Home » Posts tagged 'OEMs'

Tag Archives: OEMs

Satya Nadella on “Digital Work and Life Experiences” supported by “Cloud OS” and “Device OS and Hardware” platforms–all from Microsoft

Update: Gates Says He’s Very Happy With Microsoft’s Nadella [Bloomberg TV, Oct 2, 2014] + Bill Gates is trying to make Microsoft Office ‘dramatically better’ [The Verge, Oct 3, 2014]

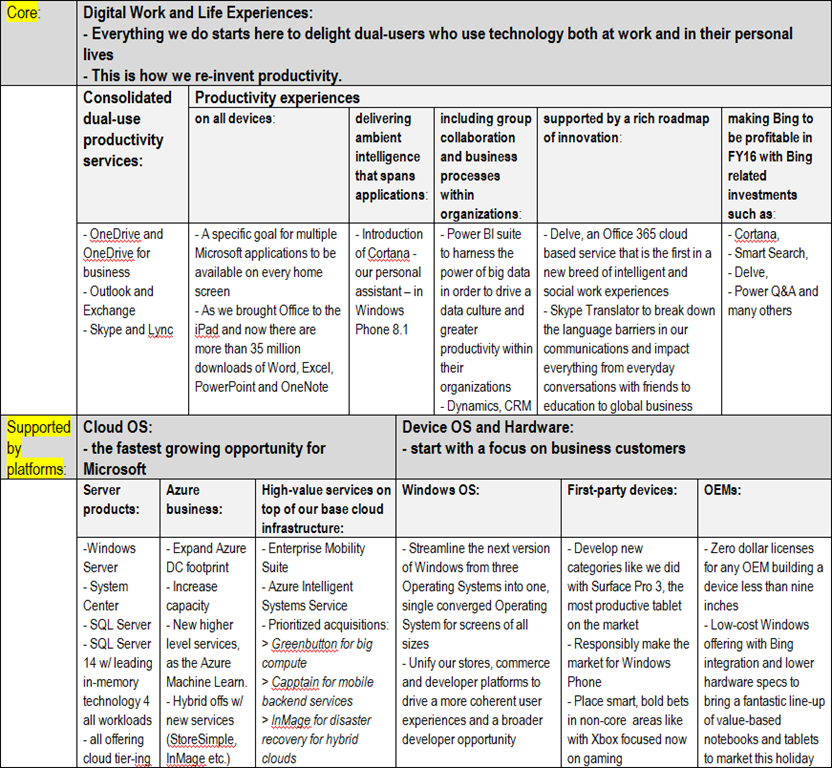

This is the essence of Microsoft Fiscal Year 2014 Fourth Quarter Earnings Conference Call(see also the Press Release and Download Files) for me, as the new, extremely encouraging, overall setup of Microsoft in strategic terms (the below table is mine based on what Satya Nadella told on the conference call):

These are extremely encouraging strategic advancements vis–à–vis previously publicized ones here in the following, Microsoft related posts of mine:

- Microsoft Surface Pro 3 is the ultimate tablet product from Microsoft. What the market response will be? [this same blog, May 21, 2014]

- What Microsoft will do with the Nokia Devices and Services now taken over, but currently producing a yearly loss rate of as much as $1.5 billion? [this same blog, April 29, 2014]

- Microsoft BUILD 2014 Day 2: “rebranding” to Microsoft Azure and moving toward a comprehensive set of fully-integrated backend services [this same blog, April 27, 2014]

- Microsoft is transitioning to a world with more usage and more software driven value add (rather than the old device driven world) in mobility and the cloud, the latter also helping to grow the server business well above its peers [this same blog, April 25, 2014]

- Intel’s desperate attempt to establish a sizeable foothold on the tablet market until its 14nm manufacturing leadership could provide a profitable position for the company in 2016 [this same blog, April 27, 2014]

- Intel CTE initiative: Bay Trail-Entry V0 (Z3735E and Z3735D) SoCs are shipping next week in $129 Onda (昂达) V819i Android tablets—Bay Trail-Entry V2.1 (Z3735G and Z3735F) SoCs might ship in $60+ Windows 8.1 tablets from Emdoor Digital (亿道) in the 3d quarter [this same blog, April 11, 2014]

- Enhanced cloud-based content delivery services to anyone, on any device – from Microsoft (Microsoft Azure Media Services) and its solution partners [this same blog, April 8, 2014]

- Microsoft BUILD 2014 Day 1: new and exciting stuff for MS developers [this same blog, April 5, 2014]

- IDF14 Shenzhen: Intel is levelling the Wintel playing field with Android-ARM by introducing new competitive Windows tablet price points from $99 – $129 [this same blog, April 4, 2014]

- Microsoft BUILD 2014 Day 1: consistency and superiority accross the whole Windows family extended now to TVs and IoT devices as well—$0 royalty licensing program for OEM and ODM partners in sub 9” phone and tablet space [this same blog, April 2, 2014]

- An upcoming new era: personalised, pro-active search and discovery experiences for Office 365 (Oslo) [this same blog, April 2, 2014]

- OneNote is available now on every platform (+free!!) and supported by cloud services API for application and device builders [this same blog, March 18, 2014]

- View from Redmond via Tim O’Brien, GM, Platform Strategy at Microsoft [this same blog, Feb 21, 2014]

- “Cloud first”: the origins and the current meaning [this same blog, Feb 18, 2014]

- “Mobile first”: the origins and the current meaning [this same blog, Feb 18, 2014]

- Microsoft’s half-baked cloud computing strategy (H1’FY14) [this same blog, Feb 17, 2014]

- The first “post-Ballmer” offering launched: with Power BI for Office 365 everyone can analyze, visualize and share data in the cloud [this same blog, Feb 10, 2014]

- John W. Thompson, Chairman of the Board of Microsoft: the least recognized person in the radical two-men shakeup of the uppermost leadership [this same blog, Feb 6, 2014]

- The extraordinary attempt by Nokia/Microsoft to crack the U.S. market in terms of volumes with Nokia Lumia 521 (with 4G/LTE) and Nokia Lumia 520 [this same blog, Jan 18, 2014]

- 2014 will be the last year of making sufficient changes for Microsoft’s smartphone and tablet strategies, and those changes should be radical if the company wants to succeed with its devices and services strategy [this same blog, Jan 17, 2014]

- Will, with disappearing old guard, Satya Nadella break up the Microsoft behemoth soon enough, if any? [this same blog, Feb 5, 2014]

- Microsoft products for the Cloud OS [this same blog, Dec 18, 2013]

- Satya Nadella’s (?the next Microsoft CEO?) next ten years’ vision of “digitizing everything”, Microsoft opportunities and challenges seen by him with that, and the case of Big Data [this same blog, Dec 13, 2013]

- Leading PC vendors of the past: Go enterprise or die! [this same blog, Nov 7, 2013]

- Microsoft could be acquired in years to come by Amazon? The joke of the day, or a certain possibility (among other ones)? [this same blog, Sept 16, 2013]

- The question mark over Wintel’s future will hang in the air for two more years [this same blog, Sept 15, 2013]

- The long awaited Windows 8.1 breakthrough opportunity with the new Intel “Bay Trail-T”, “Bay Trail-M” and “Bay Trail-D” SoCs? [this same blog, Sept 14, 2013]

- How the device play will unfold in the new Microsoft organization? [this same blog, July 14, 2013]

- Microsoft reorg for delivering/supporting high-value experiences/activities [this same blog, July 11, 2013]

- Microsoft partners empowered with ‘cloud first’, high-value and next-gen experiences for big data, enterprise social, and mobility on wide variety of Windows devices and Windows Server + Windows Azure + Visual Studio as the platform [this same blog, July 10, 2013]

- Windows Azure becoming an unbeatable offering on the cloud computing market [this same blog, June 28, 2013]

- Proper Oracle Java, Database and WebLogic support in Windows Azure including pay-per-use licensing via Microsoft + the same Oracle software supported on Microsoft Hyper-V as well [this same blog, June 25, 2013]

- “Cloud first” from Microsoft is ready to change enterprise computing in all of its facets [this same blog, June 4, 2013]

I see, however, particularly challenging the continuation of the Lumia story with the above strategy, as with the previous, combined Ballmer/Elop(Nokia) strategy the results were extremely weak:

Worthwhile to include here the videos Bloomberg was publishing simultaneously with Microsoft Fourth Quarter Earnings Conference Call:

Inside Microsoft’s Secret Surface Labs [Bloomberg News, July 22, 2014]

Will Microsoft Kinect Be a Medical Game-Changer? [Bloomberg News, July 22, 2014]

Why Microsoft Puts GPS In Meat For Alligators [Bloomberg News, July 22, 2014]

To this it is important to add: How Pier 1 is using the Microsoft Cloud to build a better relationship with their customers [Microsoft Server and Cloud YouTube channel, July 21, 2014]

as well as:

Microsoft Surface Pro 3 vs. MacBook Air 13″ 2014 [CNET YouTube channel, July 21, 2014]

Surface Pro 3 vs. MacBook Air (2014) [CTNtechnologynews YouTube channel, July 1, 2014]

In addition here are some explanatory quotes (for the new overall setup of Microsoft) worth to include here from the Q&A part of Microsoft’s (MSFT) CEO Satya Nadella on Q4 2014 Results – Earnings Call Transcript [Seeking Alpha, Jul. 22, 2014 10:59 PM ET]

…

Mark Moerdler – Sanford Bernstein

Thank you. And Amy one quick question, we saw a significant acceleration this quarter in cloud revenue, or I guess Amy or Satya. You saw acceleration in cloud revenue year-over-year what’s – is this Office for the iPad, is this Azure, what’s driving the acceleration and how long do you think we can keep this going?

Mark, I will take it and if Satya wants to add, obviously, he should do that. In general, I wouldn’t point to one product area. It was across Office 365, Azure and even CRM online. I think some of the important dynamics that you could point to particularly in Office 365; I really think over the course of the year, we saw an acceleration in moving the product down the market into increasing what we would call the mid-market and even small business at a pace. That’s a particular place I would tie back to some of the things Satya mentioned in the answer to your first question.

Improvements to analytics, improvements to understanding the use scenarios, improving the product in real-time, understanding trial ease of use, ease of sign-up all of these things actually can afford us the ability to go to different categories, go to different geos into different segments. And in addition, I think what you will see more as we initially moved many of our customers to Office 365, it came on one workload. And I think what we’ve increasingly seen is our ability to add more workloads and sell the entirety of the suite through that process. I also mentioned in Azure, our increased ability to sell some of these higher value services. So while, I can speak broadly but all of them, I think I would generally think about the strength of being both completion of our product suite ability to enter new segments and ability to sell new workloads.

The only thing I would add is it’s the combination of our SaaS like Dynamics in Office 365, a public cloud offering in Azure. But also our private and hybrid cloud infrastructure which also benefits, because they run on our servers, cloud runs on our servers. So it’s that combination which makes us both unique and reinforcing. And the best example is what we are doing with Azure active directory, the fact that somebody gets on-boarded to Office 365 means that tenant information is in Azure AD that fact that the tenant information is in Azure AD is what makes EMS or our Enterprise Mobility Suite more attractive to a customer manager iOS, Android or Windows devices. That network effect is really now helping us a lot across all of our cloud efforts.

…

Keith Weiss – Morgan Stanley

Excellent, thank you for the question and a very nice quarter. First, I think to talk a little bit about the growth strategy of Nokia, you guys look to cut expenses pretty aggressively there, but this is – particularly smartphones is a very competitive marketplace, can you tell us a little bit about sort of the strategy to how you actually start to gain share with Lumia on a going forward basis? And may be give us an idea of what levels of share or what levels of kind unit volumes are you going to need to hit to get to that breakeven in FY16?

Let me start and Amy you can even add. So overall, we are very focused on I would say thinking about mobility share across the entire Windows family. I already talked about in my remarks about how mobility for us even goes beyond devices, but for this specific question I would even say that, we want to think about mobility not just one form factor of a mobile device because I think that’s where the ultimate price is.

But that said, we are even year-over-year basis seen increased volume for Lumia, it’s coming at the low end in the entry smartphone market and we are pleased with it. It’s come in many markets we now have over 10% that’s the first market I would sort of say that we need to track country-by-country. And the key places where we are going to differentiate is looking at productivity scenarios or the digital work and life scenario that we can light up on our phone in unique ways.

When I can take my Office Lens App use the camera on the phone take a picture of anything and have it automatically OCR recognized and into OneNote in searchable fashion that’s the unique scenario. What we have done with Surface and PPI shows us the way that there is a lot more we can do with phones by broadly thinking about productivity. So this is not about just a Word or Excel on your phone, it is about thinking about Cortana and Office Lens and those kinds of scenarios in compelling ways. And that’s what at the end of the day is going to drive our differentiation and higher end Lumia phones.

And Keith to answer your specific question, regarding FY16, I think we’ve made the difficult choices to get the cost base to a place where we can deliver, on the exact scenario Satya as outlined, and we do assume that we continue to grow our units through the year and into 2016 in order to get to breakeven.

…

Rick Sherlund – Nomura

Thanks. I’m wondering if you could talk about the Office for a moment. I’m curious whether you think we’ve seen the worst for Office here with the consumer fall off. In Office 365 growth in margins expanding their – just sort of if you can look through the dynamics and give us a sense, do you think you are actually turned the corner there and we may be seeing the worse in terms of Office growth and margins?

Rick, let me just start qualitatively in terms of how I view Office, the category and how it relates to productivity broadly and then I’ll have Amy even specifically talk about margins and what we are seeing in terms of I’m assuming Office renewals is that probably the question. First of all, I believe the category that Office is in, which is productivity broadly for people, the group as well as organization is something that we are investing significantly and seeing significant growth in.

On one end you have new things that we are doing like Cortana. This is for individuals on new form factors like the phones where it’s not about anything that application, but an intelligent agent that knows everything about my calendar, everything about my life and tries to help me with my everyday task.

On the other end, it’s something like Delve which is a completely new tool that’s taking some – what is enterprise search and making it more like the Facebook news feed where it has a graph of all my artifacts, all my people, all my group and uses that graph to give me relevant information and discover. Same thing with Power Q&A and Power BI, it’s a part of Office 365. So we have a pretty expansive view of how we look at Office and what it can do. So that’s the growth strategy and now specifically on Office renewals.

And I would say in general, let me make two comments. In terms of Office on the consumer side between what we sold on prem as well as the Home and Personal we feel quite good with attach continuing to grow and increasing the value prop. So I think that’s to address the consumer portion.

On the commercial portion, we actually saw Office grow as you said this quarter; I think the broader definition that Satya spoke to the Office value prop and we continued to see Office renewed in our enterprise agreement. So in general, I think I feel like we’re in a growth phase for that franchise.

…

Walter Pritchard – Citigroup

Hi, thanks. Satya, I wanted to ask you about two statements that you made, one around responsibly making the market for Windows Phone, just kind of following on Keith’s question here. And that’s a – it’s a really competitive market it feels like ultimately you need to be a very, very meaningful share player in that market to have value for developer to leverage the universal apps that you’re talking about in terms of presentations you’ve given and build in and so forth.

And I’m trying to understand how you can do both of those things once and in terms of responsibly making the market for Windows Phone, it feels difficult given your nearest competitors there are doing things that you might argue or irresponsible in terms of making their market given that they monetize it in different ways?

Yes. One of beauties of universal Windows app is, it aggregates for the first time for us all of our Windows volume. The fact that even what is an app that runs with a mouse and keyboard on the desktop can be in the store and you can have the same app run in the touch-first on a mobile-first way gives developers the entire volume of Windows which is 300 plus million units as opposed to just our 4% share of mobile in the U.S. or 10% in some country.

So that’s really the reason why we are actively making sure that universal Windows apps is available and developers are taking advantage of it, we have great tooling. Because that’s the way we are going to be able to create the broadest opportunity to your very point about developers getting an ROI for building to Windows. For that’s how I think we will do it in a responsible way.

Heather Bellini – Goldman Sachs

Great. Thank you so much for your time. I wanted to ask a question about – Satya your comments about combining the next version of Windows and to one for all devices and just wondering if you look out, I mean you’ve got kind of different SKU segmentations right now, you’ve got enterprise, you’ve got consumer less than 9 inches for free, the offering that you mentioned earlier that you recently announced. How do we think about when you come out with this one version for all devices, how do you see this changing kind of the go-to-market and also kind of a traditional SKU segmentation and pricing that we’ve seen in the past?

Yes. My statement Heather was more to do with just even the engineering approach. The reality is that we actually did not have one Windows; we had multiple Windows operating systems inside of Microsoft. We had one for phone, one for tablets and PCs, one for Xbox, one for even embedded. So we had many, many of these efforts. So now we have one team with the layered architecture that enables us to in fact one for developers bring that collective opportunity with one store, one commerce system, one discoverability mechanism. It also allows us to scale the UI across all screen sizes; it allows us to create this notion of universal Windows apps and being coherent there.

So that’s what more I was referencing and our SKU strategy will remain by segment, we will have multiple SKUs for enterprises, we will have for OEM, we will have for end-users. And so we will – be disclosing and talking about our SKUs as we get further along, but this my statement was more to do with how we are bringing teams together to approach Windows as one ecosystem very differently than we ourselves have done in the past.

Ed Maguire – CLSA

Hi, good afternoon. Satya you made some comments about harmonizing some of the different products across consumer and enterprise and I was curious what your approach is to viewing your different hardware offerings both in phone and with Surface, how you’re go-to-market may change around that and also since you decided to make the operating system for sub 9-inch devices free, how you see the value proposition and your ability to monetize that user base evolving over time?

Yes. The statement I made about bringing together our productivity applications across work and life is to really reflect the notion of dual use because when I think about productivity it doesn’t separate out what I use as a tool for communication with my family and what I use to collaborate at work. So that’s why having this one team that thinks about outlook.com as well as Exchange helps us think about those dual use. Same thing with files and OneDrive and OneDrive for business because we want to have the software have the smart about separating out the state carrying about IT control and data protection while me as an end user get to have the experiences that I want. That’s how we are thinking about harmonizing those digital life and work experiences.

On the hardware side, we would continue to build hardware that fits with these experiences if I understand your question right, which is how will be differentiate our first party hardware, we will build first party hardware that’s creating category, a good example is what we have done with Surface Pro 3. And in other places where we have really changed the Windows business model to encourage a plethora of OEMs to build great hardware and we are seeing that in fact in this holiday season, I think you will see a lot of value notebooks, you will see clamshells. So we will have the full price range of our hardware offering enabled by this new windows business model.

And I think the last part was how will we monetize? Of course, we will again have a combination, we will have our OEM monetization and some of these new business models are about monetizing on the backend with Bing integration as well as our services attached and that’s the reason fundamentally why we have these zero-priced Windows SKUs today.

…

2014 will be the last year of “free ride” in the smartphone and tablet spaces for ARM-based competitors of Intel – at least what Intel is insisting again

With 2013 performance of only 10 million tablet chip sets (for Windows mostly) Intel is still confident in its ability to deliver 40 million of those (with increased Android portion) in 2014. To achieve this they will be doing a lot of enabling across the industry to take the Bay Trail-based tablet BOM cost down to an equivalent level. They expect that the company’s overall margin will be hit just by 1.5% because of this required in 2014 effort. They are saying that Intel will be safe from 2015 on as moving to 14nm process technology with next-generation (even in terms of micro-architecture) Broxton and SOFIA SoCs for tablet and smartphone devices. They are basing this statement on their inherent “transistor density” advantage against TSMC from that point in time on, despite some analysts’ opinion of the economy of scale advantage of TSMC in terms of the number of wafers produced.

Meanwhile the possible direction of leading OEMs got a hint with New Acer CEO introduced to the media [Formosa EnglishNews, Jan 14, 2014]

With media generally reporting that Acer’s biggest mistake was its too early and too heavy bet on ultrabooks it is clear that OEMs will take a very cautious approach with Intel’s efforts to decrease the Bay-Trail based tablet costs down on the BOM level, as it is exactly what happened with ultrabooks. Instead the will try to solidify their tablet market position with ARM-based tablets in all segments of the tablet market, from the lowest cost upto the premium. Moreover, Jason Chen’s appointment to the CEO position of Acer is also showing that even for ongoing efforts OEMs need a very detailed and deep understanding of the SoC manufacturing and even the process technologies. Take note of Jason Chen’s history of employment in order to understand that:

- TSMC: 2005-2013

- Intel: 1991-2005

- IBM: 1991-1998

In other regards we only know that Acer to start new operation strategy in April to focus on BYOC (Build Your Own Cloud) [DIGITIMES, Jan 13, 2014] and that “In the future, all of Acer’s businesses including desktop, notebook and tablet will involve the BYOC platform and it is hoping to strengthen its product lines through the services.” It will be interesting to watch what that means as my previous conclusion was Leading PC vendors of the past: Go enterprise or die! [‘Experiencing the Cloud’, Nov 7, 2013].

Now back to the Intel related information in terms of details in their earnings call. Note before that the correlation of Intel and Microsoft stock prices (as well that the stock market was absolutely not happy with Intel results and especially with the “flat 2014” outlook):

The company’s stance for 2014 is indeed not rosy as Intel to reduce global workforce by five percent in 2014 [Reuters, Jan 17, 2014].

From: Intel’s CEO Discusses Q4 2013 Results – Earnings Call Transcript [Seeking Alpha, Jan 16, 2014]

Inserted slides are from Investor Meeting – Stacy Smith (CFO) [Nov 21, 2013] while the acompanying text is from Intel Shares Mobile Progress, Priorities and Product Pipeline at Annual Investor Day [Technology@Intel, Nov 25, 2013] if reference is not put underneath

[On transistor density and wafer cost]

Mark Lipacis – Jefferies

Thanks for taking my question. At the Analyst Day, you addressed your view on transistor density and your expectation for leadership on that vector, but I have to say this discussing that idea with investors is a consensus view that seems to be that Intel has an inherent wafer cost disadvantage that relative to TSMC that neutralizes or more than neutralizes your transistor density advantage and the argument is that TSMC ships more wafers and therefore has more better purchasing power than you and its lower labor cost, so net-net, they have just a big huge advantage of wafer cost that you should have a hard to, too hard of a time to overcome. So my question is do you think that’s a fair view. Can you help us talk to the relative elements of the wafer cost and how you think you can compare? Any kind of help that you give us on the cost dimension would be extremely helpful. Thank you.

From: CES: Process Will Still Win in Mobile, Says Intel’s Eul [Barrons.com, Jan 9, 2014]

Eul points out that Qualcomm, and other competitors such as Nvidia (NVDA) and Broadcom (BRCM), all of whom are dependent on Taiwan Semiconductor Manufacturing Company to actually make the chips they design, will run into a problem as Taiwan Semi’s technology stops scaling.

Intel had made the point at the analyst day presentation, and Eul repeated it: As TSMC moves from 28 nanometer to 20 nanometer, it will run into a problem at the subsequent step, 16 nanometer, where TSMC will not add any real reduction in transistor size. That, says Eul, means that 16-nanometer parts a few years from now will be stuck at a 20-nanometer feature size while intel presumably zooms ahead to 10 nanometer by that time.

And what that means is that, unable to scale the density of a chip as Intel can, Qualcomm and Nvidia and Broadcom and the others will not be able to integrate as many parts as Intel on a single semiconductor die.

And so to those who point out that Intel hasn’t yet released its integrated baseband chip, Sofia, mentioned above, Eul contends the company will have the last laugh in a few years’ time as Qualcomm and the rest hitting a scaling wall.

Brian Krzanich – Chief Executive Officer

You know I think the first thing to remember is that what really counts in all of this is transistor cost and what we really talk about in our Moore’s Law of Curves and when we talk about transistor density is driving a consistent cost reduction of the transistors and so wafer cost is one segment of that. I’m not going to comment on you know TSMC’s wafer cost versus our wafer cost but we feel confident that our relative level of scaling and our internal wafer cost are such that we believe we have a leadership position in transistor cost.

When you’re talking about any product whatever it is, a logic product that’s a low-end microprocessor for wearable or internet of things or high-end Xeon server. You’re talking about the number of case and hence the number of transistors required to put that logic device together, it doesn’t matter whose technology it’s on to some extent. It doesn’t matter what node and so the more cost effective those transistors are whether it’s 500 million or 3 billion the lower the product cost there is and that’s really what we focus on and why we focus on transistor cost. So I think we stand by our what we said at the investor meeting.

[On tablets]

Brian Krzanich: Our disclosure in November of a new smartphone and tablet road map that will include SoFIA our first IA SSD with integrated comps later this year is further evident that we’re innovating and bringing products to market at faster pace. Looking ahead 2014 will be an exciting year as we build further on this new foundation. We have established a goal to grow our tablet volumes to more than 40 million units. Within an emphasis on the value segment. As we’re finishing 2013 with more than 10 million units and a strong book of design wins we’re off to a good start.

Stacy Smith: In the tablet market, we launched the Bay Trail SoC and have started to expand our footprint and market signature in this growing market.

The 4X Tablet Campaign: This year, Intel increased its focus on tablets with key design wins and the introduction of Bay Trail. Next year, Intel plans to increase tablet volumes by 4X! Eul signaled a rich pipeline of tablet and phablet design wins for Bay Trail including Android and Windows devices spanning price points from premium to sub $99 products from leading OEMs and the China tech ecosystem. He also said industry leading performance, competitive battery life, cost-reduced SOCs and unique features like 64 bit will help drive growth. Intel gave a first-time demo of the performance gains achieved with a 64 bit Bay Trail system running Windows and showed a 64 bit kernel running on an Android tablet.

Note the details about the 2014 tablet market of ~289+ million units in the 2014 will be the last year of making sufficient changes for Microsoft’s smartphone and tablet strategies, and those changes should be radical if the company wants to suceed with its devices and services strategy [‘Experiencing the Cloud’, Jan 17, 2014] post of mine. The 40 million target of Intel is therefore less than 14% of that.

Note the details about the 2014 tablet market of ~289+ million units in the 2014 will be the last year of making sufficient changes for Microsoft’s smartphone and tablet strategies, and those changes should be radical if the company wants to suceed with its devices and services strategy [‘Experiencing the Cloud’, Jan 17, 2014] post of mine. The 40 million target of Intel is therefore less than 14% of that.

[regarding: So on the tablet strategy to get the 40 million you’re saying it’s going to be a 1.5 percentage hit.

CFO Commentary on Fourth-Quarter and Full Year 2013 Results

2014 Outlook

Gross Margin Reconciliation: 2013 to 2014 Outlook (59.8% to 60% +/- a few points)

– 1.5 points: Tablet impact

Let’s say you guys get into the second half of the year and you’re not quite to the 40 million if it’s a pretty significant short fall. Would you consider canning that strategy I guess I’m just wondering what the commitment is if the volumes aren’t there but the cost is there by the end of the year?]

Brian Krzanich: This isn’t a price reduction as normal price reduction would be; it’s not where you are just simply reducing. It’s truly a BOM cost equalizer and remember a lot of our 40 million tablets in ’14 will be based on Bay Trail. Bay Trail was originally designed for Avoton-based PC segments and the upper end tablet [and all Windows]. And so it’s what we are doing here is doing a BOM cast delta relative to the, what the mid and lower end tablets require. And so those are things like Bay Trail may require more layers of a printed circuit board for the board itself, more components on the board and tighter power management controls and things like that. We have a whole program to reduce those throughout the year. So that gives us confidence that as we go through the year, the BOM cast delta will shrink, but if the volume didn’t show up for some reason and I am not going to say that, that’s what’s going to happen, but I am confident it will, but if it didn’t it’s on a per unit basis. And so the spending on that contra would be reduced equivalently.

Stacy Smith: And I would just add as Brian said we are doing a lot of enabling across the industry to take the BOM cast out in equivalent. These are costs at the system level not at our chip level and it will vary a lot by SKU, but to give you a sense for a Bay Trail platform from the beginning of the year to the end of the year we think that, that BOM penalty drops by more than half. And so it kind of gets better out in time. And then when we get to the Broxton generation we think it’s de minimis.

Brian Krzanich: Both Broxton and SoFIA are just specifically designed to eliminate that delta.

Say “hello” to SoFIA: By the end of 2014, Intel will deliver a new integrated Atom processor + communications solution for entry and value smartphones and tablets, code-named SoFIA. In his presentation, Eul highlighted that Intel’s Infineon wireless assets make the company an “incumbent” in the mobile phone market, shipping more than 360M mobile platforms a year spanning 2G and 3G solutions. He said SoFIA builds on the proven 3G communications platform to deliver a competitive and highly integrated, IA-based mobile solution aimed at the fast-growing market for entry smartphones and tablets. The 3G version of SoFIA is expected by the end of 2014, and Eul said an LTE version would follow in the first half of 2015.

Accelerated Mobile Roadmap: While specific product details will be saved for a later date, Eul signaled a robust pipeline of new Atom processors and multi-comms solutions for 2014 and beyond to address devices spanning market segments from entry to performance smartphones and tablets, an approach he called “market-oriented pragmatism.” In addition to SoFIA, Eul noted:

…

-

Broxton – in 2015 Intel plans to deliver a 14nm, 64 bit SOC based on a new, next generation Atom architecture (Goldmont) targeted for hero devices. Broxton is being designed for pairing with Intel’s next generation LTE solutions.

[regarding: If we look at tablets and smartphone, what type of units do you need to reach for that business to stop having a material impact in gross margin from is 10 points higher utilization rates and excluding the contra revenue impact and that’s it? So just looking at the 40 million units target for this year, what type of volume do you need to get in order for gross margin to start appreciating from the west of the business if you exclude the contra revenue impact?]

Brian Krzanich: Yes, it’s hard to say. I mean, I will bridge back to our strategy here. Our strategy is that we are going to use our process technology leads. We will have leadership products that also are competitive or maybe even leadership in terms of cost and I showed some data at the investor meeting that just kind of showed the die size as we progress from Bay Trail to Broxton to SoFIA and so you can get a sense of the kinds of cost structure that we are going to have on a per unit basis. I don’t think it causes on a percentage basis. Yes, I can’t – I am not envisioning if this causes the gross margin percentage to go up, but you can definitely get to a space once we get through these contra enabling dollars where every unit we sell is accretive on a gross margin dollars per unit. It’s utilizing factories that we have in place for PCs. And so it’s a nice adder of that gross margin dollar per unit standpoint.

[regarding: Bay Trail Android tablets]

Brian Krzanich: Most of the Bay Trail Android tablets really start showing up more in Q2 than in Q1 and that’s again purely you know remember we made a shift, an original program for Bay Trail was all Windows. As we came into the midpoint of the year we sandbox [ph] shift and make it Windows and Android and so you know our OEM partners as well are targeting more towards Q2 and it’s just when you do you go and start putting back in that back to school event which is a next seasonal place where upside usually occur.

[regarding: On the smartphone or on tablet space, I think it is true that Intel has a manufacturing lead, but do you think your cost reduction efforts and then the Moore’s Law advantages ever progressed faster than the ASP declines in the space. In other words, do you think Intel can be sustainably profitable in the mobile space which is maturing?]

Brian Krzanich: Yes, we absolutely do. You saw at the investor meeting products like SoFIA, which really are going to be put on to 14-nanometer are fully integrated all the way through with the 3G option or an LTE option and that LTE is with carrier aggregation. Those kinds of products we believe are very, very cost competitive in fact leading from a cost position. In addition, we don’t talk a lot about, but we are already in that low cost Asia market. We are inch and then we are working with ODMs there. That’s actually where a lot of the innovations coming out of for some of these cost reductions on tablets and where we are getting the cost reduction ideas. So we are in that market now. We sold out of that Shenzhen low cost market in Q4. We will continue through it – through 2014 and with products like SoFIA on leading edge technology, we are very comfortable that we can get into those very low price points.

Microsoft answers to the questions about Nokia devices and services acquisition: tablets, Windows downscaling, reorg effects, Windows Phone OEMs, cost rationalization, ‘One Microsoft’ empowerment, and supporting developers for an aggressive growth in market share

Preceding analysis of the announcement materials on this blog:

Unique Nokia assets (from factories to global device distribution & sales, and the Asha sub $100 smartphone platform etc.) will now empower the One Microsoft devices and services strategy [‘Experiencing the Cloud’, Sept 3, 2013]

Other views are given here as well, after the Q&A excerpts coming immediately below. From a Reuters’ editor, an IHS senior analyst, an investment bank executive, and a business news presenter on France24 – in the form of 4 embedded videos. Those views could be summarized as “Nokia did a good deal while the success of Microsoft with this acqusition is uncertain and needs a lot of further investment”.

Let’s see how much the answers to the questions on the Microsoft Nokia Transaction Conference Call (Sept 3, 2013 ) were able to clarify the analyses and critical views:

Tablets?

STEVE BALLMER: Tablets is an area where we absolutely have our own first-party hardware, as you know, and see opportunities to continue to build and strengthen. And it’s an area where we have very strong programs in place with our OEMs, particularly on the Intel Atom-processor-based product lines that people will really get a lot of value on, and you’ll see a range of new products coming for the holiday season.

Scaling Windows down?

TERRY MYERSON: It’s definitely a priority for us to bring Windows to as many customers as we can around the world. Lower-price phones is a strategic initiative for the next Windows Phone release, but we have nothing more really to say now.

Acquisition effect on the reorg?

STEVE BALLMER: No [effect], the reorg is absolutely intact. Obviously, the devices business has a broader scale and new capability. Julie Larson-Green, who is running devices and studios is flat out. We’ve got a lot of work we’re doing here over the next several months. And Julie and her team will work on a planning and integration phase. Julie will continue. She’s excited about working on devices, but absolutely, the critical mass of the group with that acquisition is in the phone space, and Stephen Elop will run the group and will take the appropriate steps with Julie working with Stephen to figure out appropriate integrations.

Windows Phones coming from OEMs in the future?

STEVE BALLMER: Today, Nokia, as I said, is well over 80 percent of all of our phones, and I don’t foresee that changing dramatically in the short run, but as the market grows, I expect to see additional percentages, if you will, go to our OEMs, but it’s premature to predict today. We definitely have interest from OEMs in the Windows Phone opportunity given that people understand we’re going to blaze the trails here with our own first-party hardware.

Cost rationalization over time?

STEVE BALLMER: Amy will take it. I do want to highlight that in many hardware companies, manufacturing labor is primarily outsourced. And Amy can remind us the numbers, but in Nokia, there is more in-sourced manufacturing. Nokia has had a strategy about that that, obviously, they’ve executed very well. But you kind of have apples and oranges a little bit between the 32,000 and our almost 100,000. But Amy, why don’t you provide some context and detail?

AMY HOOD: Sure. Thanks, Brent. About 18,000 of those 32,000 employees are really directly a part of the manufacturing business. And so I think a better way as you think about the scale and opportunity is to really focus on the percentage of Nokia outside of that.

I think both Steve and Stephen did a thoughtful job in the execution slide about talking about the philosophy we’re using as we go through the integration process around the benefits of the incremental sales force that we’re getting with Chris and his team, as well as really going through and being thoughtful about the rationalization so that we get to one voice, one brand, one team that can best execute and be efficient.

What was not possible that the acquisition enables now, or is it only ensuring a presence in the smartphone market for a long-term basis, i.e. ‘One Microsoft’ empowerment?

STEVE BALLMER: Well, the latter is certainly true. We see at least three distinct opportunities to do better as one company than as two.

Number one, we talk about one brand and the unified voice to the market. I will say that I think we can probably do better for consumer name than the Nokia Lumia Windows Phone 1020. And yet, because of where both companies are and the independent nature of the businesses, we haven’t been able to shorten that. Just take that as a proxy for a range of improvements that we feel we can make, we can simplify, the way in which we work with operators and the overall consumer branding and messaging gets much simpler. That is an efficiency of being one company.

On the innovation front, we’ve done a lot of great work together, and yet as two companies, there’s always some lines along which it’s hard to innovate. The Lumia 1020 is awesome in terms of what it has for camera and imaging, and yet I think as one company we would have doubled down on that bet and made an even greater range of software and services investments around the core hardware platform.

Third, I think we get business agility. As two companies, we’re making two independent sets of decisions about where and when and how to invest by country, by operator, by price point, and there is, let me say, an inefficiency financially as well as a lack of agility that comes with that.

So in all three of those areas, despite the fact that I think we’ve done a really good job, we can improve and accelerate quite noticeably.

How the much needed developer support for the fairly aggressive market share assumption will be ensured?

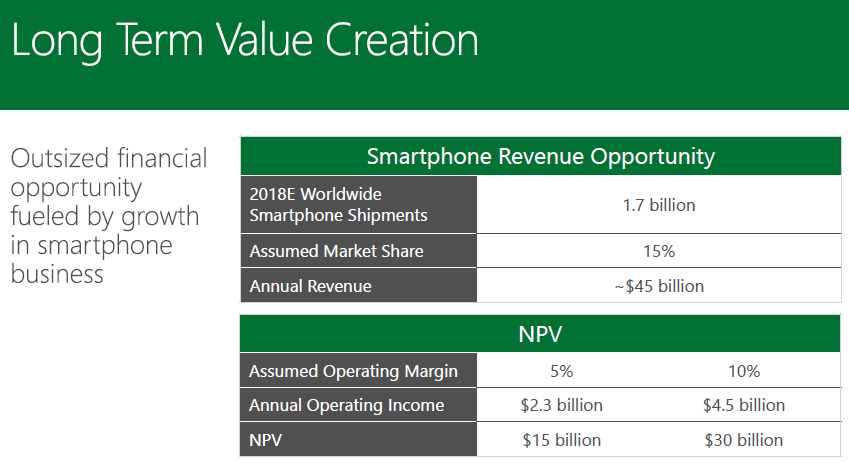

Note: the “fairly aggressive market share assumption” was presented by Microsoft as:

To which I added the following calculation and judgment in my analysis post:

15% of the 1.7B units in 2018 is 255M units. The ~$45 billion estimated revenue at that time means ~$176 ASP. Considering the latest Q2’13 EUR 157 [$207] ASP of Lumia it seems feasible, but in 5 years timeframe it needs a strong premium strategy to achieve that. … NPV – Net Present Value.

TERRY MYERSON: Well, for developers today, Windows offers an incredible opportunity with the installed base of PCs, phones, and tablets, and soon the new Xbox One. We want to offer them this opportunity to build either HTML5 applications or native applications that span all of those devices, enabling them to reach segments of users on those devices, users in an enterprise, users on a gaming console, and just provide them very unique opportunities to monetize their application investments.

So we’re pretty excited about the platforms we’re bringing to market. Developer reception in some areas is certainly better than others, but overall we’re making progress, and we know we’ve got a lot more work to do.

STEVE BALLMER: One of the keys, of course, is driving volume. We think we have differentiated products. We can tell the story a little bit better. We can get the volume up, and we have over 160,000 applications in the store. We know we have a long way to go, and the key is really offering with our own first-party applications and first-party hardware, enough reasons to buy to drive volumes and then attract the broader developer ecosystem.

Obviously, HTML5 would be kind of a neutral thing. I would expect all the major platforms to embrace it to some extent. And in some senses, it takes away a little bit of the apps barrier to entry, which we know we need to work hard on right now.

See also Microsoft Nokia Transaction Conference Call with slides from Microsoft Strategic Rationale inserted- ebook – 3-Sept-2013

edited by Sándor Nacsa from those two sources into an ebook format PDF

The real question around the web is: Can Microsoft do a better job as in Breakingviews: Nokia’s smart to take money & run [Reuters TV YouTube channel, Sept 3, 2013]

The view of an expert from IHS, a big business analysis firm, for comparison:

Microsoft & Nokia still face huge ‘brand and cool’ challenge – Gleeson [4-traders.com, 09/03/2013 | 12:30pm US/Eastern]

Microsoft buys Nokia’s handset business for $7.2 bln. Both companies will be hoping it heralds a new era, but overcoming brand weakness will be a huge challenge. For them both, says IHS Senior Mobile Analyst, Daniel Gleeson.

SHOWS: LONDON, ENGLAND, UK (REUTERS – ACCESS ALL) (SEPTEMBER 3, 2013)

1. IHS, SENIOR MOBILE ANALYST, DANIEL GLEESON, SAYING:

JOURNALIST ASKING DANIEL GLEESON: ‘Well is this a good deal for Nokia and is it enough to drag it into the 21st century?’

DANIEL GLEESON: ‘It is a big deal. Whether it’s not- I don’t think it is enough really. You’ve got two titans of the past really kind of clashing together. It does provide Microsoft with the ability to merge the handset and the software side of the mobile businesses together which gives it a better chance of breaking through. However I think Microsoft are probably being overambitious. Microsoft has stated that they’re aiming to get 15% of the smartphone market by 2018 which will be equivalent to somewhere in the region of more than 200 million smartphones. Given that the current Nokia smartphone run rate is somewhere in the region of 30 million units, that’s quite a lot of growth that they’re looking for and practically I don’t think that’s possible.

JOURNALIST: ‘So you don’t think that Apple and Samsung and the like will be quaking in their boots?’

DANIEL GLEESON: ‘Not at the moment. Microsoft had been very slow in developing the Windows Phone platform over the past few years. There’s been very little development on the software side. Most of the innovation on it has actually come from Nokia. So obviously the hope is that Nokia will be able to bring this innovation to Microsoft and spur on the software development. However, with the current reorganization that Microsoft is going through and the fact that Ballmer is going to be stepping aside at the end of the year or within the next 12 months, that is very uncertain. So it remains to be seen about how Microsoft can evolve and adapt to taking in the hardware unit.’

JOURNALIST: ‘Sorry, just going to say, Nokia’s shares rose almost 50% this morning. But the company as we all know is still a shadow of its former self.’

DANIEL GLEESON: ‘Yeah, it very much is. It used- obviously a couple of years ago Nokia was the largest smartphone and handset vendor in the world. It is now I think like behind the many Chinese, smaller Chinese companies in terms of smartphone shipments and dropping rapidly in terms of the handset market. What we see though is that Nokia does have a good future with its NSN business, its network vendoring business. That’s after going through major turnaround over the past while and then past four quarters it’s managed to turn a profit on that. So that’s going to be the future that Nokia’s looking at and that part of the business is looking bright.’

JOURNALIST: ‘Does this deal do anything to address I suppose what is fundamental certainly in the public’s perception of both companies, the fundamental premise that neither brand is cool in anyway whatsoever. I mean the brands are very, very weak. Does this do anything to address that?’

DANIEL GLEESON: ‘Fundamentally it doesn’t because as you said this is just simply the uniting of two uncool brands. This doesn’t make it any better. It’s going to take a lot of investment from Microsoft to try to turn that brand around. Of course the upside of it is Microsoft has much deeper pockets to do this than Nokia on its own would have. So you are in the situation where Microsoft was funneling a lot of cash into Nokia anyway to try to support the smartphone unit. So Microsoft presumably just by taking it in-house is just absorbing that cost and it’s going to be able to push even more money into it to try to build that brand and to make it better in the future.’

And here is a similar view of an executive from a Danish online investment bank, Saxo Bank: The Nokia deal: What’s Microsoft thinking? [TradingFloorCom YouTube channel, Sept 3, 2013]

Why has Microsoft agreed to buy Nokia’s moible phone business for more than five billion euros? It’s somewhat perplexing to Saxo Bank’s Head of Equity Strategy, Peter Garnry. It’s a great deal for the struggling Finish handset maker, he says. But he has real concerns about how good it will be for Microsoft, one of the world’s leading technology players. Nokia shares rose by around 45% on the open on Tuesday. Peter says it’s also really good news for the company’s bond holders as the company was hemorrhaging cash. However, Peter says Microsoft have paid a lot of money in this deal, which is due to be finalised next year. He says they’re still not as good a hardware company as Samsung or Apple and he adds that nine out of ten acquisitions do not fulfill synergy expectations. He says it’ll be very difficult for Microsoft to integrate Nokia into its business and move it foreward. So where does this leave rival Blackberry, which is already struggling to compete on the smartphone market? Peter says the company should start focusing on what they are good; mobile security and increase shareholder value that way. Nokia’s phone business marks the exit of a 150-year-old company that once dominated the global cellphone market.

The stock market reaction is discussed further in Investors cautious over Microsoft move on Nokia and how one man got his lost bags delivered [FRANCE 24 English YouTube channel, Sept 4, 2013]

Full text of Q&A part of the

Transcript of Microsoft Nokia Transaction Conference Call: Steve Ballmer, Stephen Elop, Brad Smith, Terry Myerson, Amy Hood; September 3, 2013 [Microsoft, Sept 3, 2013] to have the full Q&A context

OPERATOR: Walter Pritchard, Citigroup, your line is open.

WALTER PRITCHARD: Great. Thanks for taking the question. Steve Ballmer, on the tablet side, obviously, we could say many of the same things as you’ve put into this slide deck as rationale for doing an acquisition on the phone side as we could say about the tablet side including picking up more gross margin.

I’m wondering how this transaction impacts the strategy going forward in tablets and whether or not you need to, in a sense, double down further on first-party hardware in the tablet market. And then just have one follow up.

STEVE BALLMER: Okay. Terry, do you want to talk a little bit about that? That would be great.

TERRY MYERSON: Well, phones and tablets are definitely a continuum. You know, we see the phone products growing up, the screen sizes and the user experience we have on the phones. We’ve now made that available in our Windows tablets, our application platform spans from phone to tablet. And I think it’s fair to say that our customers are expecting us to offer great tablets that look and feel and act in every way like our phones. We’ll be pursuing a strategy along those lines.

STEVE BALLMER: Tablets is an area where we absolutely have our own first-party hardware, as you know, and see opportunities to continue to build and strengthen. And it’s an area where we have very strong programs in place with our OEMs, particularly on the Intel Atom-processor-based product lines that people will really get a lot of value on, and you’ll see a range of new products coming for the holiday season.

WALTER PRITCHARD: And then, Terry, can you talk about just the ability to scale Windows down? Obviously, Nokia has a large base of very low-price feature phones. That base may be sort of dwindling over time, but you’ve been cost-reducing Windows, the specs and so forth, to be able to get Windows down to low-price devices. Can you talk about any efforts to accelerate that process given potentially access to a much bigger pool of low-cost phones that are out there already?

TERRY MYERSON: It’s definitely a priority for us to bring Windows to as many customers as we can around the world. Lower-price phones is a strategic initiative for the next Windows Phone release, but we have nothing more really to say now.

STEVE BALLMER: Operator, we’ll move to the next question please, thanks, Walter.

(Break for direction.)

OPERATOR: Our next question is from Mark Moerdler from Sanford Bernstein, your line is open.

MARK MOERDLER: Thank you. Steve Ballmer, two questions: The first one is how does this affect the reorg? Given hardware was in one group and operating systems in another, software in another, does the Nokia device — does the merger affect that? Does it merge into the hardware business, and hardware/content device group? Or does this now change that? And then I have a follow up.

STEVE BALLMER: No, the reorg is absolutely intact. Obviously, the devices business has a broader scale and new capability. Julie Larson-Green, who is running devices and studios is flat out. We’ve got a lot of work we’re doing here over the next several months. And Julie and her team will work on a planning and integration phase. Julie will continue. She’s excited about working on devices, but absolutely, the critical mass of the group with that acquisition is in the phone space, and Stephen Elop will run the group and will take the appropriate steps with Julie working with Stephen to figure out appropriate integrations.

MARK MOERDLER: Excellent. And then as follow up on it, what’s your expectation going forward in terms of — I just want to clarify this — the percentage of Windows Phones that will be from OEMs?

STEVE BALLMER: Today, Nokia, as I said, is well over 80 percent of all of our phones, and I don’t foresee that changing dramatically in the short run, but as the market grows, I expect to see additional percentages, if you will, go to our OEMs, but it’s premature to predict today. We definitely have interest from OEMs in the Windows Phone opportunity given that people understand we’re going to blaze the trails here with our own first-party hardware.

MARK MOERDLER: Thank you very much, appreciate it.

CHRIS SUH: Thanks, Mark. I just want to remind you, we do want to get to as many questions from as many of you as we can. So I do ask that you please just stick to one question and avoid long, or multi-part questions, please. Operator, next question, please.

OPERATOR: Brent Thill, UBS, your line is open.

BRENT THILL: Thanks. Just on the cost rationalization. Nokia has 32,000 employees versus Microsoft at 99,000. A considerable bulk of employees. Can you just talk about the rationalization over time and your view how that plays out?

STEVE BALLMER: Amy will take it. I do want to highlight that in many hardware companies, manufacturing labor is primarily outsourced. And Amy can remind us the numbers, but in Nokia, there is more in-sourced manufacturing. Nokia has had a strategy about that that, obviously, they’ve executed very well. But you kind of have apples and oranges a little bit between the 32,000 and our almost 100,000. But Amy, why don’t you provide some context and detail?

AMY HOOD: Sure. Thanks, Brent. About 18,000 of those 32,000 employees are really directly a part of the manufacturing business. And so I think a better way as you think about the scale and opportunity is to really focus on the percentage of Nokia outside of that.

I think both Steve and Stephen did a thoughtful job in the execution slide about talking about the philosophy we’re using as we go through the integration process around the benefits of the incremental sales force that we’re getting with Chris and his team, as well as really going through and being thoughtful about the rationalization so that we get to one voice, one brand, one team that can best execute and be efficient.

CHRIS SUH: Thanks, Amy. Next question, please, operator.

OPERATOR: Keith Weiss, Morgan Stanley, your line is open.

KEITH WEISS: Thank you guys for taking the question. You guys have talked about the success and the partnership to date in putting out some really good products. I was wondering, Steve, perhaps you could give us some concrete example of what does the acquisition enable you to do that you guys couldn’t do through the partnership? And maybe give us some more concrete examples there. Or is that maybe not the point? Maybe the point is more so that this really solidifies Microsoft’s presence in the smart phone market, and this is more about ensuring that you guys are going to be a presence here for a long-term basis.

STEVE BALLMER: Well, the latter is certainly true. We see at least three distinct opportunities to do better as one company than as two.

Number one, we talk about one brand and the unified voice to the market. I will say that I think we can probably do better for consumer name than the Nokia Lumia Windows Phone 1020. And yet, because of where both companies are and the independent nature of the businesses, we haven’t been able to shorten that. Just take that as a proxy for a range of improvements that we feel we can make, we can simplify, the way in which we work with operators and the overall consumer branding and messaging gets much simpler. That is an efficiency of being one company.

On the innovation front, we’ve done a lot of great work together, and yet as two companies, there’s always some lines along which it’s hard to innovate. The Lumia 1020 is awesome in terms of what it has for camera and imaging, and yet I think as one company we would have doubled down on that bet and made an even greater range of software and services investments around the core hardware platform.

Third, I think we get business agility. As two companies, we’re making two independent sets of decisions about where and when and how to invest by country, by operator, by price point, and there is, let me say, an inefficiency financially as well as a lack of agility that comes with that.

So in all three of those areas, despite the fact that I think we’ve done a really good job, we can improve and accelerate quite noticeably.

KEITH WEISS: Excellent, thank you.

CHRIS SUH: Thanks, Keith. Operator, I think we have time for two more questions, next question, please.

OPERATOR: Rolfe Winkler, Wall Street Journal, your line is open.

ROLFE WINKLER: Hi, you guys have 15 percent, a fairly aggressive market share assumption for where you guys are going to go in a few years. I guess I’m wondering, to get there, one thing you’re going to need is a lot of developer support. Developers already have IOS, Android — you can make an argument that HTML5 over the next few years will grow, that will give them a third development platform. How will you guys convince them to develop for Windows Phone?

STEVE BALLMER: Terry, why don’t you talk a little bit about developers, if you don’t mind?

TERRY MYERSON: Well, for developers today, Windows offers an incredible opportunity with the installed base of PCs, phones, and tablets, and soon the new Xbox One. We want to offer them this opportunity to build either HTML5 applications or native applications that span all of those devices, enabling them to reach segments of users on those devices, users in an enterprise, users on a gaming console, and just provide them very unique opportunities to monetize their application investments.

So we’re pretty excited about the platforms we’re bringing to market. Developer reception in some areas is certainly better than others, but overall we’re making progress, and we know we’ve got a lot more work to do.

STEVE BALLMER: One of the keys, of course, is driving volume. We think we have differentiated products. We can tell the story a little bit better. We can get the volume up, and we have over 160,000 applications in the store. We know we have a long way to go, and the key is really offering with our own first-party applications and first-party hardware, enough reasons to buy to drive volumes and then attract the broader developer ecosystem.

Obviously, HTML5 would be kind of a neutral thing. I would expect all the major platforms to embrace it to some extent. And in some senses, it takes away a little bit of the apps barrier to entry, which we know we need to work hard on right now.

CHRIS SUH: Thanks. Operator, let’s move to the last question, please.

OPERATOR: Our last question comes from Rick Sherlund.

RICK SHERLUND: Thanks. I wonder if you could just share with us whether ValueAct was made aware of this before they entered their cooperation and standstill agreement.

STEVE BALLMER: Brad, do you want to take that?

BRAD SMITH: The answer is no. You would not expect the company to disclose material, non-public information to an entity that doesn’t have an appropriate non-disclosure agreement. So the answer is no.

RICK SHERLUND: Okay, thank you.

CHRIS SUH: Okay, so that will wrap up our call today. Thank you, again, for joining us. We look forward to seeing many of you at our financial analyst meeting, which will be held on September 19th. Thanks again.

END

How the device play will unfold in the new Microsoft organization?

After the Microsoft reorg for delivering/supporting high-value experiences/activities the Devices and Studios Engineering Group lead by Julie Larson-Green will have undoubtable the far biggest challenge of all hardware development and supply chain from the smallest to the largest devices Microsoft builds. What I found below is that the conceptual structure developed by Microsoft might have much greater chance of success in general, and Julie Larson-Green is much better in meeting that challenge, in particular, than what I thought previously about her.

In Steve Ballmer and Microsoft Senior Leadership Team: One Microsoft Conference Call [Microsoft News Center, July 11, 2013] the internal part of the challenge was briefly described as:

ADRIANNE JEFFRIES, The Verge: Hi, thanks so much. My question is, Steve, with Julie and Terry leading separate software and hardware teams, how do you feel you can bring devices to the market in a way that Apple and other competitors do? Will they work closely enough and collaboratively enough to compete with Apple?

JULIE LARSON-GREEN: I think it’s a perfect way for us to approach it. Terry [Myerson leading the Operating Systems Engineering Group] and I have worked together for a long time. We both have worked on the operating system side. I’ve worked on the hardware side [as well since joined the Windows division in H2 2006 as CVP of program management for the Windows Experience], and it’s a good blending of our skills and our teams to deliver things together.

So the structure that we’re putting in place for the whole company is about working across the different disciplines and having product champions.

So Terry and I will be working to lead delivery to market of our first-party and third-party devices.

STEVE BALLMER: Yes, and maybe just also have Tony Bates [leading Business Development and Evangelism Group with dotted line management of the OEM business in the COO/SMSG] add a little bit. Tony is going to have a critical role running business development evangelism, our role with our hardware innovation partners, our OEMs.

TONY BATES: Yes, I would just add to that. Julie alluded to this — first party, there’s also a third party — and I think having a single interface to our key innovation partners [which is one of the roles of his group], but two bringing together the way we think about offers with our partners is going to be absolutely critical. So when we think about how we work together, I think of going back to one strategy, one team. So we’re all going to be part of that. It’s going to be critical that we have that interface going forward.

ADRIANNE JEFFRIES: And is Terry there?

TERRY MYERSON: Yes. I thought Julie and Tony had it very well said. We’ve got innovative ideas coming from our OEM partners, and Julie’s team has some very innovative ideas. And the platform [engineered by his group] needs to span from the PPI whiteboard that Tony talked about to Xbox, to our phone, and beyond. So it’s exciting to have all these hardware partners in the Windows ecosystem, or in the Microsoft ecosystem, and all the innovative ideas and to bring it to market together.

Regarding the product and high-value scenario champions’ role:

From: One Microsoft: Company realigns to enable innovation at greater speed, efficiency

One Strategy, One Microsoft

We are rallying behind a single strategy as one company — not a collection of divisional strategies. Although we will deliver multiple devices and services to execute and monetize the strategy, the single core strategy will drive us to set shared goals for everything we do. We will see our product line holistically, not as a set of islands. We will allocate resources and build devices and services that provide compelling, integrated experiences across the many screens in our lives, with maximum return to shareholders. All parts of the company will share and contribute to the success of core offerings, like Windows, Windows Phone, Xbox, Surface, Office 365 and our EA offer, Bing, Skype, Dynamics, Azure and our servers. All parts of the company will contribute to activating high-value experiences for our customers.

We will reshape how we interact with our customers, developers and key innovation partners, delivering a more coherent message and family of product offerings. The evangelism and business development team will drive partners across our integrated strategy and its execution. Our marketing, advertising and all our customer interaction will be designed to reflect one company with integrated approaches to our consumer and business marketplaces.

How we organize our engineering efforts will also change to reflect this strategy. We will pull together disparate engineering efforts today into a coherent set of our high-value activities. This will enable us to deliver the most capability — and be most efficient in development and operations — with the greatest coherence to all our key customers. We will plan across the company, so we can better deliver compelling integrated devices and services for the high-value experiences and core technologies around which we organize. This new planning approach will look at both the short-term deliverables and long-term initiatives needed to meet the shipment cadences of both Microsoft and third-party devices and our services.

…

How We Work

The final piece of the puzzle is how we work together and what characteristics this new Microsoft must embody. There is a process element and a culture element to discuss.

Process wise, each major initiative of the company (product or high-value scenario) will have a team that spans groups to ensure we succeed against our goals. Our strategy will drive what initiatives we agree and commit to at my staff meetings. Most disciplines and product groups will have a core that delivers key technology or services and then a piece that lines up with the initiatives. Each major initiative will have a champion who will be a direct report to me or one of my direct reports. The champion will organize to drive a cross-company team for success, but my whole staff will have commitment to the initiative’s success. We will also have outgrowths on those major initiatives that may involve only a single product group. Certainly, succeeding with mobile devices, Windows, Office 365 and Azure will be foundational. Xbox and Bing will also be key future contributors to financial success. Our focus on high-value activities — serious fun, meetings, tasks, research, information assurance and IT/Dev workloads — also will get top-level championship.

Culturally, our core values don’t change, but how we express them and act day to day must evolve so we work together to win. The keys are the following:

Nimble

In a world of continuous services, the timeframe for product releases, customer interaction and competitive response is dramatically shorter. As a company, we need to make the right decisions, and make them more quickly, balancing all the customer and business imperatives. Each employee must be able to solve problems more quickly and with more real-time data than in the past.

Communicative

In the new, rapid-turn world, we need to communicate in ways that don’t just exchange information but drive agility, action, ownership and accountability.

Collaborative

Collaborative doesn’t just mean “easy to get along with.” Collaboration means the ability to coordinate effectively, within and among teams, to get results, build better products faster, and drive customer and shareholder value.

Decisive

As a global company with literally billions of diverse customers in an accelerating business environment, we must have a clear strategic direction but also empower employees closest to the customer to make decisions in service of the larger mission. This is tricky in a big company, but it is the key to higher levels of productivity, growth and customer satisfaction.

Motivated

In our industry, every day brings more challenges and more opportunities than the day before. But we have a unique chance to make the lives of billions of people better in fundamental ways. This should inspire all of us — those who love making products and services, those who love engaging with customers, and those who love planning and running our company in the most effective way possible. We want people who get up each morning excited to make Microsoft better — that’s how we come closer to fulfilling the potential of all people around the globe.

Our leadership team has discussed these cultural aspects a lot and is committed. In my own staff meetings, we are modeling these new characteristics yet also find ourselves occasionally slipping back. One strategy, united together, with great communication, decisiveness and positive energy is the only way to fly.

From Steve Ballmer and Microsoft Senior Leadership Team: One Microsoft Conference Call [Microsoft News Center, July 11, 2013]

In order to execute then on this one Microsoft strategy, we’re organizing by discipline and by engineering area.

Of course, at the end of the day, we have to deliver great products, a great family of devices and services and experiences that help people realize high-value activities.

So we will have teams that function across the company and across engineering areas to deliver on a high-value experience or device type like Windows, which literally has engineering content already today from our entire company, and involvement from a variety of innovation partners.

So we have the notion today that teams work across the company. That’s fundamental. But we’ll formalize, we’ll organize by discipline, and we’ll have product champions who bring together our cross-company teams to deliver our core products and high-value scenarios.

…

RICHARD WATERS, Financial Times: Thank you. Hello. Does this mean that senior managers won’t have direct profit/loss account responsibility that they might have had before? And, if so, how are you going to hold people accountable, and what kind of measures are you going to use; what kind of incentives and measures are actually going to make this new senior management team work?

STEVE BALLMER: Suffice it to say, the level of accountability we all feel for the success of the company rises when we all have to look at the company’s integrated profitability. I’ll let Amy talk a little bit about sort of the concepts. I don’t know that we’ll go into the specifics, but the concepts in terms of how we’re thinking. And there are pieces, obviously, that will have to have attention.

When it comes time to how we’re doing with our consulting business, which is a multibillion dollar business that doesn’t get discussed much, I think we’re all pretty clear. Kevin is on point. He thinks about it. He lives it. He eats it. He breathes it. He sleeps it every day. And I sleep well knowing that. There will be pieces, but I think the problem we’ve had in a sense — not the problem, but the opportunity we have — is if you subdivide the thing into too fine a set of parts you don’t think about your R&D investments as a general corporate resource that should be repurposed and used very broadly. It’s my resources, my business, and so this notion even from a P&L and resourcing perspective of getting to a one Microsoft strategy is very important, and yet we need to have strong financial accountability, and maybe Amy can talk about that.

AMY HOOD: Yes, I would not say that I wouldn’t necessarily associate this new org chart to any reduction in accountability from a financial perspective. I think we have always thought about personal accountability around this table to product success. And I think that will not change in the new organizational structure. Steve’s used words like that already. I think whether we call it accountability or a P&L or financial accountability, it will still remain just as it has in the past.

In such a setup Julie Larson-Green’s group will have an absolutely critical place to succeed with Microsoft powered or pure Microsoft devices on the market. Would Larsen-Green up to that task? What follows below is all the necessary evidence to judge for yourself:

Interview: Windows President Julie Larson-Green [ABC News, Nov 13, 2012]

From Operating Segments of the 2012 [FY12] Annual Report:

Windows & Windows Live Division (“Windows Division”) develops and markets PC operating systems, related software and online services, and PC hardware products. … approximately 75% of total Windows Division revenue comes from Windows operating system software purchased by original equipment manufacturers (“OEMs”), which they pre-install on equipment they sell. In addition to PC market volume changes …

Principal Products and Services: Windows 7 operating system; Windows Live suite of applications and web services; and PC hardware products. …

From Note 21 – Segment Information and Geographic Data of the Notes to Financial Statements of the 2012 Annual Report:

(In millions) FY12 FY11 FY10 Revenue: $ 18,818 $ 18,787 $ 18,789 Operating Income: $ 11,908 $ 11,971 $ 12,193

Windows 8 Charms Developers with New Touch Experiences [WindowsVideos YouTube channel, Sept 13, 2011]

More to view from Julie Larson-Green: Microsoft Reimagines Windows, Presents Windows 8 Developer Preview [WindowsVideos YouTube channel, Sept 13, 2011]

Interview with Julie Larson-Green about Office 2007 and Windows 7 [BryZad YouTube channel, Nov 21, 2009]

D6 Conference Windows 7 Multi Touch Keynote Demo [AllTingsD, May 28, 2008]

Julie Larson-Green [Microsoft TCN –Awards and Recognitions, Feb 28, 2010]

2008 Outstanding Technical Leadership

In revamping the interface of Microsoft Office 2007, Larson-Green effected a paradigm shift in one of the company’s most successful products.

“At first, no one wanted to change Office dramatically,” says Julie Larson-Green, who was tasked with overseeing a reimagining of the product’s end-user interaction and overall experience in the fall of 2003. Larson-Green’s leadership of Microsoft Office 2007’s redesign, the most radical revamp in the product’s history, required immense courage and conviction, to which this award attests.

A specialist in user-interface design, Larson-Green began working with Office in 1997, when she program-managed FrontPage. She subsequently helmed UI design for Office XP and Office 2003, which had evolved into a large organization of carefully negotiated compromises among the application suite’s various programs. Although Office’s great success was based on customer familiarity, the Customer Experience Improvement Program was indicating that users, while basically happy with the product, were increasingly either unaware of (possibly redundant) functions among Office’s different programs or frustrated by the amount of training necessary to use an astonishingly complex set of commands, dialogs, and interaction modes.

After deciding that Office needed to be made easier to use, Larson-Green’s team arrived at the elegant solution of the browsable Ribbon (or Office Fluent user interface) and its contextual cousins that united the product’s common capabilities and ease of experimentation. “The breakthrough,” Larson-Green says, “arrived with contextualizing the user interface and realizing that all of the product’s features didn’t have to be present all the time.”

SELLING THE REDESIGN

As development of Office 2007 proceeded, Larson-Green was confronted with the equally formidable task of selling the redesign across Office’s various programs. “Our biggest challenge,” she says, “was convincing people that we had an idea that would work.” Heavily invested in the earlier version, the Word, Excel, Outlook, and other organizations were initially reluctant to relegate control to an umbrella design team. Even more significant, Larson-Green had decided not to compromise the integrity of Office 2007 with the safety net of a “classic mode.”

It’s difficult to change the direction of a large organization at the best of times. It’s even more difficult when the goal is still incomplete. Larson-Green’s ability to argue her vision without necessarily being able to address myriad objections in detail is a remarkable trait in a data-driven culture such as Microsoft’s. One by one, however, the suite’s principals bought into the design as it was being tested and fleshed out.

Office 2007 shipped to nearly universal critical acclaim in January 2007, and Larson-Green was promoted to corporate vice president of program management for the Windows Experience. As with Office 2007, she plans to identify and solve customer problems, which will in turn drive a new design and its subsequent engineering. “In the old world,” she notes, “coding would start and design would kind of evolve with the coding.”

COLLABORATIVE EFFORTS