Home » Posts tagged 'Windows RT'

Tag Archives: Windows RT

Dell’s all Intel tablets and laptops targeting the evolving mobile workforce even with their most consumer specific Android tablets

Dell is 100% committed to Intel (“for speed, responsiveness, and battery efficiency”) from now on which was, nevertheless, not discovered by the media. Otherwise the essence was well expressed by these Oct 2, 2013 media reports (being similar to others):

Read also: The long awaited Windows 8.1 breakthrough opportunity with the new Intel “Bay Trail-T”, “Bay Trail-M” and “Bay Trail-D” SoCs? [‘Experiencing the Cloud’, Sept 14-26, 2013]

- BBC News: Dell‘s latest Venue tablets shun Windows RT system

- PCWorld: With new Venue tablets, Dell signals its PC division is alive and kicking

- TechCrunch: Dell Tries To Crack The Android Tablet Code (Again) With The Venue 7 & 8

- GigaOM: New Dell Venue Pro tablets run Windows 8.1; no Windows RT in sight

- CNET: Dell gives up on Windows RT “Neil Hand [VP Consumer Marketing], head of tablets at the PC maker, says Dell won’t be releasing follow-up Windows RT products because they didn’t sell well.”

- VentureBeat: Dell gets serious about stealing market share with new consumer laptops and tablets “… ‘A year ago, Dell had two tablets,’ Hand said. ‘Now we have seven or eight, depending on how you count them. That shows our commitment.’ … Android is a force in tablets. With multiple Android tablets and even a modular, Windows 8-based convertible, Dell appears more like the Dell of yesterday, who was prepared to take share from its competitors.’ …”

- The Verge: Dell unveils first four Venue tablets, including a Microsoft Surface competitor

Conspicuously missing from Dell’s lineup is any trace of Windows RT, the stripped-down version of Windows designed for ARM processors. Dell was the last remaining Windows RT supporter outside of Microsoft, at least until the company discontinued its XPS 10 last month. When we asked Dell’s director of tablets, Bill Gorden, he said the company’s still considering its options. “We’re very happy with the direction of Windows 8.1, and we have multiple screen sizes and capabilities there,” he said. “We’re not sure what our plans are for Windows RT at the moment.”

However, Gorden suggests that we should take the Venue launch as a sign that Dell isn’t planning to abandon the consumer market after it goes private. “I think the introduction of all these devices is really a signal of how important end-user computing is to Dell,” he toldThe Verge. “I think you’re going to start seeing Dell start being prominent in the consumer space.”

What was announced (according to Dell’s press release, available here at the very end):

The Dell Venue 7, Venue 8, Venue 8 Pro, and new XPS 15 will be available from October 18 on www.dell.com in the United States and select countries around the world. The Venue 11 Pro, XPS 11 and the updated XPS 13 with touch will be available in November. Starting prices are as follows:

- Venue 7 [Android]: $149.99

- Venue 8 [Android]: $179.99

- Venue 8 Pro: $299.99

- Venue 11 Pro: $499.99

- New XPS 15: $1,499.99

- XPS 11: $999.99

- New XPS 13: $999.99

…

All Dell Venue tablets are based on Intel processing power for speed, responsiveness, and battery efficiency. The Dell Venue 7 and Dell Venue 8 [Android tablets] feature Intel Atom Z2760 (“Clover Trail”) processors, while the Dell Venue 8 Pro and Dell Venue 11 Pro [Windows 8.1 tablets] feature the new Intel Atom quad-core processors, code named “Bay Trail.” The Venue 11 Pro offers up to 4th Generation Intel Core [”Haswell”] i3 and i5 processor options and Intel vPro for manageability.

Dell messages:

From the press release:

- New Dell Venue tablets offer the ability to connect, share, and access content with ease

- XPS 11 is the world’s thinnest, lightest and most compact 2-in-1 in the world with the world’s first Quad HD display on an 11.6-inch 2-in-1

- XPS 15 powerhouse laptop offers the world’s first 15.6-inch Quad HD+ display for jaw-dropping visuals and the ultimate experience

…

Dell Venue tablets are designed to give people on-the-go a wide-selection of sizes and options to meet their varying needs. From 8 and 11-inch Windows-based tablets complete with keyboard and stylus options, to the 7 and 8-inch Android tablets, Dell has created a dedicated brand of tablets to meet the needs of customers who are the epitome of the evolving workforce.

For New Dell Venue 7 and 8 Tablets [DellVlog YouTube channel, Oct 2, 2013]

Stay connected with Venue 7 and 8 tablets featuring fast Intel processors and easy to use Android OS.

For New Dell Venue 8 Pro Tablet [DellVlog YouTube channel, Oct 2, 2013]

Connect to what you need easily, quickly and securely with the Dell Venue 8 Pro tablet [powered by Intel quad-core processor].

For New Dell Venue 11 Pro Tablet [DellVlog YouTube channel, Oct 2, 2013]

http://www.dell.com/tablets

The no compromise tablet for those that expect more and do more [featuring Intel Core processors].

For Enabling the mobile workforce with Dell [DellVlog YouTube channel, Oct 2, 2013]

Learn more about the evolving mobile workforce, bring your own device (BYOD) trends and the opportunity they present you as a Dell partner.

For Dell Venue 11 Pro Tablet for Work and Home [DellVlog YouTube channel, Oct 2, 2013]

See how the Venue 11 Pro goes from your home life to work life, with no compromises.

Only here, and only inside there is a Microsoft related message (while Intel is everywhere here and especially in the above videos):

- Stay connected with the Intel Core based Dell Venue 11 Pro tablet.

- Keep in touch with loved ones across the globe.

- Portability and performance in one device.

- Chair projects with the stunning Full HD wide angle screen.

- Run Windows 8.1 and Microsoft Office powered by Intel processors.

- Interact like never before with near-field communication.

- Present new ideas with Miracast technology.

- Designed for on the go or on the couch.

- Do more with the do it all Dell Venue 11 Pro tablet.

While at least one media source, CNET was much more Microsoft/Windows focussed:

The Dell Venue 8 Pro delivers full Windows 8.1 in a $299 package [CNETTV YouTube channel, Oct 2, 2013]

http://cnet.co/19ZguLY

Dell’s Venue 8 Pro is a full Windows 8.1 tablet with an 8-inch screen.

The Dell Venue 7 and 8 mark Dell’s return to Android tablets [CNETTV YouTube channel, Oct 2, 2013]

http://cnet.co/1bw0Mdk

Dell finally moves beyond the Streak with two new Android tablets.

Get accessorized with the Dell Venue 11 Pro [CNETTV YouTube channel, Oct 2, 2013]

http://cnet.co/173mhOm

The 11-inch Venue 11 Pro from Dell features a removable battery and plenty of accessory options.

The Dell XPS 11 and 12 feature unique hybrid designs [CNETTV YouTube channel, Oct 2, 2013]

http://cnet.co/1fJpImK

Both the Dell XPS 11 and 12 are take traditional hybrid design and throws it on its ear.

The Dell XPS 13 and 15 feature high-end specs and thin designs [CNETTV YouTube channel, Oct 2, 2013]

http://cnet.co/1brtC1U

Dell goes ultra high-end with its XPS 13 and 15 laptops.

Press release from the company:

Dell Introduces New Line of Tablets and Updated XPS Laptops: Create, Share and Access Content from Virtually Anywhere [Oct 2, 2013]

- New Dell Venue tablets offer the ability to connect, share, and access content with ease

- XPS 11 is the world’s thinnest, lightest and most compact 2-in-1 in the world with the world’s first Quad HD display on an 11.6-inch 2-in-1

- XPS 15 powerhouse laptop offers the world’s first 15.6-inch Quad HD+ display for jaw-dropping visuals and the ultimate experience

Dell today took a bold step in unveiling a new family of tablets and new laptops, including a 2-in-1 Ultrabook. The Dell Venue line of tablets is comprised of four new ultrathin models designed to address the changing way people live and work today. Dell’s “damned sexy” tablets, as described by leading Enderle Group analyst, Rob Enderle, deliver leading performance and quality, backed by Intel processing technology. With compact designs that make it easy to stay connected on the go, the Dell Venue tablets have an exquisite fit and finish.

In addition to the versatile new Dell Venue tablets, Dell is introducing new XPS laptops, each with breakthrough displays for a phenomenal viewing experience with vibrant, crisp images in any available screen size. The new XPS 11, the thinnest, most compact 2-in-1 in the world, also features the first Quad HD (2560 x 1440) display on an 11.6-inch 2-in-1. The XPS 15 multimedia powerhouse boasts a stunningly thin design, and offers as an option the first 15.6-inch Quad HD+ (3200 x 1800) display in the world, which is the highest resolution available on a laptop of that size. Dell is also refreshing its award-winning XPS 13 Ultrabook with faster processors, touch Full HD (1920 x 1080) display and improved battery life. With these three laptops, Dell is leading the industry with the highest resolution displays possible.

“People today expect the best experience possible from their technology – they are counting on it to keep them connected and move with them, wherever they are,” said Sam Burd, vice president Dell Personal Computing Group. “The new Dell Venue tablets and XPS laptops give customers the stellar experience they expect from us, with performance that allows them to work how they want, when they want, in a design they’ll be proud to show off and own.”

Dell Venue Tablets: Connect, Share and Access Content with Ease

Dell Venue tablets are designed to give people on-the-go a wide-selection of sizes and options to meet their varying needs. From 8 and 11-inch Windows-based tablets complete with keyboard and stylus options, to the 7 and 8-inch Android tablets, Dell has created a dedicated brand of tablets to meet the needs of customers who are the epitome of the evolving workforce.

- The Dell Venue 8 Pro and Dell Venue 11 Pro Windows 8.1-based tablets combine the level of performance, design and responsiveness end-users love while giving IT departments what they need – the ability to integrate into an existing corporate environment with full compatibility with current Windows applications and Microsoft Office integration. Both tablets feature optional advanced security features and services such as TPM and Dell Enterprise Services.

- The lightweight Dell Venue 8 Pro runs Windows 8.1, has a bright HD IPS display, advanced connectivity options and provides long battery life so range anxiety is no longer an issue. People can also stay productive with Office 2013 Home & Student, included with the device, and the optional Dell Active Stylus.

- The Dell Venue 11 Pro, also based on Windows 8.1, provides ultimate 2-in-1 flexibility with the power of an Ultrabook, convenience of a detachable keyboard and experience of a desktop. Unlike competitive tablets, it has a user removable/replaceable battery, and its large, Full HD display with wide viewing angles makes it easy to read and create content while staying mobile. It is also available with a variety of keyboard and stylus options:

- Dell Active Stylus makes it easy to annotate, draw or take notes.

- Dell Slim Keyboard, designed for travel, also serves as a cover for the screen when folded up.

- Dell Mobile Keyboard with integrated battery provides all day productivity with a full-sized keyboard while extending the battery life.

- Dell Tablet Desktop Dock delivers full productivity on a desk with USB 3.0 ports, and dual display out ports for display extension.

- The Dell Venue 7 and Dell Venue 8 Android-based tablets are affordable, feature-rich tablets for people who want to be constantly connected wherever they are. Both tablets have an upscale fit and finish, and are designed with longevity in mind with the right components so that customers will be just as delighted with their tablet one year from now, as they are on the day they take it out of the box.

All Dell Venue tablets are based on Intel processing power for speed, responsiveness, and battery efficiency. The Dell Venue 7 and Dell Venue 8 feature Intel Atom Z2760 (“Clover Trail”) processors, while the Dell Venue 8 Pro and Dell Venue 11 Pro feature the new Intel Atom quad-core processors, code named “Bay Trail.” The Venue 11 Pro offers up to 4th Generation Intel Core i3 and i5 processor options and Intel vPro for manageability.

Dell XPS Laptops and 2-in-1: The Ultimate Experience with Gorgeous Displays

Dell’s award-winning XPS laptop line just got even better with the new XPS 15 powerhouse laptop, the introduction of the XPS 11 2-in-1, and an update to the flagship XPS 13 Ultrabook. In keeping with the XPS tradition of offering the best computing experience in any product category, the XPS laptops and 2-in-1 feature machined aluminum, carbon fiber, vibrant displays, and Corning Gorilla Glass NBT for performance, durability and the ultimate experience.

- Starting at 2.5lbs[i] and just 11-15mm thin, the XPS 11 is the world’s thinnest, lightest and most compact 2-in-1 Ultrabook available today, offering a tablet-first design with laptop functionality. It easily transitions from tablet to laptop with a 360 degree rotating hinge design, and an innovative solid surface backlit touch keyboard that provides a superb experience from lap to bag. With a Quad HD (2560 x 1440) display, the highest resolution display in an 11.6-inch 2-in-1 today, the XPS 11 has a bright, crisp viewing experience. The display also features True Color viewing powered by eeColor, which enables customers to enjoy true, rich consistent color in nearly any lighting environment.

- The XPS 15 continues to be a multimedia powerhouse delivering the highest resolution in its class, and incredible power in an ultra-thin, light wedge design, starting at 4.44lbsi. The XPS 15 is the first 15.6-inch laptop in the world to feature a Quad HD+ display, and also available with a touch option, boasts over 5.7 million pixels – five times the amount of standard HD – for jaw-dropping resolution. Designed for creative enthusiasts, the XPS 15 packs 4th Generation Intel Core i5 and i7 quad core processor options and NVIDIA discrete graphics options. Every XPS 15 boots and resumes within seconds with hard drive configuration options from 500GB to 1TB[ii], both with a 32GB mSATA SSD, to a 512GB solid state drive, all including Intel Rapid Start Technology[iii].

- The award-winning XPS 13, with its 13.3-inch, edge-to-edge display that innovatively fits into a footprint similar to an 11-inch laptop, is razor thin and light, starting at under 3lbsi. It is now even faster with 4thgeneration Intel Core processors, Intel HD 4400 graphics, and has longer battery life for the mobile professional who values a sleek design, responsiveness and ultimate mobility. Its Full HD display provides a brilliant viewing experience and is now even more versatile with a touch option.

“Dell appears to have its innovative mojo back,” said Tim Bajarin, President of Creative Strategies. “These new products clearly emphasize Dell’s commitment to create innovative mobile solutions for businesses and consumers and I believe represent some of the best products they have made in many years.”

Personal and Professional Content Anytime, Anywhere

The Dell PocketCloud application is pre-installed on all XPS and Venue products, helping users build their own “personal cloud” and remotely manage personal and professional content. By combining PocketCloud with the portability of the new Venue tablets and XPS laptops, mobile workers will be able to enjoy an easy and connected experience with access to all of their apps and content from virtually anywhere.Get the Most Out of Your Technology with Dell Services

Dell customers can get the most out of their technology with Dell Services, dedicated to keeping them connected and productive, whether they’re using their Dell Venue tablet or XPS purchase for work or home. In addition to the Dell Limited Hardware Warranty, consumers can elect to include additional protection such as Accidental Damage Service[iv], Premium Phone Support and Rapid Return for Repair after Remote Diagnosis[v], which means that their system will be repaired and returned to them within 3-5 business days after remote diagnosis. Likewise, business customers can be rest assured that their devices will fit seamlessly and securely into their corporate IT environment with Dell Enterprise Services like ProSupport[vi] on the Dell Venue 8 Pro and Venue 11 Pro tablets.Availability and Pricing

The Dell Venue 7, Venue 8, Venue 8 Pro, and new XPS 15 will be available from October 18 on www.dell.com in the United States and select countries around the world. The Venue 11 Pro, XPS 11 and the updated XPS 13 with touch will be available in November. Starting prices are as follows:

- Venue 7: $149.99

- Venue 8: $179.99

- Venue 8 Pro: $299.99

- Venue 11 Pro: $499.99

- New XPS 15: $1,499.99

- XPS 11: $999.99

- New XPS 13: $999.99

About Dell

Dell Inc. (NASDAQ: DELL) listens to customers and delivers innovative technology and services that give them the power to do more. For more information, visit www.dell.com.Dell World

Join us at Dell World 2013, Dell’s premier customer event exploring how technology solutions and services are driving business innovation. Learn more at www.dellworld.com and follow #DellWorldon Twitter.Dell, Dell Venue and XPS are trademarks of Dell Inc. Dell disclaims any proprietary interest in the marks and names of others.

[i] Weights vary depending on configuration and manufacturing variability.

[ii] Hard drives: GB means 1 billion bytes and TB equals 1 trillion bytes; actual capacity varies with preloaded material and operating environment and will be less.

[iii] Intel Rapid Start Technology: Requires a Solid-State Drive (SSD) or properly configured HDD + SSD.

For copy of Limited Hardware Warranty, write Dell USA LP, Attn: Warranties, One Dell Way, Round Rock, TX 78682 or see http://www.dell.com/warranty

[iv] Accidental Damage Service excludes theft, loss and damage due to fire, flood or other acts of nature, or intentional damage. Customer may be required to return unit to Dell. For complete details, visitwww.dell.com/servicecontracts

[v] Remote Diagnosis is determination by online/phone technician of cause of issue, which may take multiple extended sessions. If issue is covered by Limited Hardware Warranty and not resolved remotely, shipping instructions will be provided. Next Business Day shipping not available in all areas, which may delay repair and return times. Other conditions apply. For complete details about Rapid Return for Repair after Remote Diagnosis Service, visit Dell.com/servicecontracts.

[vi] Availability and terms of Dell Services vary by region. For more information, visitwww.dell.com/servicedescriptions.

Android to overtake the overall PC market?

I came to this after the recent posts of mine (between July 20 and August 17, 2013):

- With Android and forked Android smartphones as the industry standard Nokia relegated to a niche market status while Apple should radically alter its previous premium strategy for long term

- Google Play catchup with iOS App Store and its way of assuring compatibility across Android 1.6 to 4.3

- The Upcoming Mobile Internet Superpower

- China is the epicenter of the mobile Internet world, so of the next-gen HTML5 web

- Superphones turning point: segment satured with Tier 1 globals while the Chinese locals are at less than 40% of the Samsung price

- Xiaomi, OPPO and Meizu–top Chinese brands of smartphone innovation

- GiONEE (金立), the emerging global competitor on the smartphone market

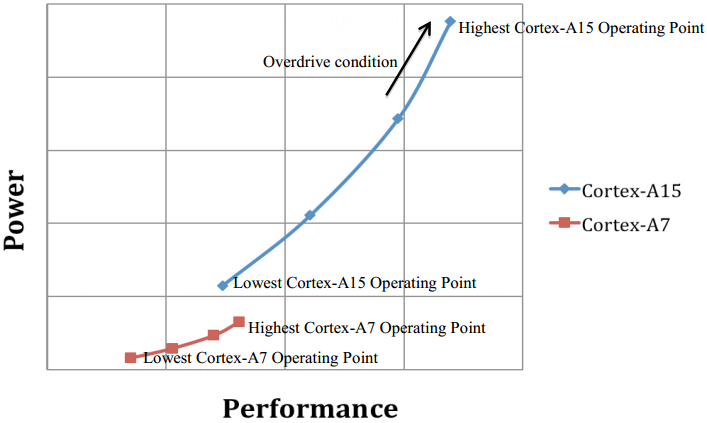

- Eight-core MT6592 for superphones and big.LITTLE MT8135 for tablets implemented in 28nm HKMG are coming from MediaTek to further disrupt the operations of Qualcomm and Samsung

as well as after the accumulated contents of my separated website on the whole issue of ‘USD99 Allwinner’ devoted to a multifaceted disruption to not only the traditional PC market but even to the current tablet market as the analyst companies are viewing that.

Those analyst companies are already hinting indirectly to the possibility of Android (sooner or later) overtaking the overall PC market via the following headlines which I derived from their recent press release contents:

- IDC: ‘Tablets will surpass portable PC volumes already this year’

- Gartner: ‘Traditional PC shipments to decline as tablets are becoming the primary consumption device’

- Digitimes Research: ‘Overtaking iPad will happen in 2H13’

- Canalys says ‘Yes’

- EnfoDesk (Analysys International) from China says ‘For sure, as it is already happening against the iPad in China even at a nascent stage of the local tablet market’

You can read those release in the detailed sections given below.

Before that first note: Everything is rooted in the established fact that: TrendForce: iPad Marked Historically Low Market Share 35% of Global Q2 Tablet Shipment [press release, July 25, 2013] (although the exact number differs between the different market research organisations, as you will see in the detailed sections below)

According to the survey by WitsView, the display research division of the global market intelligence provider TrendForce, the global shipment of the 7” tablets with WSVGA resolution and above attained 41.1 million units, dropping 12.4% from the previous quarter. The seasonal factor, the generation shuffles for some mainstream products, and the inventory adjustments amid the weakening sales were all key reasons for declining shipments.

WitsView’s research director Eric Chiou says that Apple, as one single brand that controls the most volumetric tablet shipment, saw its 9.7” iPad entering the end of life cycle in Q2, and iPad mini’s relatively selling prices caused slow sales and the impacts from the inventory adjustments, leading to a dropping shipment of 14.6 million units compared with 19.5 million units in Q1. On top of the quarterly drop as high as 25%, its market share has dropped to 35.5%, the new historical low.

Samsung’s ambition of boosting the tablet shipment was also shown on the Q2 shipment. Despite its slightly decreased shipment of 8.8 million units from the previous quarter, the Korean maker’s market share, supported by the newly launched 8” model, grew from 20.2% to 21.5%, still a remarkable result. As for the two leading PC brands, Asus and Acer, their business cores both were placed on the under-$130 7” products, and the price-cutting strategy helped them become the two of a few brands counter to the declining trend, seeing excellent QoQ growth of 60% and 36%, respectively.

“The two long-term winners of the entry-level tablet segment, Amazon and Google, showed unideal shipment results, holding shipment volumes of only 1.1 million and 0.9 million units, respectively,” Chiou indicates. Amazon’s 2013 new models are all concentrated after September and the brand is in an empty-product period, while Google’s fighter model Nexus 7 had the 1st generation approach the end of life cycle in Q2 and saw a significantly dropping shipment. The single-quarter shipment will bounce back to more than 2 million units in Q3 as the 2nd generation product is projected to ship smoothly.

The white-box tablet couldn’t avoid the decline in Q2. The price increases and the short supply for the key component RAM led to double strikes of cost increase and insufficient supply to white-box tablets that had smaller production scales, in addition to brands’ strongly promoted entry-level tablets that squeezed their room for survival. Under both the internal and external impacts, the white-box tablet saw a shipment volume of only 9.7 million units, declining 7% QoQ

Based on WitsView’s analysis, on top of Amazon’s yearly new 7” model and the 2nd generation of Nexus 7, several highly-anticipated models will be revealed in Q3, including Apple’s heavyweight Generation 5 iPad and the new Android 10.1” tablet intensively designed by PC brands. With the stimulation of improved spec and tempting prices, the Q3 shipment is projected to reach an amount of 49.6 million units, challenging a QoQ growth of 21%. The tablet shipment for the entire 2013 is estimated at 196.5 million units, including 153.2 million units of brand tablets and 43.3 million units of white-box tablets.

The second well established fact affecting the future is that Surface RT was a huge market failure first recognized indirectly via the FORM 10-K submission of the Microsoft on July 18, 2013.

… The general availability of Surface RT and Windows 8 started on October 26, 2012. The general availability of Surface Pro started on February 9, 2013. …

ITEM 6. SELECTED FINANCIAL DATA

… includes a charge for Surface RT inventory adjustments recorded in the fourth quarter of fiscal year 2013, which decreased operating income by $900 million, net income by $596 million, and diluted earnings per share by $0.07. …

RESULTS OF OPERATIONS

…

- Cost of revenue increased $2.7 billion or 16%, reflecting increased product costs associated with Surface and Windows 8, including an approximately $900 million charge for Surface RT inventory adjustments, higher headcount-related expenses, payments made to Nokia related to joint strategic initiatives, royalties on Xbox LIVE content, and retail stores expenses, offset in part by decreased costs associated with lower sales of Xbox 360 consoles and decreased traffic acquisition costs.

- Sales and marketing expenses increased $1.4 billion or 10%, reflecting advertising of Windows 8 and Surface.

…

Windows Division

…

Fiscal year 2013 compared with fiscal year 2012

Windows Division revenue increased $839 million. Surface revenue was $853 million. …

Cost of revenue increased $1.8 billion, reflecting a $1.6 billion increase in product costs associated with Surface and Windows 8, including a charge for Surface RT inventory adjustments of approximately $900 million. Sales and marketing expenses increased $1.0 billion or 34%, reflecting an $898 million increase in advertising costs associated primarily with Windows 8 and Surface.

…

The possibility of such failure was already recognized in my other posts:

- Microsoft Surface with some questions about the performance and smoothness of the experience [Nov 12 –28, 2012]

- Steven Sinofsky, ex Microsoft: The victim of an extremely complex web of the “western world” high-tech interests [Nov 13-20, 2012]

IDC: ‘Tablets will surpass portable PC volumes already this year’

IDC Forecasts Worldwide Tablet Shipments to Surpass Portable PC Shipments in 2013, Total PC Shipments in 2015 [press release, May 28, 2013]

According to a new forecast from the International Data Corporation (IDC) Worldwide Quarterly Tablet Tracker, tablet shipments are expected to grow 58.7% year over year in 2013 reaching 229.3 million units, up from 144.5 million units last year. IDC now predicts tablet shipments will exceed those of portable PCs this year, as the slumping PC market is expected to see negative growth for the second consecutive year. In addition, IDC expects tablet shipments to outpace the entire PC market (portables and desktops combined) by 2015. (A press release summarizing IDC’s latest PC market forecast can be found here.)

“What started as a sign of tough economic times has quickly shifted to a change in the global computing paradigm with mobile being the primary benefactor,” said Ryan Reith, Program Manager for IDC’s Mobility Trackers. “Tablets surpassing portables in 2013, and total PCs in 2015, marks a significant change in consumer attitudes about compute devices and the applications and ecosystems that power them. IDC continues to believe that PCs will have an important role in this new era of computing, especially among business users. But for many consumers, a tablet is a simple and elegant solution for core use cases that were previously addressed by the PC.”

While Apple has been at the forefront of the tablet revolution, the current market expansion has been increasingly fueled by low-cost Android devices. In 2013, the worldwide average selling price (ASP) for tablets is expected to decline -10.8% to $381. In comparison, the ASP of a PC in 2013 is nearly double that at $635. IDC expects tablet prices to decline further, which will allow vendors to deliver a viable computing experience into the hands of many more people at price points the PC industry has strived to meet for years.

“Apple’s success in the education market has proven that tablets can be used as more than just a content consumption or gaming device,” said Jitesh Ubrani, Research Analyst for the Worldwide Quarterly Tablet Tracker. “These devices are learning companions, and as tablet prices continue to drop, the dream of having a PC for every child gets replaced with the reality that we can actually provide a tablet for every child.”

In addition to lower prices, another major shift in the tablet market has occurred around screen sizes. Apple’s first generation iPad, which included a 9.7-inch display, was perceived by many as the sweet spot for tablets. That is, until 7-inch Android-based tablets began to gain traction in the market. Apple responded with the iPad mini in the fourth quarter of 2012, and in the space of two quarters the sub-8-inch category exploded to overtake the larger-sized segment in terms of total shipments.

Worldwide Tablet Market Share by Screen Size Band, 2011 – 2017

Screen Size

2011

2013

2017

< 8″

27%

55%

57%

8″ – 11″

73%

43%

37%

11″+

0%

2%

6%

Total

100%

100%

100%

Source: IDC Worldwide Tablet Tracker, May 28, 2013.

* Forecast Data

Table Notes:

- Shipments include shipments to distribution channels or end users. OEM sales are counted under the vendor/brand under which they are sold.

- IDC considers all LCD-based slate devices with screens between 7 and 16 inches as tablets, regardless of whether or not they include a removable keyboard (such as the Surface RT). Convertible devices with non-removable keyboards (such as Lenovo’s Yoga) are not counted as Tablets.

Tablet Shipments Slow in the Second Quarter As Vendors Look To Capitalize on a Strong Second Half of 2013, According to IDC [press release, Aug 5, 2013]

As expected, worldwide tablet shipment growth slowed in the second quarter of 2013 (2Q13), according to preliminary data from the International Data Corporation (IDC)Worldwide Quarterly Tablet Tracker. Worldwide tablet shipments finally experienced a sequential decline as total volumes fell -9.7% from 1Q13. However, the 45.1 million units shipped in the second quarter was up 59.6% from the same quarter in 2012, when tablet vendors shipped 28.3 million devices.

Lacking a new product launch in March to help spur shipments, Apple’s iPad saw a lower-than-predicted shipment total of 14.6 million units for the quarter, down from 19.5 million in 1Q13. In years past, Apple has launched a new tablet heading into the second quarter, which resulted in strong quarter-over-quarter growth. Now, Apple is expected to launch new tablet products in the second half of the year, a move that better positions it to compete during the holiday season. Meanwhile, the other two vendors in the top 3 also saw a decline in their unit shipments during the quarter. Second-place Samsung shipped 8.1 million units, down from 8.6 million in the first quarter of 2013, although up significantly from the 2.1 million units shipped in 2Q12. And third-place ASUS shipped a total of 2.0 million units in 2Q13, down from 2.6 million in 1Q13.

“A new iPad launch always piques consumer interest in the tablet category and traditionally that has helped both Apple and its competitors,” said Tom Mainelli, Research Director, Tablets at IDC. “With no new iPads, the market slowed for many vendors, and that’s likely to continue into the third quarter. However, by the fourth quarter we expect new products from Apple, Amazon, and others to drive impressive growth in the market.”

Not all vendors experienced a slowdown during the quarter. PC stalwarts Lenovo and Acer both re-entered the top five this quarter. Lenovo continued to make headway into the world of mobility and for the first time had shipments surpass the million unit mark in a quarter, shipping a total of 1.5 million devices. This was up 313.9% from a year ago and enough to capture 3.3% market share. Rounding out the top 5 was Acer, which shipped 1.4 million tablets in 2Q13 for 247.9% year-over-year growth and an increase of 35.4% over the first quarter of 2013.

“The tablet market is still evolving and vendors can rise and fall quickly as a result,” said Ryan Reith, Program Manager for IDC’s Mobility Tracker programs. “Apple aside, the remaining vendors are still very much figuring out which platform strategy will be successful over the long run. To date, Android has been far more successful than the Windows 8 platform. However, Microsoft-fueled products are starting to make notable progress into the market.”

Top Five Tablet Vendors, Shipments, and Market Share, Second Quarter 2013 (Shipments in millions)

Vendor

2Q13 Unit Ship-ments

2Q13 Market Share

2Q12 Unit Ship-ments

2Q12 Market Share

Year-over-Year Growth

1. Apple

14.6

32.4%

17.0

60.3%

-14.1%

2.Samsung

8.1

18.0%

2.1

7.6%

277.0%

3. ASUS

2.0

4.5%

0.9

3.3%

120.3%

4. Lenovo

1.5

3.3%

0.4

1.3%

313.9%

5. Acer

1.4

3.1%

0.4

1.4%

247.9%

Others

17.5

38.8%

7.4

26.2%

136.6%

Total

45.1

100.0%

28.3

100.0%

59.6%

Source: IDC Worldwide Tablet Tracker, August 5, 2013.

See additional Table Notes following the last table.

Top Tablet Operating Systems, Shipments, and Market Share, Second Quarter 2013 (Shipments in Millions)

Vendor

2Q13 Unit Ship-ments

2Q13 Market Share

2Q12 Unit Ship-ments

2Q12 Market Share

Year-over-Year Growth

1. Android

28.2

62.6%

10.7

38.0%

162.9%

2. iOS

14.6

32.5%

17.0

60.3%

-14.1%

3.Windows

1.8

4.0%

0.3

1.0%

527.0%

4. Windows RT

0.2

0.5%

N/A

N/A

N/A

5.BlackBerry OS

0.1

0.3%

0.2

0.7%

-32.8%

Others

0.1

0.2%

N/A

N/A

N/A

Total

45.1

100.0%

28.3

100.0%

59.6%

Source: IDC Worldwide Tablet Tracker, August 5, 2013

Table Notes:

- All data are preliminary and subject to change. Vendor shipments are branded shipments and exclude OEM sales for all vendors.

- Some IDC estimates prior to financial earnings reports.

- Shipments include shipments to distribution channels or end users. OEM sales are counted under the vendor/brand under which they are sold.

- IDC considers all LCD-based slate devices with screens between 7 and 16 inches as tablets, regardless of whether or not they include a removable keyboard (such as the Surface RT). Convertible devices with non-removable keyboards (such as Lenovo’s Yoga) are not counted as Tablets.

Gartner: ‘Traditional PC shipments to decline as tablets are becoming the primary consumption device’

Gartner Says Worldwide PC, Tablet and Mobile Phone Shipments to Grow 5.9 Percent in 2013 as Anytime-Anywhere-Computing Drives Buyer Behavior [press release, June 24, 2013]

Traditional PC Shipments to Decline 10.6 Percent in 2013, While Tablet Shipments Increase 67.9 Percent

Worldwide devices (the combined shipments of PCs, tablets and mobile phones) are projected to reach 2.35 billion units in 2013, a 5.9 percent increase from 2012, according to Gartner, Inc. The market is being driven by sales in tablets, smartphones, and to a lesser extent, ultramobiles, as PC shipments are on the decline.

Worldwide traditional PC (desk-based and notebook) shipments are forecast to total 305 million units in 2013, a 10.6 percent decline from 2012 , while the PC market including ultramobiles is forecast to decline 7.3 percent in 2013 (see Table 1). Tablet shipments are expected to grow 67.9 percent, with shipments reaching 202 million units, while the mobile phone market will grow 4.3 percent, with volume of more than 1.8 billion units. The sharp decline in PC sales recorded in the first quarter was the result in a change in preferences in consumers’ wants and needs, but also an adjustment in the channel to make room for new products hitting the market in the second half of 2013.

“Consumers want anytime-anywhere computing that allows them to consume and create content with ease, but also share and access that content from a different portfolio of products. Mobility is paramount in both mature and emerging markets,” said Carolina Milanesi, research vice president at Gartner.

Table 1

Worldwide Devices Shipments by Segment (Thousands of Units)

Device Type

2012

2013

2014

PC (Desk-Based and Notebook)

341,273

305,178

289,239

Ultramobile

9,787

20,301

39,824

Tablet

120,203

201,825

276,178

Mobile Phone

1,746,177

1,821,193

1901,188

Total

2,217,440

2,348,497

2,506,429

Source: Gartner (June 2013)

Demand for ultramobiles (which includes Chromebooks, thin and light clamshell designs, and slate and hybrid devices running Windows 8) will come from upgrades of both notebooks and premium tablets, such as the Apple iPad or Galaxy Tab10.1. Analysts said ultramobile devices are gaining in attractiveness and drawing demand away from other devices. This will be even more evident in the fourth quarter of 2013 when the combination of new design based on Intel processors Bay Trail and Haswell running on Windows 8.1 will hit the market. Although these devices will only marginally help overall sales volumes initially, they are expected to help vendors increase average selling prices (ASPs) and margins.

The tablet and smartphone markets are facing some challenges as these devices gain longer life cycles. There has also been a shift as many consumers go from premium tablets to basic tablets. The share of basic tablets is expected to increase faster than anticipated, as sales of the iPad Mini already represented 60 percent of overall iOS tablet sales in the first quarter of 2013.

“The increased availability of lower priced basic tablets, plus the value add shifting to software rather than hardware will result in the lifetimes of premium tablets extending as they remain active in the household for longer. We will also see consumer preferences split between basic tablets and ultramobile devices,” said Ranjit Atwal, research director at Gartner. “With mobile phones, volume expectations for 2013 have been brought down as the life cycles lengthen as consumers wait for new models and lower prices to hit the market in the Fall and holiday season. The challenge in the smartphone market is also that, as penetration moves more and more to the mass market, price points are lowering and in most cases so do margins.”

“Although the numbers seem to paint a clear picture of who the winner will be when it comes to operating systems (OS) in the device market (see Table 2), the reality is that today ecosystem owners are challenged in having the same relevance in all segments,” said Ms. Milanesi. “Apple is currently the more homogeneous presence across all device segments, while 90 percent of Android sales are currently in the mobile phone market and 85 percent of Microsoft sales are in the PC market.”

Table 2

Worldwide Devices Shipments by Operating System (Thousands of Units)

Operating System

2012

2013

2014

Android

505,509

866,781

1,061,270

Windows

346,464

339,545

378,142

iOS/MacOS

212,878

296,356

354,849

RIM

34,584

25,224

22,291

Others

1,118,004

820,592

689,877

Total

2,217,440

2,348,497

2,506,429

Source: Gartner (June 2013)

Additionally, with enterprises’ growing acceptance of bring your own device (BYOD), there is an increase in consumer-owned devices in the computing world. Gartner forecasts that computing devices bought by consumers will grow from 65 percent in 2013 to 72 percent in 2017. This signifies the growing importance of designing for the consumer inside the enterprise.

Gartner’s detailed market forecast data is available in the report, “Forecast: Devices by Operating System and User Type, Worldwide, 2010-2017, 2Q13 Update.” The report is on Gartner’s website athttp://www.gartner.com/resId=2524916.

Gartner Says Worldwide PC Shipments in the Second Quarter of 2013 Declined 10.9 Percent [press release, July 10, 2013]

PC Industry Continues to Shrink as the Installed Base Restructures to Accommodate Tablets as the Primary Consumption Device

Worldwide PC shipments dropped to 76 million units in the second quarter of 2013, a 10.9 percent decrease from the same period last year, according to preliminary results by Gartner, Inc. This marks the fifth consecutive quarter of declining shipments, which is the longest duration of decline in the PC market’s history.

All regions showed a decline compared to a year ago. The fall in the Asia/Pacific PC market continued, showing five consecutive quarters of the shipment decline, while the EMEA PC market registered two consecutive quarters of double-digit decline.

“We are seeing the PC market reduction directly tied to the shrinking installed base of PCs, as inexpensive tablets displace the low-end machines used primarily for consumption in mature and developed markets,” said Mikako Kitagawa, principal analyst at Gartner. “In emerging markets, inexpensive tablets have become the first computing device for many people, who at best are deferring the purchase of a PC. This is also accounting for the collapse of the mini notebook market.”

HP and Lenovo’s neck-and-neck competition continued. This time, Lenovo was back in the top position by only a small difference in share (see Table 1). Lenovo showed mixed regional results, as it experienced strong growth in the Americas and EMEA, while showing a major decline in Asia/Pacific. Weakness in China was most likely the contributor of Lenovo’s shipment decline in the region as the majority of Lenovo’s volume came from China.

While HP was slightly behind Lenovo, HP is a market leader in key regions including the U.S., EMEA and Latin America. Asia/Pacific has been a weakness the last three years for HP, but preliminary second quarter results suggest an improvement of their performance in the region.

Table 1

Preliminary Worldwide PC Vendor Unit Shipment Estimates for 2Q13 (Units)

Company

2Q13 Ship-ments

2Q13 Market Share (%)

2Q12 Ship-ments

2Q12 Market Share (%)

2Q12-2Q13 Growth (%)

Lenovo

12,677,265

16.7

12,755,068

14.9

-0.6

HP

12,402,887

16.3

13,028,822

15.3

-4.8

Dell

8,984,634

11.8

9,349,171

11.0

-3.9

Acer Group

6,305,000

8.3

9,743,663

11.4

-35.3

ASUS

4,590,071

6.0

5,772,043

6.8

-20.5

Others

31,041,130

40.8

34,675,824

40.6

-10.5

Total

76,000,986

100.0

85,324,591

100.0

-10.9

Note: Data includes desk-based PCs and mobile PCs, including mini-notebooks but not media tablets such as the iPad.

Source: Gartner (July 2013)

Dell’s shipments declined compared to a year ago, but its 2Q13 results showed a smaller decline than the past several quarters. Dell showed good growth in the U.S. and Japan, but struggled to increase shipments in Asia/Pacific and EMEA. Both Acer and ASUS showed steep declines compared to the second quarter last year. The decline was partly affected by their strategies to exit the mini-notebook market.

“While Windows 8 has been blamed by some as the reason for the PC market’s decline, we believe this is unfounded as it does not explain the sustained decline in PC shipments, nor does it explain Apple’s market performance,” Ms. Kitagawa said.

In the U.S. market, PC shipments totaled 15 million units in the second quarter of 2013, a 1.4 percent decline from the second quarter of 2012 (see Table 2). This decline was less than the past seven quarters, and the market grew 8.5 percent sequentially.

“Our preliminary results indicate that this reduced market decline was attributed to solid growth in the professional market,” Ms. Kitagawa said. “Three of the major professional PC suppliers, HP, Dell and Lenovo, all registered better than U.S. average growth rate. The end of Windows XP support potentially drove the remaining PC refresh in the U.S. professional market.”

Table 2

Preliminary U.S. PC Vendor Unit Shipment Estimates for 2Q13 (Units)

Company

2Q13 Ship-ments

2Q13 Market Share (%)

2Q12 Ship-ments

2Q12 Market Share (%)

2Q12-2Q13 Growth (%)

HP

3,957,761

26.4

3,976,041

26.2

-0.5

Dell

3,681,725

24.6

3,458,736

22.8

6.4

Apple

1,740,500

11.6

1,818,959

12.0

-4.3

Lenovo

1,515,562

10.1

1,266,109

8.3

19.7

Toshiba

848,984

5.7

1,006,900

6.6

-15.7

Others

3,230,717

21.6

3,659,220

24.1

-11.7

Total

14,975,249

100.0

15,185,965

100.0

-1.4

Note: Data includes desk-based PCs and mobile PCs, including mini-notebooks but not media tablets such as the iPad.

Source: Gartner (July 2013)

PC shipments in Europe, Middle East and Africa (EMEA) were weakened in the second quarter of 2013, with a 16.8 per cent decline over the same period last year, marking the fifth consecutive quarter of decreasing shipments.

“The sharp decline in the second quarter of 2013 was partly due to the shift in usage patterns away from notebooks to tablets, and partly because the PC market was exposed to inventory reductions in the channel due to the start of the transition to new Haswell-based products,” said Isabelle Durand, principal research analyst at Gartner. “Touch-based notebooks still account for less than 10 per cent of the total consumer notebook shipments in the last quarter.”

“Shipment levels remained weak in Western Europe in the second quarter of 2013 as PC replacement rates continued to be extremely low, while the challenging economic environment is muting spending in consumer markets,” said Ms Durand. “Shipments in Eastern Europe also remained low as this is typically a quiet quarter for business buyers in the region, and consumers are predominantly looking for Android-based tablets. In the Middle East and Africa, tablet and smartphone adoption also continued to draw demand away from PCs in the second quarter of 2013.”

Despite the steep shipment decline, HP retained the top position in EMEA due to better results in the professional PC market. Lenovo was the only top five vendor to exhibit shipment growth, recording a fourth consecutive quarter of growth and taking second place in the EMEA PC vendor rankings in the second quarter of 2013.

Acer exhibited the worst performance of the second quarter with a shipment decline of 38.5 percent year-on-year. Most of Acer’s decline resulted from its portfolio shifting away from netbooks to Android tablets. ASUS also experienced a PC shipment decline in the second quarter 2013. The drop of its netbooks continued to impact its overall notebook results.

Table 3

Preliminary EMEA PC Vendor Unit Shipment Estimates for 2Q13 (Units)

Company

2Q13 Ship-ments

2Q13 Market Share (%)

2Q12 Ship-ments

2Q12 Market Share (%)

2Q12-2Q13 Growth (%)

HP

3,779,160

17.8

4,683,376

18.3

-19.3

Lenovo

2,641,622

12.4

2,180,362

8.5

21.2

Acer Group

2,456,255

11.5

3,995,518

15.6

-38.5

Dell

1,979,895

9.3

2,173,552

8.5

-8.9

ASUS

1,743,345

8.2

2,670,268

10.4

-34.7

Others

8,675,143

40.8

9,864,285

38.6

-12.1

Total

21,275,420

100.0

25,567,361

100.0

-16.8

Notes: Data includes desk-based PCs and mobile PCs, including x86 tablets equipped with Windows 8. All data is estimated, based on a preliminary study. Final estimates will be subject to change. The statistics are based on the shipments selling into channels.

Source: Gartner (July 2013)

In Asia/Pacific, PC shipments surpassed 26.8 million units in the second quarter of 2013, an 11.5 percent decline from the first quarter of 2012. All country markets across the region showed weakness, but India performed slightly better due to a state PC tender fulfillment. China’s PC shipment remained weak as the consumer market was hampered with lack of new demand generation programs, such as subsidized PC program in the rural cities.

These results are preliminary. Final statistics will be available soon to clients of Gartner’s PC Quarterly Statistics Worldwide by Region program. This program offers a comprehensive and timely picture of the worldwide PC market, allowing product planning, distribution, marketing and sales organizations to keep abreast of key issues and their future implications around the globe. Additional research can be found on Gartner’s Computing Hardware section on Gartner’s website at http://www.gartner.com/it/products/research/asset_129157_2395.jsp.

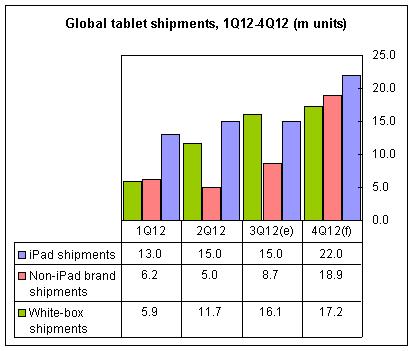

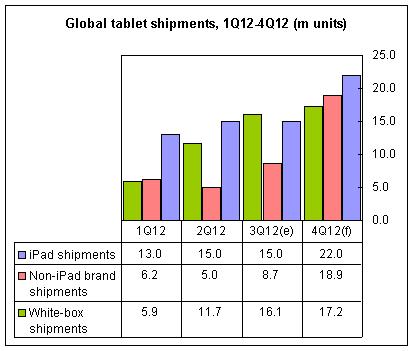

Digitimes Research: ‘Overtaking iPad will happen in 2H13’

Digitimes Research: iPad sees its first on-year shipment drop in 2Q13 [July 29, 2013]

Global tablet shipments reached 29.32 million units in the second quarter of 2013, down 8.2% sequentially, but still up 46.6% compared to the same period a year ago. As overall market demand is declining, both iPad and non-iPad product shipments have been impacted. Because of the iPad mini’s significant shipment drop, Apple’s tablet shipments in the second quarter were only 14.6 million units, down 25.1% sequentially and 2.7% on year, according to Digitimes Research’s latest figures.

As for non-iPad tablet shipments, non-Apple brand vendors’ new products and the second-generation Nexus 7 have both contributed to the volume, helping it to grow 18.5% on quarter and reach 14.72 million units. However, since Samsung Electronics and Lenovo have both increased their in-house production rates, Taiwan’s share of global tablet shipments dropped below 70% in the second quarter with shipments of only 20.38 million units, Digitimes Research figures showed.

In terms of brand vendors’ ranking, Apple and Samsung Electronics were the top-two players, followed by Asustek Computer third, Lenovo fourth and Acer sixth. As for processor rankings, MediaTek was the third-largest supplier in the second quarter thanks to its strategy of pushing mainly in the entry-level segment, only behind Apple and Texas Instruments (TI). Nvidia was the fourth largest with Samsung and Intel following closely behind.

Digitimes Research: Tablet shipments to grow 17.7% on year in 2H13 [Aug 6, 2013]

Tablet shipments in the second half are expected to reach 82.07 million units, up 17.7% on year; however, several changes will also occur during the period: hardware brand vendors will dominate the small-size tablet segment; non-iPad tablet shipments will surpass those of iPad; closed Android platforms will be impacted by the official Android platform; and Qualcomm and MediaTek will replace Texas Instruments (TI) and Nvidia in the non-Apple camp, according to Digitimes Research’s latest figures.

Small-size devices are expected to become mainstream products of the tablet market, accounting for 70% of total shipments in the second half. Non-iPad tablet shipments are also expected to surpass those of iPad and reach 45.07 million units. With the non-iPad camp’s strong shipments, over 50% of global tablets will adopt the Android operating system in the second half, Digitimes Research estimates.

Android’s large market share will also strongly impact closed Android platforms such as Amazon’s operating system for its tablets due to lack of key application support.

The Retina display-featured iPad mini may not appear before the end of 2013 due to the panel’s weak yield rate and the possibility that the device may undermine sales of the new high-end iPad. As a result, Apple’s shipments in the second half may drop to 37 million units with an on-year growth of 3%.

As for Windows-based tablets, although Microsoft is offering more price cuts for its Small Screen Touch (SST) program, the deal is unlikely to help push vendors to release Windows-based devices and the platform will only account for 3.8% of second-half tablet shipments.

Qualcomm became the processor supplier of the second-generation Nexus 7 and the third-generation Kindle Fire, replacing Nvidia and TI. Qualcomm will ship close to 10 million processors in the second half of 2013, becoming the largest CPU supplier of the non-Apple camp. MediaTek, thanks to its hardware brand clients’ small-size tablet orders, will become the second largest supplier, followed by Samsung Electronics and Intel, both of whom will ship over seven million units.

Taiwan makers’s tablet shipments will reach 59.45 million units in the second half, but as Samsung and Lenovo are increasing their in-house production rates, Taiwan makers’ share of global tablet shipments will drop to around 70%. As ODMs are aggressively competing for orders, Apple, Amazon and Asustek Computer will no longer place most of their orders with only Foxconn Electronics (Hon Hai Precision Industry) and Quanta Computer and will spread out their orders more evenly, Digitimes Research believes.

Canalys says ‘Yes’

Small tablets drive big share gains for Android [Canalys press release, Aug 1, 2013]

– Android overtakes iOS with 53% market share in tablets

Over 34 million tablets shipped in Q2 2013, a 43% year-on-year increase. Tablets now account for 31% of worldwide PC shipments. But Apple’s performance faltered. Its tablet shipments declined 14% on Q2 2012 and its market share dropped to 43%. The chasing pack of Samsung, Amazon, Lenovo and Acer each grew annually by over 200%, driven by increasing demand for small-screen tablets. Canalys estimates that 68% of tablets shipped in Q2 had a screen size smaller than 9″. ‘Consumers have been evaluating tablets and the results are now in,’ said Tim Coulling, Canalys Senior Analyst. ‘With touch-screens contributing to a high proportion of the build cost of a tablet, small-screen products can be priced very aggressively.’

Apple’s decline in shipments and share has been partly attributed to its aging portfolio. But Canalys believes that new product launches will have less impact on its shipments in future. ‘When Apple does decide to refresh its iPad range it will not experience the buzz of previous launches,’ said Canalys Analyst James Wang. ‘Tablets are now mainstream products and hardware innovation is increasingly difficult. With branded Android tablets available for less than $150, the PC market has never been so good for consumers, who are voting with their wallets.’ The move to smaller tablets has sparked a price war that has real consequences for the entire supply chain. These products generate little absolute margin for channel partners, vendors or component manufacturers. Content, applications and accessories (especially cases and keyboards) are now even more important to boost margins – areas where Apple remains a leader.

In addition to disappearing margins, inventory management is emerging as a major challenge. If a vendor overcommits at the product planning stage, unsold inventory can play havoc with a company’s balance sheet, even with other hit products in a portfolio. The market for full-sized tablets has stalled and even Apple has found it harder to sell its larger iPads in recent quarters. ‘Microsoft’s inventory issues with the Surface have been well publicized,’ said Coulling. ‘Heavily discounted Surface RTs will fly off the shelves. Expect prices to continue to fall though, as the starting price of $350 is still too expensive to spark an HP TouchPad-style buying frenzy.’

Despite its 53% share, Android still lags far behind iOS in the availability of fully-optimized tablet apps, and tablet app downloads from the Apple App Store dwarf those from Google Play. But Android is expected to continue to close the ecosystem lead iOS has in tablets and increase share in coming quarters. ‘Developers can and will quickly switch their priorities as different opportunities evolve and improve,’ said Canalys Senior Analyst Tim Shepherd. ‘We expect to see a substantial increase in the quantity, as well as the quality, of apps built or optimized for Android tablets over the next 12 months, as Google brings more attention to them through improvements to the Play store, and as the addressable base of devices continues to soar.’

While it is true that Apple is losing its stranglehold on the tablet market in terms of volume, it will remain its most profitable vendor for years to come. Apple has already faced a similar battle in the smart phone market, and it now looks increasingly likely that it is readying a product that can address lower price tiers and high-growth markets in that space. If this is indeed the case, Apple could replicate a similar portfolio play in the tablet market. It will be in no rush – after all, the launch of the iPad mini was designed to address this segment. But its hand could be forced if competitors’ prices continue to plummet. The margin models in the smart phone and tablet markets are very different. It will still make good margin on a cheaper iPhone but will struggle to do so with a cheaper tablet, and would instead need to rely increasingly on accessory sales and, likely, subsidy from apps and content purchases.

PC market flat in Q2 2013, despite tablet growth [Canalys press release, Aug 6, 2013]

– Android takes 17% of PC market in Q2 as PC vendors turn to Google for tablets

The worldwide PC market experienced a quarter without growth, as a 42.9% increase in tablet shipments was offset by declines in desktop and notebook shipments, which fell 7.4% and 13.9% respectively. Despite tablet growth slowing in Q2, Canalys still believes that tablets will outsell notebooks by Q4 of this year.

PC shipments in EMEA fell by 3% year-on-year in Q2, the first decline after two successive quarters of double-digit growth. Western Europe and Central and Eastern Europe continue to be challenging for vendors, with annual declines of 10% and 3% respectively. PC shipments in the Asia Pacific region declined 0.5% year-on-year to just over 40 million units. The region was badly affected by slow shipments in the People’s Republic of China, which accounted for almost 45% of the region’s shipments and declined by approximately 6%. Demand for smart phones and tablets is increasing around the world. Faced by an industry in transition, channel partners are exercising caution when planning and placing orders.

Apple remained the top PC vendor in Q2, with a 4.5 million unit lead over second-placed Lenovo. But Apple’s share fell more than two percentage points to 17.1% from 19.4% in Q2 last year due an annual decrease in iPad shipments. Desktop and notebook shipments only accounted for around 20% of its total PC shipments. With tablet vendors attacking Apple on price it must bring fresh innovation to future generations of its iPad range if it is to maintain the lead it has built in the PC market.

Lenovo had a strong quarter, gaining share in its core notebook and desktop categories, as well as tablets. Its performance in Q2 was helped by strong annual growth in EMEA (34%), the US (28%) and Latin America (93%). Lenovo’s tablet business also performed well – it shipped around 1.5 million units. ‘It is striking how successful it has been in globalizing its PC business and breaking the 1 million unit barrier is an important milestone for its tablet shipments,’ noted Canalys Analyst James Wang. ‘Lenovo is on an upward curve with its tablets, expanding in mainland China and Latin America, where there is little competition from the likes of Google or Amazon.’

HP has overtaken Samsung to regain third place. HP has recently changed its tablet strategy and launched its first Android tablet in Q2, the Slate 7. ‘HP has a broad enterprise portfolio, channel relationships and global reach that others still cannot match,’ said Canalys Research Analyst Pin-Chen Tang. ‘To increase its market share it should look to leverage its strengths in the enterprise to advance Android in business.’

iOS and Android have profited from the shift to tablets, as they have proved to be the only type of PC with any momentum. Android’s share of the total PC market increased to 17% in Q2 2013 from 6% a year ago. With the likes of HP, Lenovo and Samsung looking to use Android to compete with iOS in the tablet space, the platform is well placed to continue increasing its share. Google is targeting the consumer market and has its sights set on beating Apple in the smart phone and tablet space. Android remains weak in management and security, which is preventing commercial uptake. Google, or its partners, must address this shortfall quickly if it is to penetrate the enterprise

There has been rapid innovation in the Windows category, as vendors such as HP, Lenovo, Toshiba and Acer have built PCs using a variety of new form factors. These products are struggling to take off as the difference in price between Android and Windows-based tablets remains high. ‘Component pricing has been an issue, particularly with multi-touch screens, though scale economies make this less of an issue as demand increases. The price of Windows itself is a contributing factor and one that Microsoft must address as a matter of urgency. Its PC OEM partners are in an increasingly difficult position and consolidation in the PC market is inevitable within the next 12 months,’ said Tim Coulling, Canalys Senior Analyst.

Half a billion PCs to ship in 2013 as tablet sales rocket [Canalys press release, June 11, 2013] – Tablet shipments to grow by 59% this year to reach 182.5 million units

Canalys’ latest forecasts for the PC market (desktops, notebooks and tablets) predict that 493.1 million units will ship in 2013, representing 7% year-on-year growth. The key driver behind this growth will be tablets, which will account for 37% of the market, up from a quarter in 2012. Looking ahead to 2017, Canalys expects that 713.8 million PCs will ship worldwide (a CAGR of 9.7%), with 64% being tablets and 25% notebooks.

Worldwide demand for tablets has gone from strength to strength, while that for desktops and notebooks has waned. In the first quarter of 2013, the desktop market fell 10.3% and the notebook market declined 13.1%. The size of the tablet market, however, more than doubled in Q1 2013, with a 106.1% increase in shipments to 41.9 million units. Shipments show no sign of slowing and Canalys forecasts that in 2013 tablet shipments will reach 182.5 million units, with global tablet shipments surpassing those of notebooks in the final quarter of the year.

The reception to Windows 8 has not reinvigorated demand for Microsoft-based PCs but there is a glimmer of hope for OEMs with Microsoft’s plan to release Windows 8.1 as a free upgrade. ‘Microsoft will continue to innovate. New versions will come and its OS release cycle will gain speed. But it must address some of the criticisms that have been directed at the OS’s user interface or it risks losing even more ground to iOS and Android in the PC space,’ said Tim Coulling, Senior Analyst at Canalys.

A plethora of PC vendors have now come to market with cheaper Android devices, notably Acer, Asus and HP, but these vendors are joining a crowded market. ‘Shipment numbers can be high but absolute margins on these products are expected to be small. Low-priced tablets will not be lucrative but it is necessary to compete or a vendor will simply lose relevance and scale. In fact, accessories, particularly cases, as well as the new generation of high-tech ‘appcessories’ will likely provide higher margins than the products themselves,’ said Pin-Chen Tang, Research Analyst. ‘This new influx of Android devices will provide a boost to the platform and

Canalysthereforeexpects Android to take a 45% share this year, behind Apple at 49%[this prediction failed already for Q2 results as was reported on Aug 1 by Canalys: ‘Android overtakes iOS with 53% market share in tablets‘]. The iPad mini is expected to continue selling well, becoming more significant in terms of the product mix and spawning a further increase in consumer demand for smaller tablets.’The great hope for Windows 8 was that it would unleash new PC form factors, combining the best of both PCs and tablets. But James Wang, an Analyst at Canalys, noted, ‘These convertible products have disappointed so far. Convertibles are too heavy in tablet form and too expensive when compared with clamshell products. Canalys therefore expects that, for at least the next 18 months, consumers will buy separate products, rather than compromise on a Windows 8 convertible or hybrid PC. Even for Android products, alternative form factors are not expected to grow rapidly due to the category being sandwiched between low-cost slates and more familiar Windows-based clamshell notebooks.’ Out of the 388.1 million mobile PCs (notebooks and tablets) that Canalys forecasts will ship in 2013, it estimates that less than 2% will be hybrids or convertibles.

Another ray of light for PC vendors is that PC sales to businesses are, and will continue to be, far stronger than those to consumers. This trend favors the likes of HP and Lenovo, though competition will increase as others shift resources toward the commercial channels to maximize their opportunity.

Canalys definitions

Appcessories: Products that connect to applications on smart devices (smart phones, tablets and notebook PCs).

Clamshell: A notebook with keyboard/second screen fixed with a one-directional hinge only enabling movement up to 180⁰.

Convertible: A notebook with keyboard/second screen that can be converted to a tablet form factor.

Slate: A tablet that is not designed by its manufacturer to be fixed to a keyboard accessory with a hinge.

Hybrid: A tablet that is designed by its manufacturer to be fixed to a keyboard accessory with a hinge.

About Canalys

Canalys is an independent analyst firm that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. Our customer-driven analysis and consulting services empower businesses to make informed decisions and generate sales. We stake our reputation on the quality of our data, our innovative use of technology, and our high level of customer service.

EnfoDesk (Analysys International) from China says ‘For sure, as it is already happening against the iPad in China even at a nascent stage of the local tablet market’

Industry data: 2013Q2 Chinese Tablet PC market sales of 3.58 million, the rapid expansion of domestic [products], apple [products] decline significantly [enfodesk.com, Aug 14, 2013] as translated by Google and Bing, with manual edits:

According to Analysys think tank EnfoDesk latest monitoring data shows that in the second quarter of 2013 tablet PC sales in China reached 3,576,000 units, up 5.2% Q/Q growth.

According to Analysis think tank EnfoDesk in the last quarter of 2013 sales growth on the tablet PC market in China slowed down to only 5.2% Q/Q growth rate, mainly due to weak sales of Apple’s tablet computers, as its sales fell for the first time. And Samsung had eye-catching performance this quarter, after N5110 Galaxy Note 8 has been released, and sought after by the market, so the Samsung Tablet PC overall sales increased dramatically, pulling the overall market growth. Worth mentioning this quarter is that domestic brand tablet PCs, such as Teclast (台电) [see Teclast’s Tmall site in Chinese, or Pandawill’ Teclast global online site in English] and ONDA (昂达) [see ONDA’s global site in English] have gained more market share with their low prices, ultra high yield of price/performance, and best selling online channels.

Throughout the three major tablet platforms, iOS declined significantly, it will be difficult to stop its market share erosion trends; Windows was tepid, the release of Microsoft Surface and continuous price cuts did not enhance the Windows market activity; Android cut right through the market, by virtue of many manufacturers to compete, high performance models being abundant, covering all price points of consumer groups, and with product prices constantly being refreshed, quickly seized the tablet PC market. If Apple can not launch innovative tablet PC products in the near future, [the event of] Android surpassing iOS market share is around the corner.

Compare this to the situation in 2012:

- China market: Apple shares over 71% of 4Q12 consumer tablet sales, says Analysys [DIGITIMES, April 19, 2013]

Apple occupied 71.6% of consumer tablets sold in the China market during the fourth quarter of 2012, according to China-based Analysys International.

For business-use tablets alone, Eben had the largest market share at 41.9%, followed by Samsung Electronics with 21.0%, Asustek Computer with 6.6% and Lenovo with 4.5%, Analysys indicated.

Vendor

Market share

Apple

71.6%

Lenovo

10.2%

Eben

4.0%

Samsung

3.9%

Acer

2.3%

Asustek

1.5%

Teclast

1.0%

Source: Analysys, compiled by Digitimes, April 2013

- Analysys International: iPad Sales Share Fell in Q3, 2012 [Analysys International, published in English on May 17, 2013]

According to the Quarterly Survey of China’s Tablet PC Market 2012Q3, 2.60 million sets tablet PC have been sold in Chinese market in Q3, 2012. Apple occupied 71.4% market share with a slight drop, Lenovo ranked second, reaching 10.52% and Ereneben ranked third with its market share being 3.61% and Samsung ranked fourth, taking up 3.53% market share.

EnfoDesk, Analysys International finds that 4 factors require our attention concerning China’s tablet PC manufacturers’ market layout in Q3, 2012:

- Compared with last quarter, Apple’s market share dropped from 72.66% to 71.42%. New iPad marketing promotions were made mainly in Q2. In Q3, iPad 2and The New iPad were in normal sales.

- The sales volume of Lenovo tablet PC rose considerably with its market share being 10.52%. Such a growth is resulted from the issue of its new products S2107 and S2109 and promotions when new semester begins for students.

- Ereneben issued its new product T5 in Q3, which drives the overall sales volume, and the price of T4 came down slightly in some provinces, thus increasing the sales volume of Ereneben.

- Samsung tablet PC enjoyed relatively stable sales in Chinese market. The company doubled their efforts in the marketing of tablet PC Note series (7 inches or above versions). Its branding effects gradually brought about and increased its sales in the Chinese market.

Besides, the research on e-business tablet PC market conducted by EnfoDesk, Analysys International shows that Ereneben ranked first with market share being 41.07%. Samsung offered Galaxy Note 10.1 e-tablet PC to consolidate its positioning in e-business tablet PC market. Its market share was 19.66% of total e-tablet PC market. Lenovo’s Thinkpad was in normal sales, only occupied 3.89% market share.

…

Analysys International: iPad took up 73% of Tablet PC Market 2012Q2 [Analysis International, published in English on May 16, 2013]

According to the Quarterly Survey of Tablet Market in China 2012Q2, released by EnfoDesk, Analysys International, market share of Apple rose to 72.66% with a sequential growth rate rising by 20.06%. Top 2 was Lenovo that witness a drop of its market share (Its market share was 8.38%). Eben ranked third with its market share being 3.63% and the market share of Samsung came down to 3.59% with its sequential growth rate dropping by 7.69%.

EnfoDesk Analysys International believes that three aspects should be noticed concerning the market layout of tablet PC market in Q2, 2012.

First, the market share of Apple has risen from 65.21% in Q1 to 72.66% in Q2. New iPad came into the market in March; however, since no substantial improvement has been made on the new products, consumers would rather wait to buy in Q2. The price reduction of iPad 2 promoted the sales volume of Apple products, allowing its market share to grow.

Second, compared with Q1, market share of Lenovo shrank. On one hand, it was a dull season; on the other hand, it was caused by its internal policy. In September, Lenovo will launch its promotion of new products when new term begins in September (during the peak season) and the company would rather clean up stocks of its other products in Q2.

Finally, iOS tablet PC suffers less seasonal factors than Android tablet PC. Currently, Android tablet PC market is getting stabilized. Solely relying on traditional sales channel to educate consumers was too slow and manufacturers could carry out more promotions to increase brand influence and brand concentration, grab the market share of smuggled products and clarify market layout of Android tablet PC. In addition, other tablet PC manufactures except Apple should consider its own market position and offer its unique products, gradually getting rid of homogenization of Android tablet PC. Eben as a leader in business tablet PC market offers unique products and its market positioning is clear.

…

- Analysys International: 2.34 Million Tablet PCs Were Sold in China 2012Q2 [Analysis International, published in English on May 16, 2013]

According to the statistics recently released by Analysys International, 2.34 million tablet PCs were sold in China in Q2, 2012. The sequential growth rate has reached 7.8%.

Analysys International holds that sales growth of China’s tablet PC in Q2, 2012(The growth rate has reached 7.8%) is due to the following factors:

iPad directly triggered the market fluctuation. The price reduction of iPad forced the average price of tablet PC to go down. As a result, consumers with cash in hand developed their desire to buy and such a desire transformed into procurement, which allowed the sales volume to grow in the dull season.

EnfoDesk, Analysys International predicts that the future market layout will be even clearer. Android manufacturers and others will target middle and low-end consumers with an attempt to avoid direct competition with Apple. Even though the sales volume of Apple will increase, its market share will continue to shrink. The market share of Android manufacturers is expected to grow and the market concentration will increase. The smuggled products will face the question of survival and the market will get further standardized.

Research Definitions

Tablet PC is a portable mobile internet device accessible to the network. It has independent mobile OS and is able to expand its applications. The screen ranges from 5 to 11 inch. Touch screen or pen is served as a basic input device.

The Sales Volume is tablet PC manufacturers’ sale in China, including some overseas brands which are sold by a purchasing agency (OEM labeling products is regarded as the labeled brand. Some device manufacturers also sell some products to market abroad. This part of sales volume is not calculated in the said report).

Research Statement

The industrial analyses, provided by Analysys International, mainly reflect the current situation, trend, inflection point, commercial law and manufacturers’ situation. The figures and statistics are drawn by adopting a unique industrial analysis model combined with the research and study methods used by market, industry and manufactures. All the data are based on industrial macro and historical data, seasonal end-users’ and business information.

It is believed that data concluded from research into market and trade is within acceptable errors. It can reflect the trend and commercial laws accurately.

Results obtained by the means of professional research methods are for reference. The actual data can be obtained by checking on financial report issued by manufacturers.

About Analysys International

Analysys International is a leading advisor on the technology, media and telecom (TMT) industries in China. We provide data, information and advice to 50,000 clients worldwide representing 1,500 distinct organizations, deliver over 150 consulting engagements a year, and hold more than 20 events that draw in over 8,000 attendees. Our clients include executives from companies as technology vendors, vertical information technology users, as well as professionals from professional service companies, the investment community and government agencies. Our mission is simple and clear: we help our clients make better business decisions. For more information, please visit our website at http://english.analysys.com.cn.

About EnfoDesk

EnfoDesk is an industrial data base for subscription offered by Analysys International. It aims to help you perceive opportunities and risks in the Internet age with online database search, analyst interaction, market alarms and other functions. EnfoDesk can help you get information in time and know more about:

– The business mode and trend of the Internet and mobile web market