Home » Posts tagged 'Windows'

Tag Archives: Windows

PC Market Trends

A comment from IDC brought ahead: “Competition from 2-in-1 devices and phones remains an issue“. In the notes to the IDC press release it is mentioned as well that “tablets with detachable keyboards [i.e. 2-in-1 devices] running either Windows or Android are not included in the PC category” by IDC. This approach to the PC category is one of the reasons why the decline of the PC market in Q2 2015 is 11.8% according to IDC, while it is 9.5% according to Gartner.

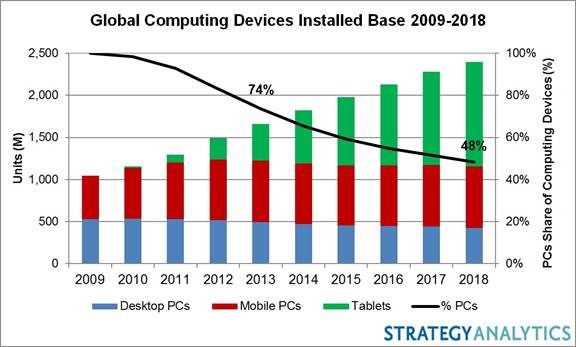

But most importantly: the PC market has continuously been shrinking for the last 3 years as is shown by the chart below:

You will find more statistics at Statista

July 14, 2015: After a brief respite throughout last year, the global PC market returned to its pre-2014 slump in the first half of 2015. According to Gartner’s latest estimates, worldwide PC shipments amounted to 68.4 million in the past three months – down 9.5 percent from last year’s June quarter.The struggling PC industry had received a boost when Microsoft ended official Windows XP support in April 2014, prompting a replacement cycle that has now apparently faded. Despite the sobering results, analysts remain cautiously optimistic about the industry’s mid-term outlook. They argue that the recent decline is no sign of structural weakness but partly a consequence of last year’s unusually positive results and partly an effect of inventory control ahead of the Windows 10 launch scheduled for later this year.

[Gartner’s latest estimates:]

July 9, 2015: Gartner Says Worldwide PC Shipments Declined 9.5 Percent in Second Quarter of 2015

PC Industry Faces Slowdown as Industry Anticipates the Launch of Windows 10

STAMFORD, Conn., July 9, 2015 — Worldwide PC shipments totaled 68.4 million units in the second quarter of 2015, a 9.5 percent decline from the second quarter of 2014, according to preliminary results by Gartner, Inc. This was the steepest PC shipment decline since the third quarter of 2013. PC shipments are projected to decline 4.4 percent in 2015.

There were many contributors to the decline of PC shipments in the second quarter of 2015, and Gartner analysts highlighted three of the major reasons for the drop in shipments. Analysts emphasized that these inhibitors are temporary events, and they are not changing the PC market’s structure. Therefore, while the PC industry is going through a decline, the market is expected to go back to slow and steady growth in 2016.

“The price hike of PCs became more apparent in some regions due to a sharp appreciation of the U.S. dollar against local currencies,” Mikako Kitagawa, principal analyst at Gartner. “The price hike could hinder PC demand in these regions. Secondly, the worldwide PC market experienced unusually positive desk-based growth last year due to the end of Windows XP support. After the XP impact was phased out, there have not been any major growth drivers to stimulate a PC refresh. Lastly, the Windows 10 launch scheduled for 3Q15 has created self-regulated inventory control. PC vendors and the channels tried clearing inventory as much as possible before the Windows 10 launch.”

Lenovo maintained the top position in worldwide PC shipments in the second quarter of 2015 (see Table 1), but the company suffered a year-on-year shipment decline for the first time since the second quarter of 2013. EMEA, Latin America and Japan were tough regions for Lenovo, as the company experienced double-digit shipment declines. HP also experienced a shipment decline after five consecutive quarters of PC shipment growth. HP showed a steep decline in EMEA, which was potentially due to the currency impact. The company was also impacted by tight inventory controls in the consumer market before the Windows 10 launch.

Table 1

Preliminary Worldwide PC Vendor Unit Shipment Estimates for 2Q15 (Thousands of Units)

Notes: Data includes desk-based PCs, notebook PCs and ultramobile premium (see “Market Definitions and Methodology: Consumer Devices”). All data is estimated based on a preliminary study. Final estimates will be subject to change. The statistics are based on shipments selling into channels.

Numbers may not add up to totals shown because of rounding.

Source: Gartner (July 2015)For the second consecutive quarter, Dell experienced a decline in PC shipments. Dell’s decline was relatively moderate in EMEA compared with Lenovo and HP. Analysts said this could be partly attributed to Dell’s lower presence in the consumer market, which created less impact to Dell from the Windows 10 prelaunch inventory control.

In the U.S., PC shipments totaled 15.1 million units in the second quarter of 2015, a 5.8 percent decline from the second quarter of 2014 (see Table 2). The decline was led by a double-digit decline of desk-based shipments, which offset single-digit growth of mobile PCs. Based on preliminary results, the desk-based PC shipment decline was the steepest since 2009 when the market was hit by the economic crisis.

“The weakness of desk-based PC shipments in the second quarter of 2015 is partly due to relatively large shipments in the second quarter last year when the market was driven by the end of XP support,” Ms. Kitagawa said. “Despite inventory controls for the Windows 10 launch, mobile PC shipments grew in the quarter, which resulted in five consecutive quarters of mobile PC growth in the U.S. Affordable thin/light notebooks are attracting more business buyers.”

HP maintained the top position for PC shipments in the U.S. in the second quarter of 2015 despite a 10.1 percent decline (see Table 2). Dell narrowed the gap with HP compared with a year ago. Lenovo was the only vendor showing year-over-year PC shipment growth among the top five vendors in the U.S.

Table 2

Preliminary U.S. PC Vendor Unit Shipment Estimates for 2Q15 (Thousands of Units)

Notes: Data includes desk-based PCs, notebook PCs and ultramobile premium (see “Market Definitions and Methodology: Consumer Devices”). All data is estimated based on a preliminary study. Final estimates will be subject to change. The statistics are based on shipments selling into channels.

Numbers may not add up to totals shown because of rounding.

Source: Gartner (July 2015)

[The Ultramobile (Premium) category includes devices such as Microsoft’s Windows 8 Intel x86 products and Apple’s MacBook Air. Source]PC shipments in EMEA totaled 18.6 million units in the second quarter of 2015, a 15.7 percent decline from the second quarter of 2014. In Europe, vendors spent most of the quarter trying to manage already high inventory levels. They tried clearing that inventory with promotions, having to absorb this with lower margins. In the third quarter of 2015, vendors should see better “sell-in” into the channel with new Windows 10-based devices.

Asia/Pacific PC shipments reached 24.2 million units in the second quarter of 2015, a 2.9 percent decline from the same period last year. Both desk-based and mobile PC shipments declined from the second quarter of 2014. PC shipments in China are estimated to have declined 4 percent in the quarter as demand for consumer PCs remained weak.

These results are preliminary. Final statistics will be available soon to clients of Gartner’s PC Quarterly Statistics Worldwide by Region program. This program offers a comprehensive and timely picture of the worldwide PC market, allowing product planning, distribution, marketing and sales organizations to keep abreast of key issues and their future implications around the globe.

See also

July 16, 2015, Forbes: Why Are IDC And Gartner’s PC Market Stats Different, And Does It Even Matter? by Scott McCutcheon

July 9, 2015: PC Market Continues to Decline Ahead of Windows 10 Release, According to IDC

FRAMINGHAM, Mass.–(BUSINESS WIRE)–Worldwide PC shipments totaled 66.1 million units in the second quarter of 2015 (2Q15), according to the International Data Corporation (IDC) Worldwide Quarterly PC Tracker. This represented a year-on-year decline of -11.8%, about one percent below projections for the quarter.

The slow PC shipments were largely anticipated as a result of stronger year-ago shipments relating to end of support for windows XP as well as channels reducing inventory ahead of the release of Windows 10. In addition, weaker or changing exchange rates for foreign currencies have effectively increased PC prices in many markets, thereby reducing purchasing power and also complicating investment planning.

“Although the second quarter decline in PC shipments was significant, and slightly more than expected, the overall trend fits with expectations,” said Loren Loverde, Vice President, Worldwide PC Trackers & Forecasting. “We continue to expect low to mid-single digit declines in volume during the second half of the year with volume stabilizing in future years. We’re expecting the Windows 10 launch to go relatively well, though many users will opt for a free OS upgrade rather than buying a new PC. Competition from 2-in-1 devices and phones remains an issue, but the economic environment has had a larger impact lately, and that should stabilize or improve going forward.”

“The U.S. market was in line with forecasts, declining -3.3% from a year ago, after avoiding the global market declines over the past five quarters. Soft retail demand, short term weakness from inventory reductions, some cannibalization from competing devices, and low demand for large commercial refreshes are among the factors that reduced PC shipments,” said Rajani Singh, Senior Research Analyst,Personal Computers. “Nevertheless, moving forward, we expect a healthy second half as inventory and purchase decisions pick up following the launch of Windows 10. Emerging product categories will remain a bright spot as attention shifts to convertibles and Chromebooks in the commercial as well as consumer segments.”

Regional Highlights

United States – With shipments totaling nearly 16.4 million PCs in 2Q15, the U.S. market shrank -3.3% from the same quarter a year ago. Although most vendors saw volume decline, gains from Apple and Lenovo helped limit the overall decline. A tough year-on-year comparison contributed to a decline in desktop shipments, while portable PCs shipments continued to grow.

Europe, Middle East, and Africa (EMEA) – In EMEA, weakening demand and high inventory levels inhibited sell-in, driving results below expectations. Vendors continued to clean stock ahead of the back-to-school season and Windows 10 launch. Moreover, unfavorable exchange rates led to increasing prices and continued to affect demand both in the business and consumer spaces. The commercial market also faced a difficult year-on-year comparison with 2Q14, when the end of support for Windows XP boosted sales.

Asia/Pacific (excluding Japan) – China was impacted by excess commercial notebook inventory from earlier quarters as the anti-corruption campaign continues to suppress commercial spending. Currency fluctuation also remained a key factor in many countries in the region, contributing to lower demand. Nevertheless, volume was close to expectations, reflecting a slight decline in growth from prior quarters.

Japan – continued to see low growth as the weak Yen contributed to a difficult market. The Japanese PC market faced a particularly difficult comparison to year ago shipments that were boosted by the end of support for Windows XP and also changes to Japan’s tax code. As the market responds to these shifts and managing inventory, Yamada Denki (one of Japan’s major electronics stores) announced the closure of unprofitable stores in both urban and rural markets.

Vendor Highlights

Lenovo held onto the top position with shipments of 13.4 million units. Volume was up 1% from the prior quarter, but down -7.5% from the prior year. The vendor continued to aggressively court expansion outside of Asia/Pacific, leading to share gains in the U.S. and EMEA.

HP remained the number 2 vendor, but saw shipments decline -10.4% from a year ago. Slowing business demand and inventory control of entry notebooks contributed to the dip. While most of the slowdown was from outside of the U.S., the vendor also saw its U.S. volume contract nearly -7%.

Dell came in at number 3, shipping more than 9.5 million units and registering a year-over-year decline of -8.7%. Strong results in 2Q14 contributed to a poor year-over-year comparison. Stronger performance in Asia/Pacific and EMEA were offset by slower growth in the U.S.

Apple continued to outperform other vendors, with growth of 16.1% globally. The vendor has largely avoided the price competition affecting other players and may be benefitting from some of the uncertainty around the launch of Windows 10, along with refreshed products like the 12-inch MacBook and a relative concentration of shipments in the U.S.

Acer continued to see growth in Chromebooks with more models introduced. However, the vendor also struggled with the larger pullback in the market, particularly in EMEA where it had seen a rebound in mid-2014. The vendor ended 2Q14 with a volume of 4.33 million, a significant decline from the prior quarter and year ago volumes.

ASUS was statistically tied* with Acer for the number 5 position. ASUS has also been affected by currency factors and inventory management, but strong growth in the U.S. boosted overall results.

Source: IDC Worldwide Quarterly PC Tracker, July 9, 2015

* Note: IDC declares a statistical tie in the worldwide PC market when there is less than one tenth of one percent difference in the revenue share of two or more vendors.In addition to the table above, an interactive graphic showing worldwide PC market share for the top 5 vendors over the previous five quarters is available here. The chart is intended for public use in online news articles and social media. Instructions on how to embed this graphic can be found by viewing this press release on IDC.com.

Source: IDC Worldwide Quarterly PC Tracker, July 9, 2015

Table Notes:

- Some IDC estimates prior to financial earnings reports.

- Shipments include shipments to distribution channels or end users. OEM sales are counted under the vendor/brand under which they are sold.

- PCs include Desktops, Portables, Ultraslim Notebooks, Chromebooks, and Workstations and do not include handhelds, x86 Servers and Tablets (i.e. iPad, or Tablets with detachable keyboards running either Windows or Android). Data for all vendors are reported for calendar periods.

IDC’s Worldwide Quarterly PC Tracker gathers PC market data in over 80 countries by vendor, form factor, brand, processor brand and speed, sales channel and user segment. The research includes historical and forecast trend analysis as well as price band and installed base data.

Tablet and smartphone market trends

September update: Qualcomm’s smartphone AP revenues declined 17% year-over-year in the second quarter of 2015, Strategy Analytics estimated. Qualcomm maintained its smartphone AP market share leadership with 45% revenue share, followed by Apple with 19% revenue share and MediaTek with 18% revenue share. For the rest 18%: After a difficult 2014, Samsung LSI continued to recover and more than doubled its smartphone AP shipments in the second quarter of 2015 compared to the same period last year. Samsung LSI capitalised on its Galaxy S6 design-win in Q2 2015. In addition the company featured in multiple mid-range smartphones from Samsung Mobile. Full report: Smartphone Apps Processor Market Share Q2 2015: Samsung LSI Maintains Momentum

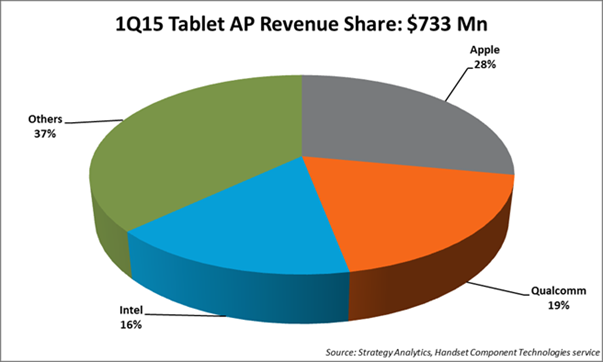

… The global tablet AP market declined 28% year-over-year to reach US$679 million in the second quarter of 2015, according to Strategy Analytics. Apple, Intel, Qualcomm, MediaTek and Samsung LSI captured the top-five revenue share rankings in the market during the quarter. Apple led the tablet AP market with 27% revenue share, followed by Intel with 18% revenue share. Qualcomm ranked number three, narrowly behind Intel. ![GT400150821[1]](https://lazure2.wordpress.com/wp-content/uploads/2015/08/gt4001508211.jpg?w=960) Full report: Tablet Apps Processor Market Share Q2 2015: Apple and Intel Maintain Top Two Spots

Full report: Tablet Apps Processor Market Share Q2 2015: Apple and Intel Maintain Top Two Spots

…

Digitimes Research saw global tablet shipments fall to 45.76 million units in second-quarter 2015, showing a 10% decrease on quarter and representing more than a 15% decrease on year. Full report: Global tablet market – 2Q 2015 End of September update

Investors.com comments on tablet and smartphone market trends — Q2’2015: 1. Apple, Samsung lose ground in tablet market — LG and Huawei gain

1. Apple, Samsung lose ground in tablet market — LG and Huawei gain

2. Apple, Huawei [and Xiaomi] buck slowing smartphone sales trend

As the commenting articles by Investors.com are based on press releases of 2 market research companies I will give the web reference here for those press releases themselves, as well as 3 other press releases not commented on by Investors.com (if there are trend indications in the press releases themselves I will copy them alongside the web reference):

- July 29, 2015: Worldwide Tablet Market Continues to Decline; Vendor Landscape is Evolving, According to IDC

“Longer life cycles, increased competition from other categories such as larger smartphones, combined with the fact that end users can install the latest operating systems on their older tablets has stifled the initial enthusiasm for these devices in the consumer market,” said Jitesh Ubrani, Senior Research Analyst, Worldwide Mobile Device Trackers. “But with newer form factors like 2-in-1s, and added productivity-enabling features like those highlighted in iOS9, vendors should be able to bring new vitality to a market that has lost its momentum.”

“Longer life cycles, increased competition from other categories such as larger smartphones, combined with the fact that end users can install the latest operating systems on their older tablets has stifled the initial enthusiasm for these devices in the consumer market,” said Jitesh Ubrani, Senior Research Analyst, Worldwide Mobile Device Trackers. “But with newer form factors like 2-in-1s, and added productivity-enabling features like those highlighted in iOS9, vendors should be able to bring new vitality to a market that has lost its momentum.” - July 30, 2015: Huawei Becomes World’s 3rd Largest Mobile Phone Vendor in Q2 2015 [says Strategy Analytics]

- Woody Oh, Director at Strategy Analytics, said, “… Smartphones accounted for 8 in 10 of total mobile phone shipments during the quarter. The 2 percent growth rate of the overall mobile phone market is the industry’s weakest performance for two years, due to slowing demand for handsets in China, Europe and the US.”

- Neil Mawston, Executive Director at Strategy Analytics, added, “… Samsung has stabilized volumes in the high-end, but its lower-tier mobile phones continue to face intense competition from rivals such as Huawei in Asia. … Apple outperformed as consumers in China and elsewhere upgraded to bigger-screen iPhone 6 and 6 Plus models.”

- Ken Hyers, Director at Strategy Analytics, added, “… Huawei is rising fast in all regions of the world, particularly China where its 4G models, such as the Mate7, are proving wildly popular. Huawei has finally overtaken Microsoft to become the world’s third largest mobile phone vendor for the first time ever.”

- Neil Mawston, Executive Director at Strategy Analytics, added, “Microsoft shipped 27.8 million mobile phones and captured 6 percent marketshare worldwide in the second quarter of 2015. Microsoft’s 6 percent global mobile phone marketshare is sitting near an all-time low. Microsoft continues to lose ground in feature phones, while its Lumia smartphone portfolio is in a holding pattern awaiting the launch of new Windows 10 models later this year. Xiaomi shipped 19.8 million mobile phones and captured 5 percent marketshare worldwide in Q2 2015. Xiaomi remains a major player in the China mobile phone market, but its local and international growth is slowing and Xiaomi is facing intense competition from Huawei, Meizu and others. As a result, Xiaomi may struggle to hold on to its top-five global mobile phone ranking in the coming quarters.”

- June 17, 2015: Business smartphones shipments in Q1 up 26% from last year, now 27% of total smartphone market [says Strategy Analytics]

Android was the most dominant OS in terms of business smartphone shipments in Q1, accounting for nearly 60% of all business smartphones (corporate- and personal-liable). It was also the dominant BYOD device; 68% of personal-liable shipments in Q1 were Android. Apple iOS accounted for only 27% of BYOD shipments in Q1, but was the dominant platform in terms of corporate-liable smartphones, with 48% of Q1 CL shipments. The difference in Android/iOS shipments between the CL and IL categories reflects the continuing corporate perception that iPhones are “safer” than Android-based devices.

Android was the most dominant OS in terms of business smartphone shipments in Q1, accounting for nearly 60% of all business smartphones (corporate- and personal-liable). It was also the dominant BYOD device; 68% of personal-liable shipments in Q1 were Android. Apple iOS accounted for only 27% of BYOD shipments in Q1, but was the dominant platform in terms of corporate-liable smartphones, with 48% of Q1 CL shipments. The difference in Android/iOS shipments between the CL and IL categories reflects the continuing corporate perception that iPhones are “safer” than Android-based devices.

- Shipments of personal-liable smartphones (i.e. “bring your own device,” or BYOD, phones) drove market growth in Q1

- Strategy analytics defines personal-liable devices as devices purchased by the end-user and expensed back to the company or organization, or devices purchased outright by individual users but used primarily for business purposes linking to corporate applications and backend systems.

- While personal liable devices dominate worldwide business smartphone shipments, some regions are more resistant to the BYOD trend than others. Such regions include Western Europe and Central Europe, where corporate-liable devices are the dominant types of business smartphones. In Western Europe in Q1, 61% of the 10 million business smart phones were corporate-liable. Central and Eastern Europe had a slightly higher rate of BYOD devices shipped in Q1 — 41% — but the majority of smartphones shipped in this regions was also corporate-liable. This a sharp contrast to North America, where three-quarters of business smartphone shipments are personal-liable. The trend in Western and Eastern Europe reflects the more corporate-centric approach businesses take to mobility in these regions.

- July 29, 2015: Mobile Broadband Tablet Subscriptions to Double to 200 Million by 2021, says Strategy Analytics

- Strategy Analytics forecasts global mobile data subscriptions on tablets will more than double from 2015 to 2021, reaching over 200 million

- Around the globe, over 100 million wireless connections on cellular enabled tablets will be added through 2021. By 2021 tablets will only account for 2 percent of total mobile subscriptions, a 2.7 percent population penetration rate.

- July 29, 2015: Intel Maintains Top Spot in Non-Apple Tablet Apps Processors in Q1 2015 says Strategy Analytics

⇒The global tablet applications processor (AP) market declined -6 percent year-over-year to reach $733 million in Q1 2015- According to Sravan Kundojjala, Associate Director, “Intel maintained its top spot in the non-Apple tablet AP market in unit terms in Q1 2015. Strategy Analytics estimate Android-based tablets accounted for over 70 percent of Intel’s total tablet AP shipments in Q1 2015. We expect Intel’s Atom X3 cellular tablet chip product line to help Intel maintain its momentum in the tablet AP market.”

- Stuart Robinson, Executive Director of the Strategy Analytics Handset Component Technologies (HCT) service added, “Strategy Analytics estimates that baseband-integrated tablet AP shipments accounted for over one-fourth of total tablet AP shipments in Q1 2015, helped by a strong push from Qualcomm, MediaTek and Spreadtrum. We expect continued momentum for integrated APs as Intel, Rockchip and others join the bandwagon.”

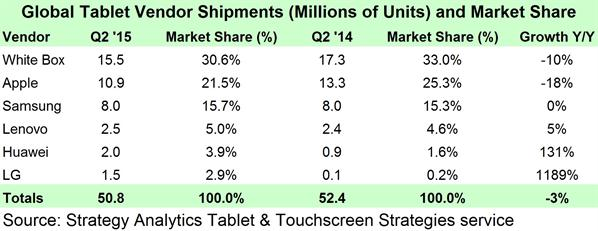

- July 30, 2015: Windows Tablet Shipments Nearly Double in Q2’15, says Strategy Analytics

⇒Global Tablet Shipments and Market Share in Q2 2015 (preliminary)

- Windows-branded Tablets comprised 9 percent of shipments in Q2 2015, up 4 points from Q2 2014

- Android-branded Tablet shipment market share was flat at 70 percent in Q2 2015

- Apple continued its slide in market share down to an all-time low of 21 percent in Q2 2015, 4 points lower than Q2 2014

- Vendors with strong 3G and LTE connected Tablet strategies such as Huawei, LG, and TCL-Alcatel gained market share as leaders like Apple, Samsung, and the White Box community lost ground

Tablet & Touchscreen Strategies Senior Analyst Eric Smith added, “Windows share continues to improve as more models become available from traditional PC vendors, White Label vendors, and Microsoft itself though a healthy Surface lineup and distribution expansion. The key going forward will be if the coming wave of 2-in-1 Detachable Tablets is a hit with consumers or if they go the way of the Netbook—we remain cautiously optimistic on this point.” |

Tablet & Touchscreen Strategies Service Director Peter King said, “Apple’s fortunes will turn around soon as it will launch the 12.9-inch iPad Pro as well as an iPad mini 4 in Q4 2015. New features in iOS 9, which are exclusive to iPad such as multi-tasking and a more convenient soft keyboard, will also help compel upgrades by owners of older iPad models. Meanwhile, Huawei and LG have posted fantastic growth primarily due to well-executed 3G and LTE connected Tablet strategies.” |

Then I will add 2 additional information pieces from Strategy Analytics:

Oct 8, 2014: Replacement Demand to Boost PC Sales in 2015, says Strategy Analytics

Having experienced negative growth since 2012, global PC sales are expected to rise 5 percent in 2015 driven by replacement of an ageing installed base according to Strategy Analytics’ Connected Home Devices (CHD) service report, “Computers in the Post-PC Era: Growth Opportunities and Strategies.”

Click here for the report:

http://www.strategyanalytics.com/default.aspx?mod=reportabstractviewer&a0=10146

- PC sales will fall by 4 percent in 2014 before returning to modest growth in 2015 and beyond to support replacement demand.

- Strategy Analytics’ consumer research of computing device usage in developed markets indicates that PCs remain essential computing devices despite healthy Tablet sales.

- Frequent Tablet usage has grown by 22 percentage points from 2011 to Q4 2013 up to 32 percent of all households while frequent Mobile PC (excluding Tablets) usage has stayed steady through this period, as 63 percent of all households indicated they frequently used Mobile PCs.

- Frequent usage of all PCs (including Mobile and Desktop PCs and excluding Tablets) remained above the 90 percent mark of all households, falling only 3 percentage points during this period.

Eric Smith, Analyst of Connected Home Devices, said: “Multiple PC ownership is falling as Tablet sales supplant replacement demand for secondary PCs mainly used for casual tasks. Still, PCs will remain essential devices as households eventually replace their primary PCs used for productivity tasks such as spreadsheet and video editing or personal banking.”

David Watkins, Service Director, Connected Home Devices, added: “The modern Tablet user experience is quickly arriving on the PC thanks to more affordable 2-in-1 Convertible PCs and new operating systems which blend traditional PC and Tablet user experiences. We see development of these forces aligning perfectly with an older PC installed base ripe for replacement in 2015.”

May 1, 2015: Children Change Disney’s Digital Strategy: “App TV” Now Central To Content Planning by David Mercer

Multiscreen TV behaviour is at the centre of television’s stormy transformation – viewing of broadcast, linear TV on the TV screen is apparently in decline while consumption on smartphones and tablets is increasing. Making sense of the big picture is increasingly challenging, and legacy players like broadcasters and the major content owners are inevitably somewhat resistant to the idea that their traditional businesses are under serious threat.

We have monitored the early stages of this transformation for the past decade and see its results in our own research, and we continue to predict further industry disruption in our forecasts. But sometimes it is only when you hear the evidence given in person by a senior executive at a leading global player that the scale of the challenge and opportunity are finally brought home.

This happened at last week’s AppsWorld event in Berlin, where I chaired the TV and Multiscreen conference. The speaker was Andreas Peters, Head of Digital for the Walt Disney Company Germany, Austria and Switzerland. Andreas presented some of the most compelling evidence I have yet heard that television is truly a multiscreen medium for the next generation of viewers.

Disney’s challenge in Germany was to launch a television show called Violetta aimed at 8-12 year old girls. It had been introduced successfully in Argentina but had failed in the UK. As it often does, Disney had invested considerable amounts in merchandising and retailers were eagerly anticipating sales of the new product lines. The show was first broadcast on German free TV on May 1st 2014 but it achieved only very low ratings.

The question for Disney managers was whether traditional TV had stopped working. A crisis meeting was held with a view to writing off the investment. Disney had previously not made its shows available online in Germany but the Violetta situation was so serious they were persuaded to experiment. Two episodes were made available on Youtube with a link to Disney’s own website. Viewing of the content on Youtube very quickly went viral until Disney had achieved a reach of 50% of 8-12 year old girls and eight million views. Violetta went on to become a success in German-speaking markets.

The evidence was clear: for some shows at least, younger children cannot now be reached using the traditional broadcast TV/big screen model. Peters explained that the Violetta experience was transformative for the Disney organisation and led to the inclusion of online and digital media as a key element in the business case for many products. In fact it also led to the development and launch of Disney’s own Watch App, which includes live streaming and seven-day catch-up programmes from the broadcast Disney Channel.

Even after the Violetta experience Disney was sceptical that an app was needed – there was a feeling that the website would be sufficient. Nevertheless the app was launched and Disney had planned for 20,000 downloads. Instead it has passed one million downloads in its first six months. Peters noted: “This was a real shock for us. We completely underestimated the demand.” Around 500,000 viewers are now using the Disney Watch app for linear television viewing, in addition to millions of shows being downloaded for catch-up viewing. Peak app viewing hours are between 6am and 8am and then between 1pm and 9pm on school days, with a different pattern at weekends. Peters made it clear that children did not want lots of features built in to the app – just like TV, they just want to hit “play” and watch.

“Our TV colleagues of course don’t want to believe this,” said Peters. “But the world has changed and it will continue to change.” Disney has also seen a knock-on effect from its app launch with an increase in free-to-air broadcast TV viewing. But the firm is now clear that mobile is not just an add-on to TV or a promotional tool; it must be an integral part of the entire process.

There are many implications for content strategy. TV and Digital have to “understand each other”, which is a challenge when the KPIs in each world are very different. As we have often heard, the video industry is crying out for a set of common metrics which can apply and support advertisers in both TV and online worlds. Video consumption patterns vary and different content may be relevant to different platforms.

But the overall lesson is clear: “TV” is not just the big screen in the corner of the living room. It must embrace multiscreen distribution strategies in order to reach its maximum potential. TV companies are betraying their audiences and their investors if they don’t target the 6.4bn addressable screens available to them.

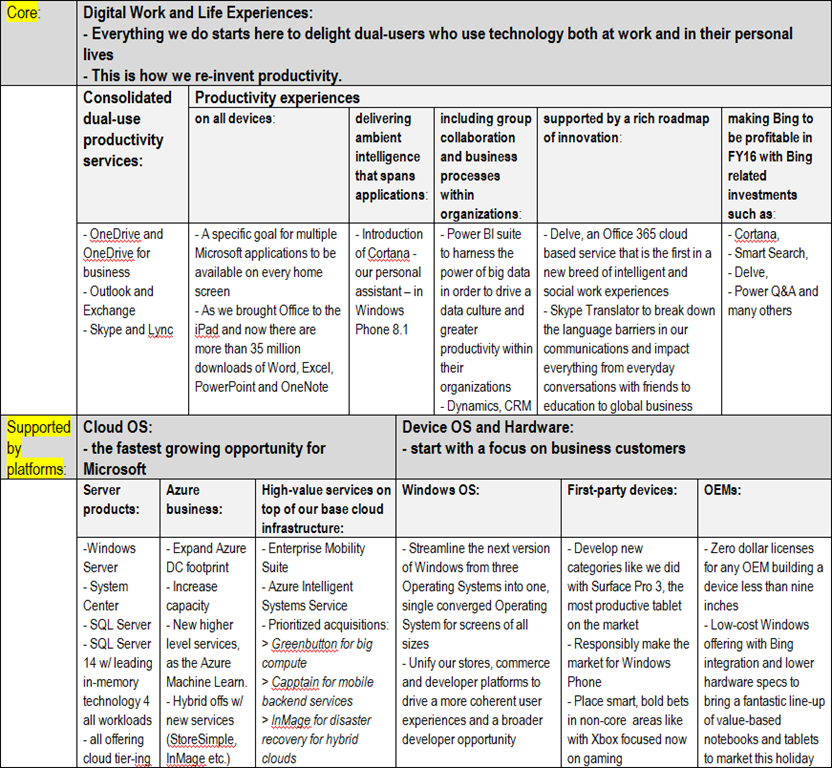

Satya Nadella on “Digital Work and Life Experiences” supported by “Cloud OS” and “Device OS and Hardware” platforms–all from Microsoft

Update: Gates Says He’s Very Happy With Microsoft’s Nadella [Bloomberg TV, Oct 2, 2014] + Bill Gates is trying to make Microsoft Office ‘dramatically better’ [The Verge, Oct 3, 2014]

This is the essence of Microsoft Fiscal Year 2014 Fourth Quarter Earnings Conference Call(see also the Press Release and Download Files) for me, as the new, extremely encouraging, overall setup of Microsoft in strategic terms (the below table is mine based on what Satya Nadella told on the conference call):

These are extremely encouraging strategic advancements vis–à–vis previously publicized ones here in the following, Microsoft related posts of mine:

- Microsoft Surface Pro 3 is the ultimate tablet product from Microsoft. What the market response will be? [this same blog, May 21, 2014]

- What Microsoft will do with the Nokia Devices and Services now taken over, but currently producing a yearly loss rate of as much as $1.5 billion? [this same blog, April 29, 2014]

- Microsoft BUILD 2014 Day 2: “rebranding” to Microsoft Azure and moving toward a comprehensive set of fully-integrated backend services [this same blog, April 27, 2014]

- Microsoft is transitioning to a world with more usage and more software driven value add (rather than the old device driven world) in mobility and the cloud, the latter also helping to grow the server business well above its peers [this same blog, April 25, 2014]

- Intel’s desperate attempt to establish a sizeable foothold on the tablet market until its 14nm manufacturing leadership could provide a profitable position for the company in 2016 [this same blog, April 27, 2014]

- Intel CTE initiative: Bay Trail-Entry V0 (Z3735E and Z3735D) SoCs are shipping next week in $129 Onda (昂达) V819i Android tablets—Bay Trail-Entry V2.1 (Z3735G and Z3735F) SoCs might ship in $60+ Windows 8.1 tablets from Emdoor Digital (亿道) in the 3d quarter [this same blog, April 11, 2014]

- Enhanced cloud-based content delivery services to anyone, on any device – from Microsoft (Microsoft Azure Media Services) and its solution partners [this same blog, April 8, 2014]

- Microsoft BUILD 2014 Day 1: new and exciting stuff for MS developers [this same blog, April 5, 2014]

- IDF14 Shenzhen: Intel is levelling the Wintel playing field with Android-ARM by introducing new competitive Windows tablet price points from $99 – $129 [this same blog, April 4, 2014]

- Microsoft BUILD 2014 Day 1: consistency and superiority accross the whole Windows family extended now to TVs and IoT devices as well—$0 royalty licensing program for OEM and ODM partners in sub 9” phone and tablet space [this same blog, April 2, 2014]

- An upcoming new era: personalised, pro-active search and discovery experiences for Office 365 (Oslo) [this same blog, April 2, 2014]

- OneNote is available now on every platform (+free!!) and supported by cloud services API for application and device builders [this same blog, March 18, 2014]

- View from Redmond via Tim O’Brien, GM, Platform Strategy at Microsoft [this same blog, Feb 21, 2014]

- “Cloud first”: the origins and the current meaning [this same blog, Feb 18, 2014]

- “Mobile first”: the origins and the current meaning [this same blog, Feb 18, 2014]

- Microsoft’s half-baked cloud computing strategy (H1’FY14) [this same blog, Feb 17, 2014]

- The first “post-Ballmer” offering launched: with Power BI for Office 365 everyone can analyze, visualize and share data in the cloud [this same blog, Feb 10, 2014]

- John W. Thompson, Chairman of the Board of Microsoft: the least recognized person in the radical two-men shakeup of the uppermost leadership [this same blog, Feb 6, 2014]

- The extraordinary attempt by Nokia/Microsoft to crack the U.S. market in terms of volumes with Nokia Lumia 521 (with 4G/LTE) and Nokia Lumia 520 [this same blog, Jan 18, 2014]

- 2014 will be the last year of making sufficient changes for Microsoft’s smartphone and tablet strategies, and those changes should be radical if the company wants to succeed with its devices and services strategy [this same blog, Jan 17, 2014]

- Will, with disappearing old guard, Satya Nadella break up the Microsoft behemoth soon enough, if any? [this same blog, Feb 5, 2014]

- Microsoft products for the Cloud OS [this same blog, Dec 18, 2013]

- Satya Nadella’s (?the next Microsoft CEO?) next ten years’ vision of “digitizing everything”, Microsoft opportunities and challenges seen by him with that, and the case of Big Data [this same blog, Dec 13, 2013]

- Leading PC vendors of the past: Go enterprise or die! [this same blog, Nov 7, 2013]

- Microsoft could be acquired in years to come by Amazon? The joke of the day, or a certain possibility (among other ones)? [this same blog, Sept 16, 2013]

- The question mark over Wintel’s future will hang in the air for two more years [this same blog, Sept 15, 2013]

- The long awaited Windows 8.1 breakthrough opportunity with the new Intel “Bay Trail-T”, “Bay Trail-M” and “Bay Trail-D” SoCs? [this same blog, Sept 14, 2013]

- How the device play will unfold in the new Microsoft organization? [this same blog, July 14, 2013]

- Microsoft reorg for delivering/supporting high-value experiences/activities [this same blog, July 11, 2013]

- Microsoft partners empowered with ‘cloud first’, high-value and next-gen experiences for big data, enterprise social, and mobility on wide variety of Windows devices and Windows Server + Windows Azure + Visual Studio as the platform [this same blog, July 10, 2013]

- Windows Azure becoming an unbeatable offering on the cloud computing market [this same blog, June 28, 2013]

- Proper Oracle Java, Database and WebLogic support in Windows Azure including pay-per-use licensing via Microsoft + the same Oracle software supported on Microsoft Hyper-V as well [this same blog, June 25, 2013]

- “Cloud first” from Microsoft is ready to change enterprise computing in all of its facets [this same blog, June 4, 2013]

I see, however, particularly challenging the continuation of the Lumia story with the above strategy, as with the previous, combined Ballmer/Elop(Nokia) strategy the results were extremely weak:

Worthwhile to include here the videos Bloomberg was publishing simultaneously with Microsoft Fourth Quarter Earnings Conference Call:

Inside Microsoft’s Secret Surface Labs [Bloomberg News, July 22, 2014]

Will Microsoft Kinect Be a Medical Game-Changer? [Bloomberg News, July 22, 2014]

Why Microsoft Puts GPS In Meat For Alligators [Bloomberg News, July 22, 2014]

To this it is important to add: How Pier 1 is using the Microsoft Cloud to build a better relationship with their customers [Microsoft Server and Cloud YouTube channel, July 21, 2014]

as well as:

Microsoft Surface Pro 3 vs. MacBook Air 13″ 2014 [CNET YouTube channel, July 21, 2014]

Surface Pro 3 vs. MacBook Air (2014) [CTNtechnologynews YouTube channel, July 1, 2014]

In addition here are some explanatory quotes (for the new overall setup of Microsoft) worth to include here from the Q&A part of Microsoft’s (MSFT) CEO Satya Nadella on Q4 2014 Results – Earnings Call Transcript [Seeking Alpha, Jul. 22, 2014 10:59 PM ET]

…

Mark Moerdler – Sanford Bernstein

Thank you. And Amy one quick question, we saw a significant acceleration this quarter in cloud revenue, or I guess Amy or Satya. You saw acceleration in cloud revenue year-over-year what’s – is this Office for the iPad, is this Azure, what’s driving the acceleration and how long do you think we can keep this going?

Mark, I will take it and if Satya wants to add, obviously, he should do that. In general, I wouldn’t point to one product area. It was across Office 365, Azure and even CRM online. I think some of the important dynamics that you could point to particularly in Office 365; I really think over the course of the year, we saw an acceleration in moving the product down the market into increasing what we would call the mid-market and even small business at a pace. That’s a particular place I would tie back to some of the things Satya mentioned in the answer to your first question.

Improvements to analytics, improvements to understanding the use scenarios, improving the product in real-time, understanding trial ease of use, ease of sign-up all of these things actually can afford us the ability to go to different categories, go to different geos into different segments. And in addition, I think what you will see more as we initially moved many of our customers to Office 365, it came on one workload. And I think what we’ve increasingly seen is our ability to add more workloads and sell the entirety of the suite through that process. I also mentioned in Azure, our increased ability to sell some of these higher value services. So while, I can speak broadly but all of them, I think I would generally think about the strength of being both completion of our product suite ability to enter new segments and ability to sell new workloads.

The only thing I would add is it’s the combination of our SaaS like Dynamics in Office 365, a public cloud offering in Azure. But also our private and hybrid cloud infrastructure which also benefits, because they run on our servers, cloud runs on our servers. So it’s that combination which makes us both unique and reinforcing. And the best example is what we are doing with Azure active directory, the fact that somebody gets on-boarded to Office 365 means that tenant information is in Azure AD that fact that the tenant information is in Azure AD is what makes EMS or our Enterprise Mobility Suite more attractive to a customer manager iOS, Android or Windows devices. That network effect is really now helping us a lot across all of our cloud efforts.

…

Keith Weiss – Morgan Stanley

Excellent, thank you for the question and a very nice quarter. First, I think to talk a little bit about the growth strategy of Nokia, you guys look to cut expenses pretty aggressively there, but this is – particularly smartphones is a very competitive marketplace, can you tell us a little bit about sort of the strategy to how you actually start to gain share with Lumia on a going forward basis? And may be give us an idea of what levels of share or what levels of kind unit volumes are you going to need to hit to get to that breakeven in FY16?

Let me start and Amy you can even add. So overall, we are very focused on I would say thinking about mobility share across the entire Windows family. I already talked about in my remarks about how mobility for us even goes beyond devices, but for this specific question I would even say that, we want to think about mobility not just one form factor of a mobile device because I think that’s where the ultimate price is.

But that said, we are even year-over-year basis seen increased volume for Lumia, it’s coming at the low end in the entry smartphone market and we are pleased with it. It’s come in many markets we now have over 10% that’s the first market I would sort of say that we need to track country-by-country. And the key places where we are going to differentiate is looking at productivity scenarios or the digital work and life scenario that we can light up on our phone in unique ways.

When I can take my Office Lens App use the camera on the phone take a picture of anything and have it automatically OCR recognized and into OneNote in searchable fashion that’s the unique scenario. What we have done with Surface and PPI shows us the way that there is a lot more we can do with phones by broadly thinking about productivity. So this is not about just a Word or Excel on your phone, it is about thinking about Cortana and Office Lens and those kinds of scenarios in compelling ways. And that’s what at the end of the day is going to drive our differentiation and higher end Lumia phones.

And Keith to answer your specific question, regarding FY16, I think we’ve made the difficult choices to get the cost base to a place where we can deliver, on the exact scenario Satya as outlined, and we do assume that we continue to grow our units through the year and into 2016 in order to get to breakeven.

…

Rick Sherlund – Nomura

Thanks. I’m wondering if you could talk about the Office for a moment. I’m curious whether you think we’ve seen the worst for Office here with the consumer fall off. In Office 365 growth in margins expanding their – just sort of if you can look through the dynamics and give us a sense, do you think you are actually turned the corner there and we may be seeing the worse in terms of Office growth and margins?

Rick, let me just start qualitatively in terms of how I view Office, the category and how it relates to productivity broadly and then I’ll have Amy even specifically talk about margins and what we are seeing in terms of I’m assuming Office renewals is that probably the question. First of all, I believe the category that Office is in, which is productivity broadly for people, the group as well as organization is something that we are investing significantly and seeing significant growth in.

On one end you have new things that we are doing like Cortana. This is for individuals on new form factors like the phones where it’s not about anything that application, but an intelligent agent that knows everything about my calendar, everything about my life and tries to help me with my everyday task.

On the other end, it’s something like Delve which is a completely new tool that’s taking some – what is enterprise search and making it more like the Facebook news feed where it has a graph of all my artifacts, all my people, all my group and uses that graph to give me relevant information and discover. Same thing with Power Q&A and Power BI, it’s a part of Office 365. So we have a pretty expansive view of how we look at Office and what it can do. So that’s the growth strategy and now specifically on Office renewals.

And I would say in general, let me make two comments. In terms of Office on the consumer side between what we sold on prem as well as the Home and Personal we feel quite good with attach continuing to grow and increasing the value prop. So I think that’s to address the consumer portion.

On the commercial portion, we actually saw Office grow as you said this quarter; I think the broader definition that Satya spoke to the Office value prop and we continued to see Office renewed in our enterprise agreement. So in general, I think I feel like we’re in a growth phase for that franchise.

…

Walter Pritchard – Citigroup

Hi, thanks. Satya, I wanted to ask you about two statements that you made, one around responsibly making the market for Windows Phone, just kind of following on Keith’s question here. And that’s a – it’s a really competitive market it feels like ultimately you need to be a very, very meaningful share player in that market to have value for developer to leverage the universal apps that you’re talking about in terms of presentations you’ve given and build in and so forth.

And I’m trying to understand how you can do both of those things once and in terms of responsibly making the market for Windows Phone, it feels difficult given your nearest competitors there are doing things that you might argue or irresponsible in terms of making their market given that they monetize it in different ways?

Yes. One of beauties of universal Windows app is, it aggregates for the first time for us all of our Windows volume. The fact that even what is an app that runs with a mouse and keyboard on the desktop can be in the store and you can have the same app run in the touch-first on a mobile-first way gives developers the entire volume of Windows which is 300 plus million units as opposed to just our 4% share of mobile in the U.S. or 10% in some country.

So that’s really the reason why we are actively making sure that universal Windows apps is available and developers are taking advantage of it, we have great tooling. Because that’s the way we are going to be able to create the broadest opportunity to your very point about developers getting an ROI for building to Windows. For that’s how I think we will do it in a responsible way.

Heather Bellini – Goldman Sachs

Great. Thank you so much for your time. I wanted to ask a question about – Satya your comments about combining the next version of Windows and to one for all devices and just wondering if you look out, I mean you’ve got kind of different SKU segmentations right now, you’ve got enterprise, you’ve got consumer less than 9 inches for free, the offering that you mentioned earlier that you recently announced. How do we think about when you come out with this one version for all devices, how do you see this changing kind of the go-to-market and also kind of a traditional SKU segmentation and pricing that we’ve seen in the past?

Yes. My statement Heather was more to do with just even the engineering approach. The reality is that we actually did not have one Windows; we had multiple Windows operating systems inside of Microsoft. We had one for phone, one for tablets and PCs, one for Xbox, one for even embedded. So we had many, many of these efforts. So now we have one team with the layered architecture that enables us to in fact one for developers bring that collective opportunity with one store, one commerce system, one discoverability mechanism. It also allows us to scale the UI across all screen sizes; it allows us to create this notion of universal Windows apps and being coherent there.

So that’s what more I was referencing and our SKU strategy will remain by segment, we will have multiple SKUs for enterprises, we will have for OEM, we will have for end-users. And so we will – be disclosing and talking about our SKUs as we get further along, but this my statement was more to do with how we are bringing teams together to approach Windows as one ecosystem very differently than we ourselves have done in the past.

Ed Maguire – CLSA

Hi, good afternoon. Satya you made some comments about harmonizing some of the different products across consumer and enterprise and I was curious what your approach is to viewing your different hardware offerings both in phone and with Surface, how you’re go-to-market may change around that and also since you decided to make the operating system for sub 9-inch devices free, how you see the value proposition and your ability to monetize that user base evolving over time?

Yes. The statement I made about bringing together our productivity applications across work and life is to really reflect the notion of dual use because when I think about productivity it doesn’t separate out what I use as a tool for communication with my family and what I use to collaborate at work. So that’s why having this one team that thinks about outlook.com as well as Exchange helps us think about those dual use. Same thing with files and OneDrive and OneDrive for business because we want to have the software have the smart about separating out the state carrying about IT control and data protection while me as an end user get to have the experiences that I want. That’s how we are thinking about harmonizing those digital life and work experiences.

On the hardware side, we would continue to build hardware that fits with these experiences if I understand your question right, which is how will be differentiate our first party hardware, we will build first party hardware that’s creating category, a good example is what we have done with Surface Pro 3. And in other places where we have really changed the Windows business model to encourage a plethora of OEMs to build great hardware and we are seeing that in fact in this holiday season, I think you will see a lot of value notebooks, you will see clamshells. So we will have the full price range of our hardware offering enabled by this new windows business model.

And I think the last part was how will we monetize? Of course, we will again have a combination, we will have our OEM monetization and some of these new business models are about monetizing on the backend with Bing integration as well as our services attached and that’s the reason fundamentally why we have these zero-priced Windows SKUs today.

…

Microsoft Surface Pro 3 is the ultimate tablet product from Microsoft. What the market response will be?

With the jury still out (as one can judge from the value of Microsoft shares – on the right) it remains to be seen whether Microsoft will be able to crack the high-end tablet market with this product.

With the jury still out (as one can judge from the value of Microsoft shares – on the right) it remains to be seen whether Microsoft will be able to crack the high-end tablet market with this product.

The Microsoft product site is entitled New Surface Pro 3 Tablet – The Tablet That Can Replace Your Laptop clearly indicating the main positioning of this 3d generation product. See also the press release for additional details, as well as the remarks by Satya Nadella, Chief Executive Officer, and Panos Panay, Corporate Vice President, Microsoft Surface, at the press event held in New York City, May 20, 2014. The brief summary video of the event is below, while a full on-demand Webcast is here. There are also several “first impression” type media feedbacks given after the brief video report.

Microsoft’s Surface Pro 3 event in under six minutes [The Verge YouTube channel, May 20, 2014]

Microsoft Introduces a Larger-Screen Surface Tablet [By SHIRA OVIDE in The Wall Street Journal , May 20, 2014]

First Look: Microsoft Surface Pro 3

[WSJDigitalNetwork YouTube channel, May 20, 2014]Microsoft tries again to combine the laptop and tablet. WSJ Personal Tech Columnist Joanna Stern has the first look. Photo/Video: Drew Evans for The Wall Street Journal

Microsoft Corp. MSFT -0.18% introduced a larger-screen version of one of its Surface tablet computers, offering a lighter and thinner device that the company cast as a potential successor for laptop PCs.

The software company introduced the new device, called the Surface Pro 3, at an eventTuesday in New York. The device, like prior Pro models in the Surface line, is powered byIntel Corp. INTC 0.00% computer chips. Microsoft said the new version’s display measures 12 inches diagonally, compared with the 10.6-inch screens of existing Surface devices.

Microsoft said the Surface Pro 3 will start at $799 without a keyboard. A keyboard that doubles as a device cover will cost $129.99. The top end of the product line, with the most powerful Intel chip, lists for $1,949 without a keyboard.

At the event Tuesday, Microsoft officials repeatedly compared the Surface Pro 3 with laptop personal computers like AppleInc.‘s MacBook Air, rather than discuss competitors in the tablet market, where Microsoft remains a bit player. The MacBook Air costs $899 and up.

Microsoft’s positioning underscores its troubles in becoming a major competitor in tablets, where price tags of less than $200 have become commonplace for consumer-oriented models. The company’s share of the market was less than 4% last year, according to research firm IDC.

Microsoft Chief Executive Satya Nadella and other officials stressed what they said were limits of existing tablet computers for activities like writing documents or other work that isn’t Web surfing or reading digital books. They also stressed drawing and note-taking with an upgraded digital-pen accessory that comes with the Surface Pro 3.

“This is the tablet that can replace your laptop,” Panos Panay, a Microsoft executive working on Surface devices, said about the Surface Pro 3.

Microsoft said it would start taking orders Wednesday for the new device.

Steven Sinofsky, a former Microsoft executive who helped spearhead development of the Surface, said Tuesday the Surface Pro 3 “realizes the ‘no compromises’ vision of Surface.”

Dating back to the early 2000s, Microsoft officials have used the expression “no compromises” to describe their vision of a device that combines the best features of tablets and laptops.

Microsoft also has been developing for months a tablet similar to Apple’s 7.9-inch iPad Mini, and some media reports had indicated that device would be announced Tuesday. Smaller tablets accounted for more than half of all tablets sold last year.

In an interview Tuesday, Mr. Panay said Microsoft is “looking at an array of devices. It comes down to what customers need right now.”

He also addressed a different type of Windows software used on more iPad-like tablets, including one model of Surface devices. That operating software, Windows RT, isn’t compatible with many older PC applications or software. Windows RT “is a critical element as well,” Mr. Panay said. “It’s still pumping.”

Some analysts said Tuesday Microsoft was sensible for targeting businesses and workers, rather than consumer applications, with the Surface Pro.

“This is a smart move by Microsoft,” said Patrick Moorhead, president of research firm Moor Insights & Strategy. “Surface Pro 3 is more of a laptop replacement than a device that replaces your seven-to-eight-inch tablet.”

As Microsoft touts the abilities of Surface to replace laptops, it has the potential to anger companies like Dell Inc. that also make tablets and laptops powered by the Windows operating system. At the event, however, Mr. Nadella said Microsoft isn’t trying to compete with its computer-hardware partners.

Some Microsoft investors don’t want Microsoft to make its own computing devices at all. The company incurs a loss on each Surface it sells, and the company’s critics say Microsoft hasn’t made a compelling case for expanding its hardware ambitions.

Microsoft officials, including Mr. Nadella on Tuesday, say homegrown devices like the Surface are the best showcase for Microsoft software like Office, Skype and digital file-storage service OneDrive.

“We are not building hardware for hardware’s sake,” Mr. Nadella said during a brief appearance at the Surface event. “We want to build experiences that bring together all the capabilities of our company.”

Daniel Ives, a Microsoft analyst with FBR Capital Markets, said Surface Pro 3 “appears to be an impressive” device, but he said persuading consumers to buy the Surface “remains a Kilimanjaro-like challenge given intense competition.”

—Joanna Stern contributed to this article.

The most popular “Surface Pro 3” YouTube videos 19 hours after the launch:

|

Surface Pro 3—The Tablet that Can Replace Your Laptop by surface 19 hours ago 440,030 views

|

|

Surface Pro 3 hands on at Surface NYC event

|

|

TLDR: My Surface Pro 3 Thoughts by LockerGnome’s Geek Lifestyles 11 hours ago 3,005 viewsBecome a patron for bonuses ASAP: http://ChrisPirillo.com/ Patron video bonus today: … |

|

Microsoft Unveils 12-inch Surface Pro 3 Tablet – IGN News by IGN 16 hours ago 19,373 viewsMicrosoft has just unveiled its latest Windows-powered tablet: the Surface Pro 3. |

|

CNET Update – Surface Pro 3 aims to replace laptops — and paper by CNET 15 hours ago 8,526 views

|

|

Microsoft Surface Pro 3 Hands On | Mashable

|

|

This is the Surface Pro 3 (hands-on)

|

|

Surface Pro 3 Hands-on by Booredatwork.com

|

|

Hands-on with the Microsoft Surface Pro 3

|

|

Hands-on with Surface Pro 3 by expertzone

|

|

Surface Pro 3 Launch Reactions & Impressions

|

|

Surface Pro 3 — Finally a Tablet that can replace your Laptop?!? by SourceFed 13 hours ago 61,977 views

|

|

Surface Pro 3 Hands On by Geek.com

|

|

Microsoft Surface Pro 3 Hands-On by laptopmag

|

|

Microsoft reveals thinner, faster Surface Pro 3 tablet

|

|

Surface Pro 3 Unboxing , Hands On , and First Impression Review by Sean Ong 6 hours ago 326 views In this video I do my very first product unboxing as I show off the shiny new Surface Pro 3! I give my first impressions of the device … |

Microsoft BUILD 2014 Day 2: “rebranding” to Microsoft Azure and moving toward a comprehensive set of fully-integrated backend services

- “Rebranding” into Microsoft Azure from the previous Windows Azure

- Microsoft Azure Momentum on the Market

- The new Azure Management Portal (preview)

- New Azure features: IaaS, web, mobile and data announcements

Microsoft Announces New Features for Cloud Computing Service [CCTV America YouTube channel, April 3, 2014]

Day two of the Microsoft Build developer conference in San Francisco wrapped up with the company announcing 44 new services. Most of those are based on Microsoft Azure – it’s cloud computing platform that manages applications across data centers. CCTV’s Mark Niu reports from San Francisco.

Watch the first 10 minutes of this presentation for a brief summary of the latest state of Microsoft Azure: #ChefConf 2014: Mark Russinovich, “Microsoft Azure Group” [Chef YouTube channel, April 16, 2014]

Then here is a fast talk and Q&A on Azure with Scott Guthrie after his keynote preseantation at BUILD 2014:

Cloud Cover Live – Ask the Gu! [jlongo62 YouTube channel, published on April 21, 2014]

The original: Cloud Cover Live – Ask the Gu! [Channel 9, April 3, 2014]

Details:

- “Rebranding” into Microsoft Azure from the previous Windows Azure

- Microsoft Azure Momentum on the Market

- The new Azure Management Portal (preview)

- New Azure features: IaaS, web, mobile and data announcements

[2:45:47] long video record of the Microsoft Build Conference 2014 Day 2 Keynote [MSFT Technology News YouTube channel, recorded on April 3, published on April 7, 2014]

The original video record on Channel 9

Day 2 Keynote transcript by Microsoft

1. “Rebranding” into Microsoft Azure from the previous Windows Azure

Yes, you’ve noticed right: the Windows prefix has gone, and the full name is now only Microsoft Azure! The change happened on April 3 as evidenced by change of the cover photo on the Facebook site, now also called Microsoft Azure:

from this cover photo used from July 23, 2013 on:

And it happened without any announcement or explanation as even the last, April 1 Microsoft video carried the Windows prefix: Tuesdays with Corey //build Edition

as well as the last, March 14 video ad: Get Your Big Bad Wolf On (Extended)

2. Microsoft Azure Momentum on the Market

The day began with Scott Guthrie, Executive Vice President, Microsoft Cloud and Enterprise group, touting Microsoft progress with Azure for the last 18 months when:

… we talked about our new strategy with Azure and our new approach, a strategy that enables me to use both infrastructure as a service and platform as a service capabilities together, a strategy that enables developers to use the best of the Windows ecosystem and the best of the Linux ecosystem together, and one that delivers unparalleled developer productivity and enables you to build great applications and services that work with every device …

- Last year … shipped more than 300 significant new features and releases

- … we’ve also been hard at work expanding the footprint of Azure around the world. The green circles you see on the slide here represent Azure regions, which are clusters of datacenters close together, and where you can go ahead and run your application code. Just last week, we opened two new regions, one in Shanghai and one in Beijing. Today, we’re the only global, major cloud provider that operates in mainland China. And by the end of the year, we’ll have more than 16 public regions available around the world, enabling you to run your applications closer to your customers than ever before.

- More than 57 percent of the Fortune 500 companies are now deployed on Azure.

- Customers run more than 250,000 public-facing websites on Azure, and we now host more than 1 million SQL databases on Azure.

- More than 20 trillion objects are now stored in the Azure storage system. We have more than 300 million users, many of them — most of them, actually, enterprise users, registered with Azure Active Directory, and we process now more than 13 billion authentications per week.

- We have now more than 1 million developers registered with our Visual Studio Online service, which is a new service we launched just last November.

Let’s go beyond the big numbers, though, and look at some of the great experiences that have recently launched and are using the full power of Azure and the cloud.

“Titanfall” was one of the most eagerly anticipated games of the year, and had a very successful launch a few weeks ago. “Titanfall” delivers an unparalleled multiplayer gaming experience, powered using Azure.

Let’s see a video of it in action, and hear what the developers who built it have to say.

[Titanfall and the Power of the Cloud [xbox YouTube channel, April 3, 2014]]

One of the key bets the developers of “Titanfall” made was for all game sessions on the cloud. In fact, you can’t play the game without the cloud, and that bet really paid off.

As you heard in the video, it enables much, much richer gaming experiences. Much richer AI experiences. And the ability to tune and adapt the game as more users use it.

To give you a taste of the scale, “Titanfall” had more than 100,000 virtual machines deployed and running on Azure on launch day. Which is sort of an unparalleled size in terms of a game launch experience, and the reviews of the game have been absolutely phenomenal.

Another amazing experience that recently launched and was powered using Azure was the Sochi Olympics delivered by NBC Sports.

NBC used Azure to stream all of the games both live and on demand to both Web and mobile devices. This was the first large-scale live event that was delivered entirely in the cloud with all of the streaming and encoding happening using Azure.

Traditionally, with live encoding, you typically run in an on-premises environment because it’s so latency dependent. With the Sochi Olympics, Azure enabled NBC to not only live encode in the cloud, but also do it across multiple Azure regions to deliver high-availability redundancy.

More than 100 million people watched the online experience, and more than 2.1 million viewers alone watched it concurrently during the U.S. versus Canada men’s hockey match, a new world record for online HD streaming.

…

RICK CORDELLA [Senior Vice President and General Manager of NBC Sports Digital]: The company bets about $1 billion on the Olympics each time it goes off. And we have 17 days to recoup that investment. Needless to say, there is no safety net when it comes to putting this content out there for America to enjoy. We need to make sure that content is out there, that it’s quality, that our advertisers and advertisements are being delivered to it. There really is no going back if something goes wrong.

…

The decision for that was taken more than a year ago: Windows Azure Teams Up With NBC Sports Group [Microsoft Azure YouTube channel, April 9, 2013]

3. The new Azure Management Portal (preview)

But in fact a new way of providing a comprehensive set of fully-integrated backend services had significantly bigger impact on the audience of developers. According to Microsoft announces new cloud experience and tools to deliver the cloud without complexity [The Official Microsoft Blog, April 3, 2014]

The following post is from Scott Guthrie, Executive Vice President, Cloud and Enterprise Group, Microsoft.

On Thursday at Build in San Francisco, we took an important step by unveiling a first-of-its kind cloud environment within Microsoft Azure that provides a fully integrated cloud experience – bringing together cross-platform technologies, services and tools that enable developers and businesses to innovate with enterprise-grade scalability at startup speed. Announced today, our new Microsoft Azure Preview [Management]Portal is an important step forward in delivering our promise of the cloud without complexity.

When cloud computing was born, it was hailed as the solution that developers and business had been waiting for – the promise of a quick and easy way to get more from your business-critical apps without the hassle and cost of infrastructure. But as the industry transitions toward mobile-first, cloud-first business models and scenarios, the promise of “quick and easy” is now at stake. There’s no question that developing for a world that is both mobile-first and cloud-first is complicated. Developers are managing thousands of virtual machines, cobbling together management and automation solutions, and working in unfamiliar environments just to make their apps work in the cloud – driving down productivity as a result.

Many cloud vendors tout the ease and cost savings of the cloud, but they leave customers without the tools or capabilities to navigate the complex realities of cloud computing. That’s why today we are continuing down a path of rapid innovation. In addition to our groundbreaking new Microsoft Azure Preview [Management] Portal, we announced several enhancements our customers need to fully tap into the power of the cloud. These include:

- Dozens of enhancements to our Azure services across Web, mobile, data and our infrastructure services

- Further commitment to building the most open and flexible cloud with Azure support for automation software from Puppet Labs and Chef.

- We’ve removed the throttle off our Application Insights preview, making it easier for all developers to build, manage and iterate on their apps in the cloud with seamless integration into the IDE

<For details see the separate section 4. New Azure features: IaaS, web, mobile and data announcements>

Here is a brief presentation by a Brazilian specialist: Microsoft Azure [Management] Portal First Touch [Bruno Vieira YouTube channel, April 3, 2014]

From Microsoft evolves the cloud experience for customers [press release, April 3, 2014]

… Thursday at Build 2014, Microsoft Corp. announced a first-of-its-kind cloud experience that brings together cross-platform technologies, services and tools, enabling developers and businesses to innovate at startup speed via a new Microsoft Azure Preview [Management] Portal.

In addition, the company announced several new milestones in Visual Studio Online and .NET that give developers access to the most complete platform and tools for building in the cloud. Thursday’s announcements are part of Microsoft’s broader vision to erase the boundaries of cloud development and operational management for customers.

“Developing for a mobile-first, cloud-first world is complicated, and Microsoft is working to simplify this world without sacrificing speed, choice, cost or quality,” said Scott Guthrie, executive vice president at Microsoft. “Imagine a world where infrastructure and platform services blend together in one seamless experience, so developers and IT professionals no longer have to work in disparate environments in the cloud. Microsoft has been rapidly innovating to solve this problem, and we have taken a big step toward that vision today.”

One simplified cloud experience

The new Microsoft Azure Preview [Management] Portal provides a fully integrated experience that will enable customers to develop and manage an application in one place, using the platform and tools of their choice. The new portal combines all the components of a cloud application into a single development and management experience. New components include the following:

Simplified Resource Management. Rather than managing standalone resources such as Microsoft Azure Web Sites, Visual Studio Projects or databases, customers can now create, manage and analyze their entire application as a single resource group in a unified, customized experience, greatly reducing complexity while enabling scale. Today, the new Azure Manager is also being released through the latest Azure SDK for customers to automate their deployment and management from any client or device.

Integrated billing. A new integrated billing experience enables developers and IT pros to take control of their costs and optimize their resources for maximum business advantage.

Gallery. A rich gallery of application and services from Microsoft and the open source community, this integrated marketplace of free and paid services enables customers to leverage the ecosystem to be more agile and productive.

Visual Studio Online. Microsoft announced key enhancements through the Microsoft Azure Preview [Management] Portal, available Thursday. This includes Team Projects supporting greater agility for application lifecycle management and the lightweight editor code-named “Monaco” for modifying and committing Web project code changes without leaving Azure. Also included is Application Insights, an analytics solution that collects telemetry data such as availability, performance and usage information to track an application’s health. Visual Studio integration enables developers to surface this data from new applications with a single click.

…

Building an open cloud ecosystem

Showcasing Microsoft’s commitment to choice and flexibility, the company announced new open source partnerships with Chef and Puppet Labs to run configuration management technologies in Azure Virtual Machines. Using these community-driven technologies, customers will now be able to more easily deploy and configure in the cloud. In addition, today Microsoft announced the release of Java Applications to Microsoft Azure Web Sites, giving Microsoft even broader support for Web applications.

…

From BUILD Day 2: Keynote Summary [by Steve Fox – DPE (MSFT) on MSDN Blogs, April 3, 2014]

….

Bill Staples then came on stage to show off the new Azure [management] portal design and features. Bill walked through a number of the new innovations in the portal, such as improved UX, app insights, “blade” views [the “blade” term is used for the dropdown that allows a drilldown], etc. A screen shot of the new portal is shown below.

Bill also walked through the comprehensive analytics (such as compute and billing) that are now available on the portal. He also walked through “Application Insights,” which is a great way to instrument your code in both the portal and in your code with easy-to-use, pre-defined code snippets. He completed his demo walkthrough by showing the Azure [management] portal as a “NOC” [Network Operations Center] view on a big-screen TV.

…

The above image is at the [1:44:24] point in time of the keynote video record on Channel 9 and it is giving more information if we provide here the part of transcript around it:

BILL STAPLES at [1:43:39]: Now, to conclude the operations part of this demo, I wanted to show you an experience for how the new Azure Portal works on a different device. You’ve seen it on the desktop, but it works equally well on a tablet device, that is really touch friendly. Check it out on your Surface or your iPad, it works great on both devices.

But we’re thinking as well if you’ve got a big-screen TV or a projector lying around your team room, you might want to think about putting the Microsoft Azure portal as your own personal NOC.

In this case, I’ve asked the Office developer team if we could have access to their live site log. So they made me promise, do not hit the stop button or the delete button, which I promised to do.

[1:44:24] This is actually the Office developer log site. And you can see it’s got almost 10 million hits already today running on Azure Websites. So very high traffic.

They’ve customized it to show off the browser usage on their website. Imagine we’re in a team Scrum with the Office developer guys and we check out, you know, how is the website doing? We’ve got some interesting trends here.

In fact, there was a spike of sessions it looks like going on about a week ago. And page views, that’s kind of a small part. It would be nice to know which page it was that spiked a week ago. Let’s go ahead and customize that.

This screen is kind of special because it has touch screen. So I can go ahead and let’s make that automatically expand there. Now we see a bigger view. Wow, that was a really big spike last week. What page was that? We can click into it. We get the full navigation experience, same on the desktop, as well as, oh, look at that. There’s a really popular blog post that happened about a week ago. What was that? Something about announcing Office on the iPad you love. Makes sense, huh? So we can see the Azure Portal in action here as the Office developer team might imagine it. [1:45:44]

The last thing I want to show is the Azure Gallery.

We populated the gallery with all of the first-party Microsoft Azure services, as well as the [services from] great partners that we’ve worked with so far in creating this gallery.

And what you’re seeing right here is just the beginning. We’ve got the core set of DevOps experiences built out, as well as websites, SQL, and MySQL support. But over the coming months, we’ll be integrating all of the developer and IT services in Microsoft as well as the partner services into this experience.