XAML.

the below rumor about the upcoming on May 9th Asha 501, that its design will be like the Nokia Lumias, would mean that programatically the same XAML interface would be delivered by Nokia for a further enhanced Nokia Asha Touch S40 operating system. It is even more likely as the J2ME platform of the Nokia Asha Touch S40 operating system was a few days ago enhanced by the Lightweight User Interface Toolkit (LWUIT) in Nokia SDK 2.0 for Java™, and this is supported by the full cross-platform Codename One development kit from the same name 3d party company, who is also preparing a XAML based 1.1 version of this toolkit for Windows Phone 8/7 (and presumably for Windows 8 as well), thus allowing the same standard Java programming by providing (see in the “Codename One cross-platform offerings for Java developers” section):

1 Java API which is the same for J2ME, Android, iOS, RIM and Win8.

It could also be quite probable that Nokia’s own Asha cross-platform offerings will extended by C#/XAML oriented cross-platform toolkit[s] on May 9th. Then we will have a complete cross-platform story for Nokia’s non-Windows offerings. We’ll see.

Nokia launching Asha 501 on 9th May? [mobile indian, May 1, 2013]

Nokia has sent out press invites for an event on May 9, which could possibly be about Asha 501 launch, and we have strong reasons to believe so.

Nokia may probably launch new phone(s) in the Asha series lineup on May 9th, on which day Nokia has organized an event and has sent out invites to various media organisations. And while the invitation does not specify the subject of the launch, we are pretty sure about it being an Asha series phone as it has been sent by a team that looks after Asha lineup.

Probably, Nokia would launch the Asha 501 which has been in the news off late.

According to rumors, Nokia Asha 501 is to come with design like the Nokia Lumia phones.

Further the Asha 501 is said to come with a 5 megapixel camera with LED flash, and a slightly larger display than Asha 311 which has a 3 inch touchscreen. Most likely this handset will have at least a 1 GHz processor.

Nokia is reemphasizing on its Asha series of phones to strengthen its market hold. Recently Stephen Elop, Nokia’s chief executive officer, had also emphasized that saying, “We have to make sure the product portfolio is as competitive as possible. We are due for a significant refresh.”

#Breaking “Nokia 501” & “Nokia 210” Passed Testing Process by Directorate Post & Telecommunication Indonesia [nokianesia blog, April 9, 2013]

Today, April 09, 2013 Directorate Post & Telecommunication Indonesia publish 2 New Nokia devices which are already passed the testing process to get certification.

There are Nokia 501 RM-902 that should be (Maybe) The next generation of Nokia Asha and Nokia 210 RM 924 that Should be Nokia Asha 210.

Right know, we still don’t have any information about specification and information. We will post if there are any information about Nokia 501 and Nokia Asha 210.

Source postel.go.id

Compare Nokia Asha 501 vs Micromax A51 Bolt [91mobiles, March 16, 2013]

| Nokia Asha 501 – 3.5”, AMOLED capacitive touchscreen – 320 x 480 pixels – 1 GHz Processor – 512 MB RAM – 5MP rear camera with LED Flash – front camera – video recording – video playback – GPRS, EDGE, HSDPA/HSUPA, WiFi 802.11 b/g/n, Bluetooth, USB – Nokia Asha Touch OS |

Micromax A51 Bolt [$79+] – 3.5” , TFT LCD capacitive Touchscreen, 262K Colors – 320 x 480 pixels – 832 MHz, BCM21552 [ARM11] – 512 MB ROM, 256 MB RAM – 2MP rear camera with Flash – 0.2MP front camera – video recording: VGA @30fps – video playback: 720×486 – 3G/Bluetooth/Wi-Fi/USB – Android V2.3.7 (Gingerbread) |

Sections of this post:

– Codename One cross-platform offerings for Java developers

– Nokia’s own Asha cross-platform efforts for developers (so far)

Codename One cross-platform offerings for Java developers

Developers Guide [Version 1.0.1, Jan 24, 2013]

Introduction

Codename One is a set of tools for mobile application development that derive a great deal of its architecture from Java. It stands both as the name of the startup that created the set of tools and as a prefix to the distinct tools that make up the Codename One product.

The goal of the Codename One project is to take the complex and fragmented task of mobile device programming and unify it under a single set of tools, APIs and services to create a more manageable approach to mobile application development without sacrificing development power/control.

History

Codename One was started by Chen Fishbein & Shai Almog who authored the Open Source LWUIT project at Sun Microsystems starting at 2007. The LWUIT project aimed at solving the fragmentation within J2ME/Blackberry devices by targeting a higher standard of user interface than the common baseline at the time. LWUIT received critical acclaim and traction within multiple industries but was limited by the declining feature phone market.

In 2012 the Codename One project has taken many of the basic concepts developed within the LWUIT project and adapted them to the smartphone world which is experiencing similar issues to the device fragmentation of the old J2ME phones.

How Does It Work

Codename One has 4 major parts: API, Designer, Simulator, Build/Cloud server.

API – abstracts platform specific functionality

Designer – allows developers/designers to design the GUI/theme and package various resources required by the application

Simulator – allows previewing and debugging applications within the IDE

Build/Cloud server – the server performs the build of the native application, removing the need to install additional software stacks.

Limitations & Capabilities

J2ME & RIM are very limited platforms to achieve partial Java 5 compatibility Codename One automatically strips the Java 5 language requirements from bytecode and injects its own implementation of Java 5 classes. Not everything is supported so consult the Codename One JavaDoc when you get a compiler error to see what is available.

Due to the implementation of the NetBeans IDE it is very difficult to properly replace and annotate the supported Java API’s so the completion and error marking might not represent correctly what is actually working and implemented on the devices. However, the compilation phase will not succeed if you used classes that are unsupported.

Lightweight UI

The biggest differentiation for Codename One is the lightweight architecture which allows for a great deal of the capabilities within Codename One. A Lightweight component is a component which is written entirely in Java, it draws its own interface and handles its own events/states.

This has huge portability advantages since the same code executes on all platforms, but it carries many additional advantages.

The components are infinitely customizable just by using standard inheritance and overriding paint/event handling. Theming and the GUI builder allow for live preview and accurate reproduction across platforms since the same code executes everywhere.

…

Codename One Benchmarked With Amazing Results [Codename One – Reinventing the Mobile Development blog, Dec 7, 2012]

Steve Hannah who ported Codename One to Avian has just completed a set of benchmarks on Codename One’s iOS performance putting Codename One’s at 33% slower performance than native C and faster performance than Objective-C!

I won’t spoil his research results so please read his full post here.

A small disclaimer is that the Objective-C benchmark is a bit heavy on the method/message calls which biases the benchmark in our favor. Method invocations in Codename One are naturally much faster than the equivalent Objective-C code due to the semantics of that language.

With 100,000 SDK Downloads, Mobile Development Platform Codename One Comes Out of Beta With 1.0 Launch [Codename One – Reinventing the Mobile Development blog, Jan 29, 2013]

Tel Aviv, Israel – Mobile development platform Codename One is announcing the launch of its 1.0 version on Tuesday, January 29. After releasing in beta last June, Codename One – the first software development kit that allows Java developers to create true high performance native mobile applications across multiple mobile operating systems using a single code base – has garnered over 100,000 downloads and emerged as one of the fastest toolkits of its kind, on par with native OS toolkits.

The platform to date has been used to build over 1,000 native mobile applications and has been touted by mobile developers and enthusiasts as the best write-once-run-everywhere solution for building native mobile apps.

“I have been developing with Codename One for a couple of months now. When you line up all of the other options for development, whether native SDKs, Appcelerator, ADF or others, Codename One wins on almost every front,” said software developer Steve Hannah.

Codename One has received widespread, viral acclaim in technology and business media including InfoWorld, Slashdot, Hacker News, VentureBeat, Business Insider, The Next Web, Dr. Dobbs and Forbes, which named the company one of the 10 greatest industry disrupting startups of 2012.

“We have been thrilled with the success of our beta launch and are very excited to release the much-awaited 1.0 version,” said co-founder and CEO Shai Almog.

Almog, along with co-founder Chen Fishbein, decided to launch the venture after noticing a growing inefficiency within mobile application development. By enabling developers to significantly cut time and costs in developing native applications for iOS, Android, Blackberry, Windows 7 Phone and other devices, Almog and Fishbein hope to make mobile application development increasingly feasible.

The Java-based platform is open-source and utilizes lightweight technology, allowing it to produce unique native interfaces highly differentiated from competitive cross-platform mobile development toolkits, which typically use HTML5 or heavyweight technology.

By drawing all components from scratch rather than utilizing native widgets, Codename One enables developers to avoid fragmentation – a major hindrance found in the majority of competitors – and additionally allows accurate desktop simulation of mobile apps.

The startup’s founders are recognized for engineering Sun Microsystems’s famous Lightweight User Interface Toolkit, a mobile platform used by leading mobile carriers and industry leaders to this date.

Codename One is available for download free of charge.

About Codename One

Codename One, named by Forbes as “one of the 10 greatest industry disrupting startups of 2012,” is an Israel-based technology company that has created a powerful cross-platform software development kit for mobile applications. The technology enables developers to create native applications across multiple operating systems using a single code base. Codename One was founded by renowned software engineers Shai Almog and Chen Fishbein in 2012.

Windows Phone 8 And The State Of 7 [Codename One – Reinventing the Mobile Development blog, April 2, 2013]

Codename One’s windows phone port is close to a public release.A preliminary Windows Phone 8 build has been available on our servers for the past couple of days. We differentiate between a Windows Phone 7 and 8 version by a build argument that indicates the version (win.ver=8) this will be exposed by the GUI in the next update of the plugin. But now I would like to discuss the architecture and logic behind this port which will help you understand how to optimize the port and maybe even help us with the actual port.

The Windows Phone 7 and 8 ports are both based on the XMLVM translation to C# code, we picked this approach because all other automated approaches proved to be duds. iKVM which seems like the most promising option, isn’t supported on mobile so that only left the XMLVM option.

The Windows Phone 7 port was based on XNA (3d C# based API) which has its share of problems but was more appropriate to our needs in Codename One. Unfortunately Microsoft chose to kill off XNA for Windows Phone 8 which put us in a bit of a bind when trying to build the Windows Phone 8 port.

While externally Windows Phone 8 and 7 look very similar, their underlying architecture is completely different and very incompatible. You cannot compile a universal binary that will work on all of Microsoft’s platforms, so just to make order within this mess:

- Windows Phone 7 – based on the old Windows CE kernel. Allows only managed runtimes (e.g. C# not C++), graphics can be done using XAML or XNA (more on that later.

- Windows Phone 8 – based on an ARM port of Windows 8 kernel. Allows unmanaged apps (C# or C++) graphics can be done in XAML or Direct3D when using C++ (but not silverlight).

- Windows RT/Desktop – the full windows 8 kernel either for ARM or for PC. They are partially compatible to one another so I’m putting them together. This is actually pretty similar to the Windows Phone 8 port, but incompatible so a different build is needed and slightly different API usage.

As you understand we can’t use XNA since it isn’t supported by the new platforms, we toyed a bit with the idea of using Direct3D but integrating it with text input, fonts etc. seemed like a nightmare. Furthermore, doing another C++ port would mean a HUGE amount of work!

So Codename One is based on the XAML API. Most people would think of XAML as an XML based API, but you can use it from C# and just ignore most of the XML aspects of it which is what we need since our UI is constructed dynamically. However, this is more complicated than it seems.

To understand the complexity you need to understand the idea of a Scene Graph. If you used Codename One you are using a more immediate mode graphics API, where the paint method is invoked and just paints the component whenever its needed. This is the simplest most portable way of doing graphics and is pretty common, its used natively by Android, OpenGL, Direct3D etc. and is very familiar to developers.

In recent years many Scene Graph API’s sprung up, XAML is one of them and so is JavaFX, Flash, SVG and many others. In a Scene Graph world you construct a graphics hierarchy and then let it be rendered, the whole paint() sequence is hidden from the developer. The best way to explain it is that our components in Codename One are really a scene graph, only at a higher abstraction level. Windows/Flash placed the scene graph on the graphics as well, so to draw a rectangle you would just add it to the tree (and remove it when you no longer need it).

This is actually pretty powerful, you can do animations just by changing component values in trees and performance can be pretty spectacular since the paint loop can be GPU optimized.

However, the reality of this is that most developers find these API’s harder to work with (since they need to keep track of a rather complex unintuitive tree), the API’s aren’t portable at all since the hierarchies are so different. Performance is also very hard to tune since so much is hidden by the underlying hidden paint logic.

For Codename One this is a huge problem, we need our API to act as if its painting in immediate mode while constructing/updating a scene! When we initially built this the performance was indeed as bad as you might imagine. While we are not in the clear yet, the performance is much improved…

How did we solve this?

There are several different issues involved, the first is the number of elements on the screen. We noticed that if we have more than 200 elements on the screen performance quickly degraded. This was a HUGE problem since we have thousands of paint operations happening just in the process of transitioning into a new form. To solve this we associate every graphics component with a component and when the component is repainted we remove all operations related to it, we also try to reuse graphics resources such as images from the previous paint operation.

When painting a component in Codename One we normally traverse up the component tree and paint the first opaque component forward (known as painters algorithm) however, since the scene already has the parent component painting it again would result in many copies of the image being within the scene graph. E.g. I have a background image on a form, when painting a translucent label I have to paint the background image within a clipping region matching the label…. In the Windows Phone port we have a special hook that just disables this functionality, this hook alone pushed us over the top to reasonable graphics performance!

We are working on getting additional performance oriented features into place and fixing some issues related to this approach, its not a simple task since the API wasn’t designed with this in mind but it is doable. We would appreciate you taking the time to review the port

Build Java Application for Mobile Devices [Shai Almog YouTube channel, Jan 10, 2013]

Codename One Executive Overview [Shai Almog YouTube channel, Jan 6, 2013]

Developer Introduction To Codename One [Shai Almog YouTube channel, Jan 6, 2013]

Series 40 Webinar: LWUIT for Nokia Asha app development [nokiadevforum YouTube channel, April 16, 2013]

More information:

– Swing into Mobile – Use the Lightweight UI Toolkit on Nokia Series 40 phones [pp. 81–84 of Java Magazine, January/February 2013]

– LWUIT for Series 40 out of beta [Nokia Developer News, Feb 26, 2013]

Great news for those of you wanting to deliver superior UIs in your Series 40 apps— Lightweight UI Toolkit (LWUIT) for Series 40 has graduated from beta to a full initial release.

LWUIT is an open source Java ME toolkit that supports a comprehensive range of visual UI components, and other user interface elements such as theming, transitions, and animation among others. It helps you create applications with appealing UIs that closely follow the native Series 40 UIs. It also helps speed up development by significantly reducing the need to create custom UI components, which might be needed when creating an app’s UI using LCDUI. LWUIT for Series 40 can be used in combination with selected Nokia UI APIs and all the JSR APIs available on the platform.

Since the last LWUIT for Series 40 release made available in the Nokia SDK 2.0 for Java, development of the toolkit has been continuing at a rapid pace. A number of new APIs have been introduced, including PopUpChoiceGroup, ContextMenu, NokiaListCellRenderer, theme selection, and full-screen mode. There have also been significant improvements in performance, particularly in lists, themes loading, and HTMLComponent. Compatibility with the native full-touch UI has been fine-tuned and many bugs fixed, particularly in command handling and text input.

The toolkit also includes all the new examples created since the last release. These include code examples that provide demonstrations of the Category bar, gestures, and lists. There are also new application examples for birthdays, showing use of the calendar component and PIM API; a slide puzzle; tourist attractions, showing the use of HERE maps and in-app purchasing APIs; and a Reddit client showing the use of a custom theme and JSON. In addition, updated version of two of the original LWUIT examples applications, LWUITDemo and LWUITBrowser, are also included.

The final component in the full release of LWUIT for Series 40 is the inclusion of comprehensive documentation in the toolkit. This is based on the LWUIT Developer’s Library, a library consisting of:

Developer’s Guide, which is based on the original LWUIT Developer Guide and provides technical information about using the LWUIT components

LWUIT UX overview, which is a new section providing a guide to designing app UIs with LWUIT for Series 40 components

If you have the Nokia SDK 2.0 for Java installed, you will receive an automatic notification of the availability of LWUIT for Series 40 1.0. You can then simply follow the instructions to install the update. If you are using LWUIT with the Nokia SDK 1.1 for Java, you can download the update from LWUIT for Series 40 project.

J2ME, Feature Phones & Nokia Devices [Codename One – Reinventing the Mobile Development blog, April 24, 2013]

Is J2ME dead or dying?

How many times have we heard this for the past 3 years or so? Sadly the answer is: Yes!

Unfortunately there is no active owner for the J2ME standard and thus no new innovation around J2ME for quite some time (MIDP 2.0 came out in 2004, 3.0 never really materialized). Android is/was the biggest innovation since and became the unofficial successor to J2ME.

Well, if J2ME is dead what about Feature Phones? Should we care about them?

The answer is: Yes! very much so!

Features Phones are still selling in millions and still beats Android sales in the developing world. Recently Nokia shipped the Asha series devices which are quite powerful and capable pieces of hardware, they are very impressive. Nokia’s revenue is driven mainly by the Feature Phone market.

There is a real battle in the developing countries between Feature Phones and Android devices, Feature Phones are still cheaper and more efficient where Android has more/better content (apps & games).

How long will it take Android to catch up? we will see…

In the meantime there is money on the table and a real opportunity for developers to make some money (and gain loyal users who will migrate to Android or other platform at some point)

To win over the competition or at least to maintain its dominate player position Nokia must bring new quality content to the devices, it’s not enough to ship cool new feature phones, the new phone needs to connect to facebook, twitter, gmail, whatsapp and have all the new cool games/apps Android has and more.

So how should you write your apps for the cool new Nokia Feature Phone if J2ME is dead? Luckily there is an option Codename One ;-).

In Codename One You have 1 Java API which is the same for J2ME, Android, iOS, RIM and Win8.

Below are some of the J2ME highlights:

Facebook Connect – did you noticed there aren’t many social apps on OVI?

There is a reason Facebook uses oauth2 which is a huge pain without a browser API, this is solved and working in Codename One.

Java 5 features – You can use generics and other Java 5 features in your app and it will work on your J2ME/RIM devices. You don’t have to limit yourself to CLDC.

Rich UI – If you know or knew LWUIT (Swing like API), well Codename One UI is effectively LWUIT 2.0.

Built in Asha skins and themes

The most important thing is the fact that your skills are not wasted on an old/dying J2ME API, by joining our growing community and writing the next amazing app your skills can target the emerging platforms of the present/future.

Codename One JavaOne Session Screencast [Shai Almog YouTube channel, Oct 25, 2012]

Nokia’s own Asha cross-platform efforts for developers (so far)

Series 40 Webinar: How to develop cool apps for Nokia Asha smartphones [nokiadevforum YouTube channel, April 5, 2013]

[25:01] Porting Resources at Nokia Developer

– Porting and Guide for Android Developers:

>>> http://www.developer.nokia.com/Develop/Porting/ [27:46]

Related to the porting vis-à-vis Android & cross-platform slides:

[27:46 > 28:50 > 29:40 > 30:20 > 30:50 > 31:15 > 31:40 > 32:25 > 33:20 Demo: Android porting Frozen Bubble: see https://projects.developer.nokia.com/frozenbubble and the video coming below > 34:24]

Tantalum Mobile [January 1, 2013] Summary

Tantalum is mobile Java tools for high performance and development speed on Android and J2ME. The focus is on practical use cases which can be included in a project to solve frequent needs in an elegant manner.

Life is many asynchronous tasks chained together and running concurrently on background threads with UI callbacks. The result may look like black magic or star wars, but as you become one with the source, the patterns emerge as ecstatic moments of clarity.

Tantalum Cross Platform Library

Tantalum 5 is nearing beta release

As the Tantalum team works hard on the new Tantalum 5 release and increasing support to the Android community, you can track that and possibly help at https://github.com/TantalumMobile/ More on that and the great support Nokia is giving to this open source effort as we release- happy changes and momentum.

* NEW 4.0 RELEASE January 1, 2013 *

New release 4.0 including cross-platform Android and J2ME app development support, simple fork-join concurrency, simple 3 layer caching and Android AsyncTask and more is now available!

Quick Start Guide and JAVADOC: Tanalum4_doc.zip

Source code and examples: Tantalum4.zip

Cross platform Series40-Android example using Tantalum4: Picasa_Viewer

JavaOne San Francisco talk and demos of Tantalum4: JavaOne_Extreme_Mobile_Java_Performance.mp4

Tantalum is a light-weight metal used used to keep mobile phone electronics compact and powerful. Tantalum4 is the 4th major release of a very light and elegant back end utility library for mobile java. With mobile applications, less is more.

This is _not_ a framework. It is a clean and light tool set which at 8-40kB it will _not_ bloat your application. Obfuscation of your release build automatically removes those features you do not use. We do just a few things really well:

The exact same JAR library runs on J2ME and Android– save time and money by reusing your code and add a native UI for each platform

Clean, fast utility model threading with Java7 fork-join-cancel and Android Java5 AsyncTask patterns

Unique async task chaining to feed the output of one Task to the input of the next is easier than overriding existing classes

WeakReference heap and persistent flash memory caching to easily make online-offlne apps which start fast and run reliably in real world mobile networks

Async HTTP GET and POST with automatic retry

Simplified async XML parsing directly into model objects

Simplified async JSON parsing directly into model objects

Logging convenience classes including J2ME USB debug and app profile from phone

The above capabilities work cleanly together to simplify your development. There is no UI assumption in Tantalum4– pick what works best for you on each platform. The bundled example applications are an RSS reader for

Forms

Nokia Series40 Asha touch devices

LWUIT 1.5

Download the sample apps and give a try. We hope you are amazed at the results and speed with which you can achieve them.

Apache 2 license. Please return your fixes and suggestions to the community here.

* NEW 3.0 RELEASE June 18, 2012 *

WHAT IS NEW

Many, many stability improvements, especially to caching and flash memory usage

Shutdown work tasks and low-priority work tasks are now supported

Support for Nokia LWUIT in the example applications

Support for Nokia full touch phones in the example applications.

Speed. Tantalum3 is wired and optimized even more than before to run well also on slower devices.

You can find a series of nice, short training videos covering Tantalum3 athttps://projects.developer.nokia.com/videotraining

CONTENTS OF THE ARCHIVE (Download link on right side of this page)

/prebuilt_examples

Pre-built example applications, run to test on various devices. Testing is mostly on Nokia SDK 1.1 and 2.0 with profiling of the S40 example tested in Oracle SDK.

/lib

Pre-built libraries you can include in your application if you don’t want to mess with the source code. There are three flavors: debug including unit tests and verbose errors, usb-debug, and release optimized. To use the usb-debug variant, connect your phone by USB and open a terminal emulator such as puttytel to the serial port you find in Window Device Manager. Use max baud rate and hardware flow control RTS/CTS.

/src

Everything you need to build the libraries and examples yourself

/doc

Javadoc for Tantalum3 library

/json_doc

Javadoc for the optional JSON suppliment

* NEW 2.2 RELEASE February 7 2012 *

Example updates with minor bug fix, reorganization of the source into 3 projects make release builds easier, added unit tests.

* NEW 2.1 RELEASE January 24 2012 *

Latest announcements

Tantalum 4 is out! – January 7th, 2013 by paul.houghton

Tantalum 4, almost ready… – December 11th, 2012 by paul.houghton

See all announcements >

Related videos:

– Series 40 Webinar: Porting Android apps to the Series 40 platform [nokiadevforum YouTube channel, Dec 17, 2012]

– Porting Android and Blackberry apps to Series 40 [Nokia Developer News, Nov 30, 2012]

If you’ve got an application for Android or BlackBerry (up to BlackBerry OS 7.1), your existing Java code puts you in a great position to take advantage of the growing demand for apps from Series 40 phone owners.

To help you take advantage of this opportunity, we’ve started to gather a collection of resources to guide you through the porting process in the Porting to Series 40 library section.

If you are starting with an Android app, the wiki provides basic information on the tools and technology needed, platform comparisons, porting considerations, code snippets, and example porting cases along with the all-important guidelines you need for an efficient port.

For your future apps, you can even consider creating a Series 40 and Android version at the same time, our Picasa Viewer example application will show you how.

If a little hands-on guidance could help even more, why not check out the Android porting webinar sessions we have on 4 December at 8 a.m. San Francisco; 10 a.m. Mexico City; 4 p.m. London and 13 December, 8 a.m. London; 1:30 p.m. New Delhi; 4 p.m. Singapore.

Life could be even easier if you have a BlackBerry app. Most generic Java ME MIDlets can be deployed to both BlackBerry and Series 40 with little more than platform-specific repackaging. However, you might want to adapt the user interface and the look & feel of the app to fit to Series 40 screen-size and UI style. Again, the wiki gives you a pointer to the porting article with code samples that will be enhanced for the later updates of the library.

You can also get practical guidance from an expert, check out our BlackBerry porting webinar on 18 December, 8 a.m. London; 1:30 p.m. New Delhi; 4 p.m. Singapore or view a recording of one of the earlier sessions on our webinars page.

Using our latest Nokia SDK 2.0 for Java, and its integrated Nokia IDE for Java ME, combined with the guidance of the updated porting library, we think you’ll find porting your app easier than you ever imagined.

We’re looking forward to welcoming you to the family of developers who have found success on the Series 40 platform.

– Designing & Optimising Graphics for your Series 40 app [nokiadevforum YouTube channel, Nov 8, 2012] https://projects.developer.nokia.com/frozenbubble

– UI Clinic – Series 40 full touch, April 2013 [nokiadevforum YouTube channel, April 24, 2013]

– Introduction to the Nokia Premium Developer Program for Asha [nokiadevforum YouTube channel, April 19, 2013]

Asha Premium Developer Program introduced [Nokia Developer News, March 26, 2013]

We’ve been having a lot of fun lately—we launched the Nokia Premium Developer Program for Lumia back in October, and it proved to be our most successful developer program ever. Our rewards program, DVLUP, has also proven extremely popular with developers, and we recently expanded it to include developers in the UK.

So we decided it was time to bring some “Premium goodness” to Asha development. Today we are excited to introduce the Nokia Premium Developer Program for Asha.

The Asha Opportunity

The Asha ecosystem has a growing installed base of superior but affordable smartphones (such as the Nokia Asha 308, 310, and 311), and with these great devices comes an increased demand for apps. The Asha Premium Developer Program is designed to provide you with tools and services to make developing for Asha faster and easier, increase the discoverability of your apps, and bring you closer to the millions of Nokia Asha users around the world.

By providing you with high-value support and tools beyond what’s provided by your standard registration with Nokia Developer, the Asha Premium Developer Program will help you fast-track your success.

The Nokia Premium Developer Program for Asha comprises two levels: enhanced productivity tools and app promotion opportunities. We know that it’s easier not only to be inspired but also to develop and test when you have a great device in hand, so the productivity tools start with a free Nokia Asha 310 smartphone. To help you with testing, we’re also offering expanded Remote Device Access with more Nokia Asha devices available to you. Finally, you’ll get two free tech tickets for Asha development support, a value of $198 (USD).

Program members who submit a new, high quality full touch Asha app to Nokia Store can apply for app promotional opportunities: greater visibility on Nokia Store, or a $500 (USD) credit to run paid ad campaigns on Nokia Ad Exchange.

Best of all membership in the Nokia Premium Developer Program for Asha is free, although you’ll need to meet certain criteria.

Explore the Nokia Premium Developer Program for Asha, and apply for membership today.

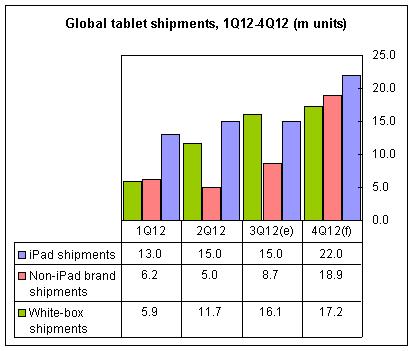

Boosting both the commodity and premium brand markets in 2013 with much more smartphones and tablets while the Windows notebook shipments will shrink by 2%

This is my conclusion after reviewing

- The ongoing trends in the commodity and premium brand ecosystems of Android devices:

– Smartphones

– Tablets

and

- The emerging new trends in the premium ecosystem of the Windows devices:

– Notebooks

– Smartphones

as reported by the most knowledgeable sources.

Updates: – ODMs see weaker profits from tablet business [DIGITIMES, March 26, 2013]

As Google and Amazon reportedly will release their next-generation 7-inch entry-level tablets in the near future, sources from the upstream supply chain have estimated that related ODMs’ profits from these tablets will be about 20% less than those from notebooks.

Since tablets have a simpler design than notebooks, the ODMs are only able to earn about US$9-10 for each tablet made, lower than US$13-20 for notebooks.

In addition, fewer components needed means that ODMs will have difficulties using their purchasing advantages to earn profits, and tablet brand vendors’ demand for specific components will also impact the makers’ profits, the sources noted.

Seeing weak growth in the notebook industry, most ODMs have turned to place their focuses on the tablet market and are competing aggressively for orders through price cuts, the sources said.

– Wintel camp mulls measures to rekindle weakening notebook industry [DIGITIMES, Feb 21, 2013]

Suppliers within the Wintel camp are mulling to launch a series of measures, including price cuts for their products, in the second quarter of 2013 to rekindle the stymied notebook industry caused by growing popularity of tablets, according to industry sources.

The launch of Windows 8 has failed to ignite replacement demand for notebooks in the end markets, resulting in a prolonged inventory adjustment process at the supply chain that has been going on since the third quarter of 2012, the sources noted.

With market reports indicating that global tablet shipments are likely to reach 200-300 million units in 2013, including 150 million units in China and other emerging markets, notebook vendors will see their market share continue to be eroded by tablets, commented the sources.

While agreeing to the consensus that price-cutting will be the only way to stimulate notebook demand, related PC chip suppliers are urging the major players in the Wintel camp, mainly Intel and Microsoft, to take the lead in action so that the entire supply chain can follow.

The Wintel camp has always chosen to start cutting their product prices in the third quarter each year, noted the sources, but it would be too late to safeguard the notebook industry as well as its supply chain if Intel and Microsoft do not take actions till the third quarter this year.

Since Intel usually will cut significantly its CPU prices prior to the launch of new models, the planned launch of Haswell platform in June may persuade the chip giant to lower the quotes for its Ivy Bridge family CPUs earlier, the sources revealed.

But it remains to be seen if price cuts by Intel alone could stir up notebook replacement demand amid the squeezing-out effect triggered by the rise of tablets, mobile phones and other mobile Internet devices, commented the sources.

End of updates

Before reading the sections of this post corresponding to the above, do not forget to read my own analytical posts which are based on the new product directions and supporting SoC trends (and as such predicting the year 2013 market even better than the external analyses quoted here which are mainly based on supply chain trends and market changes observed already in 2012):

– $48 Mogu M0 “peoplephone”, i.e. an Android smartphone for everybody to hit the Chinese market on November 15 [Nov 9, 2012]

– Lowest H2’12 device cost SoCs from Spreadtrum will redefine the entry level smartphone and feature phone markets [July 26 – Nov 9, 2012]

– The low priced, Android based smartphones of China will change the global market [Sept 10-26, 2012]

– Unique differentiators of Nokia Lumia 920/820 innovated for high-volume superphone markets of North America, Europe and elsewhere [Sept 6 – Nov 13, 2012]

– With Asha Touch starting at $83 and Lumia at $186 Nokia targeting the entry-level and low-end smartphone markets [Nov 1, 2012]

– Boosting the MediaTek MT6575 success story with the MT6577 announcement – UPDATED with MT6588/83 coming early 2013 in Q42012 and 8-core MT6599 in 2013 [June 27, July 27, Sept 11-13, Sept 26, Oct 2, 2012]

– MT6577-based JiaYu G3 with IPS Gorilla glass 2 sreen of 4.5” etc. for $154 (factory direct) in China and $183 [Sept 13, 2012]

– China’s HW engineering lead: The Rockchip RK292 series (RK2928 and RK2926) example [Oct 27, 2012]

– Nexus 7: Google wanted it in 4 months for $199/$245, ASUS delivered + Nexus Q (of Google’s own design and manufacturing) added for social streaming from Google Play to speakers and screen in home under Android device control [June 28, 2012]

– Giving up the total OEM reliance strategy: the Microsoft Surface tablet [June 19 – July 30, 2012]

– ASUS: We are the real transformers, not Microsoft [Oct 17, 2012]

– Microsoft Surface: its premium quality/price vs. even iPad3 [Oct 26, 2012]

– BUILD 2012: Notes on Day 1 and 2 Keynotes [Oct 31, 2012]

– Acer Iconia W510: Windows 8 Clover Trail (Intel Z2760) hybrid tablets from OEMs [Oct 28, 2012]

– Microsoft Surface with some questions about the performance and smoothness of the experience [Nov 12, 2012]

Update: The sections of this post are somewhat taking into the account the most dramatic disruption in the whole history of ICT, what I am calling the ‘ALLWINNER PHENOMENON’ (all ‘Allwinner et al phenomenon’ sometimes when including Allwinner’s internal mainland China competitors such as Rockchip into account as well). EVERYBODY SHOULD BE AWARE of the fact, however, that even in the latest forecasts by bigname ICT market researchers the ‘Allwinner phenomenon’ is not taken into account at all. The two very recent updates from IDC given below should therefore be read with that in mind as the ‘Allwinner phenomenon’ will add hundreds of millions to those forecasts starting as early as in 2013. Especially the numbers for the tablets will be affected. To understand more about that please read my special posts given in a newly created blog about the ‘Allwinner phenonmenon’:

– Allwinner A31 SoC is here with products and the A20 SoC is coming [Dec 10, 2012]

– Is low-cost enough for global success? [Dec 5, 2012]

– The upcoming Chinese tablet and device invasion lead by the Allwinner SoCs [Dec 4, 2012]

– $40 entry-level Allwinner tablets–now for the 220 million students Aakash project in India [Dec 4, 2012] from this alone 220 million additional tablets would have been delivered from 2013 to 2016

– USD 99 Allwinner [Nov 30, 2012]

– It’s a Strategic Inflection Point [Dec 1, 2012]

Update: HTC 1Q13 smartphone shipments to grow slower than expected, say sources [DIGITIMES, Dec 18, 2012]

Affected by the launch of iPhone 5 and rapidly declining smartphone prices in China, HTC reportedly has revamped its product roadmap for 2013 and is expected to see its smartphone shipments rise 10-15% sequentially in the first quarter of the year compared to a 20-30% growth projected previously, according to industry sources.

HTC has suspended development of a number of new models for 2013, reducing the visibility of its orders for handset components, the sources revealed.

HTC declined to comment on market speculation.

However, the industry watchers believe that HTC is heading for a bumpy road ahead, since shipments of its Windows Phone 8-based smartphones have not been as strong as expected, while Apple’s iPhone 5 and Samsung Electronics’ Galaxy III have continued to enjoy brisk sales.

In China, HTC is facing cut-throat competition from local white-box smartphone vendors and has been forced to enter the sub-CNY2,000 (US$321) segment, which runs counter to its established policy focusing mainly on the high-end sector, said the sources.

Update: Worldwide Smart Connected Device Market, Led by Samsung and Apple, Grew 27.1% in the Third Quarter, According to IDC [IDC press release, Dec 10, 2012]

The worldwide smart connected device market – a collective view of PCs, tablets, and smartphones – grew 27.1% year-over-year in the third quarter of 2012 (3Q12) reaching a record 303.6 million shipments valued at $140.4 billion dollars. Expectations for the holiday season quarter are that shipments will continue to reach record levels rising 19.2% over 3Q12 and 26.5% over the same quarter a year ago. According to the International Data Corporation (IDC) Worldwide Quarterly Smart Connected Device Tracker, 4Q12 shipments are expected to reach 362.0 million units with a market value of $169.2 billion dollars. Holiday season growth will be driven by tablets and smartphones, which are expected to grow 55.8% and 39.5% year-over-year respectfully, while PCs are expected to decline slightly from this quarter a year ago.

From a vendor perspective, Samsung maintained the top position in 3Q12 with 21.8% market share based on shipments. Apple, which ranked second overall in shipments, led all vendors in value with a total of $34.1 billion in 3Q12 and an average selling price (ASP) of $744 across all device categories. Following Samsung’s 21.8% share and Apple’s 15.1% share were Lenovo (7.0%), HP (4.6%), and Sony (3.6%). While Samsung, Apple, and Lenovo have all grown share over the past year, HP, which is virtually non-existent in the mobile space, has dropped its share from 7.4% in 3Q11 to 4.6% in 3Q12 with shipments declining -20.5% during that time.

“The battle between Samsung and Apple at the top of the smart connected device space is stronger than ever,” said Ryan Reith, program manager, Worldwide Mobile Device Trackers at IDC. “Both vendors compete at the top of the tablet and smartphone markets. However, the difference in their collective ASPs is a telling sign of different market approaches. The fact that Apple’s ASP is $310 higher than Samsung’s with just over 20 million fewer shipments in the quarter speaks volumes about the premium product line that Apple sells.”

Looking forward, IDC expects the worldwide smart connected device space will continue to surge well past the strong holiday quarter and predicts shipments to surpass 2.1 billion units in 2016 with a market value of $796.7 billion worldwide. IDC’s research clearly shows this to be a multi-device era, although market dynamics are shifting in terms of product category. In 2011, PC’s – a combination of desktop and portable PCs – accounted for 39.1% of the smart connected device market. By 2016 it is expected to drop to 19.9%. Smartphones will be the preferred product category with share growing from 53.1% in 2011 to 66.7% in 2016. Tablets will also grow significantly with share growing from 7.7% in 2011 to 13.4% in 2016. The shift in demand from the more expensive PC category to more reasonably priced smartphones and tablets will drive the collective market ASP from $534 in 2011 to $378 in 2016.

“Both consumers and business workers are finding the need for multiple ‘smart’ devices and we expect that trend to grow for several years, especially in more developed regions,” said Bob O’Donnell, program vice president, Clients and Displays. “The advent of cloud-based services is enabling people to seamlessly move from device to device, which encourages the purchase and usage of different devices for different situations.”

Top 5 Smart Connected Device Vendors, Shipments, and Market Share, Q3 2012 (shipments in millions)

Vendor

3Q12 Unit Shipments

3Q12 Market Share

3Q11 Unit Shipments

3Q11 Market Share

3Q12/3Q11 Growth

Samsung

66.1

21.8%

33.5

14.0%

97.5%

Apple

45.8

15.1%

33.1

13.9%

38.3%

Lenovo

21.1

7.0%

13.2

5.5%

60.0%

HP

14.0

4.6%

17.6

7.4%

-20.5%

Sony

11.0

3.6%

8.7

3.7%

25.4%

Other

145.6

48.0%

132.7

55.6%

9.7%

Total

303.6

100.0%

238.9

100.0%

27.1%

Source: IDC Worldwide Quarterly Smart Connected Device Tracker, December 10, 2012.

Smart Connected Device Market by Product Category, Shipments, Market Share, 2012-1016 (shipments in millions)

Product Category

2016 Unit Shipments

2016 Market Share

2012 Unit Shipments

2012 Market Share

2016/2012 Growth

Desktop PC

151.0

7.2%

149.2

12.5%

1.2%

Portable PC

268.8

12.8%

205.1

17.2%

31.1%

Smartphone

1405.3

66.7%

717.5

60.1%

95.9%

Tablet

282.7

13.4%

122.3

10.2%

131.2%

Total

2107.8

100.0%

1194.0

100.0%

76.5%

Source: IDC Worldwide Quarterly Smart Connected Device Tracker, December 10, 2012.

Update: IDC Raises Tablet Forecast for 2012 and Beyond As iOS Picks Up Steam, Android Gains Traction, and Windows Finally Enters the Market [IDC press release, Dec 5, 2012]

A strong competitive landscape—including surging Android tablet shipments and robust demand for Apple’s new iPad mini—has led International Data Corporation (IDC) to increase its 2012 forecast for the worldwide tablet market to 122.3 million, up from its previous forecast of 117.1 million units. In the latest forecast update of the Worldwide Quarterly Tablet Tracker, IDC also raised its 2013 forecast number to 172.4 million units, up from 165.9 million units. And by 2016 worldwide shipments should reach 282.7 million units, up from a previous forecast of 261.4 million units.

“Tablets continue to captivate consumers, and as the market shifts toward smaller, more mobile screen sizes and lower prices points, we expect demand to accelerate in the fourth quarter and beyond,” said Tom Mainelli, research director, Tablets at IDC. “Android tablets are gaining traction in the market thanks to solid products from Google, Amazon, Samsung, and others. And Apple’s November iPad mini launch, along with its surprise refresh of the full-sized iPad, positions the company well for a strong holiday season.”

In addition to increasing the unit totals for 2013, IDC also updated its operating system splits for the year to reflect Android’s growing strength in the tablet market. IDC now expects Android’s worldwide tablet share to increase from 39.8% in 2011 to 42.7% for the full year of 2012. During that same time Apple’s share will slip from 56.3% in 2011 to 53.8% in 2012. Long term, IDC predicts Windows-based tablets (including Windows 8 and Windows RT) will grab share from both iOS and Android, growing from 1% of the market in 2011 to 2.9% in 2012, on its way to 10.3% in 2016.

“The breadth and depth of Android has taken full effect on the tablet market as it has for the smartphone space,” said Ryan Reith, program manager for IDC’s Mobile Device Trackers. “Android tablet shipments will certainly act as the catalyst for growth in the low-cost segment in emerging markets given the platform’s low barrier to entry on manufacturing. At the same time, top-tier companies like Samsung, Lenovo, and ASUS are all launching Android tablets with comparable specs, but offered at much lower price points.”

Once again, IDC’s increase in tablet shipments comes at the expense of eReaders. IDC lowered its forecast for eReaders for 2012 and beyond. While the front-lit eReader offerings from Amazon and Barnes & Noble have captured the interest of a subset of consumers who prefer a dedicated eReader, most buyers are gravitating toward multi-use tablet products and finding a ‘good enough’ reading experience on these traditional back-lit tablets. IDC now expects 2012 eReader shipments to top out at 19.9 million units, down from the 27.7 million units that shipped in 2011.

Tablet Operating Systems, Market Share Forecast and CAGR 2012-2016

Tablet OS

2012 Market Share

2016 Market Share

CAGR 2012 – 2016 (%)

iOS

53.8%

49.7%

20.9%

Android

42.7%

39.7%

21.0%

Windows

2.9%

10.3%

69.2%

Other

0.6%

0.3%

7.7%

Grand Total

100.0%

100.0%

23.3%

Source: IDC Worldwide Quarterly Tablet Tracker, December 5, 2012

Table Notes:

- Windows shipments include Windows RT, Windows 8, and Windows 7 tablets.

- Shipments include shipments to distribution channels or end users. OEM sales are counted under the vendor/brand under which they are sold.

The ongoing trends in the commodity

and premium brand ecosystems of Android devices

Smartphones

Motorola likely to bid farewell to Taiwan handset ODMs after Google sells plants to Flextronics [DIGITIMES, Dec 17, 2012]

The partnerships between Motorola Mobility and Taiwan-based handset ODMs such as Foxconn International Holdings (FIH) will begin to fade away, as Google, the parent company of Motorola, has signed an agreement to hand over Motorola’s manufacturing operations in Tianjin, China, and Jaguariuna, Brazil to Flextronics International, according to industry sources.

After the deal between Google and Flextronics is completed in the first half of 2013, Motorola will completely withdraw from the handset manufacturing industry, and instead will transform to a brand operator targeting mainly the mid-range to high-end smartphone segment, the sources indicated.

While the streamlining of Motorola’s operations comes as no surprise to Taiwan handset ODMs, Google’s decision to sell Motorola’s plants to Flextronics, instead of its long-tern partner FIH, has raised concerns among the industry.

Flextronics is purchasing the plants in exchange for orders from Motorola since the Singapore-based EMS giant has made little progress in gaining handset orders from Apple or major players in the Android or Windows Phone camps, the sources commented.

It is also no longer necessary for FIH to buy plants in exchange for orders, as the company has transferred from handset EMS operations to focus on smartphone ODM business, indicated the sources, adding that FIH has also managed to establish partnerships with a number of major players in the smartphone sector.

However, a deepened cooperation between Motorola and Flextronics may affect the handset component supply chain in Taiwan, the sources warned.

Digitimes Research: Android phones to account for 70% of global smartphone market in 2013 [DIGITIMES Research, Dec 6, 2012]

Android will further solidify its market leadership in the smartphone operating system race in 2013, thanks to a broad support from smartphone vendors and the rollout of a wide range of low-priced models for sale in emerging markets. Shipments of Android phones are expected to top 600 million units or over 70% of global smartphone shipments in 2013, Digitimes Research estimates.

iOS will trail Android to take the number two position in the OS ratings with a 20% share, while other smartphone platforms will share the remaining 10%.

Shipments of Windows Phones, including 7.x and 8.x models, will grow 150% on year to 52.5 million units in 2013 for a 6.1% share, followed by RIM’s BlackBerry devices with a 3.7% share, Digitimes Research estimates. Other platforms, including Tizen and Firefox, will take up a portion lower than 1%.

Digitimes Research: Global smartphone shipments to grow 30% in 2013 [DIGITIMES Research, Nov 19, 2012]

Global smartphone shipments are expected to grow 30% to 865 million units in 2013, accounting for 43.9% of total handset shipments in the year, Digitimes Research has estimated.

Factors including relationships between platform providers and hardware makers, support from telecom carriers for new models, and key developments or decisions by some vendors will affect smartphone sales in 2013, Digitimes Research believes.

Google is expected to further strengthen its control over the Android ecosystem and its production partners, which may limit the development of other platforms or variant Android models.

Microsoft’s launch of own-brand smartphones may result in a reduction in support for the Window Phone platform by hardware vendors, which should otherwise serve as a key factor to push for the growth of the Window Phone to become a third major platform in the segment.

While Amazon is likely to enter the smartphone market, 2013 may be crucial a year for Nokia and RIM (Research in Motion) to make vital decisions concerning their smartphone businesses.

Demand for high-end smartphone models in Western Europe will be affected seriously by reduced government budgets and weak consumption in the region because of the prolonged financial crisis.

However, smartphones’ growing penetration in China, Russia, India, Indonesia, South America and other emerging markets will serve as a growth driver for global smartphone shipments in 2013, Digitimes Research believes.

Google, Amazon and other vendors in China to lead pricing in low-cost smartphone segment, say sources [DIGITIMES , Nov 5, 2012]

While sales of low-cost smartphones are expected to continue growing in the next few years, Google, Amazon and other Internet service companies in China may lead price competition in the segment, according to industry sources.

Shipments of low-cost smartphones, defined as models with a selling price of less than US$150, are forecast to double every year from 2010 to 2016, increasing from 4.5 to 311 million units, according to NPD DisplaySearch.

Most of the demand (60%) is from the Asia Pacific region, where a large majority of component suppliers and manufacturing factories are located – providing both time and cost savings, said DisplaySearch.

In China, the trend for telecom carriers to continue cooperating with chipset suppliers, handset design houses and handset vendors for the launch low-priced smatphone models will continue for a while, the sources noted.

Vendors including Huawei Device, ZTE, Lenovo and Coolpad have emerged as the leading group of the smartphone suppliers in China through the offerings of low-cost models, but most of vendors has suffered losses or seen the profits of their handset business decline due to fierce price competition in the segment, the sources revealed.

Lenovo’s handset business unit is still operating in red, and Huawei and Coolpad have seen their profits decline, while ZTE and TCL have seen their handset businesses swing from profitability to loss, the sources indicated.

In order to stemming losses, or improving profitability, most branded smartphone vendors in China have been trying to expand their share in the mid- and high-end segment, while pushing their sales through local retain channels or export sales.

But other China-based smartphone vendors such as Xiaomi Technology, Internet service companies including Baidu and Shada Interactive Entertainment, as well as online retail giant 360buy, are likely to continue to adopt aggressive price strategies to pushing sales of their own models, said the sources.

In the global market, the cooperation between Google and LG Electronics for the launch of Nexus 4 at prices ranging from US$299-349 is also expected to lead to the proliferation of more low-priced Android smartphone models, the sources indicated.

Amazon, which has been aggressive in the tablet segment, is expected to release its first smartphone model in 2013 with the same price tactics, which is likely to further drive down the prices of smartphones, commented the sources.

Digitimes Research: Nexus 4 to be popular in prepaid SIM card and telecom retail channels [DIGITIMES Research, Nov 7, 2012]

Google’s Nexus 4, which comes with a 4.7-inch 720p HD display and Qualcomm quad-core Snapdragon S4 processor, is expected to become a popular model in the prepaid SIM card segment as well as in telecom retail channels for unlocked subscribers, according to Digitimes Research.

With its high hardware specifications and pricing of US$299 for the 8GB version and US$349 for the 16GB version, the Nexus 4 will cause price pressure on other comparable models rolled by rival brands.

Sales of Windows phones are expected to grow 250% in 2013 due in part to support from telecom carriers which are seeking a third platform other than Android or iOS. However, Android will continue to lead the market with a wide margin, Digitimes Research said.

Google aggressive pricing for Nexus 4 smartphone to affect sales of other brands [DIGITIMES, Oct 30, 2012]

Google’s pricing of US$299-349 for its newly released 4.7-inch, quad-core Nexus 4 smartphone is lower than market expectations, and thus could affect the sales of Android-based smartphones launched by other branded vendors, according to industry sources.

Prior to the release of the Nexus 4 in cooperation with LG Electronics, Google had cooperated with HTC and Samsung Electronics, respectively, for the launch of three generations of Nexus smartphones with prices ranging from US$500-700.

The Nexus 4 will enjoy the advantage in pricing even compared to the latest quad-core Android models rolled out by other vendors, indicated the sources, noting that Asustek Computer’s 4.7-inch Padfone 2 is available for US$600, while China-based Xiaomi Technology’s second-generation Xiaomi phone is priced at CNY1,999 (US$320).

Other Android-based smartphone vendors, including HTC, Sony Mobile Communications, Huawei Device, ZTE and even Motorola Mobility, all are likely to adjust their price strategies, since chances are high that the Nexus 4 will make a strong impact on the smartphone market, commented the sources.

China market: Nexus 4 pricing to affect sales, prices of other brands, says report [DIGITIMES, Nov 7, 2012]

The aggressive pricing strategy adopted by Google for its Nexus 4 may affect sales of Xiaomi smartphones in China and may also force other brands including Samsung Electronics, Motorola and HTC to lower the prices of their offerings in China, according to a China-based 21st Century Business Herald report.

The price of US$299 (CNY1,890) for the 8G version of the Nexus 4 is more competitive than Xiaomi’s next-generation quad-core smartphone which is available at CNY1,999, the paper noted.

Xiaomi is selling its first quad-core model below its BOM of CNY2,350 and will limit initial sales of the model to 50,000 units only, said the paper, which added that Xiaomi aims to ramp up volumes to 250,000 units to bring down the BOM when it begins to offer the second round of sales in mid-November.

Although the Nexus is not yet available in China, consumers may hesitate to pick up the quad-core Xiaomi smartphones because they have to wait for several months before Xiaomi will begin delivering the devices, said the paper.

China market: Coolpad hopes to regain mid-range, high-end smartphone share [DIGITIMES , Nov 7, 2012]

China-based handset maker Coolpad hopes to re-enter the mid-range and high-end smartphone market in China by introducing smartphone products with China Mobile that will be priced above CNY5,000/unit (US$800/unit).

In the recent years, Coolpad has been focusing on smartphones at the price range of CNY1,000/unit by cooperating with China’s three telecom service providers. Entry-level and mid-range models have accounted for 85% of Coolpad’s total shipments. The firm recently introduced a new model, Coolpad 9960 (Da Guan HD), with a 4.7-inch screen, Nvidia Tegra 3 quad-core processor, and a 13-megapixel front camera. The model will be priced above CNY5,000/unit.

Currently, China’s mid-range and high-end smartphone markets have been dominated by international brands such as Apple, HTC, Motorola, and Sony. Coolpad has been the only local brand that has a relatively strong market share.

According to industry sources, in 2012, Coolpad increased investment in R&D of high-end products by 20% on year and formed an R&D team of 800 staff to strengthen its high-end product line.

Lenovo, Huawei, ZTE faced with challenges to reach quarterly shipments of 10 million smartphones, say Taiwan makers [DIGITIMES , Nov 5, 2012]

A total of 60 million smartphones were shipped to the China market in the third quarter of 2012, and Lenovo, Huawei and ZTE shipped nine million units, 8.5 million units and 7.5 million units, respectively, with a combined market share of 41.7%, according to DRAMeXchange under consulting company TrendForce.

Except for Apple and Samsung Electronics, other international vendors including HTC, Sony Mobile Communications, LG Electronics, Nokia have not been able to attain quarterly shipments of 10 million smartphones, the sources indicated. Lenovo, Huawei and ZTE stand a chance to ship 10 million smartphones a quarter if they can strengthen their branding operations, marketing and product lines of mid-range and high-end models in overseas markets, the sources pointed out.

Lenovo has focused on entry-level smartphones priced below CNY1,500 (US$240) and relied too much on the domestic market, the sources indicated. In comparison with Lenovo, Huawei and ZTE have the advantage of cooperation with mobile telecom carriers in many countries, but their brand image is not strong enough for marketing mid-range and high-end smartphones, the sources pointed out.

PC vendors recommended to target niche smartphone market to avoid direct competition [DIGITIMES , Oct 3, 2012]

Branded PC vendors including Hewlett-Packard (HP) and Asustek Computer, which plan to reignite their smartphone businesses, are recommended to offer models with strong application platforms, sleek product design and integrated cloud computing capabilities targeting niche markets, while avoiding direct competition with smartphone vendors, according to sources at Taiwan’s handset supply chain.

Among the leading brands, HP, Dell and Asustek have not launched new handsets for some time, while Acer has made little progress in the sector although it has continued rolling out new phones, indicated the sources.

Lenovo’s performance has been exceptional, taking the second-ranked title in China’s smartphone market by optimizing an array of entry-level models priced at around CNY1,000 (US$158).

The reason major branded PC vendors are considering a comeback to the smartphone market hinges on emerging business opportunities that are anticipated to come along with the launch of Windows 8. They are hoping that sales of Windows 8-based PCs will help promote the sale of Windows Phone 8 smartphones as well.

Even so, prospects are still slim for PC brands to make a strong presence in the smartphone market, given that Apple and Samsung Electronics are currently the top-2 vendors dominating the segment, while other smartphone brands including Nokia, RIM, Sony Mobile Communications, Motorola Mobility are lagging behind with heavy losses, the sources commented.

Worldwide Mobile Phone Growth Expected to Drop to 1.4% in 2012 Despite Continued Growth Of Smartphones, According to IDC [IDC press release, Nov 1, 2012]

The worldwide mobile phone market is forecast to grow 1.4% year over year in 2012, the lowest annual growth rate in three years despite a projected record number of smartphone shipments in the high-volume holiday season. According to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, vendors will ship more than 1.7 billion mobile phones this year. In 2016, IDC forecasts 2.2 billion mobile phones will be shipped to the channel.

Global smartphone volume in the fourth quarter of 2012 (4Q12) is expected to reach 224.5 million units, representing 39.5% year-over-year growth due primarily to strong consumer demand. For the year, smartphone shipments are forecast to grow 45.1% year over year to 717.5 million units. Strong smartphone growth is a result of a variety of factors, including steep device subsidies from carriers, especially in mature economic markets where carriers resell the majority of smartphones, as well as a growing array of sub-US$250 smartphones in emerging markets.

“Sluggish economic conditions worldwide have cast a pall over the mobile phone market this year,” said Kevin Restivo, senior research analyst with IDC’s Worldwide Quarterly Mobile Phone Tracker. “However, the fourth quarter will be relatively bright due in part to sales of high-profile smartphones, such as the iPhone 5 and Samsung’s Galaxy S3, in addition to lower-cost Android-powered smartphones shipped to China and other high-growth emerging markets.”

Smartphone Operating Systems

“Underpinning the worldwide smartphone market is a constantly shifting mobile operating system landscape,” added Ramon Llamas, research manager with IDC’s Mobile Phone team. “Android is expected to stay in front, but we also expect it to be the biggest target for competing operating systems to grab market share. At the same time, Windows Phone stands to gain the most market share as its smartphone and carrier partners have gained valuable experience in selling the differentiated experience Windows Phone has to offer. What bears close observation is how BlackBerry’s new platform, BlackBerry 10, and multiple versions of Linux will affect the market once the devices running these systems are available.”

IDC forecasts Android to be the clear leader in the smartphone mobile operating system race, thanks in large part to a broad selection of devices from a wide range of partners. Samsung is the leading Android smartphone seller though resurgent smartphone vendors LG Electronics and Sony, both of which cracked the top five smartphone vendors during 3Q12, are not to be overlooked. IDC believes the net result of this will be continued double-digit growth throughout the forecast period.

iOS will maintain its position as the clear number two platform behind Android at the end of 2012 and throughout the forecast. The popularity of the iPhone across multiple markets will drive steady replacements and additional carrier partners will help Apple grow iOS volume. However, the high price point of the iPhone relative to other smartphones will make it cost prohibitive for some users within many emerging markets. In order to maintain current growth rates, Apple will need to examine the possibility of offering less expensive models, similar to its iPod line. Until that happens, IDC forecasts iOS to ship lower volumes than Android.

The BlackBerry OS will grow slowly but largely maintain share over the coming years following the BlackBerry 10 launch next year. The new operating system and devices will be valued by some longtime BlackBerry fans, particularly those who have waited for the new OS as Research In Motion delayed its release. This will allow the company to maintain pockets of strength in higher-growth emerging markets such as Indonesia and various Latin American countries. But, as with many other new platforms, the success of BB 10 will be partly dependent upon channel advocacy, like sales associates who can effectively tell the BlackBerry story.

Windows Phone will battle with BlackBerry for the number three spot in 2013, but will gain further clarity in the years that follow. Windows Phone will build on the progress it made in 2012, with Nokia establishing its presence and HTC solidly jumping back into the race. Moreover, contributions by Samsung, ZTE, and Huawei will help grow its footprint. With more vendors releasing more devices aimed at multiple segments, sales associates will be better positioned to tell a compelling Windows Phone story and to explain the value of Windows Phone’s differentiated experience compared to market leaders Android and iOS.

Linux will trail the market leaders throughout our forecast though it is expected to be the dark horse of the forecast. K-Touch has quietly built its Linux volumes this year while Haier recently released its first Linux smartphones. In addition, multiple platforms are expected to announce and launch their Linux-based smartphones in 2013, including Samsung’s Tizen and Jolla’s SailFish. Benefiting these platforms are their ties to previous platforms from the LiMo Foundation and Nokia’s MeeGo, which could lead to greater developer interest.

Top Smartphone Operating Systems, Forecast Market Share and CAGR, 2012–2016

Smartphone OS

2012 Market Share

2016 Market Share

CAGR 2012 – 2016 (%)

Android

68.3%

63.8%

16.3%

iOS

18.8%

19.1%

18.8%

BlackBerry OS

4.7%

4.1%

14.6%

Windows Phone

2.6%

11.4%

71.3%

Linux

2.0%

1.5%

10.5%

Others

3.6%

0.1%

-100.0%

Total

100.0%

100.0%

18.3%

Source: IDC Worldwide Mobile Phone Tracker, December 3, 2012

Android Marks Fourth Anniversary Since Launch with 75.0% Market Share in Third Quarter, According to IDC [IDC press release, Nov 1, 2012]

The Android smartphone operating system was found on three out of every four smartphones shipped during the third quarter of 2012 (3Q12). According to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, total Android smartphone shipments worldwide reached 136.0 million units, accounting for 75.0% of the 181.1 million smartphones shipped in 3Q12. The 91.5% year-over-year growth was nearly double the overall market growth rate of 46.4%.

“Android has been one of the primary growth engines of the smartphone market since it was launched in 2008,” said Ramon Llamas, research manager, Mobile Phones at IDC. “In every year since then, Android has effectively outpaced the market and taken market share from the competition. In addition, the combination of smartphone vendors, mobile operators, and end-users who have embraced Android has driven shipment volumes higher. Even today, more vendors are introducing their first Android-powered smartphones to market.”

“The share decline of smartphone operating systems not named iOS since Android’s introduction isn’t a coincidence,” said Kevin Restivo, senior research analyst with IDC’s Worldwide Quarterly Mobile Phone Tracker. “The smartphone operating system isn’t an isolated product, it’s a crucial part of a larger technology ecosystem. Google has a thriving, multi-faceted product portfolio. Many of its competitors, with weaker tie-ins to the mobile OS, do not. This factor and others have led to loss of share for competitors with few exceptions.”

Mobile Operating System Highlights

Android, having topped the 100 million unit mark last quarter, reached a new record level in a single quarter. By comparison, Android’s total volumes for the quarter were greater than the total number of smartphones shipped in 2007, the year that Android was officially announced. Samsung once again led all vendors in this space, but saw its market share decline as numerous smaller vendors increased their production.

iOS was a distant second place to Android, but was the only other mobile operating system to amass double-digit market share for the quarter. The late quarter launch of the iPhone 5 and lower prices on older models prevented total shipment volumes from slipping to 3Q11 levels. But without a splashy new OS-driven feature like Siri in 2011 and FaceTime in 2010, the iPhone 5 relied on its larger, but not wider, screen and LTE connectivity to drive growth.

BlackBerry‘s market share continued to sink, falling to just over 4% by the end of the quarter. With the launch of BlackBerry 10 yet to come in 2013, BlackBerry will continue to rely on its aging BlackBerry 7 platform, and equally aging device line-up. Still, demand for BlackBerry and its wildly popular BBM service is strong within multiple key markets worldwide, and the number of subscribers continues to increase.

Symbian posted the largest year-on-year decline of the leading operating systems. Nokia remains the largest vendor still supporting Symbian, along with Japanese vendors Fujitsu, Sharp, and Sony. Each of these vendors is in the midst of transitioning to other operating systems and IDC believes that they will cease shipping Symbian-powered smartphones in 2013. At the same time, the installed base of Symbian users will continue well after the last Symbian smartphone ships.

Windows Phone marked its second anniversary with a total of just 3.6 million units shipped worldwide, fewer than the total number of Symbian units shipped. Even with the backing of multiple smartphone market leaders, Windows Phone has yet to make a significant dent into Android’s and iOS’s collective market share. That could change in 4Q12, when multiple Windows Phone 8 smartphones will reach the market.

Linux volume declined for the third straight quarter as did its year-over-year growth. Samsung accounted for the majority of shipments once again, but like most other vendors competing with Linux-powered smartphones, most of its attention went towards Android instead. Still, that has not deterred other vendors from experimenting, or at least considering the open-source operating system, as multiple reports of Firefox, Sailfish, and Tizen plan to release new Linux-based experiences in the future.

Top Six Smartphone Mobile Operating Systems, Shipments, and Market Share, Q3 2012 (Preliminary) (Units in Millions)

Operating System

3Q12 Shipment Volumes

3Q12 Market Share

3Q11 Shipment Volumes

3Q11 Market Share

Year-Over-Year Change

Android

136.0

75.0%

71.0

57.5%

91.5%

iOS

26.9

14.9%

17.1

13.8%

57.3%

BlackBerry

7.7

4.3%

11.8

9.5%

-34.7%

Symbian

4.1

2.3%

18.1

14.6%

-77.3%

Windows Phone 7/ Windows Mobile

3.6

2.0%

1.5

1.2%

140.0%

Linux

2.8

1.5%

4.1

3.3%

-31.7%

Others

0.0

0.0%

0.1

0.1%

-100.0%

Totals

181.1

100.0%

123.7

100.0%

46.4%

Source: IDC Worldwide Mobile Phone Tracker, November 1, 2012

Note: Data are preliminary and subject to change. Vendor shipments are branded shipments and exclude OEM sales for all vendors.Android Smartphone Shipments and Market Share, 2008 – 2012 YTD (Units in Millions)

2008

2009

2010

2011

2012 YTD

Android Total Unit Shipments

0.7

7.0

71.1

243.4

333.6

Android Market Share

0.5%

4.0%

23.3%

49.2%

68.2%

Source: IDC Worldwide Mobile Phone Tracker, November 1, 2012

Note: Data are preliminary and subject to change. Vendor shipments are branded shipments and exclude OEM sales for all vendors.

Gartner Says Worldwide Sales of Mobile Phones Declined 3 Percent in Third Quarter of 2012; Smartphone Sales Increased 47 Percent [Gartner press release, Nov 14, 2012]

Samsung Extended Its Lead in the Smartphone Market Widening the Gap with Apple

Worldwide sales of mobile phones to end users reached almost 428 million units in the third quarter of 2012, a 3.1 percent decline from the third quarter of 2011, according to Gartner, Inc. Smartphone sales accounted for 39.6 percent of total mobile phone sales, as smartphone sales increased 46.9 percent from the third quarter of 2011.

While the mobile phone market declined year-on-year, Gartner analysts said there were positive signs for the industry during the third quarter.