Home » Posts tagged 'Huawei'

Tag Archives: Huawei

Huawei’s All Cloud Networks with a Cloud-based Wireless Network (CloudAir) supporting new radio access technologies in a new architecture (CloudRAN), and network slicing in particular, for upcoming 5G, Future Internet, and In-Network Computing

April 6, 2017, Huawei Carrier Business YouTube channel: All Cloud Network Towards 5G (2½ min)

IT, cloud computing, and the Internet are reshaping the world. Video, cloud services and IoT are also revolutionizing our lifestyle. How can carriers quickly launch new services? How can they achieve business agility? How will they optimize cost structure? These are the three biggest concerns of carriers on the transformation path to All Cloud Networks.

During the process of full cloudification, carriers will have to cloudify equipment, networks, services and the whole operational system if they want to deliver real ROADS experience. Huawei launched its All Cloud strategy in order to help operators succeed in transformation.

All Cloud Network use the principles and technologies of the cloud to reconstructs carrier networks with pooled hardware resources, fully distributed software architecture, and full automation operations for more efficient utilization, more agile services and higher operational efficiency.

April 6, 2017, Huawei Carrier Business YouTube channel: ROADS to New Growth (1½ min) (more…)

Tablet and smartphone market trends

September update: Qualcomm’s smartphone AP revenues declined 17% year-over-year in the second quarter of 2015, Strategy Analytics estimated. Qualcomm maintained its smartphone AP market share leadership with 45% revenue share, followed by Apple with 19% revenue share and MediaTek with 18% revenue share. For the rest 18%: After a difficult 2014, Samsung LSI continued to recover and more than doubled its smartphone AP shipments in the second quarter of 2015 compared to the same period last year. Samsung LSI capitalised on its Galaxy S6 design-win in Q2 2015. In addition the company featured in multiple mid-range smartphones from Samsung Mobile. Full report: Smartphone Apps Processor Market Share Q2 2015: Samsung LSI Maintains Momentum

… The global tablet AP market declined 28% year-over-year to reach US$679 million in the second quarter of 2015, according to Strategy Analytics. Apple, Intel, Qualcomm, MediaTek and Samsung LSI captured the top-five revenue share rankings in the market during the quarter. Apple led the tablet AP market with 27% revenue share, followed by Intel with 18% revenue share. Qualcomm ranked number three, narrowly behind Intel. ![GT400150821[1]](https://lazure2.wordpress.com/wp-content/uploads/2015/08/gt4001508211.jpg?w=960) Full report: Tablet Apps Processor Market Share Q2 2015: Apple and Intel Maintain Top Two Spots

Full report: Tablet Apps Processor Market Share Q2 2015: Apple and Intel Maintain Top Two Spots

…

Digitimes Research saw global tablet shipments fall to 45.76 million units in second-quarter 2015, showing a 10% decrease on quarter and representing more than a 15% decrease on year. Full report: Global tablet market – 2Q 2015 End of September update

Investors.com comments on tablet and smartphone market trends — Q2’2015: 1. Apple, Samsung lose ground in tablet market — LG and Huawei gain

1. Apple, Samsung lose ground in tablet market — LG and Huawei gain

2. Apple, Huawei [and Xiaomi] buck slowing smartphone sales trend

As the commenting articles by Investors.com are based on press releases of 2 market research companies I will give the web reference here for those press releases themselves, as well as 3 other press releases not commented on by Investors.com (if there are trend indications in the press releases themselves I will copy them alongside the web reference):

- July 29, 2015: Worldwide Tablet Market Continues to Decline; Vendor Landscape is Evolving, According to IDC

“Longer life cycles, increased competition from other categories such as larger smartphones, combined with the fact that end users can install the latest operating systems on their older tablets has stifled the initial enthusiasm for these devices in the consumer market,” said Jitesh Ubrani, Senior Research Analyst, Worldwide Mobile Device Trackers. “But with newer form factors like 2-in-1s, and added productivity-enabling features like those highlighted in iOS9, vendors should be able to bring new vitality to a market that has lost its momentum.”

“Longer life cycles, increased competition from other categories such as larger smartphones, combined with the fact that end users can install the latest operating systems on their older tablets has stifled the initial enthusiasm for these devices in the consumer market,” said Jitesh Ubrani, Senior Research Analyst, Worldwide Mobile Device Trackers. “But with newer form factors like 2-in-1s, and added productivity-enabling features like those highlighted in iOS9, vendors should be able to bring new vitality to a market that has lost its momentum.” - July 30, 2015: Huawei Becomes World’s 3rd Largest Mobile Phone Vendor in Q2 2015 [says Strategy Analytics]

- Woody Oh, Director at Strategy Analytics, said, “… Smartphones accounted for 8 in 10 of total mobile phone shipments during the quarter. The 2 percent growth rate of the overall mobile phone market is the industry’s weakest performance for two years, due to slowing demand for handsets in China, Europe and the US.”

- Neil Mawston, Executive Director at Strategy Analytics, added, “… Samsung has stabilized volumes in the high-end, but its lower-tier mobile phones continue to face intense competition from rivals such as Huawei in Asia. … Apple outperformed as consumers in China and elsewhere upgraded to bigger-screen iPhone 6 and 6 Plus models.”

- Ken Hyers, Director at Strategy Analytics, added, “… Huawei is rising fast in all regions of the world, particularly China where its 4G models, such as the Mate7, are proving wildly popular. Huawei has finally overtaken Microsoft to become the world’s third largest mobile phone vendor for the first time ever.”

- Neil Mawston, Executive Director at Strategy Analytics, added, “Microsoft shipped 27.8 million mobile phones and captured 6 percent marketshare worldwide in the second quarter of 2015. Microsoft’s 6 percent global mobile phone marketshare is sitting near an all-time low. Microsoft continues to lose ground in feature phones, while its Lumia smartphone portfolio is in a holding pattern awaiting the launch of new Windows 10 models later this year. Xiaomi shipped 19.8 million mobile phones and captured 5 percent marketshare worldwide in Q2 2015. Xiaomi remains a major player in the China mobile phone market, but its local and international growth is slowing and Xiaomi is facing intense competition from Huawei, Meizu and others. As a result, Xiaomi may struggle to hold on to its top-five global mobile phone ranking in the coming quarters.”

- June 17, 2015: Business smartphones shipments in Q1 up 26% from last year, now 27% of total smartphone market [says Strategy Analytics]

Android was the most dominant OS in terms of business smartphone shipments in Q1, accounting for nearly 60% of all business smartphones (corporate- and personal-liable). It was also the dominant BYOD device; 68% of personal-liable shipments in Q1 were Android. Apple iOS accounted for only 27% of BYOD shipments in Q1, but was the dominant platform in terms of corporate-liable smartphones, with 48% of Q1 CL shipments. The difference in Android/iOS shipments between the CL and IL categories reflects the continuing corporate perception that iPhones are “safer” than Android-based devices.

Android was the most dominant OS in terms of business smartphone shipments in Q1, accounting for nearly 60% of all business smartphones (corporate- and personal-liable). It was also the dominant BYOD device; 68% of personal-liable shipments in Q1 were Android. Apple iOS accounted for only 27% of BYOD shipments in Q1, but was the dominant platform in terms of corporate-liable smartphones, with 48% of Q1 CL shipments. The difference in Android/iOS shipments between the CL and IL categories reflects the continuing corporate perception that iPhones are “safer” than Android-based devices.

- Shipments of personal-liable smartphones (i.e. “bring your own device,” or BYOD, phones) drove market growth in Q1

- Strategy analytics defines personal-liable devices as devices purchased by the end-user and expensed back to the company or organization, or devices purchased outright by individual users but used primarily for business purposes linking to corporate applications and backend systems.

- While personal liable devices dominate worldwide business smartphone shipments, some regions are more resistant to the BYOD trend than others. Such regions include Western Europe and Central Europe, where corporate-liable devices are the dominant types of business smartphones. In Western Europe in Q1, 61% of the 10 million business smart phones were corporate-liable. Central and Eastern Europe had a slightly higher rate of BYOD devices shipped in Q1 — 41% — but the majority of smartphones shipped in this regions was also corporate-liable. This a sharp contrast to North America, where three-quarters of business smartphone shipments are personal-liable. The trend in Western and Eastern Europe reflects the more corporate-centric approach businesses take to mobility in these regions.

- July 29, 2015: Mobile Broadband Tablet Subscriptions to Double to 200 Million by 2021, says Strategy Analytics

- Strategy Analytics forecasts global mobile data subscriptions on tablets will more than double from 2015 to 2021, reaching over 200 million

- Around the globe, over 100 million wireless connections on cellular enabled tablets will be added through 2021. By 2021 tablets will only account for 2 percent of total mobile subscriptions, a 2.7 percent population penetration rate.

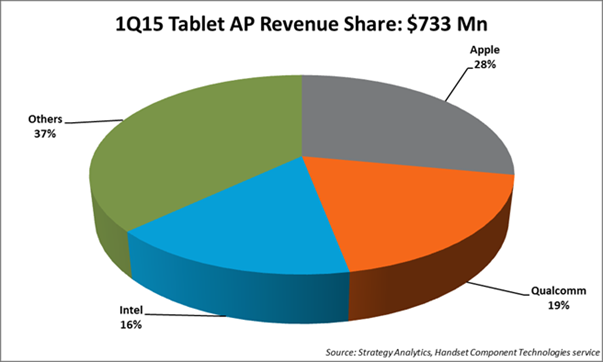

- July 29, 2015: Intel Maintains Top Spot in Non-Apple Tablet Apps Processors in Q1 2015 says Strategy Analytics

⇒The global tablet applications processor (AP) market declined -6 percent year-over-year to reach $733 million in Q1 2015- According to Sravan Kundojjala, Associate Director, “Intel maintained its top spot in the non-Apple tablet AP market in unit terms in Q1 2015. Strategy Analytics estimate Android-based tablets accounted for over 70 percent of Intel’s total tablet AP shipments in Q1 2015. We expect Intel’s Atom X3 cellular tablet chip product line to help Intel maintain its momentum in the tablet AP market.”

- Stuart Robinson, Executive Director of the Strategy Analytics Handset Component Technologies (HCT) service added, “Strategy Analytics estimates that baseband-integrated tablet AP shipments accounted for over one-fourth of total tablet AP shipments in Q1 2015, helped by a strong push from Qualcomm, MediaTek and Spreadtrum. We expect continued momentum for integrated APs as Intel, Rockchip and others join the bandwagon.”

- July 30, 2015: Windows Tablet Shipments Nearly Double in Q2’15, says Strategy Analytics

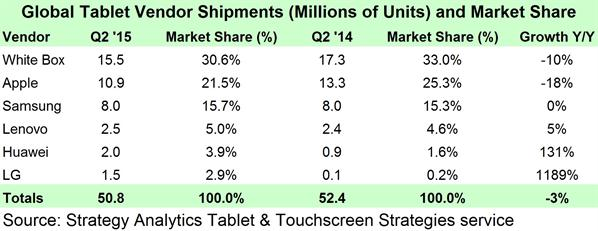

⇒Global Tablet Shipments and Market Share in Q2 2015 (preliminary)

- Windows-branded Tablets comprised 9 percent of shipments in Q2 2015, up 4 points from Q2 2014

- Android-branded Tablet shipment market share was flat at 70 percent in Q2 2015

- Apple continued its slide in market share down to an all-time low of 21 percent in Q2 2015, 4 points lower than Q2 2014

- Vendors with strong 3G and LTE connected Tablet strategies such as Huawei, LG, and TCL-Alcatel gained market share as leaders like Apple, Samsung, and the White Box community lost ground

Tablet & Touchscreen Strategies Senior Analyst Eric Smith added, “Windows share continues to improve as more models become available from traditional PC vendors, White Label vendors, and Microsoft itself though a healthy Surface lineup and distribution expansion. The key going forward will be if the coming wave of 2-in-1 Detachable Tablets is a hit with consumers or if they go the way of the Netbook—we remain cautiously optimistic on this point.” |

Tablet & Touchscreen Strategies Service Director Peter King said, “Apple’s fortunes will turn around soon as it will launch the 12.9-inch iPad Pro as well as an iPad mini 4 in Q4 2015. New features in iOS 9, which are exclusive to iPad such as multi-tasking and a more convenient soft keyboard, will also help compel upgrades by owners of older iPad models. Meanwhile, Huawei and LG have posted fantastic growth primarily due to well-executed 3G and LTE connected Tablet strategies.” |

Then I will add 2 additional information pieces from Strategy Analytics:

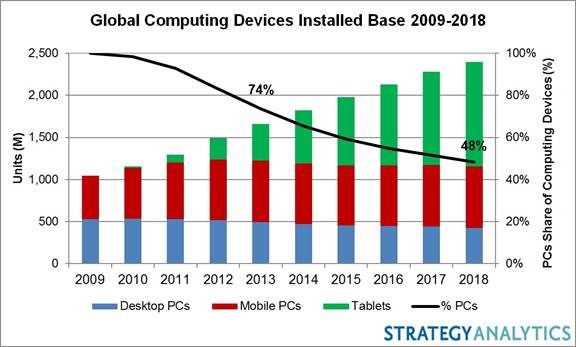

Oct 8, 2014: Replacement Demand to Boost PC Sales in 2015, says Strategy Analytics

Having experienced negative growth since 2012, global PC sales are expected to rise 5 percent in 2015 driven by replacement of an ageing installed base according to Strategy Analytics’ Connected Home Devices (CHD) service report, “Computers in the Post-PC Era: Growth Opportunities and Strategies.”

Click here for the report:

http://www.strategyanalytics.com/default.aspx?mod=reportabstractviewer&a0=10146

- PC sales will fall by 4 percent in 2014 before returning to modest growth in 2015 and beyond to support replacement demand.

- Strategy Analytics’ consumer research of computing device usage in developed markets indicates that PCs remain essential computing devices despite healthy Tablet sales.

- Frequent Tablet usage has grown by 22 percentage points from 2011 to Q4 2013 up to 32 percent of all households while frequent Mobile PC (excluding Tablets) usage has stayed steady through this period, as 63 percent of all households indicated they frequently used Mobile PCs.

- Frequent usage of all PCs (including Mobile and Desktop PCs and excluding Tablets) remained above the 90 percent mark of all households, falling only 3 percentage points during this period.

Eric Smith, Analyst of Connected Home Devices, said: “Multiple PC ownership is falling as Tablet sales supplant replacement demand for secondary PCs mainly used for casual tasks. Still, PCs will remain essential devices as households eventually replace their primary PCs used for productivity tasks such as spreadsheet and video editing or personal banking.”

David Watkins, Service Director, Connected Home Devices, added: “The modern Tablet user experience is quickly arriving on the PC thanks to more affordable 2-in-1 Convertible PCs and new operating systems which blend traditional PC and Tablet user experiences. We see development of these forces aligning perfectly with an older PC installed base ripe for replacement in 2015.”

May 1, 2015: Children Change Disney’s Digital Strategy: “App TV” Now Central To Content Planning by David Mercer

Multiscreen TV behaviour is at the centre of television’s stormy transformation – viewing of broadcast, linear TV on the TV screen is apparently in decline while consumption on smartphones and tablets is increasing. Making sense of the big picture is increasingly challenging, and legacy players like broadcasters and the major content owners are inevitably somewhat resistant to the idea that their traditional businesses are under serious threat.

We have monitored the early stages of this transformation for the past decade and see its results in our own research, and we continue to predict further industry disruption in our forecasts. But sometimes it is only when you hear the evidence given in person by a senior executive at a leading global player that the scale of the challenge and opportunity are finally brought home.

This happened at last week’s AppsWorld event in Berlin, where I chaired the TV and Multiscreen conference. The speaker was Andreas Peters, Head of Digital for the Walt Disney Company Germany, Austria and Switzerland. Andreas presented some of the most compelling evidence I have yet heard that television is truly a multiscreen medium for the next generation of viewers.

Disney’s challenge in Germany was to launch a television show called Violetta aimed at 8-12 year old girls. It had been introduced successfully in Argentina but had failed in the UK. As it often does, Disney had invested considerable amounts in merchandising and retailers were eagerly anticipating sales of the new product lines. The show was first broadcast on German free TV on May 1st 2014 but it achieved only very low ratings.

The question for Disney managers was whether traditional TV had stopped working. A crisis meeting was held with a view to writing off the investment. Disney had previously not made its shows available online in Germany but the Violetta situation was so serious they were persuaded to experiment. Two episodes were made available on Youtube with a link to Disney’s own website. Viewing of the content on Youtube very quickly went viral until Disney had achieved a reach of 50% of 8-12 year old girls and eight million views. Violetta went on to become a success in German-speaking markets.

The evidence was clear: for some shows at least, younger children cannot now be reached using the traditional broadcast TV/big screen model. Peters explained that the Violetta experience was transformative for the Disney organisation and led to the inclusion of online and digital media as a key element in the business case for many products. In fact it also led to the development and launch of Disney’s own Watch App, which includes live streaming and seven-day catch-up programmes from the broadcast Disney Channel.

Even after the Violetta experience Disney was sceptical that an app was needed – there was a feeling that the website would be sufficient. Nevertheless the app was launched and Disney had planned for 20,000 downloads. Instead it has passed one million downloads in its first six months. Peters noted: “This was a real shock for us. We completely underestimated the demand.” Around 500,000 viewers are now using the Disney Watch app for linear television viewing, in addition to millions of shows being downloaded for catch-up viewing. Peak app viewing hours are between 6am and 8am and then between 1pm and 9pm on school days, with a different pattern at weekends. Peters made it clear that children did not want lots of features built in to the app – just like TV, they just want to hit “play” and watch.

“Our TV colleagues of course don’t want to believe this,” said Peters. “But the world has changed and it will continue to change.” Disney has also seen a knock-on effect from its app launch with an increase in free-to-air broadcast TV viewing. But the firm is now clear that mobile is not just an add-on to TV or a promotional tool; it must be an integral part of the entire process.

There are many implications for content strategy. TV and Digital have to “understand each other”, which is a challenge when the KPIs in each world are very different. As we have often heard, the video industry is crying out for a set of common metrics which can apply and support advertisers in both TV and online worlds. Video consumption patterns vary and different content may be relevant to different platforms.

But the overall lesson is clear: “TV” is not just the big screen in the corner of the living room. It must embrace multiscreen distribution strategies in order to reach its maximum potential. TV companies are betraying their audiences and their investors if they don’t target the 6.4bn addressable screens available to them.

Chinese smartphone brands to conquer the global market?

The smartphone market in China became saturated between Q3’12 and Q4’13 as per the below chart from Analysys International (EnfoDesk):

Note that this chart corresponds to Chinese writing traditions, i.e. in Q2’11 16.81 million smartphones and 51.01 million feature phones were sold, while in Q4’13 97.63 million smartphones and 9.2 million feature phones. Source: 易观分析:2013年第4季度中国手机销量增速放缓,智能手机市场呈现饱和态势 (Analysys analysis: China mobile phone sales growth slowed in the fourth quarter of 2013, the smart phone market is saturated) [EnfoDesk, March 11, 2014]

Chinese Handset Vendors Will Account for Over 50% of Mobile Handset Sales in 2015 [ABI Research press release, March 10, 2014]

ABI Research reports that Chinese handset vendors will account for over 50% of mobile handsets in 2015. Chinese vendors already accounted for 38% of mobile handset shipments in 2013 and the ongoing shift in growth to low cost handsets, especially smartphones, will increase their market share.

Greater China has long dominated the mobile handset manufacturing supply chain, but now its OEMs are beginning to dominate sales at the expense of the traditional handset OEMs, including even Samsung.

Many of the Chinese OEMs have focused almost exclusively on the huge Chinese market, with little activity beyond its borders, but this is set to change. Huawei (6th in worldwide market share for 2013) and ZTE (5th) have already made an impact on the world stage, but other Chinese handset OEMs like Lenovo—the Motorola acquisition is a clear statement of intent—and Xiaomi are set to join them.

“Chinese vendors already take up five of the top ten places in terms of worldwide market share, despite three of them only really shipping into China. The Chinese vendors highlight the changing shape of the mobile handset market, as the Chinese manufacturing ecosystem, specifically reference designs, enable the next wave of smartphone growth in low cost emerging markets and amongst price conscious consumers everywhere,” said Nick Spencer, senior practice director, mobile devices.

“South East Asia has already experienced this trend, but ABI Research expects to see the impact of these Chinese vendors increasing in all emerging markets and even advanced markets, especially on prepay,” added Spencer.

The New Phone Giants: Indian And Chinese Manufacturers’ Fast Rise To Threaten Apple And Samsung [Business Insider India, March 15, 2014]

The top Indian and Chinese smartphone manufacturers are classically disruptive. They produce products that are “good enough,” at a fraction of the cost of comparable models from premium brands. These ultra low-cost devices are the key to nudging consumers in massively untapped markets like India and Indonesia onto smartphones.

And these companies are starting to aim higher – producing 4G LTE smartphones that have the same processing power as Samsung and Apple premium devices.

They’re also far more innovative than they’re given credit for in terms of their strategy, supply chain management, and hardware.

In a new report from BI Intelligence, we explain why global consumer Internet and mobile companies will increasingly need to work with companies like Xiaomi and Micromax – not to mention Lenovo, Huawei, ZTE, Coolpad, Karbonn, and others – if they don’t want to miss out on mobile’s next growth phase in emerging markets

- Major local manufacturers now account for two-fifths of China’s smartphone market, and one-fourth of India’s. Xiaomi already sells four of the top 10 best-selling Android devices in China, and operates one of the top five app stores.

- Combined, the top five manufacturers in China and the top two in India – the “Local 7” in the chart above – are now shipping about 65 million smartphones every quarter, more than Apple, and coming close to drawing even with Samsung.

- These local manufacturers wield influence in various ways. They run their own successful app stores, mobile operating systems, and mobile services. They also hold the keys to which apps are preloaded on their phones. When BlackBerry wanted to take its BBM messaging service for Android into India, it signed a deal with Micromax.

- The local manufacturers are not provincial outfits producing knock-offs, as some might be inclined to assume. But their main competitive tool, for now, remains price. Local manufacturers in China and India match the features of more expensive devices and manage to produce comparable hardware at a fraction of the price. A Micromax handset comparable to Apple’s iPhone 5C costs less than one-fourth as much.

- Xiaomi has used a four-point strategy in its three-year rise to produce four of the most popular phone models in China. We discuss all four aspects, including tight inventory management and crowdsourcing product development feedback.

- These manufacturers will continue to expand overseas, in search of new growth opportunities. Micromax is in Nepal, Bangladesh, and Sri Lanka. Xiaomi has its eyes on Malaysia and Brazil. Huawei is already in the U.S. For example, it sells a 4G LTE handset on MetroPCS.

Smartphone Prices Race to the Bottom as Emerging Markets Outside of China Come into the Spotlight for Future Growth, According to IDC [press release, Feb 24, 2014]

Singapore and London, February 24, 2014 – Emerging markets have become the center of attention when talking about present and future smartphone growth. According to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, in 2013 the worldwide smartphone market surpassed 1 billion units shipped, up from 752 million in 2012. This boom has been mainly powered by the China market, which has tripled in size over the last three years. China accounted for one out of every three smartphones shipped around the world in 2013, equaling 351 million units.

Recently the surge in growth has started to slow as smartphones already account for over 80% of China’s total phone sales. The next half billion new smartphone customers will increasingly come mainly from poorer emerging markets, notably India and in Africa.

“The China boom is now slowing,” said Melissa Chau, Senior Research Manager for mobile devices at IDC Asia/Pacific. “China is becoming like more mature markets in North America and Western Europe, where smartphone sales growth is slackening off.”

Emerging markets in Asia/Pacific outside of China, together with the Middle East and Africa, Central and Eastern Europe, and Latin America, account for four fifths of the global feature phone market, according to IDC data. “This is a very big market opportunity,” said Simon Baker, Program Manager for mobile phones at IDC CEMA. “Some 660 million feature phones were shipped last year, which could add two thirds to the size of the current global smartphone market.”

India will be key to future smartphone growth as it represents more than a quarter of the global feature phone market. “Growth in the India market doesn’t rely on high-end devices like the iPhone, but in low-cost Android phones. Nearly half of the smartphones shipped in India in 2013 cost less than US$120,” said Kiranjeet Kaur, Senior Market Analyst for mobile phones at IDC Asia/Pacific.

“Converting feature phone sales to smartphone sales implies a relentless push towards low cost,” added Baker. IDC research shows nearly half the mobile handsets sold across the world have retail prices of less than US$100 without sales tax. Two thirds of those have prices of less than US$50.

“The opportunity gets larger the lower the price falls,” continued Baker. “If you take retail prices without sales tax, in 2013 nearly three quarters of the US$100-125 price tier was already accounted for by smartphones. Within US$75-100 the proportion was down to just over half, and between $50-75 it was not much more than a third.”

Many smartphone vendors have begun gearing up for this next wave of cost pressure. Samsung is increasingly switching production to Vietnam, where manufacturing costs currently undercut mainland China. Even Hon Hai, one of the largest contract manufacturers for handsets in China, has announced plans for a plant in Indonesia to furnish a lower production cost base.

In addition to the table below, an interactive graphic showing worldwide sub-$100 feature phone shipments by region is available here. The chart is intended for public use in online news articles and social media. Instructions on how to embed this graphic can be found by viewing this press release on IDC.com.

Worldwide Sub-$100 Feature Phone Shipments by Region, 2013

Region

Shipments (M Units)

India

212.3

Middle East & Africa

150.0

Asia/Pacific (excluding Japan, China, and India)

140.7

Latin America

76.4

PRC

68.1

Central & Eastern Europe

43.6

Western Europe

39.8

North America

13.9

Total

744.9

Source: IDC Worldwide Mobile Phone Tracker, February 24, 2014

Analysys International: Xiaomi Ranked Among Top Five in Q4, 2013 [March 11, 2014]

The statistics from EnfoDesk, the Survey of China Mobile Terminals Market in Q4, 2013, newly released by Analysys International, shows that the market share of Samsung, Lenovo, Huawei, Coolpad and Xiaomi ranked the top five of China smartphone in Q4, 2013. The market share of Samsung shrink slightly over the previous quarter, but it still accounted for 15.07 percent of smartphone market and maintain the leading position.

The release of Apple‘s new product has brought efficiency in Q4, and its market share slightly rebounded. Owning to the release of MI3 (Xiaomi), the market share of Xiaomi up 3.85 percentage points compared to the previous quarter. MI3 still should be bought from booking and the booking is relatively frequent. Meanwhile, the purchase restriction of MI2(Xiaomi) and Red MI(Xiaomi) has been relaxed, coupled with the strategic cooperation between Xiaomi and mobile operators, making it easier to buy custom models as well as contributing to the enlargement of Xiaomi’s market share. It can be expected that Xiaomi will put more energy into the complement of its retail capabilities and continue to increase their market share.

From: UMENG Insight Report – China Mobile Internet 2013 Overview [UMENG, March 12, 2014]

– The number of active smart devices in China exceeded 700 Million by the end of 2013.

– The five fastest growing mobile apps categories (excluding games) are : news, health & fitness, social networking, business, and navigation. These areas will bring new opportunities for developers in 2014.

– Socializing your apps is the key to success for developers. Currently among the top 1,000 apps (apps and games) in the Chinese market, 55% of them provide links to Chinese social networking services (e.g. Sina Weibo, Wechat, QQ, Renren) The amount of app content sharing to social network platforms per mobile Internet user per day has tripled in the last 6 months.

– Social network sharing in game has become incredibly popular on all social networking platforms, 48% of in app sharing traffic to social networks are from games.

– High-end devices (pricing above 500US$) have a significant market share in China, contributing 27% of total devices. These users have dynamic needs on mobile apps . The users of below 150US$ phones prefer casual games for their entertainment requirements.

– The year of 2013 became known as the first year Chinese developers took IP seriously with many developers licensing IP from rights holders. By the end of 2013, among the Top 100 games, 20% license 3rd party IP.

– Over the course of 2013 the percentage of iOS jailbroken devices in the Chinese Mainland fell by 17% to 13% of all devices. Domestic users are becoming more hesitant to jailbreak their devices.

…

700 Million active smart devices in China

…

The market for budget Android phones is strong in China with 57% of devices under 330 USD price range. However over a quarter of users are using high-end smart phones costing over 500USD, 80% of these are iPhones.

…

Fragmented Android device market

- In the 4th quarter of 2013, Samsung and XiaoMi (a local brand) prove to be the most popular Android brands as between them they manufacture all of the top 10 active Android devices.

- However the Android market is still highly fragmented with hundreds of different handsets on the market. Samsung who manufacture many devices in all price ranges control 24% of the device market, while the domestic manufactures are battling it out with the international brands to extend their market share.

…

- In 2013, changes to device connectivity saw a large growth in WiFi connectivity, from 38% at the beginning of the year to 52% at year end. Mobile Internet infrastructure has become better in China. However Chinese users are still price sensitive to mobile data tariff.

…

- Glossary:

Active Device: active device refers to device which has activated at least one app covered by Umeng platform in the stipulated time frame. All the “devices” in the report refers to “active devices”, not the actual shipment.…

- Data Source:

Analysis data in the report is based on over 210,000 Android and iOS apps from the Umeng platform. All data was collected from January to December 2013.

From: More than 247 million mobile handsets shipped in India during CY 2013, a Y-o-Y growth of 11.6%; over 70 million mobile handsets shipped in 4Q 2013 alone [CyberMedia Research press release, Feb 26, 2014]

According to CMR’s India Monthly Mobile Handsets Market Review, CY 2013, February 2014 release, India recorded 247.2 million mobile handset shipments for CY (January-December) 2013. During the same period, 41.1 million smartphones were shipped in the country.

…

India Smartphones Market

The India smartphones market during 2H 2013 saw a rise in shipments by 60.3% over 1H 2013, taking the overall contribution of smartphones to 16.6% for the full year. Further, 65.8% of the total smartphones shipped in the country were 3G smartphones during CY 2013.

Commenting on these results, Tarun Pathak, Lead Analyst, Devices, CMR Telecoms Practicesaid, “CY 2013 was primarily the year of smartphones for the India market, particularly for local handset vendors. A first for the India market was a marginal decline in featurephone shipments on a year-on-year basis. This trend is likely to continue with more vendors focusing on entry level smartphone offerings aimed at the consumer segment.”

“Nearly 70 vendors operated in the highly competitive India smartphones market in CY 2013, with ‘Tier One’ brands like Apple, Samsung, Nokia, Sony, HTC, LG and Blackberry capturing close to 53% of the total smartphones market, followed by India brands capturing close to 43% of total smartphone shipments. The remaining market of roughly 4% smartphone shipments was captured by China OEM brands, where we expect a few more players to enter the India market directly, instead of continuing as ODM partners to Indian brands”, Tarun added.

Rapid Growth In Smartphones Offset The Slump Witnessed In Feature Phone Sales In 4Q13, Says IDC [press release, Feb 26, 2014]

India was one of the fastest growing countries worldwide in terms of smartphone adoption in 2013. According to the International Data Corporation (IDC) in 2013 the smartphone market surpassed 44 million units shipped, up from 16.2 million in 2012. This surge has been mainly powered by home grown vendors which have shown a tremendous and consistent growth over the past 4 quarters of 2013.

The overall phone market stood at close to 257 million units in CY 2013 – an 18% increase from 218 million units in CY2012.

CY2013 also witnessed a remarkable migration of the user base from feature phones to smartphones primarily due to the narrowing price gaps between these product categories.

Q413 Perspective:

The India smartphone market grew by 181% year over year (YoY) in the fourth quarter of 2013 (4Q13). According to International Data Corporation’s (IDC) APEJ Quarterly Mobile Phone Tracker, vendors shipped a total of 15.06 million smartphones in 4Q13 compared to 5.35 million units in the same period of 2012. 4Q13 grew by almost 18% Quarter-on-Quarter.

The shipment contribution of 5.0inch-6.99inch screen size smartphones (phablets) in 4Q2013 was noted to be around 20% in the overall market. The category grew by 6% in 4Q13 in terms of sheer volume over 3Q13.

The overall mobile phone market (Feature Phones and Smartphones) stood at 67.83 million units, a 16% growth YoY and a meager 2% growth quarter over quarter (QoQ).The share of feature phones slid further to make 78% of the total market in 4Q13, with the market showing a decline of 2% in 4Q13 over 3Q13.

The fourth quarter of 2013 witnessed a spike in the smartphone shipments by smaller homegrown vendors like LAVA, Intex which have shown tremendous growth in the past couple of quarters.

“The growth in the smartphone market is being propelled by the launch of low-end, cost competitive devices by international and local vendors which are further narrowing the price gaps that exist between feature phones and smartphones”, said Manasi Yadav, Senior Market Analyst with IDC India.

“The international vendors have understood the importance of creating a diverse portfolio of devices at varied price points and are striving to launch cost competitive devices that cater to every segment in the target audience ” comments Kiran Kumar, Research Manager with IDC India.

Top Five Smartphone Vendor Highlights

Samsung: Samsung maintained its leadership spot with about 38% in terms of market share. Its smartphone shipments grew by close to 37% from 3Q 2013 to 4Q2013. The fourth quarter saw quite a few new launches across price points by Samsung – however the low-end Galaxy portfolio in smartphones contribute to 50% in terms of shipment volumes

Micromax: Micromax held on to its second spot with about 16% in terms of market share in 4Q2013. Some of the top selling models were the entry level smartphones like A35 Bolt and A67. The Canvas range of devices has also done well in terms of volume contribution owing to the marketing campaigns launched around them.

Karbonn: The market share for Karbonn in 4Q2013 was close to 10%, some of the top selling models for this brand were A1+ and A51.

Sony: Sony managed to make a comeback in the top-5 smartphone vendor list in 4Q13 and garnered a market share of 5%. The top selling models included Xperia M Dual and Xperia C handsets, which are targeted at mid-tier price range.

Lava : Lava managed to hold onto the number 5 spot in the top-5 smartphone vendor list. The continued traction around the XOLO and IRIS range of devices helped the vendor garner a market share of 4.7% in 4Q13. Some of the top selling models include the newly launched XOLO A500 S and the existing models like IRIS 402 and IRIS 349.

IDC India Forecast:

IDC anticipates the growth in Smartphone segment to outpace the overall handset market growth for the foreseeable future. The end-user shift towards mid-to-high screen size products will be amplified by the declining prices and availability of feature-rich localized product offerings. Vendors who are able to differentiate their offerings at affordable prices will maintain a competitive edge and secure a strong position in the mobile phone market in CY 2014.

From: Gartner Says Annual Smartphone Sales Surpassed Sales of Feature Phones for the First Time in 2013 [press release, Feb 13, 2014]

…

Worldwide Smartphone Sales to End Users by Vendor in 2013 (Thousands of Units)

Company

2013

Units

2013 Market Share (%)

2012

Units

2012 Market Share (%)

Samsung

299,794.9

31.0

205,767.1

30.3

Apple

150,785.9

15.6

130,133.2

19.1

Huawei

46,609.4

4.8

27,168.7

4.0

LG Electronics

46,431.8

4.8

25,814.1

3.8

Lenovo

43,904.5

4.5

21,698.5

3.2

Others

380,249.3

39.3

269,526.6

39.6

Total

967,775.8

100.0

680,108.2

100.0

Source: Gartner (February 2014)

Worldwide Smartphone Sales to End Users by Vendor in 4Q13 (Thousands of Units)

Company

4Q13

Units

4Q13 Market Share (%)

4Q12

Units

4Q12 Market Share (%)

Samsung

83,317.2

29.5

64,496.3

31.1

Apple

50,224.4

17.8

43,457.4

20.9

Huawei

16,057.1

5.7

8,666.4

4.2

Lenovo

12,892.2

4.6

7,904.2

3.8

LG Electronics

12,822.9

4.5

8,038.8

3.9

Others

106,937.9

37.9

75,099.3

36.2

Total

282,251.7

100.0

207,662.4

100.0

Source: Gartner (February 2014)

Top Smartphone Vendor Analysis

Samsung: While Samsung’s smartphone share was up in 2013 it slightly fell by 1.6 percentage points in the fourth quarter of 2013. This was mainly due to a saturated high-end smartphone market in developed regions. It remains critical for Samsung to continue to build on its technology leadership at the high end. Samsung will also need to build a clearer value proposition around its midrange smartphones, defining simpler user interfaces, pushing the right features as well as seizing the opportunity of bringing innovations to stand out beyond price in this growing segment.

Apple: Strong sales of the iPhone 5s and continued strong demand for the 4s in emerging markets helped Apple see record sales of 50.2 million smartphones in the fourth quarter of 2013.

“However, Apple’s share in smartphone declined both in the fourth quarter of 2013 and in 2013, but growth in sales helped to raise share in the overall mobile phone market,” said Mr. Gupta. “With Apple adding NTT DOCOMO in Japan for the first time in September 2013 and signing a deal with China Mobile during the quarter, we are already seeing an increased growth in the Japanese market and we should see the impact of the last deal in the first quarter of 2014.”

Huawei: Huawei smartphone sales grew 85.3 percent in the fourth quarter of 2013 to maintain the No. 3 spot year over year. Huawei has moved quickly to align its organization to focus on the global market. Huawei’s overseas expansion delivered strong results in the fourth quarter of 2013, with growth in the Middle East and Africa, Asia/Pacific, Latin America and Europe.

Lenovo: Lenovo saw smartphone sales in 2013 increase by 102.3 percent and by 63.1 percent in the fourth quarter of 2013. Lenovo’s Motorola acquisition from Google will give Lenovo an opportunity to expand within the Americas.

“The acquisition will also provide Lenovo with patent protection and allow it to expand rapidly across the global market,” said Mr. Gupta. “We believe this deal is not just about entering into the U.S., but more about stepping out of China.”

Gartner expects smartphones to continue to drive overall sales in 2014 and an increasing number of manufacturers will realign their portfolios to focus on the low-cost smartphone sector. Sales of high-end smartphones will slow as increasing sales of low- and mid-price smartphones in high-growth emerging markets will shift the product mix to lower-end devices. This will lead to a decline in average selling price and a slowdown in revenue growth.

In the smartphone OS market, Android’s share grew 12 percentage points to reach 78.4 percent in 2013 (see below). The Android platform will continue to benefit from this, with sales of Android phones in 2014 approaching the billion mark.

Worldwide Smartphone Sales to End Users by Operating System in 2013 (Thousands of Units)

Operating System

2013 Units

2013 Market Share (%)

2012 Units

2012 Market Share (%)

Android

758,719.9

78.4

451,621.0

66.4

iOS

150,785.9

15.6

130,133.2

19.1

Microsoft

30,842.9

3.2

16,940.7

2.5

BlackBerry

18,605.9

1.9

34,210.3

5.0

Other OS

8,821.2

0.9

47,203.0

6.9

Total

967,775.8

100.0

680,108.2

100.0

Source: Gartner (February 2014)

…

Upcoming FireFox OS powered $25 smartphones with Spreadtrum SC6821 EDGE SoC having 128MB on chip RAM used via zRAM swap by the OS

Hands on with the $25 Smartphone running Firefox OS at MWC 2014 [TrustedReviews YouTube channel, Feb 24, 2014]

[0:15] “This is the newest … set that is running on ultra low-end memory which is 128MB RAM and 256MB ROM. So that’s why we call it the lowest [price] smartphone you probably can get on the market” [0:30]

From With Firefox OS, Mozilla begins the $25 smartphone push [CNET, Feb 23, 2014]

Mozilla doubled down on its bet that low-end smartphones will give Firefox OS a place in the crowded mobile market, announcing partnerships Sunday that will bring $25 smartphones to the large number of people who can’t afford high-end models like Apple’s iPhone 5S and Samsung’s Galaxy S5 that cost hundreds of dollars.

At the Mobile World Congress here, Mozilla announced a deal with Chinese chip designer Spreadtrum Communications that will mean Firefox OS smartphones will arrive in extremely cost-sensitive markets like India and Indonesia where people often buy phones from a bin in a store.

“We’re working with them to break through the

$50$25 barrier [should be corrected, obviously], which is hard,” Mozilla Chief Technology Officer Brendan Eich told CNET. “This is going to be for a set of [sales] channels in Asia that do not involve operators,” the carriers that in other parts of the world dominate distribution.One company that plans to make and promote the phones is Indonesia-based Polytron. And Indonesian carriers Telkomsel and Indosat plan to sell the devices. Hands-on testing shows the cheap Firefox OS phones to be workable. “This is a price point currently out of the reach of Google and even the lowest-cost Android handset vendors. It pushes Firefox OS into feature-phone territory, potentially signaling the beginning of the end for the category,” said Ovum analyst Nick Dillon in a statement.

…

Mozilla has found a small niche in the mobile OS market by pursuing its low-end strategy, with the first phones debuting in countries such as Hungary, Venezuela, Colombia, Brazil, and Greece. Mozilla, a non-profit organization, hopes to use the browser-based operating system to lower the barriers that today keep people locked into ecosystems linking hardware, OS, app store, services, content, and apps.

…

Firefox OS takes on challenges

Today, Apple’s iOS and Google’s Android dominate the market for smartphones and tablets. Challengers like Microsoft’s Windows Phone, Ubuntu Touch, WebOS, BlackBerry OS, and Samsung’s Tizen have struggled to push these aside: it’s hard to compete against an incumbent that’s got millions of users, hundreds of thousands of apps, and few signs of the complacency that can open a door for challengers.Firefox OS won’t have an easy time of it. There’s not as much money to be squeezed from low-end markets, so developers aren’t as likely to pursue it as avidly. The Spreadtrum chipset will support only 2.5G Edge mobile networks that, while common in poorer parts of the world, are too slow for a lot of modern apps. And Google is pushing toward lower-end phones, with Android 4.4 memory-saving techniques [“zRAM swap can increase the amount of memory available in the system by compressing memory pages and putting them in a dynamically allocated swap area of memory.”] that fit KitKat into phones with 512MB of RAM.

At the same time, though, Firefox is pushing, too. It uses the same ZRAM memory compression technique to halve its memory requirement to 128MB of memory, Eich said.

Getting down to $25 phones means Firefox OS will provide an alternative for people who’d otherwise buy a feature phone — a model with a few built-in apps but not much more.

So Firefox has a chance there. But in the long run, to succeed, Firefox OS will need to push up-market, and it’s not clear how Mozilla will succeed there with much stronger competition.

Think Big at #MWC14: Mozilla leadership discuss innovation and digital literacy [ThinkBigEurope YouTube channel, Feb 25, 2014]

Note: Think Big is a Telefonica initiative targeting young people in six European countries: Ireland, UK, Spain, Germany, Czech Republic and Slovakia (countries where Telefonica operates in Europe)

How good is the $25 smartphone from Mozilla – BBC News [BBC News YouTube channel, Feb 24, 2014]

Mozilla plans ‘$25 smartphone’ for emerging markets [BBC News, Feb 23, 2014]

Mozilla has shown off a prototype for a $25 (£15) smartphone that is aimed at the developing world.

The company, which is famed mostly for its Firefox browser, has partnered with Chinese low-cost chip maker Spreadtrum.

While not as powerful as more expensive models, the device will run apps and make use of mobile internet.

It would appeal to the sorts of people who currently buy cheap “feature” phones, analysts said.

Feature phones are highly popular in the developing world as a halfway point between “dumb” phones – just voice calls and other basic functions – and fully-fledged smartphones.

Mozilla hopes that it will capture an early lead in a market that is now being targeted by mobile device manufacturers who see the developing world as the remaining area for massive growth.

It will face stern competition from bigger, more established brands, however – with more announcements of this kind expected over the course of the next couple of days at the Mobile World Congress in Barcelona.

“These solutions expand the global accessibility of open web smartphones to first-time and entry-level smartphone buyers by reducing the time and cost required for handset makers to bring these devices to market,” said Spreadtrum in a press statement.

Mozilla said the phone “redefines” the entry-level phone market.

The concept of a cheap smartphone may seem likely to appeal to consumers in developed countries, particularly those who locked into long contracts in order to subsidise the cost of the likes of the Apple iPhone and Samsung Galaxy range.

But analyst Carolina Milanesi, from Kantar Worldpanel, said it should not be seen as a competitor.

“You’re not really talking about smartphone experience.

“You’re talking about a clumsy smartphone that’s a little bit better than a feature phone – still primarily for voice and text.”

The phone runs Mozilla’s own mobile operating system – something that could cause problems as competition in the cheap smartphone market steps up, Ms Milanesi added.

Mozilla also announced new high-end smartphones

In addition to the $25 smartphone, Mozilla also launched several high-end models, including devices from Huawei and ZTE.

Mozilla press conference about Firefox OS at MWC 2014 [firefoxchannel YouTube channel, Feb 23, 2014]

The $25 smartphone announcement comes at [15:30] with the following slides (note the 1Gb, i.e. 128MB LPDDR1 Embedded in the SoC!!):

From Firefox OS Unleashes the Future of Mobile [Mozilla Press Center, Feb 23, 2014]

Spreadtrum has announced WCDMA and EDGE turnkey reference designs for Firefox OS as well as the industry’s first chipset for US$25 smartphones, the SC6821, that redefines the entry level for smartphones in key growth markets. These solutions are already creating a stir, with global operators such as Telenor, Telkomsel and Indosat, and ecosystem partners such as Polytron, T2Mobile and Thundersoft expressing interest.

$25 Firefox Smartphone (MWC 2014) [ARMflix YouTube channel, Feb 25, 2014]

[0:33] “The key thing about this device is that this is only powered by 128MB of RAM. So this is only one half or one quarter of the existing entry level devices that we are seeing on the market.” [0:47]

Warning: This article does not take into account the SC6821 characteristics, especially its 128MB on chip RAM used via zRAM swap by the OS, as well as its EDGE only networking!

Is a US$25 smartphone possible? [DIGITIMES, Feb 25, 2014]

Mobile World Congress (MWC) kicked off with a bang, with Mozilla announcing a US$25 smartphone built around a turnkey solution that features silicon from China-based Spreadtrum and software from Firefox.

According to a Mozilla press release, Spreadtrum and Mozilla have now completed the integration of Firefox OS with several of Spreadtrum’s WCDMA and EDGE smartphone chipsets, including the SC6821, unveiled by Spreadtrum as the industry’s first chipset for a US$25 smartphone.

So the key to the solution is the SC6821, which Spreadtrum stated is “designed with a unique low memory configuration and high level of integration that dramatically reduces the total bill of materials required to develop low-end smartphones.” Mozilla added that with this chipset, handset makers will be able to bring to market smartphones with 3.5-inch HVGA [eg. 480×320] touchscreens, integrated Wi-Fi, Bluetooth, FM and camera functions, the advanced phone and browser features of Firefox OS, and access to an ecosystem of web and HTML5 applications.

With a clearer picture of the specs Mozilla envisions for a US$25 smartphone, I approached Digitimes Research Analyst Luke Lin to ask if he thought it was possible to deliver such a product to the market at this time. According to Lin, the simple answer is that it would be “impossible” to see a US$25 Firefox phone hit the shelves this year, unless operators are willing to provide subsidies.

Lin explained that currently, the absolute lowest smartphone BOM in China is estimated to be around US$22 (and most are significantly more than that) and that manufacturing costs are highly unlikely to go below US$20 this year, which would be the cost needed to deliver a US$25 smartphone to end users. The cost would need to get to US$15-20 FOB in order to get a selling price of US$25, Lin said.

In terms of Spreadtrum‘s claims it has produced a level of integration and memory requirements that can reduce the BOM cost significantly, Digitimes Research Analyst Anthony Chen commented that Spreadtrum’s solution is no more integrated than any other integrated solution on the market so there is no clear advantage there. And as for memory, the cheapest and smallest memory modules (ROM and mobile DRAM) for smartphones in China run about US$5 for a configuration of 256MB ROM and 256MB of mobile DRAM, and Chen highly doubts the Mozilla solution could run with a lesser configuration than that.

One other argument being offered as to why Spreadtrum could offer lower pricing than competitors is that the China government has a stake in the company. The logic is that an edge in pricing could help Spreadtrum better compete with Taiwan-based MediaTek and US-based Qualcomm.

Chen responded to the suggestion by pointing out that such a statement is not really an argument. It’s merely speculation. Moreover, Chen noted that Spreadtrum’s cheapest products currently sell in the US$3-4 range, and he doesn’t see much chance for the price to be reduced significantly, with subsidies or without.

While it is true that BOM costs are always falling, Lin and Chen agreed that component makers are much more likely to be squeezed in the higher-end segments, where they have margins. At the bottom of the market, the component makers are not really making any money. As a long term strategy for the low-end of the market, they would much prefer to provide improved specs at the same price rather than cut prices, Lin explained, while adding that it is unlikely that the BOM would drop much further at the bottom end of the market, as it is already close to US$20. Therefore, while prices may drop a little, Digitimes Research does not expect prices to drop all that much in the near future.

Another perspective was offered by Digitimes Research Analyst Jason Yang, who stated that if there is any component that could influence the low-end smartphone BOM at this point, it was the touch panel, not the application processor. Yang indicated that currently the touch panel module, with LCD display, accounts for the largest portion of the BOM, at around US$7-8 for the cheapest modules. Yang did state that he believes the price may drop this year, but not enough to bring the overall BOM cost of the cheapest phones to below US$20.

So, if ultimately the announcement was all about Mozilla driving the launch of a US$25 smartphone, Lin doubts that this will happen this year or anytime soon. Based on the current cost structure, Lin believes Firefox models priced in the US$60-80 are more likely to appear in 2014. Of course, users may be able to find spectacular deals and price cuts, but such a situation would more likely be inventory clearance or something similar, not a mainstream price point.

However, if this announcement is not about Mozilla driving the market to low-cost smartphones and is more about a trend where emerging markets will become flooded with cheap smartphones, then it should be noted that this is a process that is already underway.

Currently in China, entry-level smartphones – mostly white-box but even some brands – are already selling in the US$50 range. And these smartphones are not just being shipped to the domestic market. China vendors exported about 30% of their smartphones in 2013 and that proportion is forecast to rise in 2014. According to Digitimes Research data tracking smartphone shipments by vendor and the related market breakdown, the non top-10 segment (which is dominated by Greater China vendors and white-box players) accounted for 12% of global smartphone shipments in 2012, 21% of the global market in 2013, and Digitimes Research forecasts the share will rise to 25.6% in 2014.

So the flow of cheap smartphones from China going to emerging markets has already started and the shipments are steadily increasing, it’s just that the devices cost a bit more than US$25 and almost all of them feature Android as the OS.

Spreadtrum and Mozilla Take Aim at Global Smartphone Accessibility with Turnkey Solution for US$25 Smartphones [press release, BARCELONA, Spain, Feb. 23, 2014]

– Integration of Spreadtrum’s entry-level smartphone chipsets with turnkey reference designs for Firefox OS aims to bring Open Web Devices to an underserved audience of entry-level smartphone buyers around the world

– Spreadtrum unveils the SC6821, the industry’s first chipset for US$25 smartphones (retail), on Firefox OS

Today at Mobile World Congress, Spreadtrum Communications, Inc., a leading fabless semiconductor company in China with advanced technology in 2G, 3G and 4G wireless communications standards, and Mozilla, the mission-based organization dedicated to keeping the power of the Web in people’s hands, announced that they have teamed up to deliver turnkey Firefox OS reference designs with Spreadtrum’s entry-level smartphone chipsets. These solutions expand the global accessibility of open Web smartphones to first-time and entry-level smartphone buyers by reducing the time and cost required for handset makers to bring these devices to market. Spreadtrum and Mozilla have now completed the integration of Firefox OS with several of Spreadtrum’s WCDMA and EDGE smartphone chipsets, including the SC6821, unveiled today by Spreadtrum as the industry’s first chipset for US$25 smartphones. These smartphones are available for demos at Mozilla’s booth (3C30) at Mobile World Congress 2014 in Barcelona.

“The combination of Firefox OS with Spreadtrum’s entry-level smartphone platforms has the potential to dramatically extend the reach of smartphones and the Web globally,” said Dr. Li Gong, Mozilla Senior Vice President of Mobile Devices and President of Asia Operations. “Firefox OS delivers a customized, fun and intuitive experience for first-time smartphone buyers and our collaboration with Spreadtrum enables the industry to offer customers an extremely affordable way to get a smartphone and connect with Web apps.”

At Mobile World Congress, Spreadtrum unveiled the SC6821, its new smartphone chipset that redefines the entry level of the global smartphone market. The chipset is designed with a unique low memory configuration and high level of integration that dramatically reduces the total bill of materials required to develop low-end smartphones. With this chipset, handset makers will be able to bring to market smartphones with 3.5″ HVGA [e.g. 480×320] touchscreens, integrated WiFi, Bluetooth, FM and camera functions, the advanced phone and browser features of Firefox OS, and access to a rich ecosystem of web and HTML5 applications, at prices similar to much more minimally featured budget feature phones.

Spreadtrum’s turnkey reference design brings together this highly cost-effective chipset platform with the intuitive, easy-to-use experience and Web/HTML5 application ecosystem of Firefox OS. “Turnkey solutions benefit the vast majority of small handset makers by reducing the time and cost involved in bringing new devices to market,” said Stuart Robinson, analyst at Strategy Analytics. “This joint effort between Spreadtrum and Mozilla will help make Firefox OS more readily available to handset makers that focus on the needs of entry level smartphone buyers in emerging markets.”

Firefox OS smartphones are the first devices powered completely by Web technologies to deliver the performance, personalization and price users want in a smartphone with a beautiful, intuitive and easy-to-use experience that is unmatched by other phones. Firefox OS has all the things users need from a smartphone as well as the things they want like built-in social integration with Facebook and Twitter, HERE Maps with offline capabilities, much-loved features like the Firefox Web browser, the Firefox Marketplace for apps and more. Firefox OS features a brand new concept for smartphones – an adaptive app search that literally transforms the phone to meet a user’s needs and interests at any moment.

Firefox OS offers Mozilla-pioneered WebAPIs that unlock the power of the Web and enable developers to build fun and rich app experiences that were previously only available to proprietary native apps, which are fragmented by platform and not portable.Xiaomao Xiao, Spreadtrum’s vice president of software development added, “By integrating Firefox OS support with our smartphone platforms, we are providing our customers with flexibility and choice in how they develop and design their smartphones as well as access to the increasingly rich base of HTML5 applications that are available on this platform. We are pleased to work with Mozilla to expand Firefox OS support to all of our smartphone platforms to provide the benefits of open web technologies to consumers around the world.”

Spreadtrum and Mozilla have completed the integration of Firefox OS with Spreadtrum’s SC6821 and SC7710 WCDMA smartphone chipsets, and expect to complete a turnkey reference design for the SC7715, Spreadtrum’s single-core WCDMA smartphone chipset with integrated connectivity, next month. Spreadtrum and Mozilla’s collaboration will extend across Spreadtrum’s full chipset portfolio.

About Spreadtrum Communications, Inc.

Spreadtrum Communications, Inc. is a fabless semiconductor company that develops mobile chipset platforms for smartphones, feature phones and other consumer electronics products, supporting 2G, 3G and 4G wireless communications standards. Spreadtrum’s solutions combine its highly integrated, power-efficient chipsets with customizable software and reference designs in a complete turnkey platform, enabling customers to achieve faster design cycles with a lower development cost. Spreadtrum’s customers include global and China-based manufacturers developing mobile products for consumers in China and emerging markets around the world. Spreadtrum is a privately held company headquartered in Shanghai and an affiliate of Tsinghua Unigroup, Ltd. For more information, visit www.spreadtrum.com.About Mozilla

Mozilla has been a pioneer and advocate for the Web for more than 15 years. We create and promote open standards that enable innovation and advance the Web as a platform for all. Today, half a billion people worldwide use Mozilla Firefox to discover, experience and connect to the Web on computers, tablets and mobile phones. For more information please visit https://www.mozilla.org/.

Firefox OS Expands to Higher-Performance Devices and Pushes the Boundaries of Entry-Level Smartphones [Mozilla Press Center, Feb 23, 2014]

Mozilla, the mission-based organization dedicated to keeping the power of the Web in people’s hands, today previewed the future of Firefox OS to show how the flexibility, scalability and powerful customization will empower users, developers and industry partners to create the exact mobile experience they want with relevant and innovative features, localized services and more.

Expanding Ecosystem

Today, device partners ALCATEL ONETOUCH, Huawei, LG and ZTE are all using Firefox OS on a broad range of smartphones that are tailored for different types of consumers. The Firefox OS devices unveiled today showcase dual-core processors for better performance, higher screen resolution and more. The newest Firefox OS devices to join the family include the ZTE Open C and Open II, Alcatel ONETOUCH Fire C, Fire E, Fire S and Fire 7 tablet, all using Snapdragon™ processors from Qualcomm Technologies Inc., a leader in mobile communications.

In the few months since initial launch, Firefox OS smartphones are now available in 15 markets, with new operators and new markets around the globe announced today. Mozilla is working to create a level playing field with the openness of the Web. The ecosystem is catching fire and resulting in development of new form factors beyond the smartphone. For example, Panasonic announced they will make SmartTVs powered by Firefox OS, Foxconn and Via are making Firefox OS tablets, and Mozilla is working with suppliers to enable devices for all target user groups.

Significant growth is also happening with apps and content on Firefox OS, proving the Web has the potential to be the world’s largest marketplace. Firefox OS offers two ways to discover and utilize apps and content – the Firefox Marketplace and an adaptive app search that enables discovery and access to apps that users can instantly use once or download to keep. This innovative approach helps maximize data and storage usage.

The Firefox Marketplace has seen thousands of developers submitting apps and millions of downloads of popular global and relevant local apps. Top global apps include Cut the Rope, Disney’s Where’s My Water?, Facebook, EverNav, HERE, Line, Pinterest, SoundCloud, The Weather Channel, TimeOut, Twitter, Yelp and YouTube.

The ZTE Open C will offer the latest version of Firefox OS

in Venezuela and Uruguay in Q2 of 2014The Firefox Marketplace makes it possible to create local and niche apps with relevant regional content by allowing developers to build on basic Web technologies, without gatekeepers. The top new local apps in the Firefox Marketplace include Despegar.com travel booking, Capp World Cup highlights, Captain Rogers game, Manana reading app, Napster, SurfTime and more.

Future of Firefox OS

At Mobile World Congress, Mozilla is showing off a preview of what to expect from Firefox OS in the coming year and what’s possible when the Web is the platform.Firefox OS is made to change with each individual and adapt to his or her interests and needs with features like adaptive app search, offline use and cost control. New content can be enjoyed instantly with a simple search, making downloads virtually a thing of the past. Firefox OS offers deep levels of customization that are unmatched by any platform or device. This is possible because Firefox OS is built on the flexible technologies of the Web and the user interface is made of a modular architecture of building blocks that make it easy for anyone to customize.

Upcoming versions of Firefox OS will offer users fun and innovative new features and services including new and intuitive navigation, a powerful universal search feature, support for LTE networks and dual SIM cards, easy ways to share content, ability to create custom ringtones, replaceable home screens and Firefox Accounts.

New versions of Firefox OS have many performance improvements that dramatically improve the user experience including speedier launch times, smoother scrolling and improved keyboard accuracy.

Here are highlights on a few of the features coming next for Firefox OS:

- Deep customization options for operators and manufacturers, developers and users. This includes the ability to create custom ringtones and replaceable home screens, which were direct requests from Firefox OS users.

- A new universal search that will revolutionize how users discover content on their phones. The feature is available on any screen – simply swipe down from the top to find new apps, content or navigate to anything on the phone or the Web.

- New navigation features to make multitasking intuitive, fluid and smart, much like how users interact with the Web. Users can easily swipe from the left and right edges to seamlessly move between pages, content and apps in a fun way that saves time.

- Easy and direct sharing of content (and even software updates) in a secure way with NFC support, without the need for data or Wifi.

- LTE support to make the mobile experience even faster.

- Firefox OS will introduce Firefox Accounts and services. Firefox Accounts is a safe and easy way for users to create an account that enables them to sign in and take Firefox everywhere. With Firefox Accounts, Mozilla can better integrate services including Firefox Marketplace, Firefox Sync, backup, storage, or even a service to help locate, message or wipe a phone if it were lost or stolen.

As the platform evolves, Firefox OS will enable new technologies for the mobile industry. Mozilla is already leading the way in areas like gaming, privacy and security, WebRTC and other services. Firefox OS is a great platform for which partners can build additional services that meet the needs of their customers regionally and individually.

Early examples:

- Telefonica offers a very helpful cost control app for customers to manage their usage and top off their account.

- Deutsche Telekom just announced they are utilizing the deep levels of customization Firefox OS offers to develop new privacy features for the Future of Mobile Privacy project, a joint effort with Mozilla to create effective, user-driven privacy functionality for mobile devices.

- WebRTC is an open, standards-based technology that enables operators to offer services like real time chat, image and file sharing. With WebRTC, operators can let users make calls to any desktop or mobile device, regardless of platform or service provider.

“We’re pleased to see the Firefox OS ecosystem grow so quickly as users, developers and partners come together to experience and build the future of mobile experiences,” said Andreas Gal, Mozilla Vice President of Mobile. “Firefox OS will continue to evolve and add more features to offer choice and customization that is unmatched by any other smartphone. We’re excited to see what other features and services will result from an open platform being contributed to by developers, partners and community around the world.”

About Mozilla

Mozilla has been a pioneer and advocate for the Web for more than 15 years. We create and promote open standards that enable innovation and advance the Web as a platform for all. Today, half a billion people worldwide use Mozilla Firefox to experience the Web on computers, tablets and mobile devices. With Firefox OS and

Firefox Marketplace, Mozilla is driving a mobile ecosystem built entirely on open Web standards, freeing mobile providers, manufacturers, developers and consumers from the limitations and restrictions imposed by proprietary platforms. For more information, visit http://www.mozilla.org.For More information: https://blog.mozilla.org/press/kits/firefox-os/

New Developer Hardware and Tools Show Firefox OS Ecosystem Momentum [Mozilla Press Center, Feb 23, 2014]

Mozilla, the mission-based organization dedicated to keeping the power of the Web in people’s hands, today announced new developer reference hardware and tools that will continue to accelerate momentum around the Firefox OS ecosystem, making it cheaper, faster and easier for developers, operators and OEMs to deploy innovative Web apps and create personalized Firefox OS experiences.

Mozilla announced a 4.5” dual-core reference phone, enabling developers to test new Firefox OS features and apps against different memory configurations. It also expanded the Mozilla tablet program that helps developers test their apps and build out Firefox OS for tablets.

New Firefox OS developer tools and hardware demonstrate ecosystem momentum

New Firefox OS PhoneGap integration was also announced, allowing hundreds of thousands of PhoneGap developers to port their existing apps to Firefox OS in a matter of hours, while new WebAPIs will continue to narrow the gap between native and Web apps. At Mobile World Congress, Mozilla also launched developer tools that will allow OEMs and operators to easily customize Firefox OS for a variety of customer segments.

Developers have always been the key to driving innovation around the Web, and continue to enable it as a platform for app development and distribution. With these new reference devices, tools, and WebAPIs, Mozilla is catalyzing the growth of Web apps and continuing to break down the barriers and restrictions inflicted by other app ecosystems. The Web not only simplifies app development and reduces fragmentation, but allows developers to own the direct customer relationship with the option to host their own apps and or sell them through the Firefox Marketplace.

Vision Mobile recently published a report showing that developer interest for Firefox OS continues to grow, capturing 7% of developer mindshare in just six months. The report also highlighted that during Q1 2014, 52% of developers were already using HTML5 for mobile websites or Web apps with an additional 16% indicating their intention to join them.

A recent survey by Strategy Analytics found that the number of mobile app developers building for Firefox OS is expected to triple this year, showing the biggest rise in developer interest of any mobile platform.

This industry momentum is fueled by the fact that there are already millions of Web developers programming in HTML5 who are eager to target mobile without having to learn a new programming language, or pay engineers to target specific mobile platforms.

The following expanded reference hardware, tools, and WebAPIs, will continue to drive growth of the Firefox OS ecosystem and help prove why the Web is a powerful platform for app development and distribution:

New Reference Phone

At Mobile World Congress, Mozilla is showcasing its new developer reference phone, the Firefox OS Flame, enabling developers to test the capabilities of Firefox OS in a real environment with a mobile network and true hardware characteristics like the accelerometer, NFC and camera. Like the commercially available Firefox OS phones, the Flame developer reference phone is powered by a Qualcomm processor, in this instance a high powered 1.2GH dual core processor, so developers can test their more processor-intensive games and apps with ease. Developers looking to target their apps for specific Firefox OS phones with lower memory footprints also have the option to alter the RAM capacity of the Flame, from 1GB to 256MB, to see how their apps would perform on lower specked phones. The Flame also provides developers and early adopters with access to the latest Firefox OS builds to test nightly releases and contribute to the overall development platform.

Firefox OS Flame Specs (Reference device):

- Qualcomm MSM8210 Snapdragon, 1.2GHZ Dual core [Cortex-A7 with Qualcomm Adreno 302 GPU] processor

- 4.5” screen (FWVGA 854×480 pixels)

- Cameras: Rear: 5MP / Front: 2MP

- 3G UMTS quad-band (850/900/1900/2100)

- 8GB memory

- 256MB -1GB RAM (adjustable by developer)

- A-GPS, NFC

- Dual SIM support

- Battery capacity: 1,800 mAh

- WiFi: 802.11 b/g/n, Bluetooth, Micro USB

Hundreds of Thousands of PhoneGap Users Can Now Target Firefox OS

Firefox OS will be supported in the next release of PhoneGap, the leading developer tool for building apps across platforms. This builds on the recently announced Firefox OS integration with Cordova, a popular Apache Foundation open source project that allows HTML5 applications to be packaged as native apps.

PhoneGap is a mobile application development framework used by hundreds of thousands of developers. It is based upon the open source Apache Cordova project and allows developers to write an app with HTML, CSS and JavaScript, and then deploy it to a wide range of mobile devices with the same capabilities as native apps. With the Firefox OS integration, developers can now port their existing PhoneGap apps to Firefox OS in a matter of hours, with minimal work. For more information, please see this Hacks post.

App Manager Simplifies App Development with Live Prototyping and Debugging

App Manager brings the Firefox Web developer tools to mobile app developers. It shows how the power of the Web helps developers test, deploy and debug Web apps on Firefox OS phones directly from their desktop. The Firefox Web developer tools are already used by millions of Web developers for creating Web pages, and now the App Manager extends these capabilities to mobile app creation, with the same familiar workflow. There is no SDK to download, developers simply use the App Manager as part of the integrated developer tools in the Firefox browser.

Because the App Manager and Firefox OS both use open Web technologies, debugging, live editing and prototyping is straightforward. For example, an operator or OEM may want to prototype different branded homescreen themes for different audiences. Using the App Manager, they can code this on their desktop and in real-time see the changes appear on their connected Firefox OS phone, eliminating lengthy build times. To see how this is done, please see this MDN article.

New WebAPIs and Industry Adoption