Home » Posts tagged 'SoC vendors'

Tag Archives: SoC vendors

Linux client market share gains outside the Android? Instead of gains will it shrink to 5% in the next 3 years?

The Linux Foudation quite proundly referred to ReadWriteMobile: The ‘Year of the Linux Desktop’? That’s So 2012 [Feb 3, 2013]

For those Linux enthusiasts still pining for the mythical “Year of the Linux Desktop,” the wait is over. In fact, it already happened. In 2012 Microsoft’s share of computing devices fell to 20% from a high of 97% as recently as 2000, as a Goldman Sachs report reveals [”Clash of the titans” downloadable from here, dated Dec 7, 2012]. While Apple has taken a big chunk of Microsoft’s Windows lead, it’s actually Google that plays Robin Hood in the operating system market, now claiming 42% of all computing devices with its free “Linux desktop” OS, Android.

Read more at ReadWriteMobile.

from which I will include here the following chart:

for which Goldman Sachs commented as:

The compute landscape has undergone a dramatic transformation over the last decade with consumers responsible for the massive market realignment. While PCs were the primary internet connected device in 2000 (139mn shipped that year), today they represent just 29% of all internet connected devices (1.2bn devices to ship in 2012), while smartphones and tablets comprise 66% of the total. Further, although Microsoft was the leading OS provider for compute devices in 2000 at 97% share, today the consumer compute market (1.07bn devices) is led by Android at 42% share, followed by Apple at 24%, Microsoft at 20% and other vendors at 14%.

Note from Goldman Sachs: Microsoft has gone from 97 percent share of compute market to 20 percent [The Seattke Times Dec 7, 2012]:

I asked Goldman Sachs about what happened in the 2004-2005 time frame — as seen in the above chart — that made Apple’s vendor share jump, Microsoft’s share plummet and the “other” category to go from zero to 29 percent. Goldman Sachs replied that it has to do with more mainstream adoption of non-PC consumer computing devices but declined to elaborate beyond that.

Microsoft was put into the “Challenged” category (along with Google BTW) by Golmann Sachs noting that:

… we estimate that Microsoft would have to sell roughly 5 Windows Phones or roughly two Windows 8 RT tablets to offset the loss of one traditional Windows PC sale, which we estimate has an overall blended selling price of $60 for business and consumer.

but a kind of more positive than negative outlook was predicted for the company by

… we expect the recent launches of Windows Phone 8 and Windows 8 tablets to help the company reclaim some share in coming years.

Apple, at the same time, was into the “Beneficiaries” category (along with Facebook and Samsung BTW) by Goldmann Sachs for the reason of:

… we believe loyalty to the company’s ecosystem is only increasing and this should translate into continued growth going forward. In particular, we see the potential for Apple to capture additional growth as existing iOS users move to multiple device ownership and as the company penetrates emerging regions with new devices such as the iPad miniAAPL and lower priced iPhones. As a result, we believe Apple’s market share in phones has room to rise much further, and that its dominant tablet market share appears to be more resilient than most expect. We expect these factors to continue to drive the stock higher.

This is, however, not going to happen if taking a judgement from the stock market reflections since then with 13.7% drop in Apple’ share price vs. that of Dec 7 (the report publishing date) and a whopping 34.5% drop vs. its last peak on Sept 19, 2012 (at $702.1):

source: Yahoo! Finance

Why Did $AAPL Stock Go Down After Beating Earnings Estimates And $AMZN Stock Go Up After Missing? [Techcrunch, Jan 29, 2013] had the following explanation:

The moves in different directions for Amazon and Apple have been about expectations and guidance. Wall Street has higher expectations for Apple and ‘different’ expectations for Amazon. Wall Street wants Apple’s ‘gross margins’ to grow. They don’t expect Amazon’s ‘profits’ to grow. It sounds silly, but if Apple has reported lower profits and a huge gross margin increase the stock might have shot up. If Amazon had reported record profits today on decreasing margins, Wall Street might have panicked.

…

Wall Street has stopped caring about Apple’s profits today. They were displeased with forward guidance. Growth rates have slowed measurably at Apple which is understandable for a company of its’ size. Wall Street is worried that growth is slowing and competition from Google and Samsung are taking a toll. Apple has given Wall Street so many wonderful surprises so magic has become the norm. Now that Apple is boring, they have run for the hills.

That moode didn’t change even after Apple CEO Tim Cook was trying to assure investors at the Goldman Sachs Internet and Technology Conference on Feb 12, just a week ago. Read the Wrap up: Apple CEO Tim Cook’s Goldman Sachs Conference keynote [AppleInsider, Feb 13, 2013] from which I will quote only the following excerpts as the most notable ones:

Cook went on to say that introducing a “budget device” was not something Apple would be comfortable with, and instead pointed to the strategy seen with the iPhone lineup. In that model, new variants like the iPhone 5 are sold at the highest price while preceding versions like the iPhone 4S and iPhone 4 are sold at discounted rates.

…

According to Cook, the iPad is “the poster child of the post-PC revolution” and has driving the push to tablets since its introduction in 2010.

While Apple’s tablet has been the downfall for a number of PC alternatives, such as netbooks, the device is also said to be hurting the company’s own Mac computer sales. During the last quarter of 2012, Mac sales dropped 22 percent year-to-year on low demand and supply constraints. Apple’s iPad business, however, grew by nearly 50 percent over the same period.

“The cannibalization question raises its head a lot,” Cook said. “The truth is: we don’t really think about it that much. Our basic belief is: if we don’t cannibalize, someone else will. In the case of iPad particularly, I would argue that the Windows PC market is huge and there’s a lot more there to cannibalize than there is of Mac, or of iPad.”

Cook noted that burgeoning markets like China and Brazil will be major players in future growth, and the company is banking on its ability to draw customers in to the Apple ecosystem with “halo products.”

“Through the years, we’ve found a very clear correlation between people getting in and buying their first Apple product and some percentage of them buying other Apple products.”

At the same conference Microsoft, similarly to Apple, declared a ‘no change’ strategy despite of the obvious failure of its Windows 8 and Windows Phone efforts so far. In the No “Plan B” for Microsoft’s mobile ambitions: CFO [Reuters, Feb 13, 2013] report one can read:

“We’re very focused on continuing the success we have with PCs and taking that to tablets and phones,” Microsoft’s Chief Financial Officer Peter Klein said

…

“It’s less ‘Plan B’ than how you execute on the current plan,” said Klein. “We aim to evolve this generation of Windows to make sure we have the right set of experiences at the right price points for all customers.”

…

Gartner estimates that Microsoft sold fewer than 900,000 Surface tablets in the fourth quarter, which is a fraction of the 23 million iPads sold by Apple. Microsoft has not released its own figures but has not disputed Gartner’s.

Windows phones now account for 3 percent of the global smartphone market, Gartner says, which is almost double their share a year ago but way behind Google’s Android with 70 percent and Apple with 21 percent.

To grab more share, Klein said Microsoft was working with hardware makers to make sure Windows software is available on devices ranging from phones to tablets to larger all-in-one PCs.

“It’s probably more nuanced than just you lower prices or raise prices,” said Klein. “It’s less a Plan B and more, how do you tweak your plan, how do you bring these things to market to make sure you have the right offerings at the right price points?”

So the last 3 months went against Goldmann Sachs’ November 2012 predictions. The only question now remains whether those 3 months brought any changes in the non-Apple and non-Microsoft territories which would question other parts of the Goldmann Sachs’ forecast as well?

There were no negative changes just strengthening of the already established dominant position against both Apple and Microsoft:

1. Mainstream tablets 7-inch at US$199, say Taiwan makes [DIGITIMES, Feb 19, 2013]

Google’s Nexus 7 and Amazon’s Kindle Fire HD have reshuffled the global tablet market and consequently 7-inch with a price cap of US$199 has become the mainstream standard for tablets, according to Taiwan-based supply chain makers.

Cumulative sales of the Nexus 7 have reached six million and are expected to reach eight million units before the expected launch of the second-generation model in June 2013, the sources said. The Nexus 7 and Kindle Fire have driven vendors to develop inexpensive 7-inch tablet models instead of 10-inch ones, the sources indicated.

In order to be as reach US$199, 7-inch tablets are equipped with basic required functions such as access to the Internet and watching video, the sources noted. While Google, Amazon, Samsung Electronics and Asustek Computer are competitive at US$199 for 7-inch tablets, white-box or other vendors need to launch 7-inch models at lower prices such as US$149, the sources said. Fox example, China-based graphics card vendor Galaxy Microsystems has cooperated with Nvidia to launch a 7-inch tablet in the China market at CNY999 (US$160).

2. Digitimes Research: 68.6% of touch panels shipped in 4Q12 from the Greater China area [DIGITIMES, Feb 19, 2013] meaning that in supply chain terms there is a growing concentration on suppliers not only from Greater China but especially from mainland China:

Taiwan- and China-based touch panel makers held a 68.6% global market share for touch panels shipped during the fourth quarter of 2012, according to Digitimes Research.

China-based panel makers saw the biggest share in the handset touch panel market during the fourth quarter due to smartphone demand in China, while Taiwan-based panel makers only held a 27.5% share in the market largely due to lower-than-expected sales of the iPhone 5, said Digitimes Research.

In terms of touch panels used in tablets, Taiwan-based panel makers saw a drop in their global market share to 59.9% during the period largely due to the iPad mini using DITO thin-film type touch screens provided from Japan-based touch panel makers. China-based panel makers meanwhile held 18.6% in the market due to demand for white-box tablets in China, added Digitimes Research.

Meanwhile, Digitimes Research found that Taiwan-based TPK provided 70.9% of all touch panels used in notebook applications in 2012.

3. Touch Panel Market Projected for a 34% Growth in 2013 from 2012 [Displaybank, sent in a newsletter form, Feb 19, 2013] published to promote Touch Panel Market Forecast and Cost/Issue/Industry Analysis for 2013 [Jan 30, 2013]

The touch panel market is growing rapidly due to the increasing sale of smartphones and tablet PCs. The touch panel market size in 2012 was 1.3 billion units, a 39.4% growth over 2011. The market is projected to grow 34% in 2013, growing to more than 1.8 billion units.

Touch Panel Market Forecast (Unit: Million)

(Source: Displaybank, “Touch Panel Market Forecast and Cost/Issue/Industry Analysis for 2013”)

Smartphone and tablet PCs, major applications that use touch panels, are expected to continue to grow at a high rate. In addition, most IT devices that use display panels have either switched to or will start using the touch panels soon. Therefore the touch panel market will show a double digit growth annually until 2016, by unit. The market size is expected to reach more than 2.75 billion units by 2016.

With the explosion in the sale of smartphones and tablet PCs during the past few years, our lives have changed dramatically. They are now common place in our lives, and have a huge influence in the IT industry in general. With the introduction of Windows 8 OS in October 2012, upsizing of touch panels has begun. The impact of this event on the immediate growth of the touch panel market and the long-term effect is so immense that it cannot be estimated at the moment.

The financial crisis that started in 2008 left much of the IT industry hobbling worldwide. But only the touch panel market is enjoying a boom. Many new players are pouring into the industry, and those on the sidelines are waiting for the opportune moment to enter. As more players enter the competitive landscape, touch panel prices are falling rapidly. In addition, to gain competitiveness and to differentiate itself in the market has led players to develop and improve structure, technique and process, and seek out new materials.

The introduction of Windows 8 is leading the increase in touch capable Notebook and AIO PCs. It is still too early for the touch interface to completely displace keyboard and mouse, but the touch functionality does add convenience to some operations. We are sure to see an increase in specialized apps that capitalize on such functions. Therefore, touch functions will complement traditional input methods. As the technology is still in early implementation stages, it is used only in select high-end Ultrabooks. But it’s only a matter of time before touch functions make its way to mid-end products.

Forecasting the future of touch panel industry is not only difficult, but also outright confusing in the current landscape due to the rapid expansion; the increase in number of devices that use touch panels; more players in the market; and rapid development of new products and new processes. In serving clients, Displaybank has released “Touch Panel Market Forecast and Cost/Issue/Industry Analysis for 2013” to provide industry outlook by application, product, and capacitive touch structure. The report also includes the supply chain of set makers and touch panel manufacturers; and cost analysis of major capacitive touch panels by size and type. This report will serve as a guide to bring clarity and understanding of rapidly transforming touch panel industry.

4. Cheaper components could allow 7-inch tablets priced below US$150, says TrendForce [DIGITIMES, Dec 14, 2012]

Viewing that Google and Amazon have launched 7-inch tablets at US$199, other vendors can offer 7-inch tablets at below US$150 only by adopting cheaper components, according to Taiwan-based TrendForce.

As panels and touch modules together account for 35-40% of the total material costs of a 7-inch tablet, replacing the commonly used 7-inch FFS panels with 7-inch TN LCD panels accompanied by additional wide-view angle compensation could save over 50% in panel costs, TrendForce indicated. In addition, replacing a G/G (glass/glass) or OGS (one glass solution) touch module with a G/F/F (glass/film/film) one, although inferior in terms of transmittance and touch sensitivity, can cut costs by about 70%. Thus, the adoption of a TN LCD panel and a G/F/F touch module for a 7-inch tablet could reduce material costs by about US$25, TrendForce said.

Given that the type of DRAM affects standby time only as far as user experience is concerned, costs can be reduced through replacing 1GB mobile DRAM priced at about US$10 with 1GB commodity DRAM priced at about US$3.50, TrendForce noted. As for NAND flash, 8GB and 4GB eMMC cost US$6 and US$4, respectively, and therefore the latter should be the preferred choice to save costs.

For CPUs, China-based IC design houses, including Allwinner Technology, Fuzhou Rockchip Electronics, Ingenic Semiconductor, Amlogic and Nufront Software Technology (Beijing), provide 40-55nm-based processors at about US$12 per chip which could be alternatives to chips used in high-end tablets which cost about US$24, TrendForce indicated.

While the sales performance of tablets below US$150 is yet to be seen, such cheap models are expected to put pressure upon China-based white-box vendors, and in turn intensify price competition in the tablet market in 2013, TrendForce commented.

5. Strong demand from non-iPad tablet sector to boost short-term performance of IC vendors [DIGITIMES, Jan 28, 2013]

Demand for IC parts from the tablet industry in China has been stronger than expected in the first quarter of 2013, which could help boost the short-term performance of IC design houses, while offsetting the impact of slow demand from China’s smartphone sector caused by high inventory levels, according to industry sources.

Entry-level tablets meet market demand in terms of pricing and functionality, particularly in China, said the sources, adding that demand for entry-level tablets in China and other emerging markets could top 4-5 million a month in 2013 compared to 2-3 million in the second half of 2012.

MediaTek, while seeing demand for its handset solutions from China decrease in the first quarter of 2013, has also enjoyed emerging IC demand from the tablet sector, with plans to release chipset solutions for the segment in the second quarter of the year, the source revealed.

Since the growth momentum for tablets in 2013 is expected to come from non-iPad vendors in China and other emerging markets, Taiwan-based suppliers of LCD driver, analog and touch-controller ICs as well as those of Wi-Fi, audio and Bluetooth chips will benefit from the trend thanks to cost advantages and strong business ties in these markets, the sources commented.

6. Allwinner A31 SoC is here with products and the A20 SoC, its A10 pin-compatible dual-core is coming in February 2013 [Dec 10, 2012] and The upcoming Chinese tablet and device invasion lead by the Allwinner SoCs [Dec 4, 2012], both from my own separated trend tracking site devoted to the ‘Allwinner phenomenon’ coming from mainland China and having the potential of drastically altering the 2013 device market (not taken into account at all by Goldmann Sachs report):

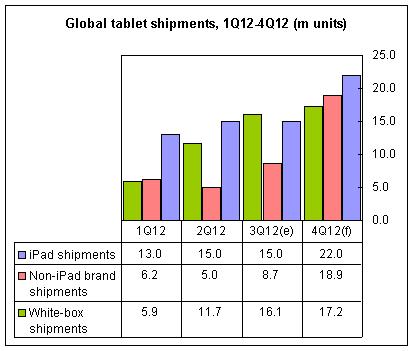

that already resulted in huge growth of the mainland China Android tablet manufacturing in 2012, as well shown by this chart: which has already fundamentally affected the worldwide tablet market in 2012:

which has already fundamentally affected the worldwide tablet market in 2012:

7. What Allwinner started in 2012 with the single core A10/A13 SoCs and which was further boosted by the quad-core Cortex-A7 A31 SoC on Dec 5, 2012 with the release of Onda V972 and V812 tablets (for US$ 208 and US$144 respectively) is an incredible strategic inflection point for the whole ICT industry, which ALL SoC vendors should compete with. Rockchip shown as the #2 on the mainland China market just followed the suite:

8. Now the most ambitious external challenger Marvell Announces Industry’s Most Advanced Single-chip Quad-core World Phone Processor to Power High-performance, Smartphones and Tablets with Worldwide Automatic Roaming on 3G Networks [press release, Feb 19, 2013] which is going to add to the competition the integrated on the SoC 3.5G modems:

Marvell’s PXA1088 is the industry’s most advanced single-chip solution to feature a quad-core processor with support for 3G field-proven cellular modems including High Speed Packet Access Plus (HSPA+), Time division High Speed Packet Access Plus (TD-HSPA+) and Enhanced Data for GSM Environment (EDGE).

The Marvell PXA1088 solution incorporates the performance of a quad-core ARM Cortex-A7 with Marvell’s mature and proven WCDMA and TD-SCDMA modem technology to provide a low-cost [elsewhere stated by Marvell that this SoC is for the phones space in the “$100 range”] 3G platform for both smartphones and tablets. The advanced application processor technology of the PXA1088 enables a breakthrough end user experience for multimedia and gaming applications with universal connectivity. Marvell’s complete mobile platform solution includes the Avastar® 88W8777 WLAN + Bluetooth 4.0 + FM single-chip SoC and the L2000 GNSS Hybrid Location Processor, and an integrated power management and audio codec IC.

Marvell’s PXA1088 is backward pin-to-pin compatible with its dual-core single-chip Unified 3G Platform, the PXA988/PXA986, enabling device partners to upgrade their next-generation mobile devices to quad-core without additional design cost.

…

Currently, the PXA1088 platform is sampling with leading global customers. Products based on this platform are expected to be commercially available in 2013 [elsewhere stated by Marvell that “We’ll start seeing PXA1088-based phones in the first half of this year”].

9. Yesterday we had two significant advancements described in the Ubuntu and HTC in lockstep [Feb 19, 2013] post here. Especially the Ubuntu related part is remarkable as first time we had a new platform which can span the whole spectrum of devices: from smartphones, to tablets, to desktops, to TVs – actually all from a smartphone capability expanded via docking and other means to a screen, to a TV, a keyboard, and a mouse. This is certainly an extreme case of the new Ubuntu capability which can have implementation in different devices as well. Even in that case, however, the source and binary codes could be the same. This is also cleverly using the already well established Android drivers and Android Board Support Package (BSP) infrastructure of the most cost-efficient ARM SoC vendors. Note that this is furthest from any “license violation” attacks as the original OHA terms and conditions are stating the Apache V2 licencing which:

The Apache license allows manufacturers and mobile operators to innovate using the platform without the requirement to contribute those innovations back to the open source community. Because these innovations and differentiated features can be kept proprietary … Because the Apache license does not have a copyleft clause, industry players can add proprietary functionality to their products based on Android without needing to contribute anything back to the platform. As the entire platform is open, companies can remove functionality if they choose.

10. Finally today came Google Glass: showing how radically the user experience might be changing in the next 2-3 years:

More information: Google Glass – Home [Feb 20, 2013] where it is also possible to grasp its wonderful, non-intrusive seign like this:

Conclusion: There are even more uncalculated by Goldmann and Sachs advancements in the non-Apple and non-Microsoft spaces than in Apple and Microsoft ones. Just in these 3 months! Therefore it would be ridiculous if Goldmann and Sachs’ “consumer compute platform share” forecast as shown in the chart above will be fullfilled!

Steven Sinofsky, ex Microsoft: The victim of an extremely complex web of the “western world” high-tech interests

See: Ballmer’s memo announcing Steven Sinofsky’s departure [CNET, Nov 12, 2012]

and Microsoft Announces Leadership Changes to Drive Next Wave of Products [Microsoft press release, Nov 12, 2012]

A Microsoft Without Sinofsky? Mini-Microsoft Monday, November 12, 2012

Well, I can’t believe it: Microsoft Announces Leadership Changes to Drive Next Wave of Products.

People walking the hallways tonight at work certainly can’t believe it. I can’t believe it – working at a Microsoft without Sinofsky?

Inconceivable.But, if you’re going to leave on a high-note, it doesn’t get much better. Mr. Sinofsky got a standing ovation from the Windows team during the Company Meeting for all that he’s done to take them on a multi-year journey to create Windows 7 and then hit the big multi-division reset button for Windows 8. He truly demonstrated technical leadership at its best.

And I don’t believe his departure rules him out at all for Microsoft CEO. In fact, I think if he stays in tech and becomes CEO of another company it makes him an even more obvious choice to come back to Microsoft as its leader.

Meanwhile, Ms. Larson-Green: best of luck following this act.

The only response to A Microsoft Without Sinofsky? I think is worth to include here as representing the only factual evidence which might be behind Steven Sinofsky’s abrupt departure from Microsoft (although not in such a direct way as you might think from this, see my remarks following that):

1. Monday, November 12, 2012 10:58:00 PM

So Sinofsky is gone and replaced with a completely talentless hack like Julie Larson-Green. Seriously? Her ascent through the ranks is a case study in the Peter Principle… I worked with Julie when she was on FrontPage, and she was nothing more than a talking head then. She’s now a ridiculous joke, and she’s running the show.

Surface RT is on track to be a disaster, as is the upcoming Surface Ultrabook thing. Someone stick a fork in Microsoft already, jeez.

2. Monday, November 12, 2012 11:31:00 PM

“What facts do you have to back that up? Sounds like you’re another opinionated MSoftie.

Also, why are you panning Julie already? Another ax to grind?”

First: I drive by the Microsoft store every day. The first week after Surface released it was fairly busy — it’s now a ghost town while the Apple store across the street is always SRO. Given that it’s the only store where can buy Surface, that tells you everything you need to know.

And seriously – real the media commentary. Even ignoring Ballmer’s “sales are modest” quote, they’re all saying that consumer interest has fallen off a cliff over the last week. It’s as dead as Windows Phone. But don’t take my word for it, just wait and see.

As for Julie, she’s one of those Microsofties who everyone always threw their hands up about whenver we heard she was promoted again. They are all over Microsoft — people with no actual talent but who excel in the art of succeeding in a big corporate environment. Seriously, search out her talks on Youtube — the woman is barely cogent at the best of times, and at her worst she’s an unintentional comedian.

I left Microsoft a while ago so my axes are long since ground. Now I just enjoy watching the clown car roll along.

So the real question is: Why “Surface RT is on track to be a disaster”?

My answer to that was already published yesterday:

Microsoft Surface with some questions about the performance and smoothness of the experience [this same blog, Nov 12, 2012]

In the end of that post I’ve included also the reasons for the performance and smoothness problems of Microsoft Surface as it stands now, and in very factual way:

Who is gaining with that?

It is no doubt that Intel is the party gaining most with that!

Look at the stakes:

– Intel market capitalisation: US$ 103.50B which is critical for large investors because a collapse of Intel may cause an unprecedented upheaval on the stock market. Also note that Windows 8 is the last chance for Intel to prevent such collapse to happen.

– Intel fabs which are:

Huge, numerous and most of them are representing the latest manufacturing technologies: see List of Intel manufacturing sites on Wikipedia

Each representing multibillion dollars of multi-year investments:

see New $5 billion Intel facility planned for Chandler [AZCentral.com, Feb 19, 2011] as the latest exampleA tremendous effort made by Intel to outgun its fabless competitors exactly through such cutting-edge manufacturing. It is now described not only as leading edge in terms of smaller die sizes and thus higher chip volumes on the same wafers, better performance and/or lower power use, but also speed and agility with the time to manufacture a component halved in the past five years.

Strategic for the US economy as whole to prevent its advanced manufacturing sector to go the way of its lower-tech predecessors – to Asia. See Insight: As chip plants get pricey, U.S. risks losing edge [Reuters, May 1, 2012].

Entering into a critical phase against its major by far fab competitor, TSMC for whom the capacity shortage of its leading 28nm nodes will end by December, 2012. See my Qualcomm’s critical reliance on supply constrained 28nm foundry capacity [this same ‘Experiencing the cloud’ blog, July 27-Nov 8, 2012] post as updated just 4 days ago. Considering that the competitive strength of all of its fabless competitors depend on TSMC manufacturing capabilities this is the most critical window for strategic survival in Intel’s whole history.

A further evidence of why Intel’s survival might be behind that is the fact that the latest mobile SoC from Intel, so called Clover Trail will be in the Windows 8 tablets only in the later part of November. Even the first tablets based on that, the Acer Iconia W510 models are “Temporarily out of stock” on the Amazon while it was oiginally promised to be available from Nov 9 in the US and Canada. See: Acer Iconia W510: Windows 8 Clover Trail (Intel Z2760) hybrid tablets from OEMs [this same ‘Experiencing the cloud’ blog, Oct 28, 2012]. So the tuning was going on well after the “final” Windows 8 launch of Oct 26, and might continue even these days.

Another evidence is the fact that the x86-based version of the Microsoft Surface, Surface Pro will arrive just 3 month later as was pointed out in the leParisien interview of Steve Ballmer referred to in beginning of this post. Moreover when it was announced it was for the much better performing Ivy Bridge processor, not the Clover Trail we indicated here as available in a numerous products by the end of November. This could mean a delivery of Surface Pro as late as January next year! Plenty of time to make the new Windows software and the available applications performing well and smooth in all respects.

Which needs only a few additional explanations, mainly for the overwhelming misunderstandings absolutely typical in the opinions about the reasons of Sinofsky’s abrupt departure from the company he was working for since he finished his university studies in 1989.

- Microsoft is sitting in the centre of an extremely complex web of interests. In fact most of the high-tech pile up of the “Western world” on the stock market is highly dependent on the course of actions Microsoft is taking along the ARM route of the hardware platform opportunity.

- As the HW future of the Android SW platform is already outside of the influence of that high-tech pile up, the only remaining potential to defend its diminishing position is in the Windows.

- The measures taken during the Windows development to pressure Microsoft and its CEO to “under-engineer” the Windows RT version (which is well reflected in Microsoft Surface as it was brought out 18 days ago) were clearly not enough to achieve the established goals of such a defensive strategy. It might even be the case that the “half-hearted” Windows RT effort was decided to be “downscaled” even further as a last ditch effort by the forces of “Western world high-tech pile-up” interests.

Just to remind you:

– The SoC behind the $48 Mogu M0 “peoplephone”, i.e. an Android smartphone for everybody to hit the Chinese market on November 15 [this same blog, Nov 9, 2012] is sold for about $6 according to CEO of Spreadtrum saying that 37% of its Q3CY12 revenue of US$187.9 million “mostly address the smartphones” which were 11 million SoCs in the official financial release then “raised” somewhat to 12 million towards the end of the Earnings Call.

– The leading entry level SoC for the Chinese made Android tablets, the Allwinner A10 and A13 is sold for $7 and $5 respectively, and the volume of them was quite high already in Q3CY12: 3.5 million SoCs in August rising to 5 million SoCs in October, according to Yoshida in China: ‘Shanzhai’ clouds tablet data [EE Times, Nov 8, 2012]

– Intel’s latest technology entry level SoC, the Z2760 “Cover Trail” should definitely be more than $50 (even much more) as the latest (Q1’12 intro, with the same 32nm litography) traditional Atom model D2550, having price indication, has a published tray price of $47. This means an order of magnitude SoC price difference considering that by the end of 2012 the entry level tablet SoCs will come down at least to 2xCortex-A9 performance at 1 GHz+ (could be even quadcore at 28nm litography, we will see), so performance wise there will be at least parity.

So these are the things everybody should think first and not the simplistic reasoning reflected everywhere. See a 24 hour search on “Sinofsky departure” which currently has headlines such as:

- Sinofsky’s departure from Microsoft: Politics or products to blame?

- Controversial Windows boss Steven Sinofsky leaves Microsoft

- Sources inside Microsoft say a clash of personalities led to Sinofsky’s departure

- The departure of Steven Sinofsky: Jump, or pushed?

-

Microsoft follows Forstall departure by firing their head of software Steve Sinofsky

-

Did Windows 8’s Metro interface cost Steven Sinofsky his job?

- Sinofsky Out: Were We Right about Windows 8 Usability?

End of the original post (as seen above), publication time: UTC 11:00 a.m.

Postscripts:

… Many have scratched their head about Windows RT, and in particular its lack of support for third-party “desktop” apps. Ultimately I think Windows RT is the result of heavy reliance on telemetry. … reliance on statistical analysis may explain why the end-user reaction to Windows RT and Windows 8 overall seems much better than that of pundits and power users. …

…

Why did 90+% of users choose to pay more for a Windows-based Netbook than to go with a Linux-based Netbook? If these devices were simply used for web browsing than the user behavior doesn’t make sense. We can speculate on this of course. Familiarity of UI, compatibility with devices such as printers, ability to run Windows applications (even though that is counter to the original idea behind netbooks), etc. As I said we can speculate. And analysts can survey customers and make their claims. But Microsoft? Microsoft has precise data from the CEIP.

…

And what do you think Microsoft got from the CEIP telemetry? I’m guessing that they saw the vast majority of Netbook usage was for web browsing, with use of Microsoft Office representing a much smaller but still substantial portion. And then I’m guessing they saw a dramatic fall-off with no apps really registering as significant. Netbooks were basically web browsing plus Office machines. Then they looked at the web usage and saw that a great deal of it matched the kinds of “consumption” apps that were popular on the iPhone and that they were going to target with the new Windows 8 “Metro” app model. And they saw heavy use of traditional Windows features like broad peripheral support, network connectivity, etc. Combine the actual usage data on Netbooks with the emergence of Natural User Interface and the re-invigoration of local apps that was demonstrated by the Apple App Store and you have Windows RT.

…

So take a look at Windows RT, or even better the Microsoft Surface, and realize what it is. The Surface is the intersection of Netbook meets iPad. It brings exactly what most users liked about Windows on Netbooks into the modern era while dispensing with much of the Windows world that Netbook users simply didn’t take advantage of. It is exactly what users told Microsoft via their actual usage data, extrapolated from the historical Netbook world into the modern device world, they wanted.

…

The use of Telemetry may explain why Windows 8, Windows RT, and the Surface seem to do better with average users than the pundits and power users out around and beyond two standard deviations. Windows RT and the Surface are designed to actual usage data on a segment of the computing spectrum that was also derided by many pundits and power users. A segment that garnered (as I recall) about 20% of PC unit volume before being obliterated in the “post-PC” shift. If Microsoft has used its wealth of telemetry to build something that nails the real world usage scenarios that originally made Netbooks popular, while also being roughly as good as the iPad for the scenarios Apple optimized for, than they have a huge winner. Even if pundits and power users don’t seem to like what they’ve done.

And if Windows RT fails? Well it could be the result of pundits and power users convincing the target audience not to give it a chance. Or it could be the result of poor design decisions being made despite having excellent data. Or it could be a series of marketing, sales, and partner missteps that have little to do with the product itself. Or it could be that particularly vicious form of lies known as statistics.

I was only a few reports down from Sinofsky and actually had the pleasure of working with him in person. Always very professional and energetic. Nothing unreasonable for a corporate environment. And definitely nothing like what people compare to Steve Jobs or Bill Gates (check out “BillG review” on the Internet for what THAT was like).

LOL, listen this is a great post and all but if he was truly great Ballmer would have kept him, more C level execs would have fought to keep him. The truth is there is a time and place for people like Sinofsky and there is time to ring them in and say “Hey you are making people’s lives hell!” That is a big deal by the way. MS may be a huge corporation with lots of people willing and wanting to work with them but word of mouth gets around and that is bad. …

- The Steven Sinofsky defended [Microsoft-News-com, Nov 17, 2012] article which contains a very well written defense of Sinofsky from a writer named Suril Amin (about whom it is only known that he was born in 1989, and from all that he is likely to be this LinkedIn person, this twitter person, this facebook person and with this 2011 resume) which is quite worth to read. His opinion is:

… Sinofsky has been nothing but excellent for Microsoft. He has fought for consumers and made the tough decisions that others would not have. Sinofsky made the trains run on time. He embraced the Metro design language, borrowing from the Zune team and Windows Phone team. It is quite clear that Sinofsky quit. I believe he wanted more power or certain decisions to go his way that did not and he ultimately decided to quit. Ballmer has been great at protecting himself and his position of CEO over the last decade. I do not think he wanted Sinofsky to gain more power and potentially become CEO down the road. It’s telling that he split Sinofsky’s position to two women who I think he can easily control. I think Sinofsky’s influence and legacy on the company will remain even though he is not there anymore. More things are going to be kept secret until it is the appropriate time to release the information. Microsoft will also get more and more into hardware. I believe we will see Sinofsky back a few years from now as CEO of Microsoft. …

Then the whole essence of his writing is summarized in the end as:

tl;dr: Steven Sinofsky rocks and was good for Microsoft! I also believe he quit on his own accord. Bloggers hate him because they had a direct financial loss due to having less information about the company and ignore the good he did.

P.S. Love/Hate relationship with Sinofsky and bloggers can be traced way back to 2007 starting with Long Zheng http://www.istartedsomething.com/20071207/director-windows-disclosure/

- Why Microsoft is disARMed? Because of the battle cry from Intel Haswell: “Mobile computing is not limited to tiny, low-performing devices” [this same blog, Nov 15, 2012]

- Technology explanation for lower software performance on ARM from here:

He explained that creating Windows 8 and its new tablet-friendly Windows Runtime has absorbed much of the C++ team’s energy.

“We’ve been really busy for two years with our biggest release ever. There’s an industry tsunami to the tablet revolution, the GPU compute revolution. Because C++ matters is why we’re at the centre of it. Now we can emphasise conformance again,” he said.“We have a really mature compiler and optimiser. It’s been around for a decade or two, on x86 and x64. Then we have a version 1 release of ARM. You can expect that to get better.”

Note that people present on that BUILD 2012 session and even having an opportunity to speak to Herb Sutter the day before were not only confirming the importance of the above but even adding to that: “the Visual C++ team had the biggest pressure inside Microsoft in the last 2 years as everybody was relying on them

- Re: Live Long and Prosper SteveSi by Steve Sinofsky [Hal’s (Im)Perfect Vision, Nov 14, 2012]

Hal. Hey there, I find myself feeling to offer some insight — relative to what you say above, I never initiated any discussions to bring together the organizations/products you describe and no one ever approached me to manage them as part of Windows 7 or 8. Basic organization theory as described by @teyc would support the current state as a practical working model.

If we had worked together you would know that historically, very few things moved into teams I managed as (you’ve no doubt seen in internal blogs) and when they did I usually pushed back hard looking for a cross-group way to achieve the goal (in other words, decide open issues rather than force an org change to subsequently decide something). It is far better to collaborate with the org in place and avoid the disruption unless it is on a product cycle boundary and far better to plan and execute together than just organize together.

in response to Hal Berenson’s earlies assumption in his post that:

Steven had apparently lost recent battles to bring both Windows Phone and the Developer Division under his control. I suspect that he saw those loses both as a roadblock to where he wanted to take Windows over the next few years, and a clear indication that his political power within Microsoft had peaked. At the very point where he should have been able to ask for, and receive, almost anything as reward for his proven success he got slapped down. And so he chose to leave.

then Berenson acknowledged in response:

Steven, thanks for the first hand insight. I am obviously going on what others in Microsoft have told me. And seriously, good luck with whatever you do next!

- Patch Tuesday pushes out 7 updates to the Surface, including a performance update [Microsoft.News.com, Nov 13, 2012]

Patch Tuesday, the second Tuesday of the month, and the time when Microsoft pushes out software updates for their products.

On this occasion this includes includes Microsoft’s first ARM computer, the Surface, and the update is a “Cumulative Update for performance/compatibility” and another is a firmware update which hopefully addresses the same issue.

…

We noticed definite performance improvements, including in multi-tasking, text input, quicker loading times and improvements in IE, including in tab switching and closing.

…

Techtony • a day ago

Not only the Surface was updated, The Asus Vivo Tab RT was also Updated. New Firmware Message and a total of 8 UpdatesRJD • 2 days ago Absolutely notice performance improvements across the board…loading apps, screen accuracy, word accuracy, IE improved to boot.

surur Mod Eric Hon • 2 days ago Apparently apps open faster.

GG002 surur • 2 days ago And less sound stuttering while Surface sleeps. At least buggy music playback while Sleep isn’t a problem for me anymore (knock on wood).

It is indeed faster. In some cases much faster. A Hungarian developer was measuring the improvement via the CPU usage with the Mandelbrot program as a benchmark: C#: +25%, C++: +110%!, C++ AMP (software emultaion): +72% improvements were found by him (see in this Facebook message in Hungarian).

- Digitimes Research: White-box tablet shipments to surpass 50 million units in 2012 [DIGITIMES, Nov 13, 2012]

White-box tablets are expected to see a surge in shipment growth in 2012 with volumes surpassing 50 million units, according to Digitimes Research senior analyst James Wang.

There are three major drivers that will help white-box tablets achieve strong growth in the year: a large number of potential consumers brought in by Android handsets, mature development of China-based processors, and decreasing costs of white-box tablets. With the addition of white-box tablet shipments, Android is expected to surpass iOS and become the largest mobile operating system in 2012, while 7-inch displays will also become the mainstream specification for tablets.

As the branded tablet PC market is seeing fierce competition in terms of technology, capacity, yield rates, patents and prices, the rise of white-box tablets has already made these players a new force in the tablet market, with some white-box players even seeing higher shipment volumes than first-tier vendors.

Digitimes Research believes that brand vendors should be aware of white-box tablet players’ developments in the future, since even platform designers such as Google and Microsoft have used their resources to increase price competition in the tablet market, and the situation may gradually turn to favor China-based players with expertise in lowering costs.

Source: Digitimes Research, November 2012

or from the Chinese version of the same [Nov 9, 2012]:

- another worthwhile comment on Tuesday, November 13, 2012 9:10:00 PM on A Microsoft Without Sinofsky? Mini-Microsoft Monday, November 12, 2012:

I’m not a microsoftie but I can see parallels with two other companies, where I used to work.

1. Lucent. Coasting along on their previous life as the original AT&T and Bell Labs and living on their monopoly profits, I found their upper echelon to be as political and non technical as I see MSFT’s descriptions today. Pat Russo was a BA in political science for crying out loud. And she ended up running and selling Bell Labs (!) to Alcatel. Before that she ran Kodak. See the pattern?

2. Carly Fiorina at HP. Before that she was at Lucent. BA in Political Science. Political Science. Well, okay then, let’s just have her run HP. What does HP mostly sell now? Ink?

The pattern is simple. You get a large corp running off a semi monopoly, then in due course the people who rise are the politicians and sales guys. The engineers get used and thrown aside.

Now apparently this Julia person isn’t an engineer and she’s going to run the OS group. Good luck with that.

- and yet another one on Wednesday, November 14, 2012 7:02:00 AM:

Lots of noise in the comments. Been out of Microsoft for 3 years and haven’t been in Steve Si’s org since he left the Office group.

I worked in the same group as Julie Larson before her meteoric rise. I wasn’t so impressed, but remember that Steve Si was very impressed. If he likes someone’s work, they rise to the top very, very quickly. I don’t think he was making those choices for political reasons. I think he was making those decisions for engineering and product quality. That said, does heading program management translate into running a large engineering organization. I don’t know as it’s been many, many years since I worked near Julie.

Steve Si never struck me as someone who cared about rising to be the CEO. He cared about designing products that could be built and then building it. I’m not sure as an engineering guy, he was the right guy for Balmer’s job.

- Thoughts on the new Windows leadership [Hal’s (Im)Perfect Vision, Nov 16, 2012]

I’ve had a number of people question if Julie Larson-Green is up to the task of running Windows Engineering. No one has questioned Tami Reller’s expanded responsibilities because, well, Tami is pretty much doing the same job she had before except that the buck now stops with her instead of falling on the shoulders of a division President. So I’ll focus this post on Julie and her new role. And moreover on the experiment it represents.

…

So is Julie a good choice? On a strategic level I think there was no one better positioned to finish the job of re-imagining Windows that started with Windows 8. I have some evidence that Julie is indeed easier to collaborate with than Steven was. And she’s inheriting from Steven a well-functioning engineering organization that, of course, she helped create. She doesn’t have to fix anything (major) that I know of on the organizational or engineering process fronts. That means she has time for her multi-discipline general management skills to mature while focusing most of her energy on completing the Windows re-invention. Plus, by splitting the business and engineering responsibilities across two executives (and taking on the President responsibilities himself) Steve has kept Julie’s new role from being too much of a stretch. So yes, I think Julie is a good choice. Hopefully we’ll be able to look back in a few years and say that she was a great choice.

-

Curiously enough Euronews operating under Euronews SA formed by nine shareholding companies (France Televisions (France), RAI (Italy), RTR (Russia), SSR (Switzerland), RTP (Portugal), RTBF (Belgium), ERT (Greece), TV4 (Sweeden) and NTU (Ukraine)) was first (among major media channels) to put the below very short report to the YouTube:

Windows executive leaves Microsoft Corp [Euronews YouTube channel, Nov 13, 2012 [~UTC 2:30 p.m.]]

- Then WSJLive was next to put this report, around one and a half hour later to the YouTube: Microsoft’s Windows Chief to Depart [WSJDigitalNetwork YouTube channel, Nov 13, 2012., 11:01 a.m. ET [UTC 4:01 p.m.]], this with a detailed assesment, so far also the closest one to mine (although still far from that):

Arik Hesseldahl, AllThingsD reporter was the expert journalist interviewed by WSJLive. See also the similarly titled Microsoft’s Windows Chief to Depart [The Wall Street Journal, November 13, 2012, 11:01 a.m. ET [UTC 4:01 p.m.]] article which this video was embedded into.

- The IDG News Service was curiously quite late on YouTube and with a brief type of report only: Windows head Steven Sinofsky to leave Microsoft [computerworld YouTube channel, November 13, 2012, 1:25 p.m. ET [UTC 5:25 p.m.]]

although a written article by the same people behind the video was published 10 hours earlier: Windows head Steven Sinofsky to leave Microsoft [November 13, 2012 02:10 AM ET [UTC 7:10 a.m.]] albeit with a different, initial content.

- The same WSJLive realized only 10 hours after its first video report seen above the fact that there are TWO heirs to the Sinofsky’s empire: The Women Behind Microsoft Windows [WSJDigitalNetwork YouTube channel, Nov 13, 2012., 9:13 p.m. ET [Nov 14, UTC 2:13 a.m.]]

yet WSJLive missed the most important point that both report to Steve Ballmer (see the press release). The written article which contains the same video embedded into it does not contain that fact either: Windows’ Future in Hands of Two Veterans [The Wall Street Journal, Nov 13, 2012., 9:13 p.m. ET [Nov 14, UTC 2:13 a.m.]]

- Yet another: Microsoft Landing 11-14-12 [firstbusinessnews YouTube channel, Nov 14, ~UTC 2:30 a.m.], this time tied to the stock market (see below)

From Wikipedia on First Business:

First Business is a nationally syndicated financial news and analysis television program, produced by First Business Network LLC, a subsidiary of Weigel Broadcasting, in Chicago. Anchor Angela Miles, Reporters Chuck Coppola, Bill Moller, and Executive Producer Harvey Moshman bring viewers commentary from the floors of the Chicago Mercantile Exchange, and the Chicago Board Options Exchange, as well as from their studios in the West Loop. The program covers the financial and economic markets including equities, futures, options,commodities, foreign exchange and geo-political news. …

Here’s the complete letter from Steven Sinofsky to employees [WinSuperSite, Nov 12, 2012]

From: Steven Sinofsky

Sent: Monday, November 12, 2012 6:42 PM

To: Microsoft – All Employees (QBDG)

Subject: RE: Windows Leadership ChangesWith the general availability of Windows 8/RT and Surface, I have decided it is time for me to take a step back from my responsibilities at Microsoft. I’ve always advocated using the break between product cycles as an opportunity to reflect and to look ahead, and that applies to me too.

After more than 23 years working on a wide range of Microsoft products, I have decided to leave the company to seek new opportunities that build on these experiences. My passion for building products is as strong as ever and I look forward focusing my energy and creativity along similar lines.

The Windows team, in partnerships across all of Microsoft and our industry, just completed products and services introducing a new era of Windows computing. It is an incredible experience to be part of a generational change in a unique product like Windows, one accomplished with an undeniable elegance. Building on Windows, Surface excels in design and utility for a new era of PCs. With the Store, Internet Explorer, Outlook.com, SkyDrive and more, each of which lead the way, this experience is connected to amazing cloud services.

It is inspiring to think of these efforts making their way into the hands of Microsoft’s next billion customers. We can reflect on this project as a remarkable achievement for each of us and for the team. Our work is not done, such is the world of technology, and so much more is in store for customers.

It is impossible to count the blessings I have received over my years at Microsoft. I am humbled by the professionalism and generosity of everyone I have had the good fortune to work with at this awesome company. I am beyond grateful.

I have always promised myself when the right time came for me to change course, I would be brief, unlike one of my infamous short blog posts, and strive to be less memorable than the products and teams with which I have been proudly and humbly associated. The brevity of this announcement is simply a feature.

Some might notice a bit of chatter speculating about this decision or timing. I can assure you that none could be true as this was a personal and private choice that in no way reflects any speculation or theories one might read—about me, opportunity, the company or its leadership.

As I’ve always believed in making space for new leaders as quickly as possible, this announcement is effective immediately and I will assist however needed with the transition.

I am super excited for what the future holds for the team and Microsoft.

With my deepest appreciation,

Steven Sinofsky

Sent from Surface RT