Home » Posts tagged 'smartphones'

Tag Archives: smartphones

Microsoft and partners to capitalize on Continuum for Phones instead of the exited Microsoft phone business

With The Nokia phone business is to be relaunched via a $500M private startup with Android smartphones and tablets in addition to the feature phones for which manufacturing, sales and distribution, would be acquired from Microsoft by a subsidiary of Foxconn published on this same ‘Experiencing the Cloud’ blog on May 20, 2016 I now dare to publish this follow-up post to the original message which was already available on October 13, 2015 under the title “Windows 10 enhancements for tablets and phones to achieve a powerful PC experience” (that original content see in the final part of this post) and with a statement for the start:

These are significant capabilities with which (although not only with these but with quite a number of other innovations) Microsoft—first time in its history—was able to beat Apple in its own game. You couldn’t believe it?

Unfortunately I’d felt a growing uncertainty about the future of the Microsoft Device business and therefore decided to wait till the picture gets clear. With the following Terry Myerson video appearing on the HP Business YouTube channel I’ve now felt certain to make the original information available in this curent post:

June 2, 2016: HP Elite x3 and Windows 10: Terry Myerson

http://www.hp.com/go/elitex3 –Terry Myerson, Executive Vice President at Microsoft, talks about the collaboration between HP and Microsoft that brings to life the new HP Elite x3 with Windows 10 for business, pioneer in the 3-in-1 category.

My certainty was also supported by the Microsoft decision to exit the phone business as it had been acquired from Nokia:

May 25, 2016: Microsoft announces streamlining of smartphone hardware business

Microsoft Corp. on Wednesday announced plans to streamline the company’s smartphone hardware business, which will impact up to 1,850 jobs. As a result, the company will record an impairment and restructuring charge of approximately $950 million, of which approximately $200 million will relate to severance payments.

“We are focusing our phone efforts where we have differentiation — with enterprises that value security, manageability and our Continuum capability, and consumers who value the same,” said Satya Nadella, chief executive officer of Microsoft. “We will continue to innovate across devices and on our cloud services across all mobile platforms.”

Microsoft anticipates this will result in the reduction of up to 1,350 jobs at Microsoft Mobile Oy in Finland, as well as up to 500 additional jobs globally. Employees working for Microsoft Oy, a separate Microsoft sales subsidiary based in Espoo, are not in scope for the planned reductions.

As a result of the action, Microsoft will record a charge in the fourth quarter of fiscal 2016 for the impairment of assets in its More Personal Computing segment, related to these phone decisions.

The actions associated with today’s announcement are expected to be substantially complete by the end of the calendar year and fully completed by July 2017, the end of the company’s next fiscal year.

More information about these charges will be provided in Microsoft’s fourth-quarter earnings announcement on July 19, 2016, and in the company’s 2016 Annual Report on Form 10-K.

In addition to the following sentence in the previous Microsoft selling feature phone business to FIH Mobile Ltd. and HMD Global, Oy press release on May 18, 2016:

Microsoft will continue to develop Windows 10 Mobile and support Lumia phones such as the Lumia 650, Lumia 950 and Lumia 950 XL, and phones from OEM partners like Acer, Alcatel, HP, Trinity and VAIO.

That last statement was not enough for me at that time, just 3 weeks ago as I had a truly shocking experience with upgrading my wife’s Lumia 640 XL to the Windows 10 Mobile version which had been released for that type of earlier Lumia phones last March. The software was so much buggy that I had’seen in my life any time before. I’d got so much angry that immediately bought an Android based Samsung Galaxy J5 for her. However, I became again confident in the future of Window 10 Mobile based phones after her bad experience with that Android software in terms of functionality (e.g. too many steps needed for some vital functions vs. that needed on Lumia) and the success of restoring the earlier 8.5 release on the 640 XL.

Several other videos which appeared on the same HP Business YouTube channel a little earlier gave me the final assurance:

May 27, 2016: HP Elite x3 turned heads at Mobile World Congress 2016

http://www.hp.com/go/elitex3 -HP Elite x3 made a powerful first impression at Mobile World Congress 2016 in Barcelona, winning 24 awards and positive reviews from industry experts. Meet the new HP Elite x3 the one device that’s every device.

June 2, 2016: Reinventing mobility: Dion Weisler

http://www.hp.com/go/elitex3 -Dion Weisler President and Chief Executive Officer for HP Inc. introduces to the revolution of mobility. Meet the new HP Elite x3 pioneer in the 3-in-1 category; the next generation of computing, designed specifically for business.

June 2, 2016: The new HP Elite x3: Michael Park

http://www.hp.com/go/elitex3 –Michael Park, Vice President for Commercial Mobility & Software division at HP Inc., introduces the new HP Elite x3, pioneer in the 3-in-1 category that will transform business mobility.

June 2, 2016: HP Elite x3 and Qualcomm: Steve Mollenkopf

http://www.hp.com/go/elitex3 -Steve Mollenkopf, Chief Executive Officer of Qualcomm Incorporated, presents the power of Snapdragon 820 processor in HP Elite x3, as part of the recent collaboration with HP. Meet the new HP Elite x3, pioneer in the 3-in-1 category; the next generation of computing, designed specifically for business.

Now a brief retrospective for the start:

From the full text of Q&A part of the Transcript of Microsoft Nokia Transaction Conference Call: Steve Ballmer, Stephen Elop, Brad Smith, Terry Myerson, Amy Hood; September 3, 2013 [Microsoft, Sept 3, 2013]

OPERATOR: Walter Pritchard, Citigroup, your line is open.

WALTER PRITCHARD: Great. Thanks for taking the question. Steve Ballmer, on the tablet side, obviously, we could say many of the same things as you’ve put into this slide deck as rationale for doing an acquisition on the phone side as we could say about the tablet side including picking up more gross margin.I’m wondering how this transaction impacts the strategy going forward in tablets and whether or not you need to, in a sense, double down further on first-party hardware in the tablet market. And then just have one follow up.

STEVE BALLMER: Okay. Terry, do you want to talk a little bit about that? That would be great.

TERRY MYERSON: Well, phones and tablets are definitely a continuum. You know, we see the phone products growing up, the screen sizes and the user experience we have on the phones. We’ve now made that available in our Windows tablets, our application platform spans from phone to tablet. And I think it’s fair to say that our customers are expecting us to offer great tablets that look and feel and act in every way like our phones. We’ll be pursuing a strategy along those lines.

More information: Microsoft answers to the questions about Nokia devices and services acquisition: tablets, Windows downscaling, reorg effects, Windows Phone OEMs, cost rationalization, ‘One Microsoft’ empowerment, and supporting developers for an aggressive growth in market share ‘Experiencing the Cloud’, September 4, 2013

From the Microsoft Q4 2015 Earning Call Transcript by CEO Satya Nadella on July 21, 2015:

I am thrilled we are just days away from the start of Windows 10. It’s the first step towards our goal of 1 billion Windows 10 active devices in the fiscal year 2018. Our aspiration with Windows 10 is to move people from meeting to choosing to loving Windows. Based on feedback from more than 5 million people who have been using Windows 10, we believe people will love the familiarity of Windows 10 and the innovation. It’s safe, secure, and always up to date. Windows 10 is more personal and more productive with Cortana, Office, universal apps, and Continuum. And Windows 10 will deliver innovative new experiences like Inking on Microsoft Edge and gaming across Xbox and PCs, and also opens up entirely new device categories such as Hololens.

From Windows 10 available in 190 countries as a free upgrade Microsoft news release on July 28, 2015:

Windows 10 is more personal and productive, with voice, pen and gesture inputs for natural interaction with PCs. It’s designed to work with Office and Skype and allows you to switch between apps and stay organized with Snap and Task View. Windows 10 offers many innovative experiences and devices, including the following:

- Cortana, the personal digital assistant, makes it easy to find the right information at the right time.

- New Microsoft Edge browser lets people quickly browse, read, and mark up and share the Web.

- The integrated Xbox app delivers the Xbox experience to Windows 10, bringing together friends, games and accomplishments across Xbox One and Windows 10 devices.

- Continuum optimizes apps and experiences beautifully across touch and desktop modes.

- Built-in apps including Photos; Maps; Microsoft’s new music app, Groove; and Movies & TV offer entertainment and productivity options. With OneDrive, files can be easily shared and kept up-to-date across all devices.

- A Microsoft Phone Companion app enables iPhones, Android or Windows phones to work seamlessly with Windows 10 devices.

- The all new Office Mobile apps for Windows 10 tablets are available today in the Windows Store.4 Built for work on-the-go, the Word, Excel and PowerPoint apps offer a consistent, touch-first experience for small tablets. For digital note-taking needs, the full-featured OneNote app comes pre-installed with Windows 10. The upcoming release of the Office desktop apps (Office 2016) will offer the richest feature set for professional content creation. Designed for the precision of a keyboard and mouse, these apps will be optimized for large-screen PCs, laptops and 2-in-1 devices such as the Surface Pro.

More information around the above 2 excerpts:

Windows 10 is here to help regain Microsoft’s leading position in ICT ‘Experiencing the Cloud’, July 31, 2015

From 2015 Annual Report>The ambitions that drive us on July 31, 2015:

Create more personal computing

Windows 10 is the cornerstone of our ambition to usher in an era of more personal computing. We see the launch of Windows 10 in July 2015 as a critical, transformative moment for the Company because we will move from an operating system that runs on a PC to a service that can power the full spectrum of devices in our customers’ lives. We developed Windows 10 not only to be familiar to our users, but more safe and secure, and always up-to-date. We believe Windows 10 is more personal and productive, working seamlessly with functionality such as Cortana, Office, Continuum, and universal applications. We designed Windows 10 to foster innovation – from us, our partners and developers – through experiences such as our new browser Microsoft Edge, across the range of existing devices, and into entirely new device categories.

…

Our future opportunity

There are several distinct areas of technology that we aim to drive forward. Our goal is to lead the industry in these areas over the long-term, which we expect will translate to sustained growth. We are investing significant resources in:

- Delivering new productivity, entertainment, and business processes to improve how people communicate, collaborate, learn, work, play, and interact with one another.

- Establishing the Windows platform across the PC, tablet, phone, server, other devices, and the cloud to drive a thriving ecosystem of developers,unify the cross-device user experience, and increase agility when bringing new advances to market.

- Building and running cloud-based services in ways that unleash new experiences and opportunities for businesses and individuals.

- Developing new devices that have increasingly natural ways to interact with them, including speech, pen, gesture, and augmented reality holograms.

- Applying machine learning to make technology more intuitive and able to act on our behalf, instead of at our command.

January 14, 2016: Continuum for Phones: Making the Phone Work Like a PC by Keri Moran / Principal Program Manager Lead

Imagine having a phone that works like a PC. Continuum for Phones makes this a reality, enabling Windows customers to get things done like never before.

Check out the ways this capability comes alive. You’ll be able to travel and leave your laptop at home, knowing you’re still equipped to complete your most common tasks. Walk into a meeting with just your smartphone – you’re fully equipped for seamlessly projecting PowerPoint presentations to a larger screen. Or take a seat in a business center where you plug your phone into a monitor and keyboard – you’ve instantly gained PC-like productivity using Office apps and the Microsoft Edge browser.

How it all started

The road to Continuum began three years ago with a simple observation: we take our phones everywhere, we depend on them, and we feel lost without them. Yet, when the time comes to do “real work,” we reach for a laptop or desktop PC. So we end up carrying our phones plus our laptops, or we wait until we are at our desks to do the heavy lifting.

The thing is, today’s phones have more than enough processing power to handle our most common tasks and activities. We knew this was especially true in emerging markets where people rely only on their mobile phones to get online. So — with these thoughts top of mind — we set out on our mission to help people get real work done with just their phone.

Who are we? We are the small team of people who built Continuum for Phones with a passion to change the future of personal productivity.

What people want

We started by talking to customers to understand what they needed. We spoke to people around the globe – from Chicago to Shanghai – and found that most people wanted the same thing: a phone that did more. Here are the main insights from the research:

- “My most important device”: people universally describe their smartphone as the center of their connected life.

- Connect to a bigger screen: people rely on their laptops and desktops because their phone lacks a large screen, keyboard and mouse. They want to easily connect to larger screens for both work and entertainment.

- Tech-savvy people expect more: as the processing power of phones has risen, so has the expectations of the tech-savvy.

- Many people around the world don’t have PCs: because they can’t afford a PC, people have a TV and a phone and that’s it. So any computing work gets done on their phone.

We realized that people embraced the idea of having a phone that could work like a PC.

Getting it done

So we started building Continuum, and we soon realized that we faced many technical and design challenges.

For example, there were two paradigms for connecting to a second screen: (1) mirroring your phone’s screen to a larger screen or (2) connecting your PC to multiple monitors. We needed to create a new design paradigm with two independent experiences – one on the phone and a separate one on the second screen. This was important because customers wanted to continue to use their phone as a phone, even while having a PC-like experience on the second screen. We spent months iterating with paper and software prototypes to arrive at an experience that was easy to understand and use.

The technical hurdles were just as big. For example, we had to build support for keyboard and mouse into Windows 10 Mobile. And many substantial architecture changes were needed in Windows to make Continuum work.

At the //Build conference in April 2015, we did our first live demo, and at the Windows 10 launch in July, we showed the full power of a phone running Office* apps on a second screen. The response – which exceeded our expectations — motivated us to keep going, working relentlessly with hundreds of colleagues around the world to deliver an integrated solution that required major changes to Windows, new capabilities in the phones, and creation of docks such as the Microsoft Display Dock.

Announcing Continuum

So, with the debut of Continuum for Phones, you really can have something new in your pocket: a smartphone that has the power and ability to work like a PC. In the words of our CEO Satya Nadella: “This is the beginning of how we are going to change what the form and function of a phone is.”

Right now, this means that you can carry a smartphone – like the new Lumia 950 and Lumia 950XL – and use a small dock or wireless dongle to connect it to a keyboard, mouse and monitor for a familiar PC-like experience. Run Office* apps, browse the Web, edit photos, write email, and much more.

While you’re working on the larger screen, you won’t lose your phone’s unique abilities. Continuum multi-tasks flawlessly so you can keep using your phone as a phone for calls, emails, texts, or Candy Crush. Or if you don’t have a mouse, you can use your phone as the trackpad for the apps on the larger screen.

If you share my enthusiasm for Continuum for Phones, please check out all the details, including multiple usage scenarios, at windows.com.

* App experience may vary. Office 365 subscription required for some Office features.

June 4, 2016 snapshot: New features coming soon to Windows 10 Anniversary Update

This year’s Windows 10 Anniversary Update will have great new innovative features including:1

The pen just got even mightier.

Turn thoughts into action with Windows Ink – using the pen, your fingertip, or both at once.2 Pair it with Office apps to effortlessly edit documents. With Windows Ink, you’ll be able to access features like Sticky Notes with a simple click of the pen.3 When you start drawing a figure like a chart or graph, it’ll turn into the real thing right before your eyes. And because Windows Ink stays active when your device is locked, you’ll be able to jot down notes even when you don’t have time to enter a password.

Cortana’s got you covered.

No time to enter your password but need some quick help? No problem — just ask. Cortana4 will now be at your service, even before you login. Whether you want to make a note, play music or set a reminder, Cortana will have you covered.

The secret password is: you.

With Windows Hello, unlocking your PC and devices is as quick as looking or touching.5 But the new Windows Hello will also let you unlock your PC simply by tapping your Windows Hello enabled phone.6 Beyond the hardware, Windows Hello will also give you instant access to paired apps and protected websites on Microsoft Edge – all while maintaining enterprise-level security. Windows Hello lets you say goodbye to cumbersome passwords.

Got game? We’ll deliver.

Windows 10 will deliver incredible DirectX 12 games and Xbox Live features that will transform what you expect from PC gaming. Now you can play and connect with gamers across Xbox One and Windows 10 devices. From the best casual games to the next generation of PC releases, you’ll have more ways to play new games optimized for Windows.7

Windows 10 will deliver incredible DirectX 12 games and Xbox Live features that will transform what you expect from PC gaming. Now you can play and connect with gamers across Xbox One and Windows 10 devices. From the best casual games to the next generation of PC releases, you’ll have more ways to play new games optimized for Windows.7

And that’s not all: Microsoft Studios is bringing a full portfolio of new games to Windows 10, including the forthcoming Forza Motorsport 6: Apex, which will be freefor Windows 10 users.

Ongoing progress reports (only two latest ones are summarised here):

June 1, 2016: Announcing Windows 10 Mobile Insider Preview Build 14356

- Cortana Improvements:

– Get notifications from your phone to your PC

– Send a photo from your phone to PC

– New listening animation

May 26, 2016: Announcing Windows 10 Insider Preview Build 14352

- Cortana Improvements:

– Cortana, Your Personal DJ

– Set a timer - Windows Ink:

– Updated Sticky Notes

– Compass on the ruler

– General improvements to the Windows Ink experience - Other items of note:

– Windows Game bar improved with full-screen support

– Feedback Hub will now show Microsoft responses

– Updated File Explorer icon

– Deploying Windows Enterprise edition gets easier

– Limited Period Scanning

– Introducing Hyper-V Containers (ADDED 5/31)

For more information see: https://blogs.windows.com/windowsexperience/tag/windows-insider-program/

Particularly relevant recent information from A change in leadership for the Windows Insider Program on June 1, 2016 by Gabe Aul / Corporate Vice President, Engineering Systems Team:

Since we first started the Windows Insider Program back in September 2014, Windows Insiders have helped us ship Windows 10 to over 300 million devices. We have released 35 PC builds and 22 Mobile builds to Insiders to date. This is a huge change from Windows 7 and Windows 8 which only had 2 and 3 public pre-release builds respectively. Windows Insiders have been more directly plugged in to our engineering processes for Windows than ever before, including participating in our first ever public Bug Bash this year. Windows Insiders contribute problem reports and suggestions which help us shape the platform, and are currently helping us get ready to ship the next major update to Windows 10 this summer – the Windows 10 Anniversary Update. This is just the beginning of the journey we’re on though. We really appreciate having such an amazing connection with our customers, and want Windows Insiders to continue to help shape Windows releases for years to come. With that in mind, I want to talk about a change to the Windows Insider Program going forward.

When I was introduced as leader of the Windows Insider Program over 18 months ago, I was responsible for the team that built our feedback and flighting systems for Windows. It made sense for me to be on the front lines talking with customers of the systems that my team was building to get Insider Preview Builds out and hear the feedback rolling in. In August of last year, I changed jobs to work on the Engineering Systems Team in WDG. In this role, I am responsible for the tools our engineers use to build Windows, including our planning and work management systems, source code management, build infrastructure, and test automation systems. …

…

Meet Dona Sarkar

I have worked with Dona for many years and think she is the perfect person to guide the Windows Insider Program forward. Her technical expertise, passion for customers, and commitment to listening to feedback is unmatched. …

…

You can follow Dona here on Twitter. Please welcome her as the new leader of the Windows Insider Program!

Get to know more about Dona here from Microsoft Stories!

…

Finally more as well as historic information on this subject which I’d originally put together on October 13, 2015 and intended to publish under the title:

Windows 10 enhancements for tablets and phones to achieve a powerful PC experience

These are significant capabilities with which (although not only with these but with quite a number of other innovations) Microsoft—first time in its history—was able to beat Apple in its own game. You couldn’t believe it?

First watch these two very short videos from CNNMoney presenting Microsoft’s “ultimate laptop” in terms of its device innovations:

Hands-on with Microsoft Surface Book

See Microsoft’s reversible laptop in :60

Then follow with the below information which is presenting one the most important Windows 10 software innovations, called Continuum (Continuum tablet mode for touch-capable devices) which makes that “ultimate laptop” an “ultimate tablet” as well.

Then get acquainted with a similar Windows 10 software innovation, called Continuum for Phones (it is rather for Mobile devices) which is allowing an entry level tablet or a premium phone to become a true PC with an extension to an external large size display after docking to it.

Note that while the “ultimate laptop/ultimate tablet” hybrid is for the premium client market, the second one is targeted at the entry level emerging markets as well. In that scenario Microsoft is hoping to capitalize on the availability of extremely low-cost tablets which could be enhanced to a PC-like experience with Continuum for Phones. When coupled with a similarly low-priced Windows 10 phone the emerging market user will have 2 devices for around $200 and a consistent Windows 10 experience easily dockable to a large size display, and with that easily achieving a true PC experience.

Suggested other information:

– July 30, 2015: Docking – Windows 10 hardware dev, Microsoft Hardware Dev Center

– March 28, 2015: Display – Windows 10 hardware dev, Microsoft Hardware Dev Center

– March 28, 2015: Graphics – Windows 10 hardware dev, Microsoft Hardware Dev Center

Continuum tablet mode for touch-capable devices

The Continuum feature of Windows 10 desktop edition adapts between tablet and PC modes when docking/undocking. More generally: “Continuum is available on all Windows 10 desktop editions by manually turning “tablet mode” on and off through the Action Center. Tablets and 2-in-1s with GPIO indicators or those that have a laptop and slate indicator will be able to be configured to enter ‘tablet mode’ automatically.” Source: Windows 10 Specifications, Microsoft, June 1, 2015

May 4, 2015: Continuum For Windows 10 PCs and Tablets At Microsoft Ignite Event 2015

June 12, 2015: Continuum Overview – Windows 10 hardware dev, Microsoft Hardware Dev Center

Continuum is a new, adaptive user experience offered in Windows 10 that optimizes the look and behavior of apps and the Windows shell for the physical form factor and customer’s usage preferences. This document describes how to implement Continuum on 2-in-1 devices and tablets, specifically how to switch in and out of “tablet mode.”

Tablet Mode is a feature that switches your device experience from tablet mode to desktop mode and back. The primary way for a user to enter and exit “tablet mode” is manually through the Action Center. In addition, OEMs can report hardware transitions (for example, transformation of 2-in-1 device from clamshell to tablet and vice versa), enabling automatic switching between the two modes. However, a key promise of Continuum is that the user remains in control of their experience at all times, so these hardware transitions are surfaced through a toast prompt that must be confirmed by the user. The users also has the option to set the default response.

Target Devices

Tablets Detachables Convertibles Pure tablets and devices that can dock to external monitor + keyboard + mouse. Tablet-like devices with custom designed detachable keyboards. Laptop-like devices with keyboards that fold or swivel away. When the device switches to tablet mode, the following occur:

- Start resizes across the entire screen, providing an immersive experience.

- The title bars of Store apps auto-hide to remove unnecessary chrome and let content shine through.

- Store apps and Win32 apps can optimize their layout to be touch-first when in Tablet Mode.

- The user can close apps, even Win32 apps, by swiping down from the top edge.

- The user can snap up to two apps side-by-side, including Win32 apps, and easily resize them simultaneously with their finger.

- The taskbar transforms into a navigation and status bar that’s more appropriate for tablets.

- The touch keyboard can be auto-invoked.

Of course, even in “tablet mode”, users can enjoy Windows 10 features such as Snap Assist, Task View and Action Center. On touch-enabled devices, customers have access to touch-friendly invocations for those features: they can swipe in from the left edge to bring up Task View, or swipe in from the right edge to bring up Action Center.

With “tablet mode”, Continuum gives customers the flexibility to use their device in a way that is most comfortable for them. For example, a customer might want to use their 8” tablet in “tablet mode” exclusively until they dock it to an external monitor, mouse, and keyboard. At that point the customer will exit “tablet mode” and use all their apps as traditional windows on the desktop—the same way they have in previous versions of Windows. Similarly, a user of a convertible 2-in-1 device might want enter and exit “tablet mode” as they use their device throughout the day (for example, commuting on a bus, sitting at a desk in their office), using signals from the hardware to suggest appropriate transition moments.

Imagine the overall smoothness of that combined laptop and tablet experience on the brand new Microsoft Surface Book announced just on October 6, 2015. Out of a plethora of videos reporting on that new device with quite an entusiasm I’ve selected the one which—in my view—just right with its judgement and very concise at the same time.

Surface Book hands-on: Microsoft’s first laptop is simply amazing by Mark Hachman, senior editor of the PCWorld: “No one expected the Surface Book, and what they got was a true flagship for the Windows ecosystem.“

And if you don’t need the leading edge ultrabook performance provided by the clever, “more power (GPU, longer batery life …) is in the detachable keyboard part” design of the Surface Book, then the 4th generation Surface Pro 4 may be more than sufficient for you to provide a state-of-the-art productivity work capability, including the best of the pen computing available on the market (which is also on the Surface Book, you could notice the same pen in the previous video), in addition to a new type cover for the tablet part. Here again the same source has been the best to present all that.

Surface Pro 4: Hands on with Microsoft’s category-creating productivity tablet by Mark Hachman, senior editor of the PCWorld

Continuum for phones

With Continuum for phones in Windows 10 Mobile edition, connecting a phone enables a screen to become like a PC. Additionally: “Continuum for phones limited to select premium phones at launch. External monitor must support HDMI input. Continuum-compatible accessories sold separately. App availability and experience varies by device and market. Office 365 subscription required for some features.” Source: Windows 10 Specifications, Microsoft, June 1, 2015

April 29, 2015: As part of the Universal Windows Platform Microsoft shared at Build 2015 how apps can scale using Continuum for phones, enabling people to use their phones like PCs for productivity or entertainment. With that your phone app can start using a full-sized monitor, mouse, and keyboard, giving you even more mileage from your universal app’s shared code and UI.

April 29, 2015: Windows Continuum for Phones See how new Windows Continuum functionality for mobile phones tailors the app experience across devices to transform a phone into a full-powered PC, TV or a Smart TV

May 4, 2015: Continuum For Windows 10 For Phones At Microsoft Ignite Event 2015

![IC830854[1]](https://lazure2.wordpress.com/wp-content/uploads/2015/10/ic8308541.png?w=960) 7″ Tablet 7″ Tablet[Sept 17, 2015] |

![IC830852[1]](https://lazure2.wordpress.com/wp-content/uploads/2015/10/ic8308521.png?w=960) Premium Phone Premium Phone[March 29, 2015] |

||

Key Features |

Low costCortanaContinuum for Phones |

CortanaWindows HelloContinuum for Phones |

|

Operating System |

Windows 10 Mobile |

Windows 10 Mobile |

|

Recommended Components |

CPU |

Supported entry SoC |

Supported premium SoC |

RAM/Storage |

1-2GB/8-32GB eMMC w/SD card |

2-4GB / 32-64GB with SD slot |

|

Display |

7” 480×800 or 1280×720 w/touch |

4.5-5.5”+ / FHD-WQHD |

|

Dimensions |

<9mm & <.36kg |

<7.5mm & <160g |

|

Battery |

10+ hours |

2500+ mAh ( 1 day active use) |

|

Connectivity |

802.11ac+, 1 micro USB 2.0, mini HDMI, BT, LTE option |

LTE/Cat 4+ /802.11b/g/n/ac 2×2, USB, 3.5mm jack, BT LE, NFC |

|

Audio/Video/ Camera+ |

Front camera, speakers, headphones |

20MP with OIS/Flash; 5MP FFC |

|

Oct 6, 2015: Windows 10 Continuum for Phones demo on Lumia 950 and Lumia 950 XL by Bryan Roper, Microsoft marketing manager, at Microsoft Windows 10 Devices Event 2015

Tablet and smartphone market trends

September update: Qualcomm’s smartphone AP revenues declined 17% year-over-year in the second quarter of 2015, Strategy Analytics estimated. Qualcomm maintained its smartphone AP market share leadership with 45% revenue share, followed by Apple with 19% revenue share and MediaTek with 18% revenue share. For the rest 18%: After a difficult 2014, Samsung LSI continued to recover and more than doubled its smartphone AP shipments in the second quarter of 2015 compared to the same period last year. Samsung LSI capitalised on its Galaxy S6 design-win in Q2 2015. In addition the company featured in multiple mid-range smartphones from Samsung Mobile. Full report: Smartphone Apps Processor Market Share Q2 2015: Samsung LSI Maintains Momentum

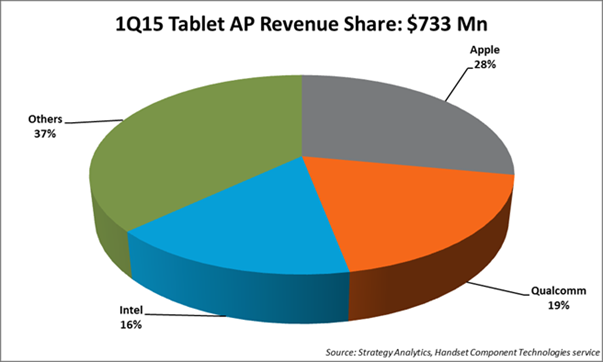

… The global tablet AP market declined 28% year-over-year to reach US$679 million in the second quarter of 2015, according to Strategy Analytics. Apple, Intel, Qualcomm, MediaTek and Samsung LSI captured the top-five revenue share rankings in the market during the quarter. Apple led the tablet AP market with 27% revenue share, followed by Intel with 18% revenue share. Qualcomm ranked number three, narrowly behind Intel. ![GT400150821[1]](https://lazure2.wordpress.com/wp-content/uploads/2015/08/gt4001508211.jpg?w=960) Full report: Tablet Apps Processor Market Share Q2 2015: Apple and Intel Maintain Top Two Spots

Full report: Tablet Apps Processor Market Share Q2 2015: Apple and Intel Maintain Top Two Spots

…

Digitimes Research saw global tablet shipments fall to 45.76 million units in second-quarter 2015, showing a 10% decrease on quarter and representing more than a 15% decrease on year. Full report: Global tablet market – 2Q 2015 End of September update

Investors.com comments on tablet and smartphone market trends — Q2’2015: 1. Apple, Samsung lose ground in tablet market — LG and Huawei gain

1. Apple, Samsung lose ground in tablet market — LG and Huawei gain

2. Apple, Huawei [and Xiaomi] buck slowing smartphone sales trend

As the commenting articles by Investors.com are based on press releases of 2 market research companies I will give the web reference here for those press releases themselves, as well as 3 other press releases not commented on by Investors.com (if there are trend indications in the press releases themselves I will copy them alongside the web reference):

- July 29, 2015: Worldwide Tablet Market Continues to Decline; Vendor Landscape is Evolving, According to IDC

“Longer life cycles, increased competition from other categories such as larger smartphones, combined with the fact that end users can install the latest operating systems on their older tablets has stifled the initial enthusiasm for these devices in the consumer market,” said Jitesh Ubrani, Senior Research Analyst, Worldwide Mobile Device Trackers. “But with newer form factors like 2-in-1s, and added productivity-enabling features like those highlighted in iOS9, vendors should be able to bring new vitality to a market that has lost its momentum.”

“Longer life cycles, increased competition from other categories such as larger smartphones, combined with the fact that end users can install the latest operating systems on their older tablets has stifled the initial enthusiasm for these devices in the consumer market,” said Jitesh Ubrani, Senior Research Analyst, Worldwide Mobile Device Trackers. “But with newer form factors like 2-in-1s, and added productivity-enabling features like those highlighted in iOS9, vendors should be able to bring new vitality to a market that has lost its momentum.” - July 30, 2015: Huawei Becomes World’s 3rd Largest Mobile Phone Vendor in Q2 2015 [says Strategy Analytics]

- Woody Oh, Director at Strategy Analytics, said, “… Smartphones accounted for 8 in 10 of total mobile phone shipments during the quarter. The 2 percent growth rate of the overall mobile phone market is the industry’s weakest performance for two years, due to slowing demand for handsets in China, Europe and the US.”

- Neil Mawston, Executive Director at Strategy Analytics, added, “… Samsung has stabilized volumes in the high-end, but its lower-tier mobile phones continue to face intense competition from rivals such as Huawei in Asia. … Apple outperformed as consumers in China and elsewhere upgraded to bigger-screen iPhone 6 and 6 Plus models.”

- Ken Hyers, Director at Strategy Analytics, added, “… Huawei is rising fast in all regions of the world, particularly China where its 4G models, such as the Mate7, are proving wildly popular. Huawei has finally overtaken Microsoft to become the world’s third largest mobile phone vendor for the first time ever.”

- Neil Mawston, Executive Director at Strategy Analytics, added, “Microsoft shipped 27.8 million mobile phones and captured 6 percent marketshare worldwide in the second quarter of 2015. Microsoft’s 6 percent global mobile phone marketshare is sitting near an all-time low. Microsoft continues to lose ground in feature phones, while its Lumia smartphone portfolio is in a holding pattern awaiting the launch of new Windows 10 models later this year. Xiaomi shipped 19.8 million mobile phones and captured 5 percent marketshare worldwide in Q2 2015. Xiaomi remains a major player in the China mobile phone market, but its local and international growth is slowing and Xiaomi is facing intense competition from Huawei, Meizu and others. As a result, Xiaomi may struggle to hold on to its top-five global mobile phone ranking in the coming quarters.”

- June 17, 2015: Business smartphones shipments in Q1 up 26% from last year, now 27% of total smartphone market [says Strategy Analytics]

Android was the most dominant OS in terms of business smartphone shipments in Q1, accounting for nearly 60% of all business smartphones (corporate- and personal-liable). It was also the dominant BYOD device; 68% of personal-liable shipments in Q1 were Android. Apple iOS accounted for only 27% of BYOD shipments in Q1, but was the dominant platform in terms of corporate-liable smartphones, with 48% of Q1 CL shipments. The difference in Android/iOS shipments between the CL and IL categories reflects the continuing corporate perception that iPhones are “safer” than Android-based devices.

Android was the most dominant OS in terms of business smartphone shipments in Q1, accounting for nearly 60% of all business smartphones (corporate- and personal-liable). It was also the dominant BYOD device; 68% of personal-liable shipments in Q1 were Android. Apple iOS accounted for only 27% of BYOD shipments in Q1, but was the dominant platform in terms of corporate-liable smartphones, with 48% of Q1 CL shipments. The difference in Android/iOS shipments between the CL and IL categories reflects the continuing corporate perception that iPhones are “safer” than Android-based devices.

- Shipments of personal-liable smartphones (i.e. “bring your own device,” or BYOD, phones) drove market growth in Q1

- Strategy analytics defines personal-liable devices as devices purchased by the end-user and expensed back to the company or organization, or devices purchased outright by individual users but used primarily for business purposes linking to corporate applications and backend systems.

- While personal liable devices dominate worldwide business smartphone shipments, some regions are more resistant to the BYOD trend than others. Such regions include Western Europe and Central Europe, where corporate-liable devices are the dominant types of business smartphones. In Western Europe in Q1, 61% of the 10 million business smart phones were corporate-liable. Central and Eastern Europe had a slightly higher rate of BYOD devices shipped in Q1 — 41% — but the majority of smartphones shipped in this regions was also corporate-liable. This a sharp contrast to North America, where three-quarters of business smartphone shipments are personal-liable. The trend in Western and Eastern Europe reflects the more corporate-centric approach businesses take to mobility in these regions.

- July 29, 2015: Mobile Broadband Tablet Subscriptions to Double to 200 Million by 2021, says Strategy Analytics

- Strategy Analytics forecasts global mobile data subscriptions on tablets will more than double from 2015 to 2021, reaching over 200 million

- Around the globe, over 100 million wireless connections on cellular enabled tablets will be added through 2021. By 2021 tablets will only account for 2 percent of total mobile subscriptions, a 2.7 percent population penetration rate.

- July 29, 2015: Intel Maintains Top Spot in Non-Apple Tablet Apps Processors in Q1 2015 says Strategy Analytics

⇒The global tablet applications processor (AP) market declined -6 percent year-over-year to reach $733 million in Q1 2015- According to Sravan Kundojjala, Associate Director, “Intel maintained its top spot in the non-Apple tablet AP market in unit terms in Q1 2015. Strategy Analytics estimate Android-based tablets accounted for over 70 percent of Intel’s total tablet AP shipments in Q1 2015. We expect Intel’s Atom X3 cellular tablet chip product line to help Intel maintain its momentum in the tablet AP market.”

- Stuart Robinson, Executive Director of the Strategy Analytics Handset Component Technologies (HCT) service added, “Strategy Analytics estimates that baseband-integrated tablet AP shipments accounted for over one-fourth of total tablet AP shipments in Q1 2015, helped by a strong push from Qualcomm, MediaTek and Spreadtrum. We expect continued momentum for integrated APs as Intel, Rockchip and others join the bandwagon.”

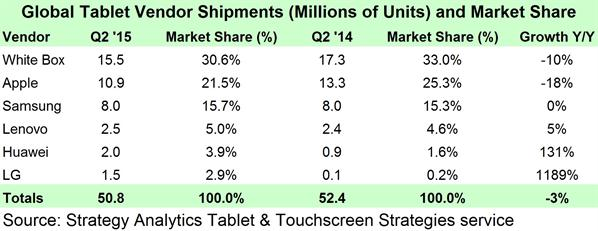

- July 30, 2015: Windows Tablet Shipments Nearly Double in Q2’15, says Strategy Analytics

⇒Global Tablet Shipments and Market Share in Q2 2015 (preliminary)

- Windows-branded Tablets comprised 9 percent of shipments in Q2 2015, up 4 points from Q2 2014

- Android-branded Tablet shipment market share was flat at 70 percent in Q2 2015

- Apple continued its slide in market share down to an all-time low of 21 percent in Q2 2015, 4 points lower than Q2 2014

- Vendors with strong 3G and LTE connected Tablet strategies such as Huawei, LG, and TCL-Alcatel gained market share as leaders like Apple, Samsung, and the White Box community lost ground

Tablet & Touchscreen Strategies Senior Analyst Eric Smith added, “Windows share continues to improve as more models become available from traditional PC vendors, White Label vendors, and Microsoft itself though a healthy Surface lineup and distribution expansion. The key going forward will be if the coming wave of 2-in-1 Detachable Tablets is a hit with consumers or if they go the way of the Netbook—we remain cautiously optimistic on this point.” |

Tablet & Touchscreen Strategies Service Director Peter King said, “Apple’s fortunes will turn around soon as it will launch the 12.9-inch iPad Pro as well as an iPad mini 4 in Q4 2015. New features in iOS 9, which are exclusive to iPad such as multi-tasking and a more convenient soft keyboard, will also help compel upgrades by owners of older iPad models. Meanwhile, Huawei and LG have posted fantastic growth primarily due to well-executed 3G and LTE connected Tablet strategies.” |

Then I will add 2 additional information pieces from Strategy Analytics:

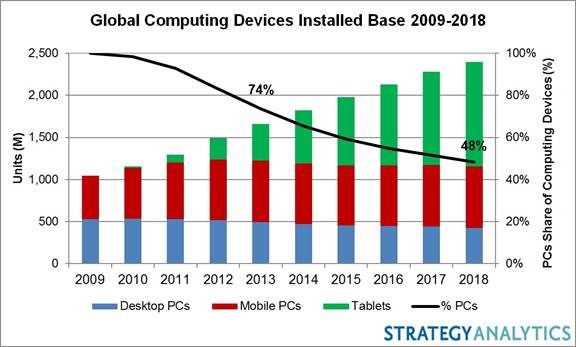

Oct 8, 2014: Replacement Demand to Boost PC Sales in 2015, says Strategy Analytics

Having experienced negative growth since 2012, global PC sales are expected to rise 5 percent in 2015 driven by replacement of an ageing installed base according to Strategy Analytics’ Connected Home Devices (CHD) service report, “Computers in the Post-PC Era: Growth Opportunities and Strategies.”

Click here for the report:

http://www.strategyanalytics.com/default.aspx?mod=reportabstractviewer&a0=10146

- PC sales will fall by 4 percent in 2014 before returning to modest growth in 2015 and beyond to support replacement demand.

- Strategy Analytics’ consumer research of computing device usage in developed markets indicates that PCs remain essential computing devices despite healthy Tablet sales.

- Frequent Tablet usage has grown by 22 percentage points from 2011 to Q4 2013 up to 32 percent of all households while frequent Mobile PC (excluding Tablets) usage has stayed steady through this period, as 63 percent of all households indicated they frequently used Mobile PCs.

- Frequent usage of all PCs (including Mobile and Desktop PCs and excluding Tablets) remained above the 90 percent mark of all households, falling only 3 percentage points during this period.

Eric Smith, Analyst of Connected Home Devices, said: “Multiple PC ownership is falling as Tablet sales supplant replacement demand for secondary PCs mainly used for casual tasks. Still, PCs will remain essential devices as households eventually replace their primary PCs used for productivity tasks such as spreadsheet and video editing or personal banking.”

David Watkins, Service Director, Connected Home Devices, added: “The modern Tablet user experience is quickly arriving on the PC thanks to more affordable 2-in-1 Convertible PCs and new operating systems which blend traditional PC and Tablet user experiences. We see development of these forces aligning perfectly with an older PC installed base ripe for replacement in 2015.”

May 1, 2015: Children Change Disney’s Digital Strategy: “App TV” Now Central To Content Planning by David Mercer

Multiscreen TV behaviour is at the centre of television’s stormy transformation – viewing of broadcast, linear TV on the TV screen is apparently in decline while consumption on smartphones and tablets is increasing. Making sense of the big picture is increasingly challenging, and legacy players like broadcasters and the major content owners are inevitably somewhat resistant to the idea that their traditional businesses are under serious threat.

We have monitored the early stages of this transformation for the past decade and see its results in our own research, and we continue to predict further industry disruption in our forecasts. But sometimes it is only when you hear the evidence given in person by a senior executive at a leading global player that the scale of the challenge and opportunity are finally brought home.

This happened at last week’s AppsWorld event in Berlin, where I chaired the TV and Multiscreen conference. The speaker was Andreas Peters, Head of Digital for the Walt Disney Company Germany, Austria and Switzerland. Andreas presented some of the most compelling evidence I have yet heard that television is truly a multiscreen medium for the next generation of viewers.

Disney’s challenge in Germany was to launch a television show called Violetta aimed at 8-12 year old girls. It had been introduced successfully in Argentina but had failed in the UK. As it often does, Disney had invested considerable amounts in merchandising and retailers were eagerly anticipating sales of the new product lines. The show was first broadcast on German free TV on May 1st 2014 but it achieved only very low ratings.

The question for Disney managers was whether traditional TV had stopped working. A crisis meeting was held with a view to writing off the investment. Disney had previously not made its shows available online in Germany but the Violetta situation was so serious they were persuaded to experiment. Two episodes were made available on Youtube with a link to Disney’s own website. Viewing of the content on Youtube very quickly went viral until Disney had achieved a reach of 50% of 8-12 year old girls and eight million views. Violetta went on to become a success in German-speaking markets.

The evidence was clear: for some shows at least, younger children cannot now be reached using the traditional broadcast TV/big screen model. Peters explained that the Violetta experience was transformative for the Disney organisation and led to the inclusion of online and digital media as a key element in the business case for many products. In fact it also led to the development and launch of Disney’s own Watch App, which includes live streaming and seven-day catch-up programmes from the broadcast Disney Channel.

Even after the Violetta experience Disney was sceptical that an app was needed – there was a feeling that the website would be sufficient. Nevertheless the app was launched and Disney had planned for 20,000 downloads. Instead it has passed one million downloads in its first six months. Peters noted: “This was a real shock for us. We completely underestimated the demand.” Around 500,000 viewers are now using the Disney Watch app for linear television viewing, in addition to millions of shows being downloaded for catch-up viewing. Peak app viewing hours are between 6am and 8am and then between 1pm and 9pm on school days, with a different pattern at weekends. Peters made it clear that children did not want lots of features built in to the app – just like TV, they just want to hit “play” and watch.

“Our TV colleagues of course don’t want to believe this,” said Peters. “But the world has changed and it will continue to change.” Disney has also seen a knock-on effect from its app launch with an increase in free-to-air broadcast TV viewing. But the firm is now clear that mobile is not just an add-on to TV or a promotional tool; it must be an integral part of the entire process.

There are many implications for content strategy. TV and Digital have to “understand each other”, which is a challenge when the KPIs in each world are very different. As we have often heard, the video industry is crying out for a set of common metrics which can apply and support advertisers in both TV and online worlds. Video consumption patterns vary and different content may be relevant to different platforms.

But the overall lesson is clear: “TV” is not just the big screen in the corner of the living room. It must embrace multiscreen distribution strategies in order to reach its maximum potential. TV companies are betraying their audiences and their investors if they don’t target the 6.4bn addressable screens available to them.

Intel is ready to push big in smartphones next year with its winning multimode voice and data, multiband LTE modem technology capable of global LTE roaming via a single SKU

To play it safe the chip is still produced by TSMC (as with Infineon bought in 2011 by Intel) and could continue so in the foreseeable future.

Intel® XMM™ 7160 LTE modem is now shipping in the 4G version of the Samsung GALAXY Tab 3 (10.1) – available in Asia and Europe.

Intel® XMM™ 7160 LTE modem is now shipping in the 4G version of the Samsung GALAXY Tab 3 (10.1) – available in Asia and Europe.- Intel® XMM™ 7160 provides multimode (2G/3G/4G LTE) voice and data with simultaneous support for 15 LTE bands for global LTE roaming.

- Intel announces PCIe M.2 LTE wireless data modules expected to ship in 2014 tablet and Ultrabook™ designs from leading manufacturers.

Intel Announces First Commercial Availability of 4G LTE Modem; Introduces Module for 4G Connected Tablets and Ultrabooks™ [press release, Oct 30, 2013]

NEWS HIGHLIGHTS

IDF 2013: Intel CEO shows 22 nanometer-based, LTE smartphone [ITworld YouTube channel, Sept 11, 2013]

From: Intel’s CEO Discusses Q3 2013 Results – Earnings Call Transcript [Seeking Alpha, Oct 15, 2013]

In the Wireless business, I was pleased with our progress on LTE. Our multimode data modem is now available in the Samsung Galaxy Tab 3. By the end of the year, we expect to have voice-over-LTE versions available for customers and our second generation of voice-over-LTE product with carrier aggregation will be available in the first half of next year.

Intel Webcast – Accelerating Wireless [intelmarkus YouTube channel, Oct 30, 2013]

See also: Intel® XMM™ 7160 Slim Modem [ARK | Your Source for Intel® Product Information, June 23, 2012]

Interview AnandTech with Aicha Evans — Scale & Integration- Addressing the Global Market for LTE [channelintel YouTube channel, Aug 14, 2013]

Interview AnandTech with Aicha Evans — Intel’s Approach to Wireless Innovation [channelintel YouTube channel, Aug 14, 2013]

Background information: Ask the Experts: Intel’s Aicha Evans Talks Wireless and Answers Your Questions [AnandTech, Aug 15, 2013]

Intel proves that it has what it takes when it comes to LTE [By Michael Thelander on Spirent blogs, March 19, 2013]

Signals Research Group (SRG) recently completed its eighth collaborative effort with Spirent Communications and its sixteenth “Chips and Salsa” report on cellular chipsets. In the most recent collaboration, we brought together LTE baseband chipsets from eight different suppliers (Altair Semiconductor, GCT, Intel, NVIDIA, Qualcomm, Renesas Mobile, Samsung, and Sequans) to determine who has the best performing chipset, based on a series of 32 test scenarios that we derived from industry accepted 3GPP test specifications. SRG facilitated the benchmark study and was responsible for reviewing and analyzing the results. Spirent provided engineering support, and most importantly, the use of its 8100 test system to conduct the automated and highly repeatable tests on each chipset.

The most recent study marked our second benchmark study of LTE chipsets. Previous studies with Spirent have included HSPA+, HSDPA, UMTS call reliability and A-GNSS. To date, we are still recognized as the only independent provider of baseband chipset performance benchmark studies in the industry. And as a testament to our long-standing relationship, the companies that participated in the most recent round are already clamoring for the next round to take place. The companies that came out on top want to prove that they are not a one trick pony and the companies that came out toward the bottom want redemption. The few companies that were not ready to participate in the last study are also ready to enter the competition. There was a reason that we titled the report, “Sweet 16 and never been benchmarked” since some of these companies have been noticeably absent from prior studies due to the uncertain viability of their chipsets.

The results from the most recent round are interesting, to say the least. First, Spirent and SRG were able to bring together numerous pre-commercial and commercial chipsets. I imagine that most people were surprised that Intel actually had a working LTE chipset, let alone find out that it was the best performing chipset (more on this facet in a bit). Additionally, the list included pre-commercial solutions from Sequans, Renesas Mobile and NVIDIA. It would be virtually impossible for any organization to assemble such a line-up!

As I hinted in the title, Intel came out on top – beating the likes of perennial favorite and San Diego native, Qualcomm. To be fair, the results were incredibly close with only a few percentage points separating the two companies, but Intel’s results were better and close only counts in horseshoes and hand grenades. We could add another activity to the list, but this blog is intended to be family friendly. And if you are assuming that Qualcomm came in second place then you might want to rethink your assumption – nothing we wrote in this blog suggests that they did.

In hindsight, Intel’s results should not be all that surprising since it highly leverages the Infineon 3G platform and stellar RF performance that has since evolved to support LTE under the Intel moniker. Infineon, I note, was always a strong performer in our HSPA+/HSDPA chipset studies and it was in the original 3G iPhone until Qualcomm won the slot, in part due to its ability to support the requirements of a certain North American operator whose name rhymes with Horizon Direless. Intel may have lost the ARM war, but you can’t throw the baby out with the bath water.

Separate from the overall results, I once again saw some pretty big performance differences among all of the chipsets, in particular for the more challenging fading scenarios. As a side note, in addition to the more basic static channel conditions, our 32 test scenarios included various simulated fading channels (EVA5, EPA5, ETU70, and ETU300), SNR values, and MIMO correlation factors to create a range of challenging, albeit realistic, scenarios. In many cases the variance between the top-performing and bottom-performing LTE baseband chipset exceeded twenty percentage points. Even for the top-performing LTE baseband chipsets, it was clearly evident in the results that some chipsets did better in some scenarios than in other scenarios.

Now that we’ve set the bar for how chipsets should perform, I expect to witness material improvements in our next round, which we have planned for later this year. Just to keep everyone honest, I plan to change the test scenarios for the next round. In the interim, Spirent and SRG are investigating some additional benchmark studies that we can do together. These studies could include the industry’s first independent over-the-air (OTA) testing of leading platforms in commercial devices (imagine Samsung S III versus Apple iPhone 5) as well as our second round of A-GNSS testing.

If you are interested in the published report, please feel free to visit our website at www.signalsresearch.com where you can download a report preview.

Click here for more information on testing LTE chipset and mobile device performance.

From Intel® Mobile Phone System Platform Products and Features

Intel® XMM™ 7160 platform

Multimode LTE & DC-HSPA

Based on Intel® X-GOLD™ 716 digital and analog baseband with integrated Power Management Unit and Intel® SMARTi™ transceiver for 2G, 3G, 4G, and LTE, the Intel® XMM™ 7160 platform is the most compact solution for LTE and DC-HSPA smartphones for worldwide deployment.

View the Intel® XMM™ 7160 platform brief > [June 23, 2012]

- LTE capabilities of 150Mbps and 50Mbps (Cat 4)

- HSDPA and HSUPA capabilities of 42Mbps and 11.5Mbps with EDGE multislot class 33

- Multi-band LTE, penta-band 3G, quad-band EDGE for worldwide connectivity

- Excellent power consumption and extremely small PCB footprint

- Hardware and software interfaces to applications processors or to a PC as a wireless modem

From the announcement in February 2012 via product launch in Q1’13 to first commercial delivery in October 2013:

From: Intel Expands Smartphone Portfolio: New Customers, Products, Software and Services [press release, Feb 27, 2012]

Addressing the growing handset opportunity in emerging markets where consumers look for more value at lower prices, Intel disclosed plans for the Intel® Atom™ processor Z2000.

The Z2000 is aimed squarely at the value smartphone market segment, which industry sources predict could reach up to 500 million units by 20151.The platform includes a 1.0 GHz Atom CPU offering great graphics and video performance, and the ability to access the Web and play Google Android* games. It also supports the Intel® XMM 6265 3G HSPA+ modem with Dual-SIM 2G/3G, offering flexibility on data/voice calling plans to save on costs. Intel will sample the Z2000 in mid-2012 with customer products scheduled by early 2013.

Building on these 32nm announcements, Otellini discussed how the Atom™ processor will outpace Moore’s Law and announced that Intel will ship 22nm SoCs for carrier certification next year, and is already in development on 14nm SoC technology.

In 2011, Intel shipped in more than 400 million cellular platforms. Building on this market segment position, Intel announced the XMM 7160, an advanced multimode LTE/3G/2G platform with support for 100Mbps downlink and 50Mbps uplink, and support for HSPA+ 42Mbps. Intel will sample the product in the second quarter with customer designs scheduled to launch by the end of 2012.

Intel also announced that it is sampling the XMM 6360 platform, a new slim modem 3G HSPA+ solution supporting 42Mbps downlink and 11.5Mbps uplink for small form factors.

From: Intel Accelerates Mobile Computing Push [press release, Feb 24, 2013]

Long-Term Evolution (4G LTE)

Intel’s strategy is to deliver a leading low-power, global modem solution that works across multiple bands, modes, regions and devices.

The Intel® XMM™ 7160 is one of the world’s smallest2 and lowest-power multimode-multiband LTE solutions (LTE / DC-HSPA+ / EDGE), supporting multiple devices including smartphones, tablets and Ultrabook™ systems. The 7160 global modem supports 15 LTE bands simultaneously, more than any other in-market solution. It also includes a highly configurable RF architecture running real time algorithms for envelope tracking and antenna tuning that enables cost-efficient multiband configurations, extended battery life, and global roaming in a single SKU.

“The 7160 is a well-timed and highly competitive 4G LTE solution that we expect will meet the growing needs of the emerging global 4G market,” [Hermann] Eul[, Intel vice president and co-general manager of the Mobile and Communications Group] said. “Independent analysts have shown our solution to be world class and I’m confident that our offerings will lead Intel into new multi-comm solutions. With LTE connections projected to double over the next 12 months to more than 120 million connections, we believe our solution will give developers and service providers a single competitive offering while delivering to consumers the best global 4G experience. Building on this, Intel will also accelerate the delivery of new advanced features to be timed with future advanced 4G network deployments.”

Intel is currently shipping its single mode 4G LTE data solution and will begin multimode shipments later in the first half of this year. The company is also optimizing its LTE solutions concurrently with its SoC roadmap to ensure the delivery of leading-edge low-power combined solutions to the marketplace.

From: Signals Ahead: Chips And Salsa XVI – Sweet 16 And Never Been Benchmarked [Feb 25, 2013]

Executive Summary

In December 2011 we published the industry’s first performance benchmark study of LTE baseband modem chipsets. In that study we tested five commercially-procured chipsets from four chipset suppliers. We tested two different Qualcomm chipsets. Fast forward fourteen months and we are finally out with the results from our most recent study in which three companies vie for top honors. Intel’s pre-commercial solution was the top-performing solution that we tested.

This report is our sixteenth Chips and Salsa report since 2004, with the overwhelming majority of these reports focused specifically on performance benchmarking. Over the years, we’ve benchmarked UMTS (call reliability) HSDPA, HSPA+, Mobile WiMAX, A-GNSS and LTE chipsets, with the results always providing the industry with a fully independent and objective assessment of how the chipsets compare with each other for the given set of evaluation criteria. For the eighth time, we have collaborated with Spirent Communications to get access to their 8100 test system and engineering support in order to obtain highly objective results.

The significant advantage of conducting lab-based tests is that we can easily replicate and repeat each test scenario in an automated fashion, thus ensuring a common and consistent set of test scenarios for each device/chipset that we tested. And with the Spirent 8100 test system that we used for the tests, we know that we went with a test platform that is widely recognized and being used in several early LTE deployments. SRG takes full responsibility for the analysis and conclusions associated with this benchmarking exercise.

In the most recent round of chipset testing, we tested a seemingly staggering number of solutions – we tested solutions from eight different chipset suppliers (reference Table 1). We attempted to test a solution from HiSilicon, but through no fault of their own we ran into some difficulties and faced time constraints with MWC just around the corner. We reserve the right to publish their results in the near future and provide updated rankings. Many of these solutions were pre-commercial chipsets and/or the chipsets that came directly from the chipset suppliers. This approach ensured that the results that we are providing in this report are very forward looking and highly differentiated. It would be virtually impossible for any single organization to get access to all of these chipsets and replicate this study.

Worth noting, we personally invited all companies with LTE chipset aspirations to participate in this study, and given our history in doing these tests, companies recognize the importance of supporting our efforts. Needless to say, if we didn’t include a company’s LTE chipset in this study then they probably don’t have a solution that is ready to be benchmarked against their peers. It is one thing to issue a press release, demonstrate a working PHY Layer without any upper protocol layers, or show a chipset operating under ideal conditions. It is another situation all together to put your proverbial money where your mouth is and allow a third party to benchmark your solution and publish the results for all to read. Sweet 16 and never been benchmarked!

As previously alluded to in this report, we used throughput as the primary criteria for evaluating the chipsets. We recognize that device manufacturers and operators use other objective and subjective criteria to select their chipset partners. The criteria includes support for multiple RF bands and legacy technologies, power consumption, time to market, price, engineering support, and the inclusion of peripherals (e.g., application processor, connectivity solutions, etc.). However, no one can dispute the importance of throughput and the ability of the chipset to make the most efficient use of available network resources.

We subjected the chipsets to 32 different test scenarios that combined a mix of fading profiles (Static Channel, EPA5, EVA5, ETU70 and ETU300) and transmission modes (Transmit Diversity, Open Loop MIMO and Closed Loop MIMO). All of the chipsets that we tested performed quite well with the less challenging test scenarios but we observed a fairly large separation of results with the more challenging test scenarios. In many cases the performance difference was in excess of 20% between the top- and bottom-performing solutions.

Based on our highly objective evaluation criteria, Intel had the top-performing solution by a very slight margin. This result may surprise some readers, but we point out that the Infineon 3G solution was always a strong contender in our previous benchmark studies. That scenario is in stark contrast to its application processor which has continuously struggled to be competitive and to attract market share. Don’t throw the baby out with the bathwater. All this and more in this issue of Signals Ahead.

From: Innovation, Reinvention on Intel® Architecture Fuel Wave of 2-in-1 Devices, New Mobile Computing Experiences [press release, Jun 3, 2013]

Accelerating Fast: Tablets, Smartphones and LTE

Intel’s 22nm low-power, high-performance Silvermont microarchitecture is enabling the company to accelerate and significantly enhance its tablet and smartphone offerings.

For tablets on shelves for holiday 2013, Intel’s next-generation, 22nm quad-core Atom SoC (“Bay Trail-T”) will deliver superior graphics and more than two times the CPU performance of the current generation. It will also enable sleek designs with 8 or more hours3 of battery life and weeks of standby, as well as support Android* and Windows 8.1*.

For the first time, [Executive Vice President Tom] Kilroy demonstrated Intel’s 4G LTE multimode solution in conjunction with the next-generation 22nm quad-core Atom SoC for tablets. The Intel® XMM 7160 is one of the world’s smallest4and lowest-power multimode-multiband LTE solutions and will support global LTE roaming in a single SKU.

With a number of phones with Intel silicon inside having shipped across more than 30 countries, Kilroy previewed what’s coming. He showed for the first time a smartphone reference design platform based on “Merrifield,” Intel’s next-generation 22nm Intel Atom SoC for smartphones that will deliver increased performance and battery life. The platform includes an integrated sensor hub for personalized services, as well as capabilities for data, device and privacy protection.

From: Intel Readies ‘Bay Trail’ for Holiday 2013 Tablets and 2-in-1 Devices [press release, Jun 4, 2013]

At an industry event in Taipei today, Hermann Eul, general manager of Intel’s Mobile and Communications Group, unveiled new details about the company’s forthcoming Intel® Atom™ processor-based SoC for tablets (“Bay Trail-T”) due in market for holiday this year.

Eul also spoke to recent momentum and announcements around the smartphone business and demonstrated the Intel® XMM 7160 multimode 4G LTE solution, now in final interoperability testing (IOT) with Tier 1 service providers across North America, Europe and Asia.

…

Long-Term Evolution (4G LTE)

Intel’s strategy is to deliver leading low-power, global modem solutions that work across multiple bands, regions and devices.Intel’s XMM 7160 is one of the world’s smallest and lowest-power multimode-multiband LTE solutions. The modem supports 15 LTE bands simultaneously, and also includes a highly configurable RF architecture running real-time algorithms for envelope tracking and antenna tuning that enables cost-efficient multiband configurations, extended battery life and global LTE roaming in a single SKU.

Eul demonstrated the solution by showcasing a Bay Trail-based tablet over an LTE network connection, and said that Intel will begin shipments of multimode data 4G LTE in the coming weeks following final IOT with Tier 1 service providers in North America, Europe and Asia.

…

Intel announced that the new Samsung GALAXY Tab 3 10.1-inch is powered by the Intel® Atom™ processor Z2560 (“Clover Trail+”). Additionally, the new Samsung GALAXY Tab 3 10.1-inch tablet will come equipped with Intel’s XMM 6262 3G modem solution or Intel’s XMM 7160 4G LTE solution.

From: New Intel CEO, President Outline Product Plans, Future of Computing Vision to ‘Mobilize’ Intel and Developers [press release, Sept 10, 2013]

In high-speed 4G wireless data communications, [Intel CEO Brian] Krzanich said Intel’s new LTE solution provides a compelling alternative for multimode, multiband 4G connectivity, removing a critical barrier to Intel’s progress in the smartphone market segment. Intel is now shipping a multimode chip, the Intel® XMM™ 7160 modem, which is one of the world’s smallest and lowest-power multimode-multiband solutions for global LTE roaming.

As an example of the accelerating development pace under Intel’s new management team, Krzanich said that the company’s next-generation LTE product, the Intel® XMM™ 7260 modem, is now under development. Expected to ship in 2014, the Intel XMM 7260 modem will deliver LTE-Advanced features, such as carrier aggregation, timed with future advanced 4G network deployments. Krzanich showed the carrier aggregation feature of the Intel XMM 7260 modem successfully doubling throughput speeds during his keynote presentation.

He also demonstrated a smartphone platform featuring both the Intel XMM 7160 LTE solution and Intel’s next-generation Intel® Atom™ SoC for 2014 smartphones and tablets codenamed “Merrifield.” Based on the Silvermont microarchitecture, “Merrifield” will deliver increased performance, power-efficiency and battery life over Intel’s current-generation offering.

Intel Announces First Commercial Availability of 4G LTE Modem; Introduces Module for 4G Connected Tablets and Ultrabooks™ [press release, Oct 30, 2013]

NEWS HIGHLIGHTS

- Intel® XMM™ 7160 LTE modem is now shipping in the 4G version of the Samsung GALAXY Tab 3 (10.1) – available in Asia and Europe.

- Intel® XMM™ 7160 provides multimode (2G/3G/4G LTE) voice and data with simultaneous support for 15 LTE bands for global LTE roaming.

- Intel announces PCIe M.2 LTE wireless data modules expected to ship in 2014 tablet and Ultrabook™ designs from leading manufacturers.

Intel Corporation today announced the commercial availability of its multimode, multiband 4G LTE solution. The Intel® XMM™ 7160 platform is featured in the LTE version of the Samsung GALAXY Tab 3 (10.1)*, now available in Asia and Europe.

Intel has also expanded its portfolio of 4G LTE connectivity solutions, introducing PCIe (PCI Express) M.2 modules for 4G connected tablets, Ultrabooks™ and 2 in 1 devices as well as an integrated radio frequency (RF) transceiver module, the Intel® SMARTi™ m4G. These new products make it simple, efficient and cost effective for device manufacturers to add high performance wireless connectivity to their product designs.

“As LTE networks expand at a rapid pace, 4G connectivity will be an expected ingredient in devices from phones to tablets as well as laptops,” said Hermann Eul, vice president and general manager of Intel’s Mobile and Communications Group. “Intel is providing customers an array of options for fast, reliable LTE connectivity while delivering a competitive choice and design flexibility for the mobile ecosystem.”

The commercial availability of the Intel XMM 7160 solution follows successful interoperability testing with major infrastructure vendors and tier-one operators across Asia, Europe and North America. The Intel XMM 7160 is one of the world’s smallest and lowest-power multimode, multiband LTE solutions for phones and tablets. The solution provides seamless connectivity across 2G, 3G and 4G LTE networks,supports 15 LTE bands simultaneously and is voice-over LTE (VoLTE) capable. It features a highly configurable RF architecture, running real-time algorithms for envelope tracking and antenna tuning that enables cost-efficient multiband configurations, extended battery life and global LTE roaming in a single SKU.

Intel offers a broad portfolio of mobile platform solutions including SoCs, cost-optimized integrated circuits, reference designs and feature-rich software stacks supporting 2G, 3G and 4G LTE. Building on the Intel XMM 7160 platform, Intel today announced two multimode LTE solutions that pave the way for 4G connected devices in a variety of form factors.

New Intel PCIe M.2 LTE Modules and Intel SMARTi m4G Solution

Intel introduced Intel PCIe M.2 LTE modules, which are small, cost-effective, embedded modules in a standardized form factor for adding multimode (2G/3G/4G LTE) data connectivity across a variety of device types. The Intel M.2 module supports peak downlink speeds of 100Mbps over LTE. The modules support up to 15 LTE frequency bands for global roaming. In addition, those modules also feature support for Global Navigation Satellite Systems (GNSS) based on the Intel CG1960 GNSS solution.

For manufacturers, the M.2 module makes it simple to add 4G connectivity to their designs while reducing integration and certification expenses, and improving time-to-market. The M.2 module is currently undergoing interoperability testing with tier-one global service providers. Intel M.2-based modules will soon be available from Huawei*, Sierra Wireless* and Telit*. These modules are expected to ship globally in 2014 tablet and Ultrabook designs from leading manufacturers.

In addition to the new M.2 LTE module, Intel also offers the new Intel SMARTi m4G – a highly integrated radio transceiver module. The Intel SMARTi m4G was developed in cooperation with Murata* and integrates the Intel SMARTi 4G transceiver with most front-end components in one LTCC (low temperature co-fired ceramic) package. When paired with the Intel® X-GOLD™ 716 baseband, manufacturers can meet the certification requirements of service providers with minimal design cycles in an easy-to-place, low-profile solution. With the Intel SMARTi m4G, the overall component count can be reduced by more than 40 components and the required PCB area is reduced up to 20 percent.

Intel plans to deliver next-generation LTE solutions, including the Intel® XMM™ 7260 in 2014. The Intel XMM 7260 adds LTE Advanced features, such as carrier aggregation, faster speeds and support for both TD-LTE and TD-SCDMA. More information about Intel’s mobile communications solutions is available at http://www.intel.com/content/www/us/en/wireless-products/mobile-communications.html.

See also: Intel Talks about Multimode LTE Modems – XMM7160 and Beyond [AnandTech, Aug 20, 2013] from which I will include here:

XMM7160 is still built on TSMC’s 40nm CMOS process, and its SMARTi 4G transceiver is built on 65nm at TSMC, but Intel still claims it has a 20–30% power advantage for modem and RF compared to a competitor smartphone platform, though it wouldn’t say which. … The transition of modem to Intel Architecture (away from two different DSP architectures) also remains to be seen, and I’m told it will be two to three years before Intel’s modems are ready to intercept the Intel fabrication roadmap and get built on Intel silicon instead of at TSMC. …

From: Mobile Wireless M2M Value Proposition Product Portfolio and Roadmap for M2M 2G-4G [Intel presentation, Nov 26, 2012]

With Android and forked Android smartphones as the industry standard Nokia relegated to a niche market status while Apple should radically alter its previous premium strategy for long term

Here is the chart reflecting the performance of the market-leading mobile phones upto Q2’13:

From this the most visible things are:

- Android and Android-forked (Xiaomi etc.) smartphones are the undisputed industry standards to dominate the market in years to come