Home » Posts tagged 'iPhone'

Tag Archives: iPhone

Tablet and smartphone market trends

September update: Qualcomm’s smartphone AP revenues declined 17% year-over-year in the second quarter of 2015, Strategy Analytics estimated. Qualcomm maintained its smartphone AP market share leadership with 45% revenue share, followed by Apple with 19% revenue share and MediaTek with 18% revenue share. For the rest 18%: After a difficult 2014, Samsung LSI continued to recover and more than doubled its smartphone AP shipments in the second quarter of 2015 compared to the same period last year. Samsung LSI capitalised on its Galaxy S6 design-win in Q2 2015. In addition the company featured in multiple mid-range smartphones from Samsung Mobile. Full report: Smartphone Apps Processor Market Share Q2 2015: Samsung LSI Maintains Momentum

… The global tablet AP market declined 28% year-over-year to reach US$679 million in the second quarter of 2015, according to Strategy Analytics. Apple, Intel, Qualcomm, MediaTek and Samsung LSI captured the top-five revenue share rankings in the market during the quarter. Apple led the tablet AP market with 27% revenue share, followed by Intel with 18% revenue share. Qualcomm ranked number three, narrowly behind Intel. ![GT400150821[1]](https://lazure2.wordpress.com/wp-content/uploads/2015/08/gt4001508211.jpg?w=960) Full report: Tablet Apps Processor Market Share Q2 2015: Apple and Intel Maintain Top Two Spots

Full report: Tablet Apps Processor Market Share Q2 2015: Apple and Intel Maintain Top Two Spots

…

Digitimes Research saw global tablet shipments fall to 45.76 million units in second-quarter 2015, showing a 10% decrease on quarter and representing more than a 15% decrease on year. Full report: Global tablet market – 2Q 2015 End of September update

Investors.com comments on tablet and smartphone market trends — Q2’2015: 1. Apple, Samsung lose ground in tablet market — LG and Huawei gain

1. Apple, Samsung lose ground in tablet market — LG and Huawei gain

2. Apple, Huawei [and Xiaomi] buck slowing smartphone sales trend

As the commenting articles by Investors.com are based on press releases of 2 market research companies I will give the web reference here for those press releases themselves, as well as 3 other press releases not commented on by Investors.com (if there are trend indications in the press releases themselves I will copy them alongside the web reference):

- July 29, 2015: Worldwide Tablet Market Continues to Decline; Vendor Landscape is Evolving, According to IDC

“Longer life cycles, increased competition from other categories such as larger smartphones, combined with the fact that end users can install the latest operating systems on their older tablets has stifled the initial enthusiasm for these devices in the consumer market,” said Jitesh Ubrani, Senior Research Analyst, Worldwide Mobile Device Trackers. “But with newer form factors like 2-in-1s, and added productivity-enabling features like those highlighted in iOS9, vendors should be able to bring new vitality to a market that has lost its momentum.”

“Longer life cycles, increased competition from other categories such as larger smartphones, combined with the fact that end users can install the latest operating systems on their older tablets has stifled the initial enthusiasm for these devices in the consumer market,” said Jitesh Ubrani, Senior Research Analyst, Worldwide Mobile Device Trackers. “But with newer form factors like 2-in-1s, and added productivity-enabling features like those highlighted in iOS9, vendors should be able to bring new vitality to a market that has lost its momentum.” - July 30, 2015: Huawei Becomes World’s 3rd Largest Mobile Phone Vendor in Q2 2015 [says Strategy Analytics]

- Woody Oh, Director at Strategy Analytics, said, “… Smartphones accounted for 8 in 10 of total mobile phone shipments during the quarter. The 2 percent growth rate of the overall mobile phone market is the industry’s weakest performance for two years, due to slowing demand for handsets in China, Europe and the US.”

- Neil Mawston, Executive Director at Strategy Analytics, added, “… Samsung has stabilized volumes in the high-end, but its lower-tier mobile phones continue to face intense competition from rivals such as Huawei in Asia. … Apple outperformed as consumers in China and elsewhere upgraded to bigger-screen iPhone 6 and 6 Plus models.”

- Ken Hyers, Director at Strategy Analytics, added, “… Huawei is rising fast in all regions of the world, particularly China where its 4G models, such as the Mate7, are proving wildly popular. Huawei has finally overtaken Microsoft to become the world’s third largest mobile phone vendor for the first time ever.”

- Neil Mawston, Executive Director at Strategy Analytics, added, “Microsoft shipped 27.8 million mobile phones and captured 6 percent marketshare worldwide in the second quarter of 2015. Microsoft’s 6 percent global mobile phone marketshare is sitting near an all-time low. Microsoft continues to lose ground in feature phones, while its Lumia smartphone portfolio is in a holding pattern awaiting the launch of new Windows 10 models later this year. Xiaomi shipped 19.8 million mobile phones and captured 5 percent marketshare worldwide in Q2 2015. Xiaomi remains a major player in the China mobile phone market, but its local and international growth is slowing and Xiaomi is facing intense competition from Huawei, Meizu and others. As a result, Xiaomi may struggle to hold on to its top-five global mobile phone ranking in the coming quarters.”

- June 17, 2015: Business smartphones shipments in Q1 up 26% from last year, now 27% of total smartphone market [says Strategy Analytics]

Android was the most dominant OS in terms of business smartphone shipments in Q1, accounting for nearly 60% of all business smartphones (corporate- and personal-liable). It was also the dominant BYOD device; 68% of personal-liable shipments in Q1 were Android. Apple iOS accounted for only 27% of BYOD shipments in Q1, but was the dominant platform in terms of corporate-liable smartphones, with 48% of Q1 CL shipments. The difference in Android/iOS shipments between the CL and IL categories reflects the continuing corporate perception that iPhones are “safer” than Android-based devices.

Android was the most dominant OS in terms of business smartphone shipments in Q1, accounting for nearly 60% of all business smartphones (corporate- and personal-liable). It was also the dominant BYOD device; 68% of personal-liable shipments in Q1 were Android. Apple iOS accounted for only 27% of BYOD shipments in Q1, but was the dominant platform in terms of corporate-liable smartphones, with 48% of Q1 CL shipments. The difference in Android/iOS shipments between the CL and IL categories reflects the continuing corporate perception that iPhones are “safer” than Android-based devices.

- Shipments of personal-liable smartphones (i.e. “bring your own device,” or BYOD, phones) drove market growth in Q1

- Strategy analytics defines personal-liable devices as devices purchased by the end-user and expensed back to the company or organization, or devices purchased outright by individual users but used primarily for business purposes linking to corporate applications and backend systems.

- While personal liable devices dominate worldwide business smartphone shipments, some regions are more resistant to the BYOD trend than others. Such regions include Western Europe and Central Europe, where corporate-liable devices are the dominant types of business smartphones. In Western Europe in Q1, 61% of the 10 million business smart phones were corporate-liable. Central and Eastern Europe had a slightly higher rate of BYOD devices shipped in Q1 — 41% — but the majority of smartphones shipped in this regions was also corporate-liable. This a sharp contrast to North America, where three-quarters of business smartphone shipments are personal-liable. The trend in Western and Eastern Europe reflects the more corporate-centric approach businesses take to mobility in these regions.

- July 29, 2015: Mobile Broadband Tablet Subscriptions to Double to 200 Million by 2021, says Strategy Analytics

- Strategy Analytics forecasts global mobile data subscriptions on tablets will more than double from 2015 to 2021, reaching over 200 million

- Around the globe, over 100 million wireless connections on cellular enabled tablets will be added through 2021. By 2021 tablets will only account for 2 percent of total mobile subscriptions, a 2.7 percent population penetration rate.

- July 29, 2015: Intel Maintains Top Spot in Non-Apple Tablet Apps Processors in Q1 2015 says Strategy Analytics

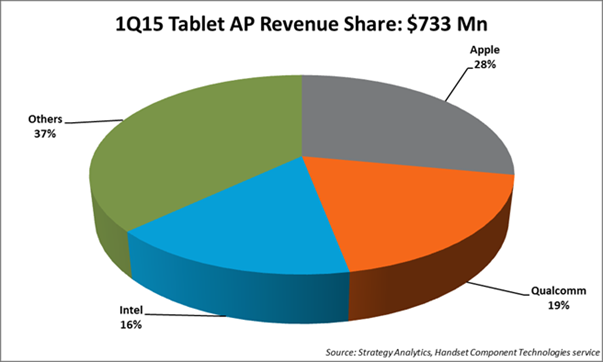

⇒The global tablet applications processor (AP) market declined -6 percent year-over-year to reach $733 million in Q1 2015- According to Sravan Kundojjala, Associate Director, “Intel maintained its top spot in the non-Apple tablet AP market in unit terms in Q1 2015. Strategy Analytics estimate Android-based tablets accounted for over 70 percent of Intel’s total tablet AP shipments in Q1 2015. We expect Intel’s Atom X3 cellular tablet chip product line to help Intel maintain its momentum in the tablet AP market.”

- Stuart Robinson, Executive Director of the Strategy Analytics Handset Component Technologies (HCT) service added, “Strategy Analytics estimates that baseband-integrated tablet AP shipments accounted for over one-fourth of total tablet AP shipments in Q1 2015, helped by a strong push from Qualcomm, MediaTek and Spreadtrum. We expect continued momentum for integrated APs as Intel, Rockchip and others join the bandwagon.”

- July 30, 2015: Windows Tablet Shipments Nearly Double in Q2’15, says Strategy Analytics

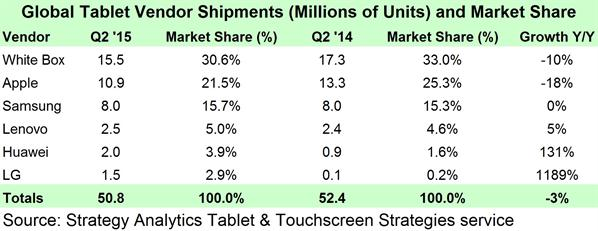

⇒Global Tablet Shipments and Market Share in Q2 2015 (preliminary)

- Windows-branded Tablets comprised 9 percent of shipments in Q2 2015, up 4 points from Q2 2014

- Android-branded Tablet shipment market share was flat at 70 percent in Q2 2015

- Apple continued its slide in market share down to an all-time low of 21 percent in Q2 2015, 4 points lower than Q2 2014

- Vendors with strong 3G and LTE connected Tablet strategies such as Huawei, LG, and TCL-Alcatel gained market share as leaders like Apple, Samsung, and the White Box community lost ground

Tablet & Touchscreen Strategies Senior Analyst Eric Smith added, “Windows share continues to improve as more models become available from traditional PC vendors, White Label vendors, and Microsoft itself though a healthy Surface lineup and distribution expansion. The key going forward will be if the coming wave of 2-in-1 Detachable Tablets is a hit with consumers or if they go the way of the Netbook—we remain cautiously optimistic on this point.” |

Tablet & Touchscreen Strategies Service Director Peter King said, “Apple’s fortunes will turn around soon as it will launch the 12.9-inch iPad Pro as well as an iPad mini 4 in Q4 2015. New features in iOS 9, which are exclusive to iPad such as multi-tasking and a more convenient soft keyboard, will also help compel upgrades by owners of older iPad models. Meanwhile, Huawei and LG have posted fantastic growth primarily due to well-executed 3G and LTE connected Tablet strategies.” |

Then I will add 2 additional information pieces from Strategy Analytics:

Oct 8, 2014: Replacement Demand to Boost PC Sales in 2015, says Strategy Analytics

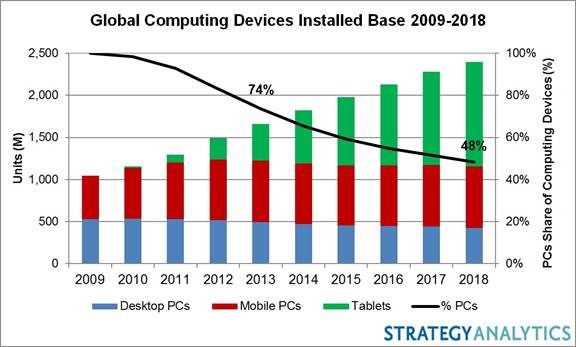

Having experienced negative growth since 2012, global PC sales are expected to rise 5 percent in 2015 driven by replacement of an ageing installed base according to Strategy Analytics’ Connected Home Devices (CHD) service report, “Computers in the Post-PC Era: Growth Opportunities and Strategies.”

Click here for the report:

http://www.strategyanalytics.com/default.aspx?mod=reportabstractviewer&a0=10146

- PC sales will fall by 4 percent in 2014 before returning to modest growth in 2015 and beyond to support replacement demand.

- Strategy Analytics’ consumer research of computing device usage in developed markets indicates that PCs remain essential computing devices despite healthy Tablet sales.

- Frequent Tablet usage has grown by 22 percentage points from 2011 to Q4 2013 up to 32 percent of all households while frequent Mobile PC (excluding Tablets) usage has stayed steady through this period, as 63 percent of all households indicated they frequently used Mobile PCs.

- Frequent usage of all PCs (including Mobile and Desktop PCs and excluding Tablets) remained above the 90 percent mark of all households, falling only 3 percentage points during this period.

Eric Smith, Analyst of Connected Home Devices, said: “Multiple PC ownership is falling as Tablet sales supplant replacement demand for secondary PCs mainly used for casual tasks. Still, PCs will remain essential devices as households eventually replace their primary PCs used for productivity tasks such as spreadsheet and video editing or personal banking.”

David Watkins, Service Director, Connected Home Devices, added: “The modern Tablet user experience is quickly arriving on the PC thanks to more affordable 2-in-1 Convertible PCs and new operating systems which blend traditional PC and Tablet user experiences. We see development of these forces aligning perfectly with an older PC installed base ripe for replacement in 2015.”

May 1, 2015: Children Change Disney’s Digital Strategy: “App TV” Now Central To Content Planning by David Mercer

Multiscreen TV behaviour is at the centre of television’s stormy transformation – viewing of broadcast, linear TV on the TV screen is apparently in decline while consumption on smartphones and tablets is increasing. Making sense of the big picture is increasingly challenging, and legacy players like broadcasters and the major content owners are inevitably somewhat resistant to the idea that their traditional businesses are under serious threat.

We have monitored the early stages of this transformation for the past decade and see its results in our own research, and we continue to predict further industry disruption in our forecasts. But sometimes it is only when you hear the evidence given in person by a senior executive at a leading global player that the scale of the challenge and opportunity are finally brought home.

This happened at last week’s AppsWorld event in Berlin, where I chaired the TV and Multiscreen conference. The speaker was Andreas Peters, Head of Digital for the Walt Disney Company Germany, Austria and Switzerland. Andreas presented some of the most compelling evidence I have yet heard that television is truly a multiscreen medium for the next generation of viewers.

Disney’s challenge in Germany was to launch a television show called Violetta aimed at 8-12 year old girls. It had been introduced successfully in Argentina but had failed in the UK. As it often does, Disney had invested considerable amounts in merchandising and retailers were eagerly anticipating sales of the new product lines. The show was first broadcast on German free TV on May 1st 2014 but it achieved only very low ratings.

The question for Disney managers was whether traditional TV had stopped working. A crisis meeting was held with a view to writing off the investment. Disney had previously not made its shows available online in Germany but the Violetta situation was so serious they were persuaded to experiment. Two episodes were made available on Youtube with a link to Disney’s own website. Viewing of the content on Youtube very quickly went viral until Disney had achieved a reach of 50% of 8-12 year old girls and eight million views. Violetta went on to become a success in German-speaking markets.

The evidence was clear: for some shows at least, younger children cannot now be reached using the traditional broadcast TV/big screen model. Peters explained that the Violetta experience was transformative for the Disney organisation and led to the inclusion of online and digital media as a key element in the business case for many products. In fact it also led to the development and launch of Disney’s own Watch App, which includes live streaming and seven-day catch-up programmes from the broadcast Disney Channel.

Even after the Violetta experience Disney was sceptical that an app was needed – there was a feeling that the website would be sufficient. Nevertheless the app was launched and Disney had planned for 20,000 downloads. Instead it has passed one million downloads in its first six months. Peters noted: “This was a real shock for us. We completely underestimated the demand.” Around 500,000 viewers are now using the Disney Watch app for linear television viewing, in addition to millions of shows being downloaded for catch-up viewing. Peak app viewing hours are between 6am and 8am and then between 1pm and 9pm on school days, with a different pattern at weekends. Peters made it clear that children did not want lots of features built in to the app – just like TV, they just want to hit “play” and watch.

“Our TV colleagues of course don’t want to believe this,” said Peters. “But the world has changed and it will continue to change.” Disney has also seen a knock-on effect from its app launch with an increase in free-to-air broadcast TV viewing. But the firm is now clear that mobile is not just an add-on to TV or a promotional tool; it must be an integral part of the entire process.

There are many implications for content strategy. TV and Digital have to “understand each other”, which is a challenge when the KPIs in each world are very different. As we have often heard, the video industry is crying out for a set of common metrics which can apply and support advertisers in both TV and online worlds. Video consumption patterns vary and different content may be relevant to different platforms.

But the overall lesson is clear: “TV” is not just the big screen in the corner of the living room. It must embrace multiscreen distribution strategies in order to reach its maximum potential. TV companies are betraying their audiences and their investors if they don’t target the 6.4bn addressable screens available to them.

HTC RE camera hands-on! (Android Central)

They took a look on the announcement day (Oct 8. 2014) at the HTC RE camera, the first foray into the post-mobile world from the Taiwanese manufacturer. It’s a small, handheld camera with a 16MP sensor that can shoot on its own, or connect to an Android device or iPhone for tethered shooting.

Q3’13 smartphone and overall mobile phone markets: Android smartphones surpassed 80% of the market, with Samsung increasing its share to 32.1% against Apple’s 12.1% only; while Nokia achieved a strong niche market position both in “proper” (Lumia) and “de facto” (Asha Touch) smartphones

Details about Samsung’s strengths you can find inside the Samsung has unbeatable supply chain management, it is incredibly good in everything which is consumer hardware, but vulnerability remains in software and M&A [‘Experiencing the Cloud’, Nov 11, 2013] post of mine.

My findings supporting the above title:

- 205 million Android smartphones were delivered in Q3’13, representing 15.2% growth sequentially (Q/Q) and 67.3% growth relative to the same period of last year (Y/Y)

- Meanwhile the number of Apple iPhones shipped increased only to 33.8 million, growing by 8.3% sequentially (Q/Q), but still representing a 25.65% growth relative to the same period of last year (Y/Y)

- The shipment of “proper” smartphones from Nokia (S60/Symbian and Lumia/Windows Phone) increased to 8.8 million units, representing 18.9% growth sequentially (Q/Q) and 39.7% growth relative to the same period of last year (Y/Y)

- Meanwhile the shipment of “de facto” smartphones from Nokia (S60/Symbian, Lumia/Windows Phone and Asha Full Touch in S40 Series) increased to 14.7 million units, representing 25.6% growth sequentially (Q/Q) and 14.8% growth relative to the same period of last year (Y/Y). It is also important that the decline of Asha Full Touch after its peak of 9.3 million units sold in Q4’12 has been reversed with 5.9 million units shipped, representing a sizable 37.2% growth sequentially (Q/Q).

- The new (in Q3’13) Asha 501 became the most popular smartphone on the Indian market in the $60-80 price range (as per Flipkart, see above), successfully beating off the best competitive offerings from Samsung and the two leading local brands, Micromax and Karbonn. This is another positive sign of successfull revival of the Asha Touch platform started with Asha 501 (via the Asha Software Platform 1.0) as described in the New Nokia Asha platform for developers [‘Experiencing the Cloud’, May 9, 2013] and New Asha platform and ecosystem to deliver a breakthrough category of affordable smartphone from Nokia [‘Experiencing the Cloud’, May 9 – July 5, 2013] posts of mine. Everything is well represented by comparing the “micro reports” included into the bottom left corner of the overall chart a quarter ago and now:

- As one currently could see this Nokia (the devices part of it soon becoming the part of Microsoft*) could realise its goal of selling “100 million of the new generation Asha smartphones over the coming years, beginning with the Nokia Asha 501”. The Asha 500, Asha 502 and Asha 503 introduced in October 22 could already deliver a huge jump in shipments of “de facto smartphones” under Asha brand, helping to defend further and even improve Nokia’s market position against the sub $100 Android smartphones in Q4’13. Note also that Asha 500 was announced for $69 list price (before taxes or subsidies) which means that—depending on “race to the bottom” competition—could easily mean a street price of $60+ on the Indian market.

-

* See also the previous posts of mine:

– Unique Nokia assets (from factories to global device distribution & sales, and the Asha sub $100 smartphone platform etc.) will now empower the One Microsoft devices and services strategy [‘Experiencing the Cloud’, Sept 3 – Oct 23, 2013]

– Microsoft answers to the questions about Nokia devices and services acquisition: tablets, Windows downscaling, reorg effects, Windows Phone OEMs, cost rationalization, ‘One Microsoft’ empowerment, and supporting developers for an aggressive growth in market share [‘Experiencing the Cloud’, Sept 3 – Oct 23, 2013]

– Microsoft Nokia Transaction Conference Call with slides from Microsoft Strategic Rationale inserted-ebook – 3-Sept-2013 edited by Sándor Nacsa from those two sources into an ebook format PDF

– Leading edge Nokia phablets for both entertainment and productivity: Lumia 1320 targeting the masses at $339, and Lumia 1520 the imaging conscious business users and individuals at $749 [‘Experiencing the Cloud’, Oct 26, 2013] - The Asha Touch revival was also able to stop the decline of the overall Nokia “mobile phones” category (Nokia S30, S40, Asha and Asha Full Touch phones) exactly at 55.8 million units, the same number as for the Q1’13.

- In addition there are now the Leading edge Nokia phablets for both entertainment and productivity: Lumia 1320 targeting the masses at $339, and Lumia 1520 the imaging conscious business users and individuals at $749 [‘Experiencing the Cloud’, Oct 26, 2016].

- With that Nokia established a strong niche market position on both the $130+ market (starting with Lumia 520 sold at that price in India, also the most popular one on Flipkart for the the $80-160 price range of devices) and the sub $80 market against the onslaught of Android devices. The rest will depend now only on Microsoft.

Than for the lead smartphone market, i.e. Mainland China I will include here:

- China market: Smartphone sales top 93 million units in 3Q13, says Analysys [Digitimes, Nov 12, 2013]

There were 102.66 million handsets sold in the China market during the third quarter of 2013, growing 13.6% on quarter and 54.5% on year, of which 93.08 million units were smartphones, increasing 20.7% on quarter and 89.3% on year, according to China-based consulting company Analysys International.

While for the worldwide market:

- China-based smartphone vendors set to rise in 2013 rankings, says IC Insights [Digitimes, Nov 13, 2013]

Lenovo, ZTE, Huawei and Yulong/Coolpad have taken advantage of the surging low-end smartphone market. According to IC Insights, the four major China-based handset companies are forecast to ship 168 million smartphones in 2013 and together hold a 17% share of the worldwide smartphone market.

Lenovo, ZTE, Huawei and Yulong/Coolpad shipped a combined 98 million smartphones in 2012, a more than 300% surge from the 29 million units shipped in 2011, IC Insights disclosed. It should be noted that the China-based suppliers of smartphones are primarily serving the China and Asia-Pacific marketplace, and offer low-end models that typically sell for less than US$200.

Low-end smartphones are expected to represent just under one-third (310 million) of the total 975 million smartphones shipped in 2013. IC Insights forecast that by 2017, low-end smartphone shipments will represent 46% of the total smartphone market with China and the Asia-Pacific region to remain the primary markets for these low-end models.

Samsung Electronics and Apple are set to continue dominating the total smartphone market in 2013. The two vendors are forecast to ship 457 million units and together hold a 47% share of the total smartphone market in 2013, IC Insights said. In 2012, Samsung and Apple shipped 354 million smartphones and took a combined 50% share of the total smartphone market.

Nokia was third-largest supplier of smartphones behind Samsung and Apple in 2011, but has seen its share of the smartphone market fall. Nokia’s smartphone shipments are forecast to decline by another 4% and grab an only 3% share of the total smartphone market in 2013, IC Insights indicated.

Other smartphone producers that have fallen on hard times include RIM and HTC. While each of these companies had about a 10% share of the smartphone market in 2011, IC Insights estimated they will have only about 2% shares of the 2013 smartphone market.

-

Gartner Says Smartphone Sales Accounted for 55 Percent of Overall Mobile Phone Sales in Third Quarter of 2013 [press release, Nov 14, 2013]

– Western Europe Grew for the First Time this Year

– Lenovo Became the No. 3 Worldwide Smartphone Vendor for the First Time

Worldwide mobile phone sales to end users totaled 455.6 million units in the third quarter of 2013, an increase of 5.7 percent from the same period last year, according to Gartner, Inc. Sales of smartphones accounted for 55 percent of overall mobile phone sales in the third quarter of 2013, and reached their highest share to date.

Worldwide smartphone sales to end users reached 250.2 million units, up 45.8 percent from the third quarter of 2012. Asia/Pacific led the growth in both markets – the smartphone segment with 77.3 percent increase and the mobile phone segment with 11.9 percent growth. The other regions to show an increase in the overall mobile phone market were Western Europe, which returned to growth for the first time this year, and the Americas.

“Sales of feature phones continued to decline and the decrease was more pronounced in markets where the average selling price (ASP) for feature phones was much closer to the ASP affordable smartphones,” said Anshul Gupta, principal research analyst at Gartner. “In markets such as China and Latin America, demand for feature phones fell significantly as users rushed to replace their old models with smartphones.”

Gartner analysts said global mobile phone sales are on pace to reach 1.81 billion units in 2013, a 3.4 percent increase from 2012. “We will see several new tablets enter the market for the holiday season, and we expect consumers in mature markets will favor the purchase of smaller-sized tablets over the replacement of their older smartphones” said Mr. Gupta.

While Samsung’s share was flat in the third quarter of 2013, Samsung increased its lead over Apple in the global smartphone market (see Table 1). The launch of the Samsung Note 3 helped reaffirm Samsung as the clear leader in the large display smartphone market, which it pioneered.

Lenovo’s sales of smartphones grew to 12.9 million units, up 84.5 percent year-on-year. It constantly raised share in the Chinese smartphone market.

Apple’s smartphone sales reached 30.3 million units in the third quarter of 2013, up 23.2 percent from a year ago. “While the arrival of the new iPhones 5s and 5c had a positive impact on overall sales, such impact could have been greater had they not started shipping late in the quarter. While we saw some inventory built up for the iPhone 5c, there was good demand for iPhone 5s with stock out in many markets,” said Mr. Gupta.

In the smartphone operating system (OS) market (see Table 2), Android surpassed 80 percent market share in the third quarter of 2013, which helped extend its leading position. “However, the winner of this quarter is Microsoft which grew 123 percent. Microsoft announced the intent to acquire Nokia’s devices and services business, which we believe will unify effort and help drive appeal of Windows ecosystem,” said Mr. Gupta. Forty-one per cent of all Android sales were in mainland China, compared to 34 percent a year ago. Samsung is the only non-Chinese vendor in the top 10 Android players ranking in China. Whitebox Yulong [Coolpad] is the third largest Android vendor in China with a 9.7 percent market share in the third quarter of 2013. Xiaomi represented 4.3 percent of Android sales in the third quarter of 2013, up from 1.4 percent a year ago.

Mobile Phone Vendor Perspective

Samsung: Samsung extended its lead in the overall mobile phone market, as its market share totaled 25.7 percent in the third quarter of 2013 (see Table 3). “While Samsung has started to address its user experience, better design is another area where Samsung needs to focus,” said Mr. Gupta. “Samsung’s recent joint venture with carbon fiber company SGL Group could bring improvements in this area in future products.”

Nokia: Nokia did better than anticipated in the third quarter of 2013, reaching 63 million mobile phones, thanks to sales of both Lumia and Asha series devices. Increased smartphone sales supported by an expanded Lumia portfolio, helped Nokia move up to the No. 8 spot in the global smartphone market. But regional and Chinese Android device manufacturers continued to beat market demand, taking larger share and creating a tough competitive environment for Lumia devices.

Apple: Gartner believes the price difference between the iPhone 5c and 5s is not enough in mature markets, where prices are skewed by operator subsidies, to drive users away from the top of the line model. In emerging markets, the iPhone 4S will continue to be the volume driver at the low end as the lack of subsidy in most markets leaves the iPhone 5c too highly priced to help drive further penetration.

Lenovo: Lenovo moved to the No. 7 spot in the global mobile phone market, with sales reaching approximately 13 million units in the third quarter of 2013. “Lenovo continues to rely heavily on its home market, which represents more than 95 per cent of its overall mobile phone sales. This could limit its growth after 2014, when the Chinese market is expected to decelerate,” said Mr. Gupta.

Superphones turning point: segment satured with Tier 1 globals while the Chinese locals are at less than 40% of the Samsung price

OR Samsung is leapfrogging Apple while the Chinese local brands are coming close to Samsung but at less than 40% price. Meanwhile the superphone segment of the market becomes saturated.

This is even more important as coinciding with:

– Eight-core MT6592 for superphones and big.LITTLE MT8135 for tablets implemented in 28nm HKMG are coming from MediaTek to further disrupt the operations of Qualcomm and Samsung [‘Experiencing the cloud’, July 20-29, 2013]

– GiONEE (金立), the emerging global competitor on the smartphone market [‘Experiencing the cloud’, July 22, 2013]

– Xiaomi, OPPO and Meizu–top Chinese brands of smartphone innovation [‘Experiencing the cloud’, Aug 1, 2013]

– UPDATE Aug’13: Xiaomi $130 Hongmi superphone END MediaTek MT6589 quad-core Cortex-A7 SoC with HSPA+ and TD-SCDMA is available for Android smartphones and tablets of Q1 delivery [‘Experiencing the Cloud’, Dec 12, 2012; Aug 1, 2013]

Now the following things are coming in addition to that:

- [Samsung is] Leapfrogging Apple while regaining only some high-end SoC supply to it

- Chinese local brands are coming close to Samsung but at less than 40% price

- The superphone segment of the market becomes saturated

- Previous (pre-saturation) milestones according to Samsung

This will be the organization of the ‘DETAILS for the assesment of upcoming changes’ part of this post.

To appreciate the real significance of the sudden change characterized above let’s first get acquainted with the current state of the lead market as described in China Report: Device and App Trends in the #1 Mobile Market [by Mary Ellen Gordon on Flurry Blog, July 23, 2013]

Smartphones and tablets have gone from being the latest gadgets for relatively affluent people in relatively affluent countries to ubiquitous devices in mainstream use in many countries around the world. In fact, as we reported in February of this year China surpassed the US to become the country with the largest installed base of connected devices as measured by Flurry Analytics. As we also reported, a second wave of countries around the world is now experiencing the type of growth mobile pioneer countries experienced previously. For example, the mobile markets in the BRIC countries are now all growing faster than the mobile markets in the U.S., U.K., and South Korea.

Knowing that the landscape is constantly shifting, we are beginning a series of blog posts reporting on the use of smartphones, tablets, and apps in particular countries and geographic regions around the world. Given China’s world-leading installed base and considering the China Joy conference (China’s largest digital conference) is this week we thought we would begin there.

In June of this year Flurry Analytics measured 261,333,271 active smartphones and tablets in China. That represented a whopping 24% of the entire worldwide connected device installed base measured by Flurry. The chart below documents the growth in the installed base. The left axis and blue line show China’s growth over the years. The right axis and red line show growth in the world as a whole (including China) a basis of comparison. As can be seen from the gap between the two lines growing through 2010 and much of 2011, growth in smartphones and tablets in China lagged the world as a whole through that period. But starting toward the end of 2011, the installed base in China began a period of exponential growth. During this period it surpassed the growth rate for the world as a whole, as shown by the blue line catching the red line in the graph. We expect China to maintain its leadership (in terms of active installed base) for the foreseeable future because device penetration rate is still relatively low and much opportunity remains, as we reported in a previous post.

Xiaomi Is A Local Manufacturer To Watch

Examining a random sample of 18,310 of the devices in our system in China that run iOS or Android apps revealed that Apple and Samsung are the top two device manufacturers, as they are most everywhere. China’s own Xiaomi was a strong third, with a 6% share of the market, ahead of HTC, Lenovo and a multitude of others. As we noted in a previous post, Xiaomi has been successful in accumulating a large number of active users for each device model it releases. Worldwide, only Apple, Amazon, and Samsung have more active users for each device model released.

It will be interesting to see if Xiaomi can continue to gain share in China – possibly by mopping up share from smaller manufacturers of Android devices – and also if they can begin making gains in other markets outside of China to become more of a global player. With rumors of a Xiaomi tablet circulating, we will also be watching to see if their entry into the tablet market will increase the use of Android tablets in China. Currently 21% of the iOS devices in our randomly drawn sample were tablets compared to only 4% of the Android devices.

Chinese Users Over Index in Reading, Utility, Productivity

In looking at how Chinese people use their connected devices we see similarities and differences compared to the rest of the world. As a general rule worldwide, games dominate time spent in apps measured by Flurry Analytics, and China is no exception. On average, Chinese owners of iOS devices spent 47% of their app in games. The percentage of app time devoted to games was even greater for Android at 56%.

Smartphones and tablets are not just about fun and games in China. Compared to iOS device owners elsewhere, the average time Chinese owners spend using Books, Newsstand, Utility, and Productivity apps is greater than the rest of the world (1.8x, 1.7x, 2.3x, and 2.1x respectively). On average Chinese owners of Android devices spend more than seven times as much time in Finance apps (7.4x) than Android owners elsewhere spend in Finance apps, but they also spend more time in Entertainment apps (1.7x).

Will China’s Exponential Growth Change The Device And App Markets?

It will be interesting to see how China now having leadership in terms of its installed base will impact the device and app markets elsewhere. Given Xiaomi’s success at building a large number of users for each model it releases, it might try to add further scale by expanding internationally – particularly to the other rapidly-growing BRIC markets where brand preferences are not already well-entrenched.

Within China itself, Chinese competitors may have an even greater advantage in the app market since cultural influences and differences are likely to be even more important in the app market than in the device market. There are already strong Chinese app companies such as Baidu and Tencent and clusters of app developers emerging in places like Chengdu. At first they are likely to concentrate on apps for the large local market, but that may eventually lead to growing app exports. For example, the fact that Chinese consumers over-index on some more work and educational-oriented apps may encourage Chinese developers to focus on those areas and innovate, and that could lead to creation of apps that end up being adopted elsewhere in the world. We’re looking forward to discovering what app is to China what Angry Birds was to Finland.

And it is also important to understand that as far as the current situation is concerned Samsung’s China magic upstages Apple [Reuters TV, July 25, 2013]

Insight: How Samsung is beating Apple in China [Reuters, July 26, 2013]

Apple Chief Executive Tim Cook believes that “over the arc of time” China is a huge opportunity for his pathbreaking company. But time looks to be on the side of rival Samsung Electronics Co Ltd, which has been around far longer and penetrated much deeper into the world’s most populous country.

Apple Inc this week said its revenue in Greater China, which also includes Hong Kong and Taiwan, slumped 43 percent to $4.65 billion from the previous quarter. That was also 14 percent lower from the year-ago quarter. Sales were weighed down by a sharp drop in revenues from Hong Kong. “It’s not totally clear why that occurred,” Cook said on a conference call with analysts.

Neither is it totally clear what Apple’s strategy is to deal with Samsung – not to mention a host of smaller, nimbler Chinese challengers.

Today, in the war for what both sides acknowledge is the 21st century’s most important market, Samsung is whipping its American rival. The South Korean giant now has a 19 percent share of the $80 billion smartphone market in China, a market expected to surge to $117 billion by 2017, according to International Data Corp (IDC). That’s 10 percentage points ahead of Apple, which has fallen to 5th in terms of China market share.

Cook said Apple planned to double the number of its retail stores over the next two years – it currently has 8 flagship stores in China and 3 in Hong Kong. But, he added, Apple will invest in distribution “very cautiously because we want to do it with great quality.”

Samsung, with a longer history in China, now has three times the number of retail stores as Apple, and has been more aggressive in courting consumers and creating partnerships with phone operators. It also appears to be in better position, over an arc of time, to fend off the growing assault of homegrown competitors such as Lenovo Group Ltd, Huawei Technologies Co Ltd and ZTE Corp, former company executives, analysts and industry sources say.

Apple declined requests for comment for this article.

VARIED MODELS

Samsung’s history and corporate culture could hardly be more different than Apple’s, the iconic Silicon Valley start-up founded by Steve Jobs and Steve Wozniak in 1976. Lee Byung-Chull started Samsung in 1938 as a noodle and sugar maker. It grew over the decades into an industrial powerhouse, or chaebol as Koreans call the family owned conglomerates that dominate the nation’s economy and are run with military-like discipline.

Apple, by contrast, became the epitome of Californian cool, an image the company revels in. That hip image translates in China – its stores are routinely packed – but hasn’t been enough to overcome the more entrenched Samsung.

A stuffy electronics bazaar in the southern Chinese city of Shenzhen illustrates part of the reason why.

Samsung Galaxys and Apple iPhones of different generations sit side by side, glinting under bright display lights as vendors call out to get customers’ attention. With its varied models, Samsung smartphones outnumber iPhones at least four to one.

While Apple releases only one smartphone a year, priced at the premium end of the market, Samsung brings out multiple models annually with different specifications and at different price points in China.

And those models, analysts say, are loaded with features tailored specifically for the local market: apps such POCO.cn, the most popular photo sharing site in China, or the two slots for SIM cards (Apple offers one), which allows service from multiple cell carriers, either at home or abroad.

“The Chinese just love features. They want their phone to have 50 different things that they’re never going to use,” said Michael Clendenin, managing director of technology consultancy RedTech Advisors. “Apple just doesn’t play that game. Unfortunately, if you want to hit the mainstream market in China, and you want a lot of market share percentage points, you have to offer the Swiss army knife of cellphones.”

“SETTING THE PACE”

Analysts believe Samsung’s increasing strength in China is a critical reason behind its rival’s possible intention to introduce globally a new and cheaper iPhone model, as well as one with bigger screens – a staple of Samsung’s offerings.

Said a Samsung executive with experience in China: “We definitely think we’re setting the pace there. They are having to respond to us.”

Most audaciously, Samsung has gone after Apple not simply by offering lower priced smartphones, but by attacking its rival directly in the pricier end of the market. “We put a lot of emphasis on the high end market in China,” co-CEO J.K. Shin told Reuters in an interview.

Samsung launched a China-only luxury smartphone together with China Telecom marketed by actor Jackie Chan that retails for about 12,000 yuan ($2,000). The flip phone, named “heart to the world,” is encased in a slim black and rose gold metal body. The sleek look – called “da qi” (elegantly grand) – is coveted by Chinese when they shop for cars, sofas or phones.

“There are a lot of ‘VVIP’s’ in China, and for them we launched luxury phones promoted by Jackie Chan. This helps target niche customers and build brand equity,” said Lee Young-hee, executive vice president of Samsung’s mobile business.

While Samsung won’t sell millions of these smartphones, the creation of the phone in conjunction with a carrier reinforces Samsung’s willingness to go local – and tap into niche markets.

“The key point is that Samsung consistently adapts to the local market,” said TZ Wong, a Singapore-based technology analyst with IDC.

Apple’s latest mobile operating system offers links to popular Chinese applications like Sina’s microblogging platform Weibo, but the application itself must be downloaded onto the phone. On all of Samsung’s entries, it’s already there.

“People know intellectually that Samsung is from Korea, but when it comes to the messaging there is always a local face,” Wong said.

RETAIL PRESENCE

Samsung opened its first office in China in 1985 in Beijing – an era in which it was all but inconceivable that Apple and Samsung would end up in one of the world’s most intense corporate grudge matches. Like other South Korean chaebols, Samsung was a first mover in China, using the market primarily as a base to produce electronics for the world.

In contrast, Apple’s big push in China came only recently, with the advent of the smartphone age roughly five years ago.

The early entry gave Samsung an undeniable edge, and it adapted fast to a rapidly changing environment. By the mid-1990s, with the economy booming, Samsung made the strategic decision to treat the Chinese market not just as a production base, but to start marketing to China higher-priced electronics, said Nomura researcher Choi Chang-hee, who wrote a history of Samsung’s experience in China.

That shift has meant Samsung’s retail presence in China far outstrips Apple’s. Aside from selling via the distribution outlets of the three major telecom carriers, Samsung also has a strong retail presence through its partners Gome Electrical Appliances and Suning Commerce Group, as well as its own “Experience” stores and small retailers all over the country.

Apple works through the same channels, but its relatively late entry means it has a significantly smaller presence. Samsung, for example, has more than 200 official distributors and resellers in Guangzhou province, while Apple lists 95.

Over the last two decades, Samsung has also taken pains to build relationships with Chinese government officials and -perhaps more critically – the three major telecom carriers.

The notion of the importance of connections – or “guanxi” – in China is occasionally overrated in business. Not, according to Samsung’s Shin, in this case. “It’s our core policy to keep friendly relationships with the operators,” he said. In China, each carrier uses a different technology and that requires Samsung “to tweak our smartphones to their request.”

“It’s not easy,” Shin said, “but we do this to be more operator friendly.”

Contrast that with the ongoing negotiations Apple has had with China Mobile, the largest cellphone operator. For years the two sides have been unable to come to an agreement on revenue sharing, effectively precluding Apple from hundreds of millions of potential customers.

SCRUTINY FROM THE TOP

Samsung’s reach extends higher than just the CEOs of the top state-owned telecom companies. Top executives have met each of the last several Chinese leaders, most recently Xi Jinping, who spent time in April with vice chairman Jay Y. Lee, son of K.H. Lee, Samsung Electronics chairman.

“What surprised me most,” said Lee later, “was that they (Chinese leadership) know very well about Samsung. They even have a group studying us.”

The Chinese government has also made clear it’s well aware of Apple – though not always in a good way. In April, state media bashed Apple for its “arrogance,” protesting among other things that its current 1-year service warranty was insufficient. Apple initially dismissed those criticisms, but Cook later apologized to Chinese consumers.

Samsung’s success in China has its roots, one former executive said, in a previous obsession for the company: its desire not to replicate the mistakes made by Japanese rivals.

“Samsung spent a lot of time benchmarking Sony, Toshiba and Panasonic,” said Mark Newman, who spent six years in Samsung’s global strategy group and is now an industry analyst at Sanford C. Bernstein in Hong Kong.

“One of the things that came out of that is the realization that the insular approach has its drawbacks, and so Samsung has made an effort over the last 10 years to be much more global.”

This strategy of decentralization is plainly evident in China, he said, home now to more Samsung employees than any country outside South Korea.

FIGHTING HIGH AND LOW

Samsung now leads in both low-end and high-end segments in China, according to IDC, and its logic of going after both ends of the market is straightforward. In China, where the average wage is roughly $640 per month, many users looking to upgrade from feature phones to smartphones cannot afford Apple.

By bracketing the market with multiple models, Samsung can breed deep relationships with customers, many of whom, market research shows, trade up to more expensive models as they get older. Playing high and low also positions Samsung to fend off the intensifying competition from Chinese firms such as Lenovo and Huawei and literally hundreds of smaller local players.

“That’s where the next battle for Samsung will be fought,” said Newman. “We’ll have to see if Apple does introduce a new, cheaper model for China – and the world.”

DETAILS for the assesment of upcoming changes

1. Leapfrogging Apple while regaining only some high-end SoC supply to it:

Samsung sells 76 mln smartphones in Q2, boosting market share-report [Reuters, July 26, 2013]

Samsung Electronics Co Ltd sold 76 million smartphones in the second quarter, expanding its market share to 33.1 percent, Strategy Analytics said on Friday.

Overall, the global smartphone market grew 47 percent to a record 229.6 million, the research firm said.

Second-ranked Apple Inc saw its market share shrink to 13.6 percent after selling 31.2 million iPhones, as smaller rivals such as LG Electronics Inc, ZTE Corp and Huawei Technologies Co Ltd seized larger slices.

Strategy Analytics: Samsung Becomes World’s Most Profitable Handset Vendor in Q2 2013 [PRNewswire, July 26, 2013]

According to the latest research from Strategy Analytics, Samsung became the world’s most profitable handset vendor in Q2 2013. Apple slipped into second position, as margins have been hit by lackluster iPhone 5 volumes and tougher competition in China.

Neil Shah, Senior Analyst at Strategy Analytics, said, “We estimate Samsung’s operating profit for its handset division stood at US$5.2 billion [61% of the overall, see below] in the second quarter of 2013. Samsung overtook Apple for the first time, which recorded an estimated iPhone operating profit of US$4.6 billion. With strong volumes, high wholesale prices and tight cost controls, Samsung has finally succeeded in becoming the handset industry’s largest and most profitable vendor.”

Neil Mawston, Executive Director at Strategy Analytics, added, “Apple’s reign as the world’s most profitable handset vendor lasted almost four years, from Q3 2009 to Q1 2013. Apple’s profit margin for its handset division has been fading recently due to lackluster iPhone 5 volumes and tougher competition from rivals. Samsung is performing well in the US market, while Huawei, ZTE and other local brands are growing vigorously in China. Apple is now under intense pressure to launch more iPhone models at cheaper price-points or with larger screens to fend off the surging competition and recapture lost profits in the second half of 2013.”

Exhibit 1: Global Handset Operating Profits in Q2 2013 [1]

Global Handset Operating Profits (US$ Billions)

Q2 ’13

Samsung

$5.2

Apple

$4.6

Source: Strategy Analytics

The full report, Samsung Becomes World’s Most Profitable Handset Vendor in Q2 2013, is published by the Strategy Analytics Wireless Device Strategies (WDS) service, details of which can be found here: http://tinyurl.com/cr7fhmb.

But: while handset revenue was up by 9% the operating profit for handsets and network products together were down by 3%. Considering that 97.3% of the IM (IT & Mobile Communications) revenue is for handsets that essentially means a similar operating profit drop of ~3% for handsets alone. Note as well that while the margin was 17.7% a year ago (in 2Q ’12) now (in 2Q ‘13) it was the same 17.7%, so with that 3% drop there was no fundamental problem (yet).

From: Earnings Release Q2 2013, Samsung Electronics, July 2013 presentation [July 26, 2013]

Samsung explains that by “marginal profit decline due to increased costs of new product launches, R&D and retail channels investments, etc.” as you could see below:

Fundamental problem could well be with the market share outlook, as neither for 2Q ‘13, nor for the outlook market share was talked about at all.

Samsung Electronics Announces Earnings for Q2 in 2013 [press release, July 26, 2013]

Samsung Electronics Co., Ltd. today announced revenues of 57.46 trillion won [$51.6B] on a consolidated basis for the second quarter ended June 30, 2013, a 9-percent increase from the previous quarter. Consolidated operating profit for the quarter reached 9.53 trillion won [$8.53B, ~61% of which is estimated for its handset division, see above], representing a 9-percent increase on quarter, while consolidated net profit for the same quarter was 7.77 trillion won [$6.98B].

In its earnings guidance disclosed on July 5, Samsung estimated second quarter consolidated revenues would reach approximately 57 trillion won [$51.2B] with consolidated operating profit of approximately 9.5 trillion won [$8.53B].

Samsung Regains Its Biggest Client Apple [The Korea Economic Daily, July 15, 2013]

Samsung Electronics will supply mobile application processor (AP) to Apple Inc. from 2015. The mobile AP is a brain of Apple’s iPhone. Samsung Electronics will supply 14 nano A9 chips that will be used for Apple’s iPhone 7.

Samsung Electronics had supplied the AP to Apple since 2007 but lost the contract to supply 20 nano AP A8 chips [for iPhone6] to Apple to Taiwan’s TSMC last year when it was engaged in patent disputes with Apple. Samsung Electronics developed state-of-the-art 14 nano models ahead of its rival TSMC, regaining the order from Apple.

According to industry sources on July 14, Samsung Electronics signed an agreement with Apple to supply the next-generation AP that it will produce in 2015. The AP that will be produced using 14 nano FinFET technology is mounted on Apple’s iPhone 7 to be released in the second half of 2015.

Since its relations with Samsung Electronics worsened due to patent disputes, Apple has refrained from using Samsung parts since the second half of last year. Apple excluded Samsung memory chips, including mobile DRAMs, from iPhone 5 that it released in September 2012. Apple also decided to procure iPhone 6 APs from TSMC, the world’s No. 1 foundry company.

TSMC reaches deal with Apple to supply 20nm, 16nm and 10nm chips, sources claim [DIGITIMES, June 24, 2013]

Taiwan Semiconductor Manufacturing Company (TSMC) and its IC design service partner Global UniChip have secured a three-year agreement with Apple to supply foundry services for the next A-series chips built using 20nm, 16nm and 10nm process nodes, according to industry sources.

In response, both TSMC and Global Unichip said they do not comment on customer orders and statuses.

TSMC will start to manufacture Apple’s A8 chips in small volume in July 2013, and substantially ramp up its 20nm production capacity after December, the sources revealed. The foundry will complete installing a batch of new 20nm fab equipment, which is capable of processing 50,000 wafers, in the first quarter of 2014, the sources said.

A portion of the upcoming production capacity, estimated at 20,000 wafers, can later be upgraded to process wafers used to build 16nm chips, the sources continued. TSMC is scheduled to volume produce the Apple A9 and A9X processors starting the end of third-quarter 2014, the sources said.

The upcoming Apple A8 processor will be found in a new iPhone [iPhone 6] slated for release in early 2014, and the A9/A9X chips will be used in the newer-generation iPhone and iPad products, the sources claimed.

The sources did not identify whether TSMC will be the sole supplier of these Apple-designed chips.

TSMC’s phase-4, -5 and -6 facilities of Fab 14, its 12-inch fab located in southern Taiwan, will be dedicated to making Apple’s A-series processors, the sources further noted. The foundry will initially allocate a capacity of 6,000-10,000 12-inch wafers for the manufacture of those chips, and output will rise gradually starting 2014, the sources said.

TSMC chairman and CEO Morris Chang remarked previously that the foundry’s 16nm FinFET process would enter mass production in less than one year after ramping up production of 20nm chips. Risk production for its 20nm process kicked off in the first quarter of 2013.

Samsung Electronics is the Biggest Beneficiary of LTE-A [Korea IT News, July 15, 2013]

Samsung Electronics has emerged as the biggest beneficiary of the commercialization of LTE-A services by all of the three South Korean telecom operators. This is because the Samsung Galaxy S4 LTE-A is the only LTE-A smartphone put on the market at the moment. Thus, sales of the Galaxy S4 LTE-A has a good chance of making up for slower than expected domestic sales of the Galaxy S4. LG Electronics and Pantech plan to launch their LTE-A smartphones sometime next month.

150,000 Galaxy S4 LTE-A smartphones were activated in 14 days with SK Telecom alone. In other words, an average of 10,000 Galaxy S4 LTE-A smartphones went into service a day. Sales of the Galaxy S4 LTE-A is much faster than the Galaxy S4, propped up by Samsung-SK Telecom joint marketing campaigns and growing expectations of LTE-A’s twice faster speeds [LTE=75Mbps –> LTE-A=150Mbps] than LTE.

Sales of the Galaxy S4 LTE-A is projected to surge in the weeks to come since LG and Pantech’s LTE-A smartphones are scheduled to come out as early as next month.

The world’s first LTE-A [SK telecom YouTube channel, June 25, 2013]

More information:

– SK Telecom Launches World`s First LTE-Advanced Network [press release, June 26, 2013]

– World’s First Mobile Device with LTE Advanced Carrier Aggregation Powered by the Qualcomm® Snapdragon™ 800 Processor [OnQ Blog, June 26, 2013]

– Qualcomm Snapdragon 800 Processors Power World’s First LTE-Advanced Smartphone [press release, June 26, 2013]

– Samsung LTE Leadership and Future-Focused Innovation Produces World’s First LTE-Advanced Smartphone [press release, June 26, 2013]

From: 25 things my new Android phone does that makes my iPhone feel like it comes from the 1990s [ZDNet, July 11, 2013]

A few weeks ago, I told you about my plans to ditch my old iPhone 4S and get a brand-new Samsung S4 Android phone. Well, a few days later, I did just that.

- You can replace the battery

- You can add an memory card to your phone

- You can replace the back cover

- It supports wireless inductive charging without a bulky sled

- Wonder-of-wonders: you can actually plug a USB cable into it and drag and drop files from your computer

- It’s got a full 1080p HD display

- You don’t have to use iTunes

- You can completely replace your launcher

- Your home screen can be alive

- You can replace your unlock screen with a customized version

- It’s a frickin’ tricorder

- It supports near field communications (NFC)

- It has an IR emitter

- You can turn your phone into a stealthy TV-B-Gone

- The thing senses hand gestures above it

- It watches your eyes

- It has a 13 megapixel camera

- Its camera can remove objects that don’t belong in the image

- Its camera can take multiple images and composite them together automatically

- You can install apps from a browser on your PC

- It can show two apps on-screen at once

- You can automate almost everything

- When you buy something on the Google Play store, you get an email receipt within minutes, not weeks

- It integrates (mostly) nicely with Google Voice

- You can have a new hobby (whether you want it or not)

- Samsung Galaxy S4 GT-I9500 [16GB] Factory Unlocked: $618 on Amazon ($700 list)

– Exynos 5 Octa 5410 SoC with 2GB RAM

– Quad-core 1.6 GHz Cortex-A15 & quad-core 1.2 GHz Cortex-A7 CPU with tri-core 533MHz PowerVR SGX544 GPU - Samsung Galaxy S4 GT-I9505 16GB 4G/LTE Factory Unlocked: $611 on Amazon($999 list)

– Snapdragon 600 SoC with 2GB RAM

– Quad-core 1.9GHz Krait 300 CPU with 450MHz Adreno 320 GPU

2. Chinese local brands are coming close to Samsung but at less than 40% price

Let’s take Jiayu* quad-core smartphone offerings as of July 15, 2013 in China (as they are the price leaders among the MT6589/MT6589T-based devices in China):

– Jiayu G3 Quad Edition (G3s) is from $110 in retail shops throughout the country

(Note that this price is even lower than the spec-wise similar Xiaomi $130 Hongmi superphone.)

– Jiayu G4 Standard (on sale for $155 (thin) and $163 (thick) list price since April 10) now with summer offer is from $130 in retail shops throughout the country

– 1.5GHz Jiayu G4 Advanced (G4s) is $216 since July 6 with 7 working days delivery

– 1.5GHz Jiayu G4 thin version is $160 since July 13 with not later than July 24 delivery

* About Jiayu (佳域)

Baoji Jiayuyutong Electronic Co., Ltd was established in April 2009, is one of the high-tech enterprises, committed to the mobile communication product, research and development, manufacturing, sales and service. The company has more than 800 employees, including more than 30 R & D personnel and 60 engineering and technical people. At present, the company has 10 complete product lines, 2 laboratory rooms, a variety of advanced testing equipment.

Brand interpretation: “good domain”, the Chinese word for pioneering domestic smart phone “Best of the Realm”; “JIAYU” to “good domain” Chinese spelling.

Jiayu G3S quick review [nikchris69 YouTube channel, July 13, 2013]

Jiayu Store links: Jiayu S1, Jiayu G4 and Jiayu G3s (other link: Mobile Dad, July 13)

Update: JiaYu S1 CNC machining process [Gizchina YouTube channel, Aug 6, 2013]

Yiayu S1 (see above) at 1.7GHz is on par with Samsung Galaxy S4 in performance:

Yiayu S1 (see above) at 1.7GHz is on par with Samsung Galaxy S4 in performance:

according to the Antutu benchmark results at http://www.jiayu-store.com/blog/

Update: JiaYu S1 wireless charging demo Video [Gizchina YouTube channel, Aug 6, 2013]

JiaYu G4 Hands On [Gizchina YouTube channel, May 13, 2013]

3. The superphone segment of the market becomes saturated:

Smartphone slowdown could spell trouble in Taiwan [Reuters TV YouTube channel, July 9, 2013]

Samsung’s smartphone champ braves a tough crowd [Reuters TV YouTube channel, July 4, 2013]

Samsung Confronts Saturated Smartphone Market [Bloomberg YouTube channel, July 5, 2013]

Has Apple lost its cool factor? [CNNInternational YouTube channel, June 10, 2013]

China smartphone aims to rival Apple [Financial Times YouTube channel, Jun 25, 2013]

China’s Huawei launches world’s slimmest smartphone [AFP YouTube channel, June 18, 2013]

Huawei Ascend P6 — 2-Minute Encounter [HuaweiDeviceCo YouTube, June 18, 2013]

The rise of Chinese smartphones [CNN YouTube channel, May 30, 2013]

Google and Motorola’s Moto X (hands-on) [The Verge YouTube channel, Aug 1, 2013]

More information:

– Moto X. All Yours. [The Official Motorola Blog, Aug 1, 2013]

– Motorola Moto X vs. Samsung Galaxy S4 [Gizmag, Aug 2, 2013]

– 16GB Motorola Moto X to cost $575 SIM-free [GSMarena.com, Aug 2, 2013]

Motorola Moto X was unveiled yesterday and the smartphone will soon be available from the top 5 carriers in the USA. The 16 GB variant of the Moto X is priced at $200 and the 32 GB unit costs you $250 with a two-year contract.

At the announcement event Motorola did not announce the pricing details of the SIM-free editions, but they are no longer a mystery as AT&T has confirmed the pricing of the device without a contract. At launch, the 16 GB model of the Moto X will cost you $575, while the 32 GB is priced at $629.

Moto X – Motomaker [motorola YouTube channel, Aug 1, 2013]

BBC News – Can Moto X revive Motorola’s fortunes? [BBCWorldNewsWatch YouTube channel, May 30, 2013]

Moto X Phone release date, news and rumours [TechRadar YouTube channel, July 2, 2013] “could be landing in installs in October”, and “to undercut the big players of the market such as the Samsung Galaxy S4 and the HTC One –meaning we might see some very competitive pricing”

From: Samsung Electronics 2Q13 review: Fading growth momentum vs improving valuations [The Korea Economic Daily, July 8, 2013]

Samsung Electronics (Samsung) announced 2Q13 preliminary sales of W57trn [$51B] and OP of W9.5trn [$8.5B], a record quarterly high. However, OP fell short of the consensus (W10.2trn) by 6.5% and our estimate (W10trn) by 5%. Despite strong memory prices due to supply shortages and higher OLED sales and margins, OP disappointed on lower smartphone ASP and IM margins due to increased marketing costs.

As the growth of the smartphone market slows due to commoditization, concerns are mounting over eroding ASP and margins. In fact, we estimate OP at the IM division eroded from W6.51trn with an OPM of 19.8% in 1Q13 to W6.23trn [$5.6B] with an OPM of 18.4%. Considering Apple lawsuit provisions were booked in 1Q13, the effective decline in OPM is over 3% as sales of the Galaxy S3 and Note 2 deteriorated.

We revise down our earnings forecasts to reflect lower handset OPM. Specifically, we estimate 3Q13 OP at W10.1trn [$9B] (previously W11.0trn) and full-year 2013 OP at W38.1trn [$34.2B] (previously W40.3trn). We cut Galaxy S4 3Q13 sales to 20mn units (previously 23mn) to reflect the poor sales; however, we maintain OP and OPM at 2Q13 levels given the global launch of the Galaxy S4 Mini and Note 3.

*Source: Korea Investment & Securities Co.

From: Galaxy S4, 20 million sales in just two months … 40 days faster than the previous [ChosunBiz, July 3, 2013] as traslated from Korean by Google and Bing with manual edits

Samsung Electronics (005930) launched the Galaxy S4 20 million sales in two months (on the carrier supply basis) of the fastest selling Samsung smartphones ever, according to industry.

The Galaxy S4 was released only two months ago by the end of June, and the carrier supply sales exceeded 20 million.

When this morning president JK Shin of Samsung Mobile met with reporters in Samsung Electronics Seocho building in response to a question whether the amount of Galaxy S4 sales would be 20 million he told “You know, there are”, and this is a 20 million breakthrough.

Since the official launch of the Galaxy S4 on the 26th of April in 60 countries 4 million were sold in just five days, then went on to sell 10 million units in a month.

… On the other hand a Samsung official said, “as regards the Galaxy S4 sales numbers there is no answer”.

From: Analyst: Samsung Galaxy S4 Sales vs. Apple iPhone 5 Sales [Wall St. Cheat Sheet, July 7, 2013]

Although the Galaxy S4 has sold faster than any other Samsung device, it appears that it still couldn’t surpass the sales rate for the iPhone 5. Citing the slowing demand for the Galaxy S4, a mid-June report from J.P. Morgan lowered the 2013 earnings estimate for Samsung by 9 percent. After the report was released, Samsung lost $12.4 billion in market capitalization, falling to $187.8 billion.

Samsung analysts ask hard questions as S4 marketing charm wears off [Reuters, June 16, 2013]

(Reuters) – Analysts fell under Samsung Electronics Co Ltd’s marketing spell when they made what they now admit were hopelessly optimistic forecasts for its smartphone sales.

Samsung’s huge share of the high-end smartphone market also persuaded some analysts to downplay industry data pointing to a fast-saturating segment, a reality that is already eating into sales of Apple Inc’s iPhone 5.

Woori Investment & Securities, one of South Korea’s largest securities firms, cut its outlook for Samsung’s earnings and target share price on June 5. It was the first to adjust its view.

A massive wave of downgrades has since followed, with forecasters including JPMorgan, Morgan Stanley and Goldman Sachs taking a harder look at their assumptions of how well the S4, Samsung’s latest Galaxy smartphone, would actually do.

Sales estimates for the S4 were slashed by as much as 30 percent, stirring investor concerns over Samsung’s mobile devices division – the company’s biggest profit generator.

Investors in the South Korean IT giant have paid dearly. Samsung lost nearly $20 billion in market value in a week as shares plunged following the downgrades.

“I’d say most forecasters including myself had this conviction that they’ll outperform again – because it’s Samsung,” said Byun Hanjoon, an analyst at KB Investment & Securities. “They had beaten expectations before, which led many to believe they are bound to excel again with the S4.”

The S4 sold 10 million sets in just one month of its debut in late April, outperforming its predecessor, the S3.

Yet analysts now say the high-end smartphone segment is slowing, citing lacklustre prospects in Europe and South Korea in particular.

The S4, in reality, also lacks any real wow factor, they say.

“The Street, including Goldman Sachs, admittedly extrapolated the first-quarter earnings momentum through the year,” Goldman Sachs analyst Michael Bang said in a report. “This resulted in very optimistic earnings expectations.”

Most analysts have reduced their estimates for S4 shipments to around 7 million units a month from their previous average expectation of 10 million.

Bank of America Merrill Lynch has lowered its S4 sales estimate for this year by 5 million to 65 million units.

Some analysts say a loss in potential sales of 5 million S4 units would cut around $1 billion of Samsung’s operating profit.

“S4 sales are solid. It’s just that some analysts had higher expectations and then they lowered them,” J.K. Shin, head of Samsung’s mobile devices division, told reporters last week.

Over the past month, 17 out of 43 analysts have downgraded their earnings estimates for Samsung, leading to a 0.6 percent drop in their average forecast for the company’s April-to-June earnings to 10.4 trillion won ($9 billion), according to Thomson Reuters StarMine.

The lowered forecast, however, would still be a quarterly record.

Many analysts say weaker-than-expected S4 sales will not necessarily stop Samsung from posting record quarterly profits. The company has diversified into many segments of the smartphone market, Merrill Lynch says.

MID-TIER PHONES

Still, the scale of the downgrades has cast a shadow on Samsung’s dominance in the $250 billion smartphone market.

Doing it no favour, Chinese rivals are aggressively growing their market share, aided by strong sales of mid-tier models – a segment in which Samsung has relatively weak positioning, according to analysts.

The mid-tier segment accounted for less than 15 percent of Samsung’s total shipments last year.

Analysts say Samsung has to focus on this lower tier in the medium term.

The high-end segment is losing momentum, with manufacturers struggling to differentiate themselves and consumers calling for a leap in innovation, they say.

To be sure, Samsung has not sat idle.

It has gradually expanded its offerings. Among four varieties of the S4 introduced in recent weeks, there was one stripped-down version called the Galaxy Mini.

By comparison, Apple has had no new offerings since the iPhone 5 hit the market in September last year.

Samsung bulls are also pinning their hopes on product launches later this year including the Galaxy Note 3, a phone-tablet hybrid.

Some analysts say conservative forecasts will prevail.

“Expectations for innovation have been lowered, and I don’t think there’ll be as much buzz surrounding new product launches as it used to be,” said Byun at KB.

Samsung’s stock, which slumped to a six-month low on Thursday, inched up 0.9 percent on Friday.

($1 = 1134.4000 Korean won)

(Reporting by Miyoung Kim; Editing by Ryan Woo)

Samsung GALAXY S4 Hits 10 Million Milestone in First Month [Samsung Mobile Press, May 23, 2013]

Samsung Electronics Co., Ltd. today announced that global channel sales of its GALAXY S4, a life companion for a richer, fuller, simpler life, has surpassed 10 million units sold in less than one month after its commercial debut. Launched globally on April 27, the phone is estimated to be selling at a rate of four units per second.

The GALAXY S4 sets a new record for Samsung, generating sales quicker than any of its predecessors. Sales of the GALAXY S III reached the 10-million mark 50 days after its launch in 2012, while the GALAXY S II took five months and the GALAXY S seven months to reach the same milestone.

“On behalf of Samsung, I would like to thank the millions of customers around the world who have chosen the Samsung GALAXY S4. At Samsung we’ll continue to pursue innovation inspired by and for people,” said JK Shin, CEO and President of the IT & Mobile Communications Division at Samsung Electronics.

The GALAXY S4 was developed to enhance the meaningful moments in our lives through its innovative features and superior hardware. It has the world’s first Full HD Super AMOLED display that showcases images at their very best on a 5-inch screen with 441ppi. Equipped with a powerful rear 13MP camera, the GALAXY S4 also boasts a Dual Camera function that allows simultaneous use of both front and rear cameras. The GALAXY S4’s new and innovative software features include Air View and Air Gesture for effortless tasks, while it also keeps users up-to-date with information about their health and wellbeing using S Health.

Samsung GALAXY S4 is available in more than 110 countries and will gradually be rolled out to a total of 155 countries in cooperation with 327 partners.

Samsung is planning to introduce more color variations to meet various consumer tastes and preferences. In addition to the currently available Black Mist and White Forest, new color iterations will be added this summer, including Blue Arctic and Red Aurora, followed by Purple Mirage and Brown Autumn.

* All functionality, features, specifications and other product information provided in this document including, but not limited to, the benefits, design, pricing, components, performance, availability and capabilities of the product are subject to change without notice or obligation.

** Availability of colors will vary depending on the country and carrier/retailer.

Is Samsung’s Growth at the Expense of Apple? [Bloomberg YouTube channel, April 26, 2013]

4. Previous (pre-saturation) milestones according to

Samsung Mobile Press (with relevant video inserts from other sources):

See: Samsung GALAXY S II reaches 3 Million global sales [July 3, 2011]

From: Samsung GALAXY S II reaches new heights with 5 million global sales [July 28, 2011]

Samsung Electronics Co., Ltd, a global leader in digital media and digital convergence technologies, today announced that the Samsung GALAXY S II (Model: GT-I9100) has passed the 5 million global sales milestone.

The GALAXY S II is Samsung’s flagship smartphone device; a beautifully thin, (8.49mm) and lightweight dual-core smartphone that combines an unmatched Super AMOLED Plus viewing experience with incredible performance, all on Android – the world’s fastest-growing mobile operating system. The next generation smartphone also includes exclusive access to Samsung’s four new content and entertainment hubs, seamlessly integrated to provide instant access to music, games, e-reading and social networking services.

The 5 million mark has been reached in just 85 days, a rate which is 40 days faster than the original GALAXY S took to reach the same sales mark. This rate is set to accelerate as Samsung has just launched GALAXY S II in China, the world’s largest market.

…

From: Samsung GALAXY S II continues success reaching 10 Million in global sales [Sept 26, 2011]

Samsung Electronics Co., Ltd, a global leader in digital media and digital convergence technologies, today announced that the Samsung GALAXY S II (Model: GT-I9100) has achieved 10 million global channel sales, doubling from five million in just eight weeks.

The GALAXY S II is Samsung’s flagship smartphone device – a beautifully thin (8.49mm) and lightweight dual-core smartphone that combines an unmatched SuperAMOLED Plus viewing experience with powerful performance, all on Android, the world’s fastest-growing mobile operating system. The next generation smartphone also includes Samsung’s four content and entertainment hubs, seamlessly integrated to provide instant access to music, games, e-reading and social networking services.

Samsung celebrates 30 million global sales of GALAXY S and GALAXY S II [Oct 17, 2011]

Samsung Electronics Co., Ltd, a leading mobile handset provider, today announced that its Samsung GALAXY S and GALAXY SII smartphones have achieved a combined total of 30 million global sales.

GALAXY SII has set a new record for Samsung, generating more than 10 million sales – quicker than any device in Samsung’s history. The device also recently received five out of the total ten Mobile Choice Consumer Awards 2011 in the UK as well as 2011 Gadget Award for being chosen as the best smartphone of the year by T3, confirming it as a run-away favorite smartphone with consumers this year. It continues to gain traction as Samsung’s flagship smartphone – a stylishly designed, slim and ultra-portable device combining an unrivalled viewing experience with powerful dual-core processor performance.